Intro

The Annual Percentage Rate (APR) is a crucial concept in personal finance, as it helps individuals understand the true cost of borrowing money. Calculating APR can be complex, but fortunately, Excel provides a straightforward way to do so. In this article, we will explore the importance of APR, its calculation, and how to create an APR calculator in Excel.

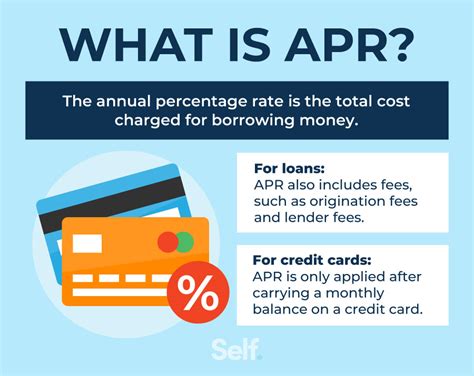

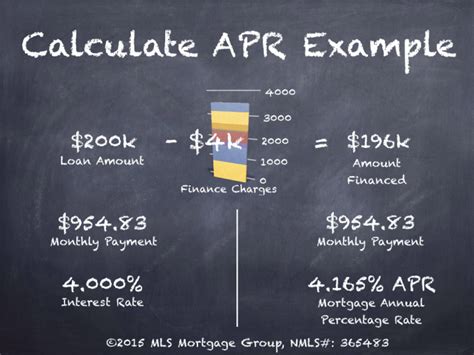

APR is a measure of the total cost of credit, including interest rates and fees, expressed as a yearly rate. It is essential to understand APR when taking out loans, credit cards, or other forms of credit, as it can significantly impact the overall cost of borrowing. A higher APR means that the borrower will pay more in interest and fees over the life of the loan.

Calculating APR manually can be time-consuming and prone to errors. However, with Excel, you can create a simple and accurate APR calculator. Before we dive into the calculation, let's discuss the importance of APR in personal finance. Understanding APR can help individuals make informed decisions when choosing credit products, such as loans or credit cards.

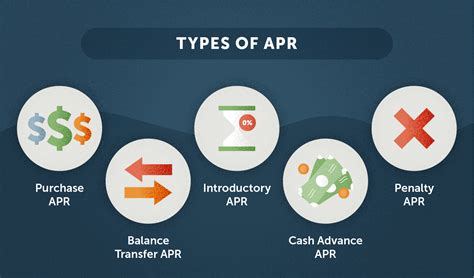

Understanding APR

APR takes into account the interest rate, fees, and compounding frequency to provide a comprehensive picture of the cost of credit. It is expressed as a percentage, and lenders are required to disclose the APR to borrowers. APR is calculated based on the following factors:

- Interest rate: The nominal interest rate charged on the loan or credit product.

- Fees: Any fees associated with the loan or credit product, such as origination fees or late payment fees.

- Compounding frequency: The frequency at which interest is compounded, such as monthly or annually.

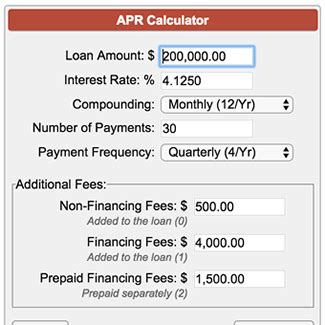

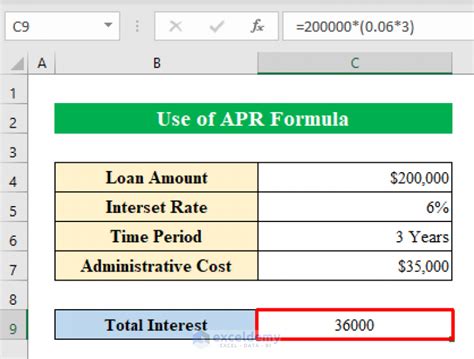

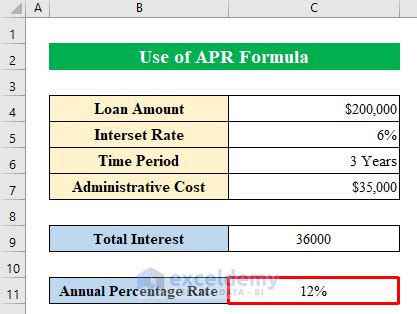

Calculating APR in Excel

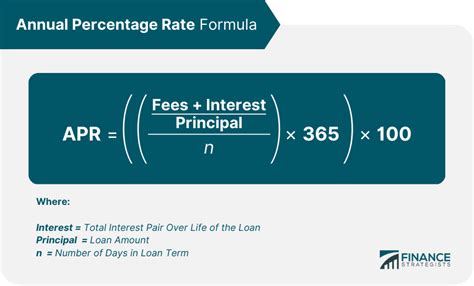

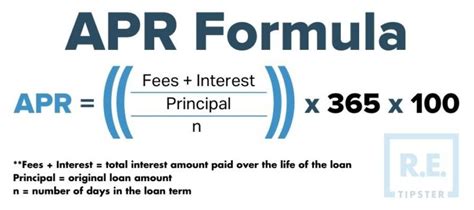

To calculate APR in Excel, you can use the following formula:

APR = (1 + (Interest Rate / Number of Compounding Periods))^Number of Compounding Periods - 1

Where:

- Interest Rate is the nominal interest rate charged on the loan or credit product.

