Intro

Discover 5 ways Payback Excel simplifies financial analysis with automated reporting, data visualization, and cash flow management, enhancing ROI and investment tracking with actionable insights.

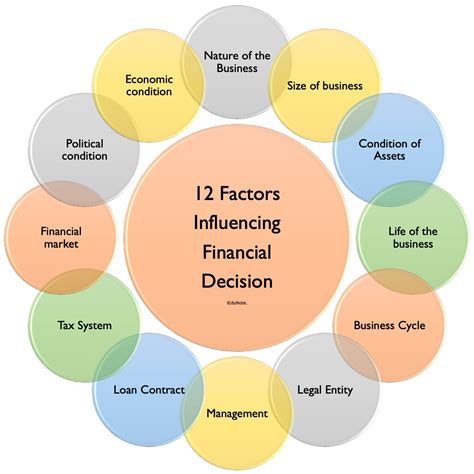

The concept of payback period is a crucial aspect of financial analysis, allowing investors and businesses to gauge the feasibility of a project or investment. The payback period is the time it takes for an investment to generate returns equal to its initial cost. In the context of Excel, calculating the payback period can be efficiently done using various formulas and functions. Understanding how to apply these methods is essential for making informed financial decisions.

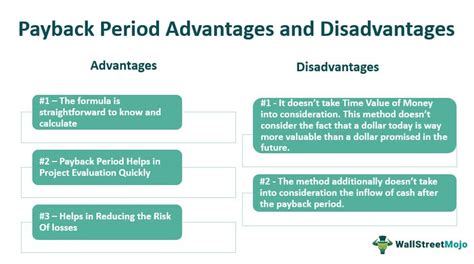

The importance of calculating the payback period in Excel lies in its ability to provide a clear, quantitative measure of an investment's viability. It helps in comparing different investment opportunities by estimating how long it will take for each to pay off. This metric is particularly useful for businesses with limited capital, as it enables them to prioritize investments that offer quicker returns. Moreover, the payback period calculation can be adapted to various financial scenarios, making it a versatile tool in financial planning.

For individuals and businesses looking to maximize their returns, understanding the payback period is not just beneficial but necessary. It allows for the optimization of investment portfolios by focusing on projects that promise quicker paybacks, thereby improving cash flow and reducing financial risk. The calculation of the payback period in Excel is straightforward and can be approached in several ways, including the use of specific formulas designed to handle different types of cash flow scenarios.

Understanding Payback Period Calculation

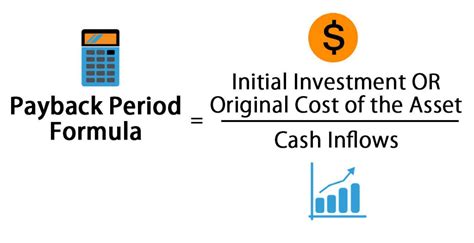

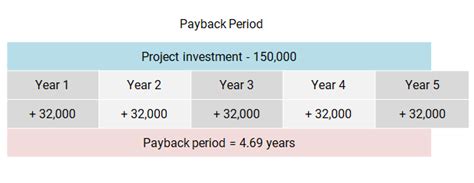

The payback period is essentially the length of time required to recover the cost of an investment. It's a simple yet powerful metric that can be calculated manually or using Excel. For investments with even cash flows, the calculation is straightforward: it's the initial investment divided by the annual cash flow. However, for projects with uneven cash flows, Excel's XNPV function becomes particularly useful, as it allows for the calculation of the present value of a series of cash flows that occur at irregular intervals.

Using Excel Formulas for Payback Period

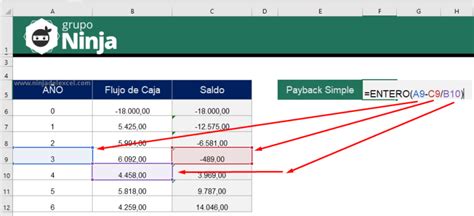

Excel offers several formulas that can be used to calculate the payback period, depending on the specifics of the cash flow. For simple, uniform cash flows, a basic formula can be used. However, for more complex scenarios involving variable cash flows at different times, functions like XNPV and XIRR provide more accurate calculations. These functions are especially useful for investments with fluctuating returns or for projects that have both inflows and outflows of cash over time.

Step-by-Step Calculation

To calculate the payback period in Excel, follow these steps: 1. **List Cash Flows:** Start by listing all the initial and subsequent cash flows related to the investment, including both outflows (costs) and inflows (returns). 2. **Apply the Formula:** For uniform cash flows, use the formula Payback Period = Initial Investment / Annual Cash Flow. For more complex cash flows, consider using the XNPV or XIRR functions. 3. **Consider Time Value of Money:** Especially for longer-term investments, it's crucial to consider the time value of money. This is where functions like XNPV become invaluable, as they calculate the present value of future cash flows, giving a more accurate picture of an investment's worth.Benefits of Using Excel for Payback Period Calculation

Using Excel for calculating the payback period offers several benefits, including ease of use, flexibility, and accuracy. Excel's built-in functions can handle complex financial scenarios, providing quick and reliable calculations. This enables investors and financial analysts to make informed decisions based on precise data. Furthermore, Excel's graphical capabilities allow for the visualization of data, making it easier to understand and compare different investment opportunities.

Enhancing Decision Making

The payback period, when calculated accurately using Excel, serves as a powerful tool for enhancing decision making in financial contexts. It helps in: - **Prioritizing Investments:** By comparing the payback periods of different investments, businesses can prioritize those that offer the quickest returns. - **Risk Assessment:** A shorter payback period generally indicates lower risk, as the investment is recovered sooner. - **Cash Flow Management:** Understanding how long it takes for an investment to pay off is crucial for managing cash flow effectively, ensuring that a business has sufficient liquidity to meet its obligations.Practical Applications and Examples

In practical terms, the payback period calculation can be applied to a wide range of investment scenarios, from real estate investments to business expansions. For instance, a company considering investing in new equipment can calculate the payback period based on the cost of the equipment and the anticipated increase in revenue or reduction in costs it will bring. This helps the company decide whether the investment is worthwhile and how it compares to other potential investments.

Real-World Scenarios

Consider the following scenarios: - **Investing in Renewable Energy:** A homeowner calculates the payback period of installing solar panels based on the initial cost and anticipated savings on electricity bills. - **Business Expansion:** A small business owner evaluates the payback period of opening a new location, considering initial investment costs and projected revenue increases.Gallery of Payback Period Calculations

Payback Period Image Gallery

Frequently Asked Questions

What is the Payback Period?

+The payback period is the time it takes for an investment to generate returns equal to its initial cost.

Why is the Payback Period Important?

+It helps in comparing different investment opportunities and prioritizing those with quicker returns, thus aiding in financial decision making.

How to Calculate the Payback Period in Excel?

+For uniform cash flows, use the formula Payback Period = Initial Investment / Annual Cash Flow. For complex cash flows, consider using the XNPV or XIRR functions.

In conclusion, calculating the payback period in Excel is a straightforward yet powerful tool for financial analysis. It provides a clear insight into the viability of an investment, enabling informed decisions. Whether you're an investor looking to maximize returns or a business seeking to optimize its investment portfolio, understanding and applying the payback period calculation in Excel can significantly enhance your financial planning and decision-making processes. We invite you to share your experiences with calculating payback periods and how it has influenced your investment strategies. Feel free to comment below or share this article with others who might benefit from this insightful financial tool.