Intro

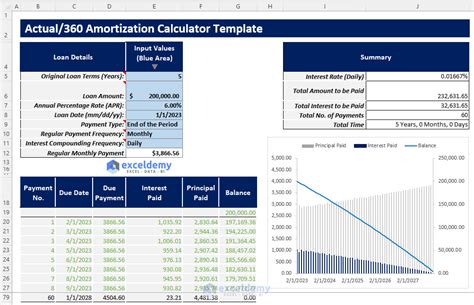

Calculate loan repayments with our 365/360 Loan Calculator Excel Tool, featuring daily interest accrual, amortization schedules, and financial forecasting, ideal for borrowers and lenders needing precise loan calculations and repayment planning.

Calculating loan payments and understanding the terms of a loan can be a daunting task, especially when dealing with complex interest calculations. The 365/360 loan calculator Excel tool is designed to simplify this process, providing borrowers and lenders with an accurate and efficient way to determine loan payments. In this article, we will delve into the importance of using a 365/360 loan calculator, its benefits, and how it works.

The 365/360 method of calculating interest is commonly used in commercial loans, where the interest is calculated based on a 360-day year instead of the actual 365 days. This can lead to a slightly higher interest payment over the life of the loan. To accurately calculate loan payments and interest, a reliable tool like the 365/360 loan calculator Excel tool is essential.

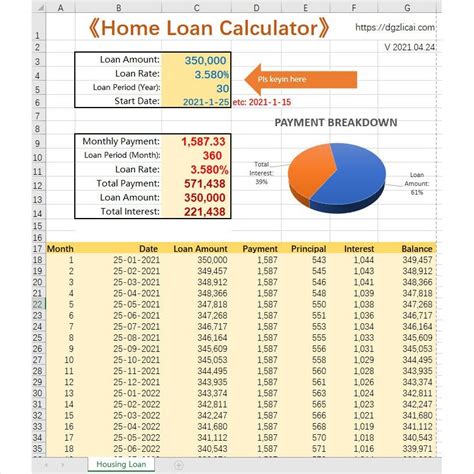

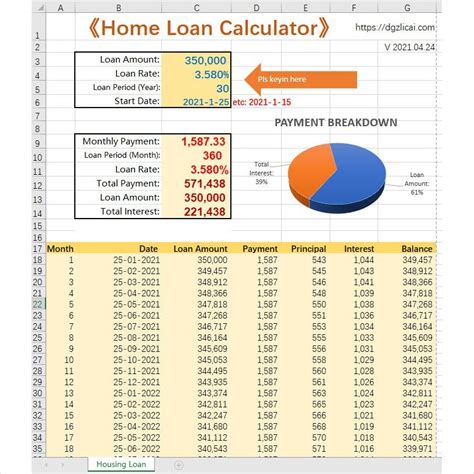

Understanding how to calculate loan payments and interest can help borrowers make informed decisions when choosing a loan. The 365/360 loan calculator Excel tool takes into account the loan amount, interest rate, and repayment term to provide an accurate calculation of the monthly payment and total interest paid over the life of the loan. This information can be used to compare different loan options and choose the one that best fits the borrower's needs.

Benefits of Using a 365/360 Loan Calculator Excel Tool

The 365/360 loan calculator Excel tool offers several benefits, including accuracy, efficiency, and flexibility. By using this tool, borrowers and lenders can quickly and easily calculate loan payments and interest, reducing the risk of errors and saving time. The tool can also be customized to accommodate different loan scenarios, making it a valuable resource for anyone involved in the loan process.

Some of the key benefits of using a 365/360 loan calculator Excel tool include:

- Accuracy: The tool provides accurate calculations of loan payments and interest, reducing the risk of errors and ensuring that borrowers and lenders have a clear understanding of the loan terms.

- Efficiency: The tool is quick and easy to use, saving time and effort when calculating loan payments and interest.

- Flexibility: The tool can be customized to accommodate different loan scenarios, making it a valuable resource for anyone involved in the loan process.

