Intro

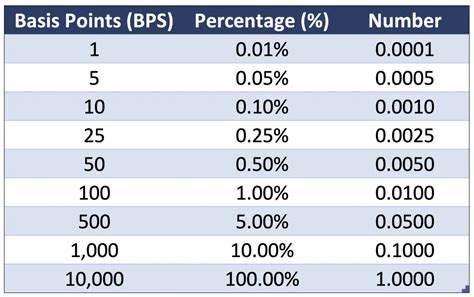

The basis points calculator is a valuable tool in finance, used to calculate the difference in yield between two securities or the change in yield of a single security over time. Basis points are a unit of measurement, where 1 basis point equals 0.01% or 0.0001 in decimal form. Understanding and calculating basis points is crucial for investors, financial analysts, and traders to assess the performance and risk of investments.

In the realm of finance, the ability to quickly and accurately calculate basis points can make a significant difference in decision-making. One of the most efficient ways to perform these calculations is by using Excel, a powerful spreadsheet software that offers a wide range of financial functions. Excel's flexibility and the ease with which one can set up formulas make it an ideal platform for creating a basis points calculator.

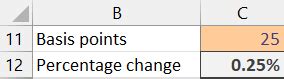

To delve into the world of basis points and understand how to create a basis points calculator in Excel, it's essential to grasp the basic concept of basis points and their importance in financial markets. Basis points are used to express the difference in interest rates or yields of different financial instruments, such as bonds, loans, or credit cards. For example, if a bond's yield increases from 5% to 5.25%, it has increased by 25 basis points.

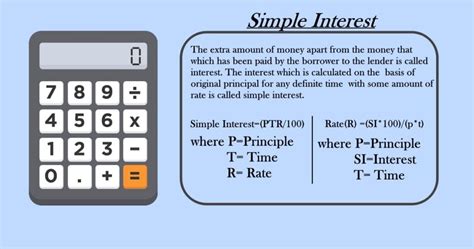

The calculation of basis points involves simple arithmetic. If you're comparing two interest rates, you subtract the lower rate from the higher rate and then multiply by 100 to convert the decimal to a percentage, and further to basis points. For instance, to find the difference in basis points between a 4.5% and a 4.7% interest rate, you calculate (4.7% - 4.5%) * 100 = 0.2%, which is equivalent to 20 basis points.

Setting Up a Basis Points Calculator in Excel

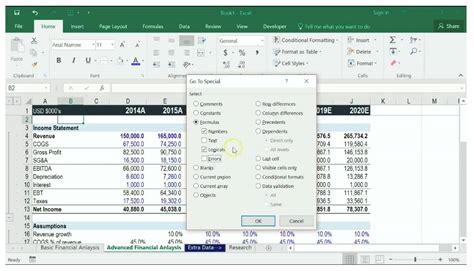

Creating a basis points calculator in Excel is straightforward and requires setting up a simple spreadsheet with input fields for the two interest rates you want to compare and a formula to calculate the difference in basis points. Here's a step-by-step guide:

- Open Excel and create a new spreadsheet.

- Set up input fields for the two interest rates. For example, in cells A1 and A2, you can label "Interest Rate 1" and "Interest Rate 2", respectively. In cells B1 and B2, you'll input the actual rates.

- Create a formula to calculate the difference in basis points. In a new cell, say B3, you can use the formula

=(B2-B1)*100to calculate the percentage difference, and since 1% equals 100 basis points, this formula directly gives you the difference in basis points. - Refine your calculator for better usability. You can add more functionality, such as automatically converting percentages to decimals if your inputs are in percentage form, or setting up the calculator to handle multiple comparisons at once.

Advanced Basis Points Calculations in Excel

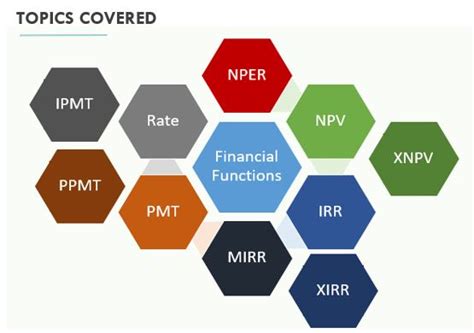

While the basic calculation of basis points is straightforward, financial scenarios often require more complex analyses, such as calculating the basis point value of a bond or determining the impact of a change in interest rates on a portfolio. Excel's array of financial functions, including the PRICE, YIELD, and MDURATION functions, can be invaluable in these calculations.

For instance, the YIELD function in Excel can be used to calculate the yield of a bond, given its price, maturity, and other characteristics. By comparing the yields of two bonds or the yield of a bond at two different times, you can calculate the difference in basis points, providing insight into the bond's performance or the effect of market changes.

Using Excel for Basis Points Value Calculation

The basis point value (BPV) of a bond, also known as the dollar value of a basis point, measures the change in the bond's price for a one basis point change in yield. Calculating BPV involves using the bond's modified duration, which can be found using Excel's MDURATION function. The formula for BPV is BPV = Modified Duration * Price / 100.

By using Excel to calculate the BPV, investors and analysts can better understand the sensitivity of a bond or a portfolio to changes in interest rates, allowing for more informed investment decisions.

Best Practices for Using Excel in Financial Calculations

When using Excel for financial calculations, including basis points calculations, several best practices can enhance accuracy and efficiency:

- Use built-in financial functions: Excel offers a range of financial functions that can simplify complex calculations.

- Validate inputs: Ensure that the numbers you're inputting are correct and in the right format.

- Test formulas: Always test your formulas with known values to ensure they're working as expected.

- Keep it simple: Avoid overly complex spreadsheets. Break down calculations into simpler, more manageable parts.

- Document your work: Use comments or notes to explain what each part of your spreadsheet does, making it easier for others (or yourself in the future) to understand.

Gallery of Basis Points Calculators and Financial Tools

Basis Points Calculators and Financial Tools Image Gallery

Frequently Asked Questions

What is a basis point in finance?

+A basis point is a unit of measurement equal to 0.01% or 0.0001 in decimal form, used to express the difference in interest rates or yields of financial instruments.

How do I calculate basis points in Excel?

+To calculate basis points in Excel, subtract the lower interest rate from the higher rate and multiply by 100. For example, if you're comparing 4.5% and 4.7%, the formula would be =(4.7%-4.5%)*100, resulting in 20 basis points.

What is the basis point value (BPV) of a bond?

+The basis point value (BPV) measures the change in a bond's price for a one basis point change in yield. It's calculated using the bond's modified duration and price.

In conclusion, mastering the basis points calculator in Excel is a fundamental skill for anyone involved in finance, offering a powerful tool for analyzing and comparing financial instruments. By understanding how to set up and use a basis points calculator, and by leveraging Excel's financial functions, individuals can make more informed decisions and navigate the complex world of finance with greater ease. Whether you're an investor, analyst, or student of finance, the ability to calculate and understand basis points is indispensable, providing a deeper insight into the workings of financial markets and the performance of investments.