Intro

Streamline cash handling with a cash drawer count sheet, optimizing inventory management, reducing discrepancies, and enhancing point-of-sale accuracy and security.

Effective cash handling is crucial for any business, and a key component of this process is the cash drawer count sheet. This tool helps in maintaining accuracy and transparency in cash transactions, ensuring that businesses can track their cash flow efficiently. In this article, we will delve into the importance of the cash drawer count sheet, its benefits, how it works, and provide practical examples to illustrate its use.

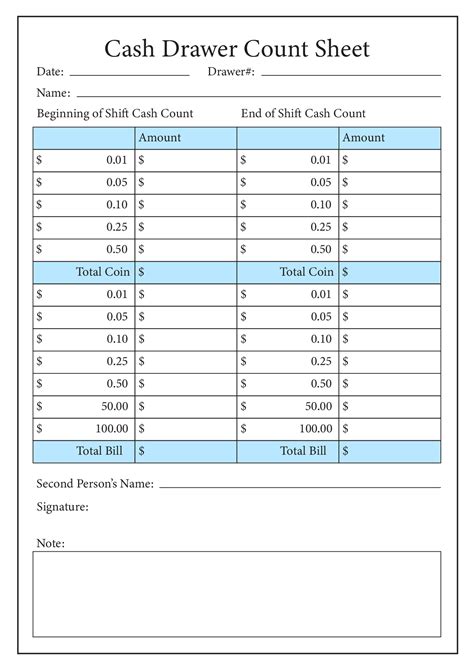

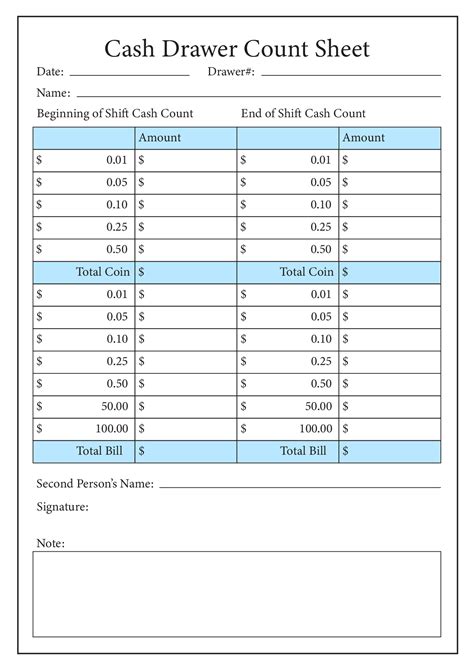

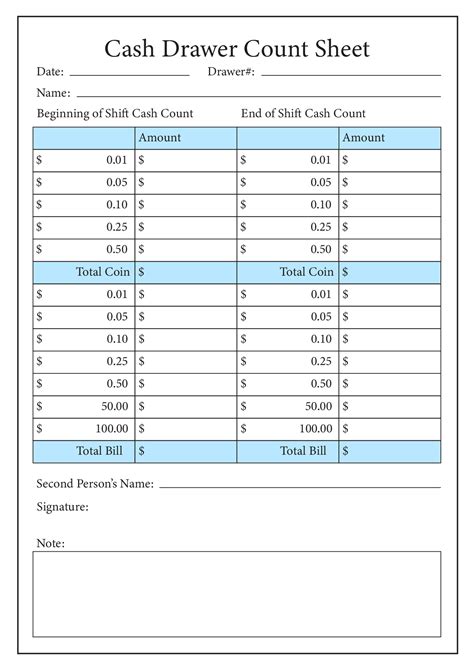

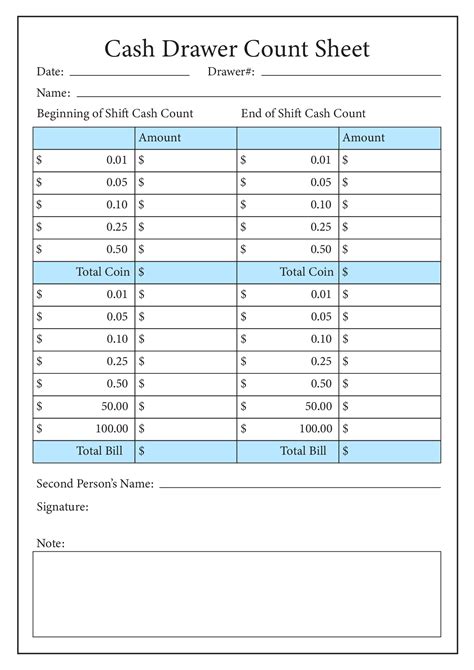

The cash drawer count sheet is a document used by businesses to record and reconcile the cash in their cash drawers at the beginning and end of each shift or business day. It is an essential tool for cash handling, as it helps prevent discrepancies and theft. By using a cash drawer count sheet, businesses can ensure that their cash handling processes are secure, reliable, and compliant with financial regulations.

