Intro

As people approach retirement, they often find themselves wondering if they have saved enough to maintain their lifestyle after they stop working. Creating a retirement spreadsheet using Google Sheets can be a great way to track expenses, income, and savings to ensure a comfortable retirement. In this article, we will explore the importance of planning for retirement, the benefits of using a spreadsheet to track retirement finances, and provide a step-by-step guide on how to create a retirement spreadsheet using Google Sheets.

Planning for retirement is crucial to ensure that individuals have enough money to support themselves during their golden years. Many people underestimate the amount of money they will need in retirement, and this can lead to financial difficulties. By creating a retirement spreadsheet, individuals can get a clear picture of their financial situation and make informed decisions about their retirement goals. A well-planned retirement can provide peace of mind, financial security, and the freedom to pursue hobbies and interests without worrying about money.

Using a spreadsheet to track retirement finances has several benefits. It allows individuals to visualize their income and expenses, identify areas where they can cut back, and make adjustments to their budget as needed. A spreadsheet can also help individuals to prioritize their spending, make smart investment decisions, and ensure that they are on track to meet their retirement goals. With a spreadsheet, individuals can easily track their progress, make changes, and see the impact of different scenarios on their retirement finances.

Benefits of Using Google Sheets for Retirement Planning

Google Sheets is a popular choice for creating a retirement spreadsheet due to its ease of use, flexibility, and collaboration features. With Google Sheets, individuals can access their spreadsheet from anywhere, at any time, and share it with their partner or financial advisor. Google Sheets also offers a range of templates and add-ons that can help individuals to create a comprehensive retirement plan. Additionally, Google Sheets is free, and individuals can use it without worrying about the cost of software or subscriptions.

Getting Started with Google Sheets

To get started with creating a retirement spreadsheet using Google Sheets, individuals will need to sign up for a Google account if they don't already have one. Once they have a Google account, they can access Google Sheets by going to the Google Drive website and clicking on the "New" button. From there, they can select "Google Sheets" and choose a template or start from scratch.Creating a Retirement Spreadsheet

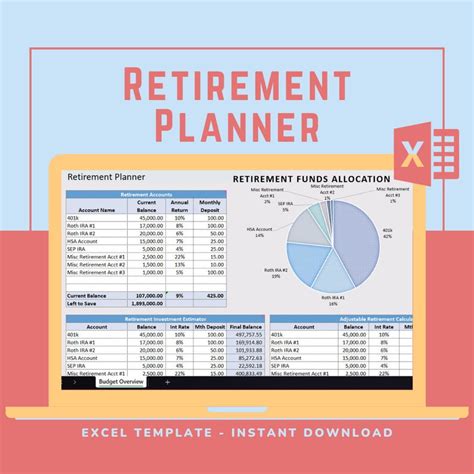

Creating a retirement spreadsheet involves several steps, including setting up the spreadsheet structure, entering data, and creating formulas and charts. The first step is to set up the spreadsheet structure, which includes creating separate sheets for income, expenses, savings, and investments. Individuals can use the "Sheet" tab to create new sheets and name them accordingly.

The next step is to enter data into the spreadsheet, including income, expenses, savings, and investments. Individuals can use the "Format" tab to format the cells and make the data easier to read. They can also use formulas to calculate totals and percentages.

Setting Up the Spreadsheet Structure

To set up the spreadsheet structure, individuals will need to create separate sheets for income, expenses, savings, and investments. They can use the "Sheet" tab to create new sheets and name them accordingly. For example, they can create a sheet called "Income" and enter their monthly income, including salary, investments, and any other sources of income.Entering Data into the Spreadsheet

Entering data into the spreadsheet is a crucial step in creating a retirement plan. Individuals will need to enter their income, expenses, savings, and investments into the respective sheets. They can use the "Format" tab to format the cells and make the data easier to read. They can also use formulas to calculate totals and percentages.

Creating Formulas and Charts

To create formulas and charts, individuals can use the "Formulas" tab and select from a range of functions, including SUM, AVERAGE, and PERCENTAGE. They can also use the "Charts" tab to create visual representations of their data, including bar charts, line charts, and pie charts.Using Formulas and Charts to Analyze Data

Using formulas and charts to analyze data is a powerful way to gain insights into retirement finances. Individuals can use formulas to calculate totals and percentages, and charts to visualize their data. For example, they can use a formula to calculate their total income and expenses, and a chart to show their income and expenses over time.

Tracking Progress and Making Adjustments

To track progress and make adjustments, individuals can use the spreadsheet to monitor their income, expenses, savings, and investments over time. They can also use the spreadsheet to identify areas where they can cut back and make adjustments to their budget as needed.Common Retirement Planning Mistakes to Avoid

There are several common retirement planning mistakes that individuals should avoid, including underestimating expenses, not saving enough, and not diversifying investments. Individuals should also avoid withdrawing too much from their retirement accounts, and not having a plan for long-term care.

Best Practices for Retirement Planning

To ensure a successful retirement, individuals should follow best practices, including starting to save early, being consistent, and avoiding common mistakes. They should also review and update their retirement plan regularly to ensure that they are on track to meet their goals.Gallery of Retirement Planning Images

Retirement Planning Image Gallery

Frequently Asked Questions

What is the best way to start planning for retirement?

+The best way to start planning for retirement is to create a comprehensive retirement plan that includes a budget, savings goals, and investment strategy.

How much money do I need to save for retirement?

+The amount of money you need to save for retirement depends on your individual circumstances, including your age, income, and expenses. A general rule of thumb is to save at least 10% to 15% of your income for retirement.

What are the benefits of using a spreadsheet to track retirement finances?

+The benefits of using a spreadsheet to track retirement finances include being able to visualize your income and expenses, identify areas where you can cut back, and make adjustments to your budget as needed.

In conclusion, creating a retirement spreadsheet using Google Sheets is a great way to track expenses, income, and savings to ensure a comfortable retirement. By following the steps outlined in this article, individuals can create a comprehensive retirement plan that includes a budget, savings goals, and investment strategy. Remember to review and update your retirement plan regularly to ensure that you are on track to meet your goals. Share this article with your friends and family to help them plan for their retirement, and don't forget to comment below with your thoughts and questions.