Intro

Create a Biweekly Amortization Schedule in Excel to manage loan repayments, calculate interest rates, and track payment schedules with ease, using mortgage calculators and spreadsheet templates.

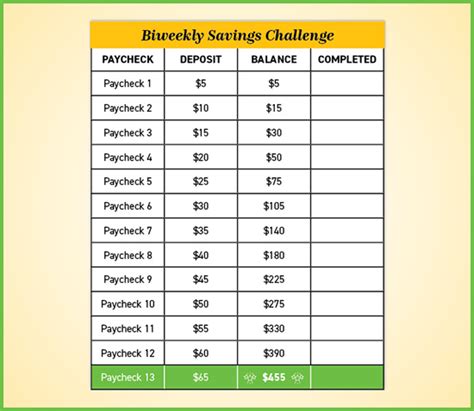

Creating a biweekly amortization schedule in Excel can be a valuable tool for managing loans, such as mortgages, car loans, or personal loans, where payments are made every two weeks instead of the traditional monthly payment schedule. This approach can help in paying off the loan faster and reducing the total interest paid over the life of the loan. Here's how you can set up a basic biweekly amortization schedule in Excel.

First, it's essential to understand the components involved in creating an amortization schedule. These include the loan amount (principal), the annual interest rate, and the loan term (the number of years you have to repay the loan). For a biweekly schedule, you'll also need to calculate how many biweekly payments you'll make in a year, which is 26.

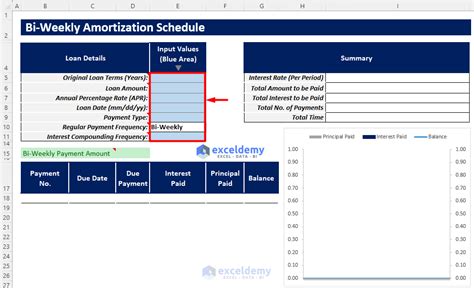

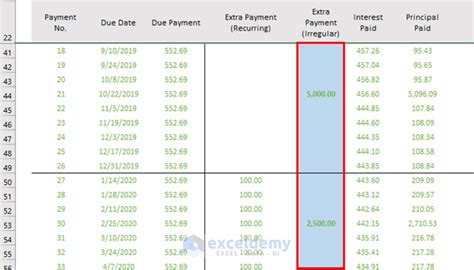

To start, open a new Excel spreadsheet and set up the following columns: Payment Number, Payment Date, Beginning Balance, Payment, Interest, Principal, and Ending Balance. You'll also need to input your loan details at the top of the sheet for easy reference.

Setting Up the Biweekly Amortization Schedule

- Input Loan Details: At the top of your Excel sheet, create cells for the loan amount, annual interest rate, and loan term in years.

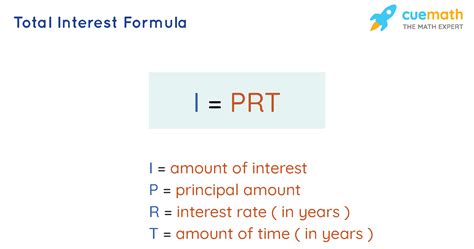

- Calculate Biweekly Payment: The formula to calculate the biweekly payment (PMT) is

PMT = P [ i(1 + i)^n ] / [ (1 + i)^n – 1], where P is the principal loan amount, i is the monthly interest rate (annual rate divided by 12 and then by 2 for biweekly), and n is the total number of payments (loan term in years * 26). You can use Excel's PMT function:=PMT(rate, nper, pv), adjusting the rate and nper for biweekly payments. - Create the Schedule: Start your schedule below the input section. The first row under the headers will be for the initial loan details (Payment Number 1, Beginning Balance as the loan amount, $0 for Payment, Interest, and Principal, and the Ending Balance the same as the Beginning Balance).

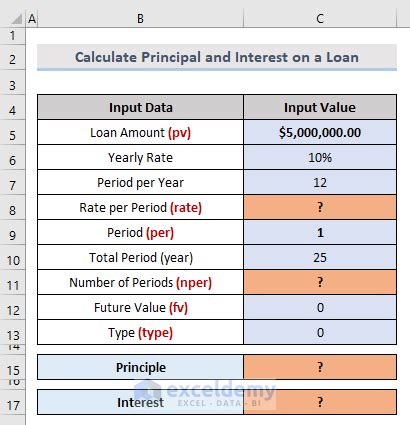

Calculating Interest and Principal

For each subsequent payment:

- The Payment Number increments by 1.

- The Payment Date can be calculated by adding 14 days to the previous payment date.

- The Interest for the period is calculated as the Beginning Balance * (annual interest rate / 26).

- The Principal paid is the Payment - Interest.

- The Ending Balance is the Beginning Balance - Principal.

Using Excel Formulas for Automation

To automate the process:

- Interest Calculation:

=Beginning Balance*(Annual Interest Rate/26). - Principal Calculation:

=Biweekly Payment-Interest. - Ending Balance:

=Beginning Balance-Principal. - Drag and Drop: Once you've set up the formulas for the first payment, you can drag the formulas down for all subsequent payments.

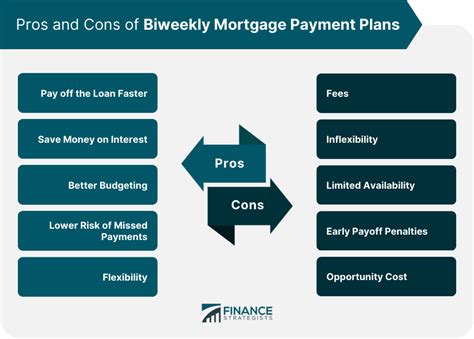

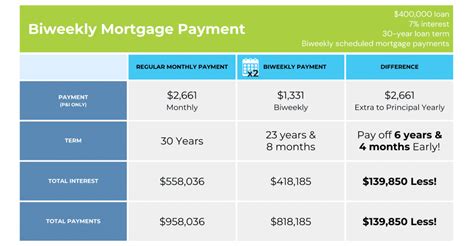

Benefits of Biweekly Payments

Making biweekly payments instead of monthly payments can significantly reduce the total interest paid over the life of the loan and shorten the loan term. This is because you're making 26 payments a year instead of 12, which means you're paying more towards the principal each year.

Customizing Your Schedule

You can customize your biweekly amortization schedule further by considering factors such as:

- Extra payments: Adding an extra payment or two each year can further reduce the loan term and total interest.

- Interest rate changes: If your loan has a variable interest rate, you'll need to adjust the schedule when the rate changes.

Gallery of Biweekly Amortization Schedules

Biweekly Amortization Schedule Examples

What is a biweekly amortization schedule?

+A biweekly amortization schedule is a table that outlines the payments, interest, and principal paid towards a loan over its term, with payments made every two weeks.

How does making biweekly payments affect my loan?

+Making biweekly payments can reduce the total interest paid and shorten the loan term because you're making more payments per year compared to monthly payments.

Can I use Excel to create a customized biweekly amortization schedule for my specific loan?

+Yes, Excel can be used to create a customized schedule by inputting your loan details and using formulas to calculate payments, interest, and principal.

In conclusion, creating a biweekly amortization schedule in Excel is a straightforward process that can provide valuable insights into your loan payments and help you manage your finances more effectively. By understanding how biweekly payments work and using the right tools, you can make informed decisions about your loans and potentially save money on interest over the life of the loan. We invite you to share your experiences with biweekly amortization schedules or ask any questions you may have in the comments below. Additionally, feel free to share this article with anyone who might benefit from learning more about managing their loans more efficiently.