Intro

Discover the Aging Formula in Excel, calculating age from birthdate using date functions, formulas, and Excel aging calculations for precise age determination.

As we navigate through the complexities of data analysis, it's essential to understand the various formulas and functions that can help us extract valuable insights from our data. One such formula is the aging formula in Excel, which plays a crucial role in calculating the age of a person, product, or asset. In this article, we will delve into the world of aging formulas in Excel, exploring their importance, benefits, and applications.

The aging formula is a fundamental concept in Excel, and its significance cannot be overstated. It helps us determine the age of an individual, product, or asset, which is vital in various industries such as finance, healthcare, and manufacturing. For instance, in the financial sector, the aging formula is used to calculate the age of accounts receivable and payable, allowing businesses to manage their cash flow effectively. In the healthcare industry, the aging formula is used to calculate the age of patients, which helps in determining the risk of certain diseases and developing effective treatment plans.

The importance of the aging formula in Excel lies in its ability to provide accurate and timely information. By using this formula, businesses and individuals can make informed decisions, identify trends, and optimize their operations. Moreover, the aging formula is easy to use and can be applied to various scenarios, making it a versatile tool in the world of data analysis.

Aging Formula in Excel

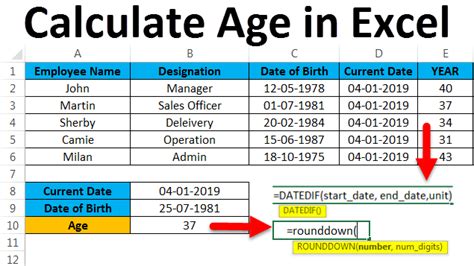

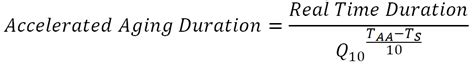

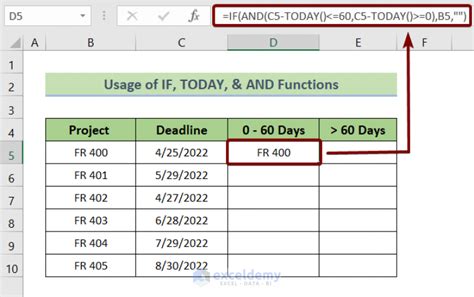

The aging formula in Excel is calculated using the following syntax: =DATEDIF(start_date, end_date, unit). This formula takes three arguments: the start date, the end date, and the unit of time. The unit of time can be days, months, or years, depending on the desired outcome. For example, if we want to calculate the age of a person in years, we can use the formula =DATEDIF(A2, TODAY(), "Y"), where A2 is the birth date and TODAY() is the current date.

Benefits of Using the Aging Formula

The benefits of using the aging formula in Excel are numerous. Some of the most significant advantages include:

- Accurate calculations: The aging formula provides accurate calculations, which is essential in making informed decisions.

- Time-saving: The formula saves time and effort, as it eliminates the need for manual calculations.

- Flexibility: The aging formula can be applied to various scenarios, making it a versatile tool in data analysis.

- Easy to use: The formula is easy to use, even for those with limited knowledge of Excel.

Applications of the Aging Formula

The aging formula has various applications in different industries. Some of the most significant applications include:

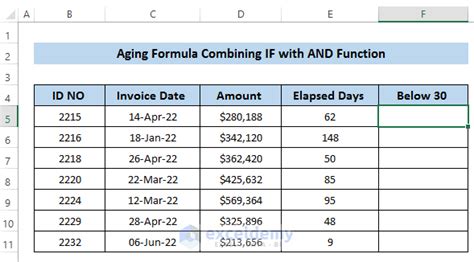

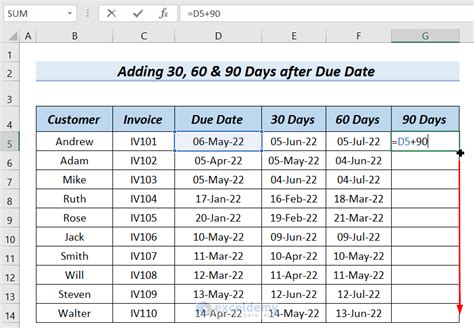

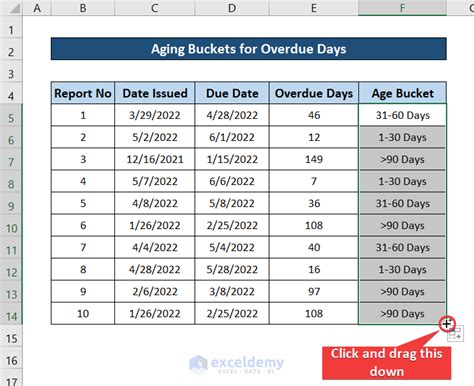

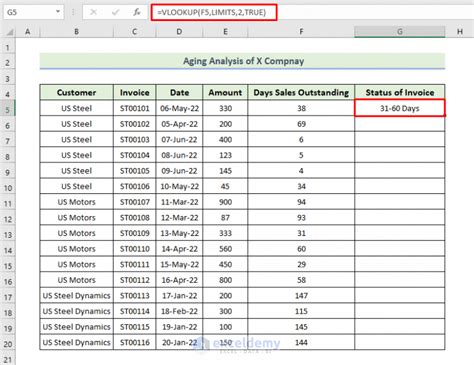

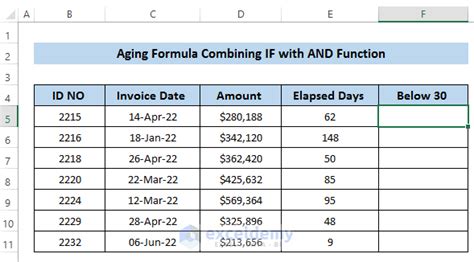

- Finance: The aging formula is used to calculate the age of accounts receivable and payable, allowing businesses to manage their cash flow effectively.