How the 365/360 Loan Calculator Excel Tool Works

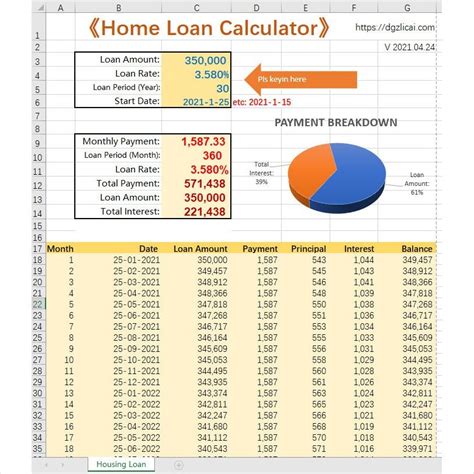

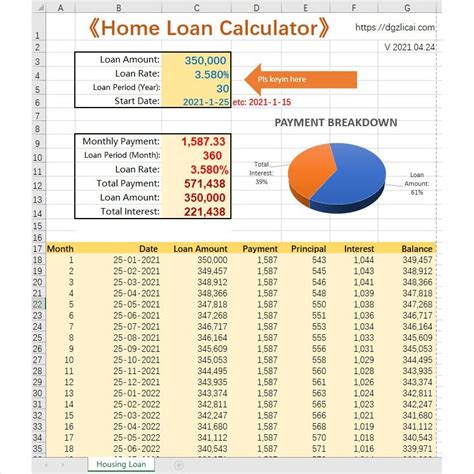

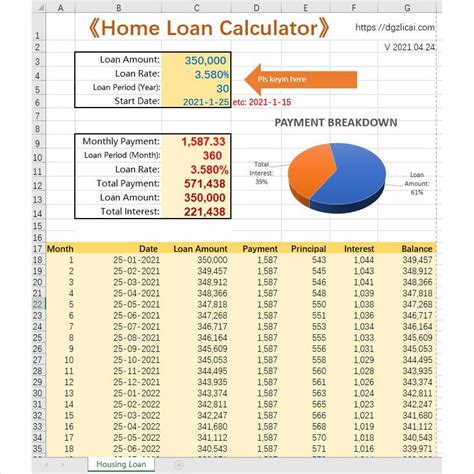

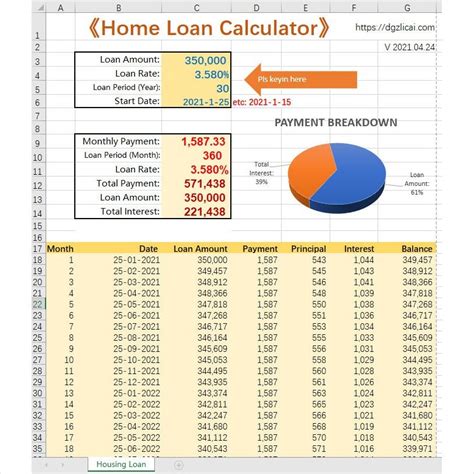

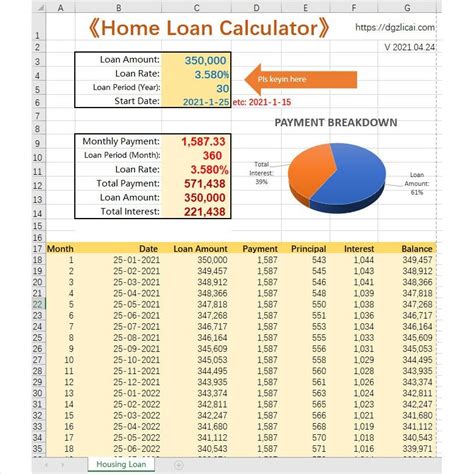

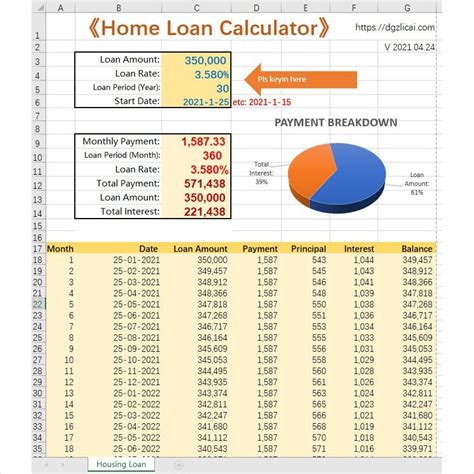

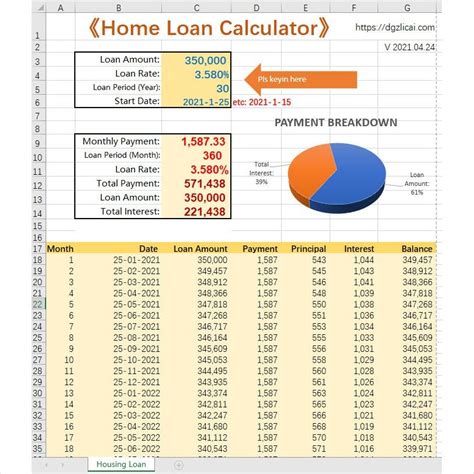

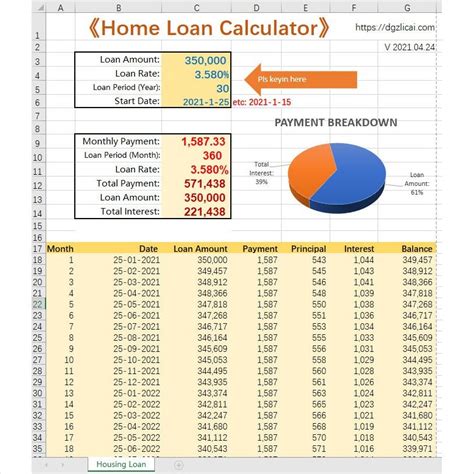

The 365/360 loan calculator Excel tool is designed to be user-friendly and easy to use. To calculate loan payments and interest, simply enter the loan amount, interest rate, and repayment term into the tool. The tool will then calculate the monthly payment and total interest paid over the life of the loan, providing a clear and accurate picture of the loan terms.Here are the steps to use the 365/360 loan calculator Excel tool:

- Enter the loan amount: This is the total amount borrowed.

- Enter the interest rate: This is the annual interest rate as a decimal.

- Enter the repayment term: This is the number of years the loan will be repaid over.

- Calculate the monthly payment: The tool will calculate the monthly payment based on the loan amount, interest rate, and repayment term.

- Calculate the total interest paid: The tool will calculate the total interest paid over the life of the loan.

Features of the 365/360 Loan Calculator Excel Tool

The 365/360 loan calculator Excel tool offers a range of features that make it a valuable resource for anyone involved in the loan process. Some of the key features of the tool include:

- Customizable loan scenarios: The tool can be customized to accommodate different loan scenarios, making it a valuable resource for anyone involved in the loan process.

- Accurate calculations: The tool provides accurate calculations of loan payments and interest, reducing the risk of errors and ensuring that borrowers and lenders have a clear understanding of the loan terms.

- Easy to use: The tool is quick and easy to use, saving time and effort when calculating loan payments and interest.

Benefits for Borrowers

The 365/360 loan calculator Excel tool offers several benefits for borrowers, including: * Accurate calculations: The tool provides accurate calculations of loan payments and interest, reducing the risk of errors and ensuring that borrowers have a clear understanding of the loan terms. * Comparison of loan options: The tool can be used to compare different loan options, helping borrowers to choose the loan that best fits their needs. * Budgeting: The tool can be used to help borrowers budget for their loan payments, ensuring that they have sufficient funds to meet their repayment obligations.Benefits for Lenders