- Number of Compounding Periods is the number of times interest is compounded per year.

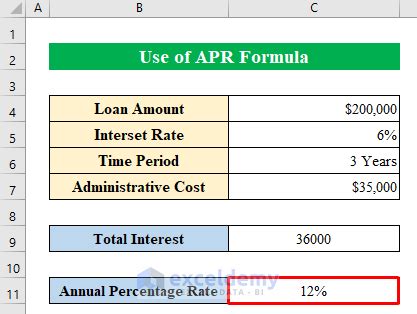

For example, if the interest rate is 12% and interest is compounded monthly, the APR would be:

APR = (1 + (0.12 / 12))^12 - 1 = 12.68%

This means that the borrower will pay an effective interest rate of 12.68% per year, taking into account the compounding frequency.

Creating an APR Calculator in Excel

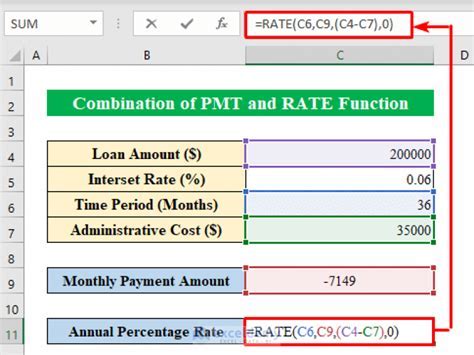

To create an APR calculator in Excel, follow these steps:

- Open a new Excel spreadsheet and create a table with the following columns:

- Interest Rate

- Number of Compounding Periods

- APR

- Enter the formula for calculating APR in the APR column:

=(1 + (A2 / B2))^B2 - 1, where A2 is the interest rate and B2 is the number of compounding periods. - Format the APR column to display the result as a percentage.

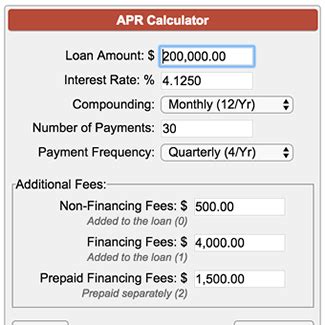

- Create a dropdown menu for the number of compounding periods, with options such as monthly, quarterly, or annually.

- Use the

IFfunction to adjust the number of compounding periods based on the selected option.

For example:

=IF(B2="Monthly", 12, IF(B2="Quarterly", 4, IF(B2="Annually", 1)))

This will adjust the number of compounding periods based on the selected option.

Using the APR Calculator

To use the APR calculator, simply enter the interest rate and select the number of compounding periods from the dropdown menu. The APR will be calculated automatically and displayed in the APR column.

For example, if the interest rate is 12% and interest is compounded monthly, the APR calculator will display an APR of 12.68%.

Benefits of Using an APR Calculator

Using an APR calculator can help individuals make informed decisions when choosing credit products. By understanding the true cost of credit, borrowers can:

- Compare different credit products and choose the one with the lowest APR.

- Avoid hidden fees and charges.

- Make informed decisions about loan terms and repayment schedules.

Common Mistakes to Avoid

When using an APR calculator, it's essential to avoid common mistakes, such as:

- Not considering all fees and charges associated with the loan or credit product.

- Not taking into account the compounding frequency.

- Not comparing different credit products and choosing the one with the lowest APR.

By avoiding these mistakes, individuals can ensure that they are making informed decisions about their credit products and avoiding costly mistakes.

Gallery of APR Calculators

APR Calculator Image Gallery

Frequently Asked Questions

What is APR?

+APR stands for Annual Percentage Rate, which is the total cost of credit, including interest rates and fees, expressed as a yearly rate.

How is APR calculated?

+APR is calculated based on the interest rate, fees, and compounding frequency.

Why is APR important?

+APR is important because it helps individuals understand the true cost of credit and make informed decisions when choosing credit products.

Can I use an APR calculator to compare different credit products?

+Yes, an APR calculator can help you compare different credit products and choose the one with the lowest APR.

Are there any common mistakes to avoid when using an APR calculator?

+Yes, common mistakes to avoid include not considering all fees and charges, not taking into account the compounding frequency, and not comparing different credit products.

In conclusion, creating an APR calculator in Excel is a straightforward process that can help individuals make informed decisions about their credit products. By understanding the true cost of credit, borrowers can avoid costly mistakes and choose the credit product that best suits their needs. We encourage you to share your experiences with APR calculators and provide feedback on this article. If you have any questions or need further clarification, please don't hesitate to ask.