- Healthcare: The aging formula is used to calculate the age of patients, which helps in determining the risk of certain diseases and developing effective treatment plans.

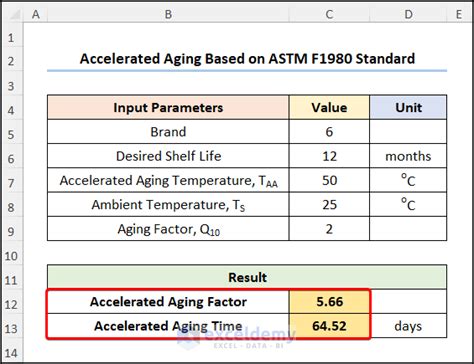

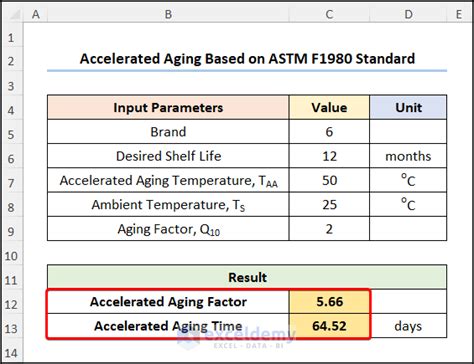

- Manufacturing: The aging formula is used to calculate the age of products, which helps in determining the shelf life and optimizing production.

Steps to Use the Aging Formula

Using the aging formula in Excel is a straightforward process. Here are the steps to follow:

- Enter the start date and end date in separate cells.

- Select the cell where you want to display the result.

- Type the formula

=DATEDIF(start_date, end_date, unit). - Press Enter to calculate the result.

Common Errors and Troubleshooting

When using the aging formula, you may encounter some common errors. Here are some troubleshooting tips:

- Check the date format: Ensure that the start and end dates are in the correct format.

- Verify the unit of time: Ensure that the unit of time is correct, as it can affect the result.

- Check for errors in the formula: Ensure that the formula is entered correctly, without any typos or syntax errors.

Best Practices for Using the Aging Formula

To get the most out of the aging formula, follow these best practices:

- Use the correct date format: Ensure that the start and end dates are in the correct format.

- Use the correct unit of time: Ensure that the unit of time is correct, as it can affect the result.

- Test the formula: Test the formula with different scenarios to ensure that it is working correctly.

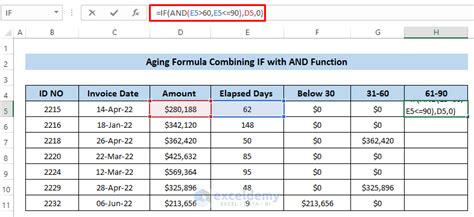

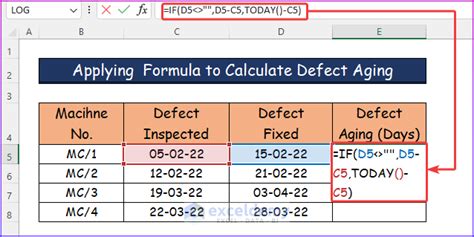

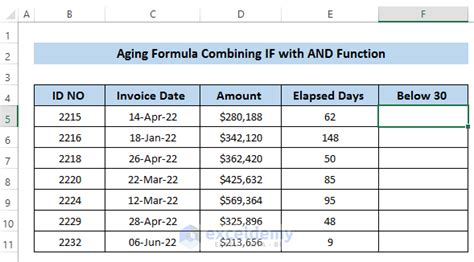

Real-World Examples of the Aging Formula

The aging formula has various real-world applications. Here are some examples:

- Calculating the age of a person: The aging formula can be used to calculate the age of a person, which is essential in determining the risk of certain diseases.

- Calculating the age of a product: The aging formula can be used to calculate the age of a product, which helps in determining the shelf life and optimizing production.

- Calculating the age of accounts receivable and payable: The aging formula can be used to calculate the age of accounts receivable and payable, allowing businesses to manage their cash flow effectively.

Gallery of Aging Formula Examples

Aging Formula Image Gallery

What is the aging formula in Excel?

+The aging formula in Excel is used to calculate the age of a person, product, or asset. It takes three arguments: the start date, the end date, and the unit of time.

How do I use the aging formula in Excel?

+To use the aging formula in Excel, enter the start date and end date in separate cells, select the cell where you want to display the result, and type the formula `=DATEDIF(start_date, end_date, unit)`. Press Enter to calculate the result.

What are the benefits of using the aging formula in Excel?

+The benefits of using the aging formula in Excel include accurate calculations, time-saving, flexibility, and ease of use. It provides accurate calculations, saves time and effort, and can be applied to various scenarios.

In conclusion, the aging formula in Excel is a powerful tool that can help you calculate the age of a person, product, or asset. By following the steps outlined in this article, you can use the aging formula to make informed decisions, identify trends, and optimize your operations. Whether you're a business owner, financial analyst, or healthcare professional, the aging formula is an essential tool to have in your toolkit. So, go ahead and give it a try – you might be surprised at how much you can achieve with this simple yet powerful formula! We encourage you to share your experiences, ask questions, or provide feedback on this article. Your input will help us create more informative and engaging content in the future.