The 365/360 loan calculator Excel tool also offers several benefits for lenders, including:

- Accurate calculations: The tool provides accurate calculations of loan payments and interest, reducing the risk of errors and ensuring that lenders have a clear understanding of the loan terms.

- Streamlined loan process: The tool can be used to streamline the loan process, saving time and effort when calculating loan payments and interest.

- Improved customer service: The tool can be used to provide borrowers with accurate and timely information about their loan payments and interest, improving customer satisfaction and loyalty.

Common Uses of the 365/360 Loan Calculator Excel Tool

The 365/360 loan calculator Excel tool has a range of common uses, including: * Calculating loan payments and interest: The tool can be used to calculate loan payments and interest for a range of loan scenarios. * Comparing loan options: The tool can be used to compare different loan options, helping borrowers to choose the loan that best fits their needs. * Budgeting: The tool can be used to help borrowers budget for their loan payments, ensuring that they have sufficient funds to meet their repayment obligations.Gallery of 365 360 Loan Calculator Excel Tool

365 360 Loan Calculator Excel Tool Image Gallery

Frequently Asked Questions

What is the 365/360 loan calculator Excel tool?

+The 365/360 loan calculator Excel tool is a spreadsheet-based tool used to calculate loan payments and interest based on the 365/360 method of calculating interest.

How does the 365/360 loan calculator Excel tool work?

+The tool uses a formula to calculate the monthly payment and total interest paid over the life of the loan, based on the loan amount, interest rate, and repayment term.

What are the benefits of using the 365/360 loan calculator Excel tool?

+The tool provides accurate calculations, is easy to use, and can be customized to accommodate different loan scenarios, making it a valuable resource for anyone involved in the loan process.

In conclusion, the 365/360 loan calculator Excel tool is a valuable resource for anyone involved in the loan process. Its ability to provide accurate calculations, ease of use, and customization options make it an essential tool for borrowers and lenders alike. By using this tool, individuals can make informed decisions about their loan options, budget for their loan payments, and ensure that they have a clear understanding of the loan terms. We encourage you to share your thoughts and experiences with the 365/360 loan calculator Excel tool in the comments below, and to share this article with anyone who may benefit from this valuable resource.