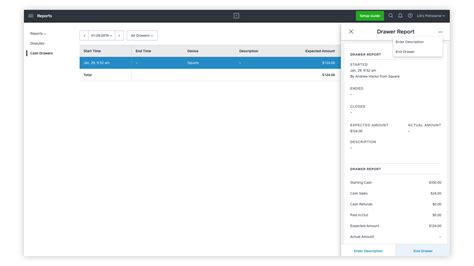

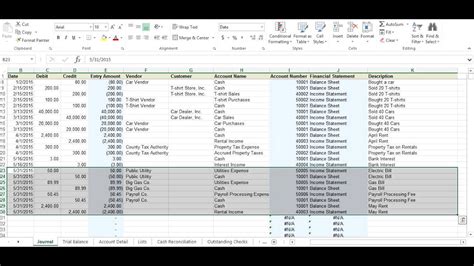

The process of using a cash drawer count sheet begins with the initial count of cash at the start of a shift or day. This involves counting the cash in the drawer, including bills and coins, and recording the total amount on the sheet. Throughout the day, as cash is added to or removed from the drawer, these transactions are recorded on the sheet. At the end of the shift or day, the cash in the drawer is recounted, and the total is compared to the recorded transactions to ensure that the amounts match.

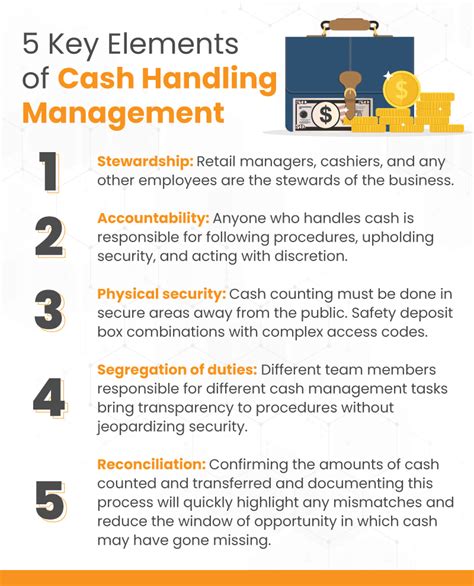

Benefits of Using a Cash Drawer Count Sheet

The benefits of using a cash drawer count sheet are numerous. It helps in preventing cash discrepancies and theft by providing a clear record of all cash transactions. This transparency can deter employees from attempting to steal from the business, as they know that their actions can be traced. Additionally, the sheet helps in identifying any errors or discrepancies in cash handling, allowing businesses to take corrective action promptly.

Another significant benefit of the cash drawer count sheet is that it simplifies the process of reconciling cash transactions. By having a detailed record of all cash added to or removed from the drawer, businesses can easily reconcile their cash transactions at the end of each day. This helps in maintaining accurate financial records and ensures that the business's cash flow is properly accounted for.

Key Components of a Cash Drawer Count Sheet

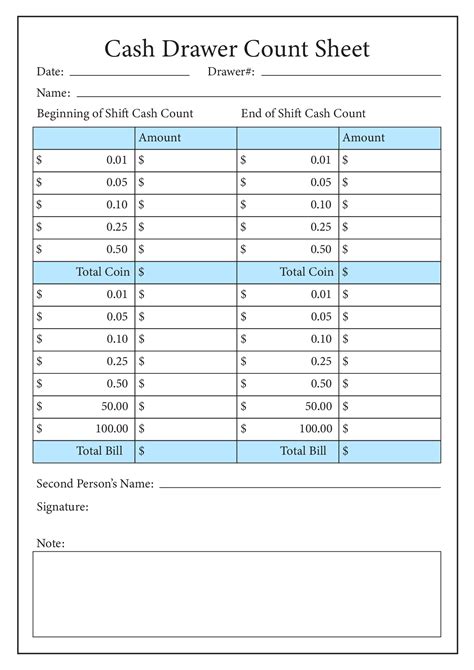

A cash drawer count sheet typically includes several key components. These may vary depending on the specific needs of the business, but generally, they include: - The date and time of the count - The initial amount of cash in the drawer - A record of all cash transactions throughout the day, including sales, refunds, and any other additions or removals of cash - The final count of cash in the drawer at the end of the shift or day - Any discrepancies or notes regarding the cash countHow to Implement a Cash Drawer Count Sheet

Implementing a cash drawer count sheet is a straightforward process. Businesses can create their own sheets based on their specific needs or use pre-designed templates. The key is to ensure that the sheet is easy to use and understand, and that it captures all necessary information regarding cash transactions.

