Intro

Streamline accounts payable with an Excel template, featuring automated invoicing, payment tracking, and vendor management, to enhance financial organization and reduce errors.

Managing accounts payable is a critical aspect of any business's financial operations. It involves tracking and paying debts owed to suppliers, vendors, and other creditors. An Excel accounts payable template can be a valuable tool in streamlining this process, offering a structured and organized way to monitor and manage outstanding payments. In this article, we will delve into the importance of effective accounts payable management, the benefits of using an Excel template for this purpose, and provide guidance on how to create and utilize such a template.

Effective management of accounts payable is crucial for maintaining healthy relationships with suppliers, avoiding late payment penalties, and ensuring the financial stability of the company. It requires meticulous tracking of invoices, due dates, and payment amounts. Without a systematic approach, businesses risk overlooking payments, which can lead to strained supplier relationships, additional fees, and negative impacts on credit scores.

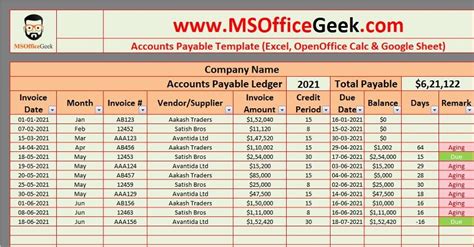

Using an Excel accounts payable template offers several benefits. It provides a centralized platform for managing all payable accounts, making it easier to track and prioritize payments. Excel templates are also highly customizable, allowing businesses to tailor them to their specific needs and accounting practices. Furthermore, Excel's built-in functions enable automatic calculations, reducing the risk of human error and saving time in managing and updating the accounts payable ledger.

Benefits of Using Excel for Accounts Payable Management

The use of Excel for managing accounts payable comes with several key benefits:

- Enhanced Organization: Excel templates help in organizing accounts payable data in a structured and easily accessible format.

- Customization: Businesses can customize the template to fit their specific accounting and management needs.

- Error Reduction: Automated calculations reduce the likelihood of errors, ensuring accuracy in financial reporting and payment management.

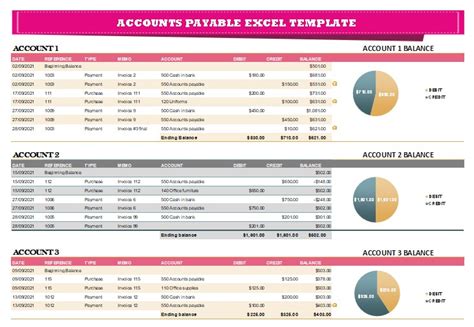

- Scalability: As the business grows, the Excel template can be easily expanded to accommodate more suppliers, invoices, and payments.

Creating an Excel Accounts Payable Template

Creating an effective Excel accounts payable template involves several steps:

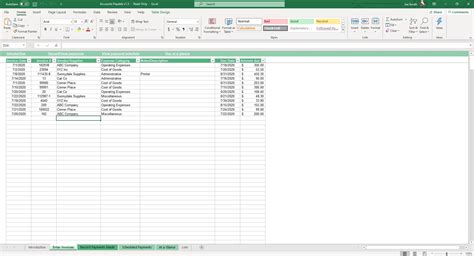

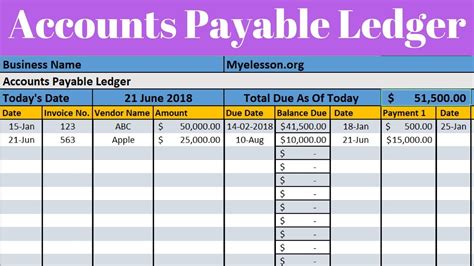

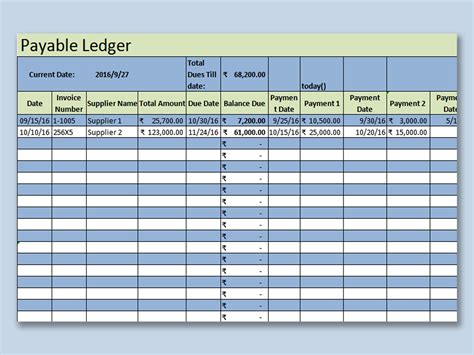

- Setting Up the Template: Start with a basic Excel spreadsheet and set up columns for essential information such as supplier name, invoice number, invoice date, due date, payment amount, and payment status.