To start using a cash drawer count sheet, businesses should first determine the frequency of the cash counts. This could be at the start and end of each shift, or at the beginning and end of each business day. The initial count of cash should be performed by two people to ensure accuracy, and the results should be recorded on the sheet.

Throughout the day, as cash transactions occur, they should be recorded on the sheet. This includes not just sales and refunds, but also any other additions or removals of cash from the drawer, such as cash drops or pickups by armored car services.

At the end of the shift or day, the cash in the drawer should be recounted, and the total compared to the recorded transactions. Any discrepancies should be investigated and resolved promptly.

Best Practices for Using a Cash Drawer Count Sheet

To get the most out of a cash drawer count sheet, businesses should follow several best practices. These include: - Ensuring that the sheet is filled out accurately and completely - Performing cash counts at regular intervals - Investigating and resolving any discrepancies promptly - Keeping the cash drawer count sheet in a secure location to prevent tampering - Reviewing the sheet regularly to identify any trends or issues in cash handlingCommon Challenges and Solutions

Despite the benefits of using a cash drawer count sheet, businesses may encounter several challenges. One common issue is discrepancies between the recorded transactions and the actual cash in the drawer. These discrepancies can be due to errors in recording transactions, theft, or other factors.

To address these discrepancies, businesses should first review the cash drawer count sheet to identify the source of the error. If the discrepancy is due to an error in recording transactions, the business should take steps to correct the mistake and prevent it from happening again in the future.

If the discrepancy suggests theft, the business should investigate the matter promptly and take appropriate action. This may involve reviewing security footage, interviewing employees, and potentially involving law enforcement.

Another challenge businesses may face is ensuring that employees understand the importance of accurately filling out the cash drawer count sheet. To address this, businesses should provide clear instructions and training on how to use the sheet, and emphasize the role it plays in maintaining the security and integrity of the business's cash handling processes.

Technological Solutions

In recent years, technological solutions have become increasingly popular for managing cash transactions and reconciling cash drawers. These solutions can range from simple spreadsheet templates to complex point-of-sale (POS) systems that automatically track and record cash transactions.One of the benefits of technological solutions is that they can reduce the risk of human error in recording transactions. They can also provide real-time tracking of cash transactions, making it easier for businesses to identify and address discrepancies.

However, technological solutions also have their limitations. They can be expensive to implement, especially for small businesses, and may require significant training for employees to use effectively.

Conclusion and Future Directions

In conclusion, the cash drawer count sheet is a vital tool for businesses looking to maintain accurate and secure cash handling processes. By providing a clear record of all cash transactions, it helps prevent discrepancies and theft, and simplifies the process of reconciling cash transactions.

As businesses continue to evolve and grow, the importance of the cash drawer count sheet will only continue to increase. Whether through traditional manual methods or technological solutions, accurate cash handling will remain a cornerstone of successful business operations.

Final Thoughts

In final thoughts, the cash drawer count sheet is an essential component of any business's cash handling processes. Its benefits, including preventing discrepancies and theft, simplifying reconciliation, and providing a clear record of cash transactions, make it an indispensable tool for businesses of all sizes.By understanding how to implement and use a cash drawer count sheet effectively, businesses can ensure that their cash handling processes are secure, reliable, and compliant with financial regulations. Whether you are a small business owner or a manager of a large retail chain, the cash drawer count sheet is a tool that you cannot afford to overlook.

Cash Drawer Count Sheet Image Gallery

What is a cash drawer count sheet?

+A cash drawer count sheet is a document used to record and reconcile the cash in a business's cash drawers at the beginning and end of each shift or business day.

Why is a cash drawer count sheet important?

+A cash drawer count sheet is important because it helps prevent discrepancies and theft, simplifies the process of reconciling cash transactions, and provides a clear record of all cash transactions.

How do I implement a cash drawer count sheet in my business?

+To implement a cash drawer count sheet, determine the frequency of cash counts, create a sheet that captures all necessary information, and ensure that it is filled out accurately and completely at each count.

What are some common challenges when using a cash drawer count sheet?

+Common challenges include discrepancies between recorded transactions and actual cash, errors in recording transactions, and theft. These can be addressed by reviewing the sheet, investigating discrepancies, and taking corrective action.

Can technology help with cash drawer count sheets?

+Yes, technological solutions such as point-of-sale systems and cash counting machines can help reduce errors, provide real-time tracking of cash transactions, and simplify the reconciliation process.

We hope this article has provided you with a comprehensive understanding of the cash drawer count sheet and its importance in maintaining secure and accurate cash handling processes. Whether you are just starting your business or looking to improve your existing cash management practices, the insights and tips shared here can help you achieve your goals. Feel free to share your thoughts or questions in the comments below, and don't forget to share this article with anyone who might find it useful.