- Customizing Columns: Depending on the business's specific needs, additional columns can be added for tracking other relevant details, such as purchase order numbers, item descriptions, and payment methods.

- Formulas and Functions: Utilize Excel's formulas and functions to automate calculations, such as summing up total payments due or calculating late payment fees.

- Conditional Formatting: Apply conditional formatting to highlight important information, such as overdue payments or invoices nearing their due dates.

- Data Validation: Use data validation to restrict input and ensure consistency in data entry, reducing errors and making the template more user-friendly.

Steps to Implement the Template

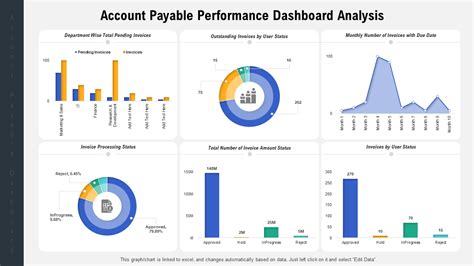

Implementing the Excel accounts payable template into daily operations involves: - **Data Entry:** Regularly update the template with new invoices and payment information. - **Review and Prioritize:** Use the template to review outstanding payments and prioritize them based on due dates and amounts. - **Payment Processing:** Process payments according to the prioritized list, ensuring timely payments to suppliers. - **Reconciliation:** Regularly reconcile the accounts payable ledger with bank statements to ensure accuracy and detect any discrepancies.Best Practices for Managing Accounts Payable

Several best practices can enhance the management of accounts payable:

- Regular Audits: Conduct regular audits of the accounts payable process to identify areas for improvement and ensure compliance with financial regulations.

- Supplier Communication: Maintain open communication with suppliers to negotiate better terms, resolve disputes, and ensure smooth transactions.

- Employee Training: Provide ongoing training to employees involved in the accounts payable process to ensure they are proficient in using the Excel template and understand the importance of accurate and timely payments.

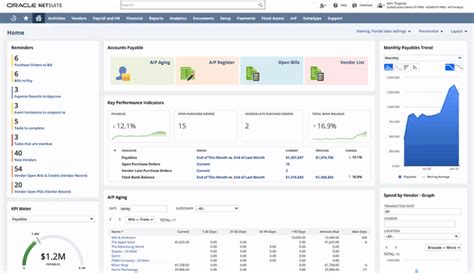

- Technology Integration: Consider integrating the Excel template with other financial management tools or accounting software to streamline processes and improve efficiency.

Common Challenges and Solutions

Common challenges in managing accounts payable include: - **Late Payments:** Implement a strict payment schedule and consider automating payments to avoid late fees. - **Disputes with Suppliers:** Establish clear communication channels with suppliers to quickly resolve any disputes or issues with invoices or payments. - **Data Entry Errors:** Implement data validation and regularly review the template for errors to ensure accuracy.Gallery of Accounts Payable Management

Accounts Payable Management Image Gallery

What is the primary purpose of an Excel accounts payable template?

+The primary purpose of an Excel accounts payable template is to provide a structured and organized way to track and manage outstanding payments to suppliers and vendors.

How can I customize an Excel accounts payable template for my business?

+You can customize an Excel accounts payable template by adding or removing columns based on your business's specific needs, using formulas and functions for automated calculations, and applying conditional formatting to highlight important information.

What are the benefits of using an Excel accounts payable template over manual tracking methods?

+The benefits include enhanced organization, reduction in errors, scalability, and the ability to automate calculations and prioritize payments, leading to more efficient management of accounts payable.

In conclusion, an Excel accounts payable template is a powerful tool for businesses looking to streamline their financial operations and improve their relationships with suppliers. By understanding the benefits, creating a customized template, and following best practices for management, businesses can ensure timely payments, reduce errors, and maintain a healthy financial position. Whether you're a small startup or a large corporation, leveraging Excel for accounts payable management can significantly contribute to your overall financial health and success. We invite you to share your experiences with Excel accounts payable templates, ask questions, or explore more topics related to financial management and Excel applications.