Intro

Calculate treasury bill returns with ease using a T Bill Calculator Excel. Discover 5 ways to leverage Excel for treasury bill investments, including yield calculations and maturity dates, to optimize your financial portfolio and maximize returns.

The importance of accurately calculating the return on investment for treasury bills cannot be overstated. Treasury bills, or T-bills, are short-term debt obligations issued by governments to finance their operations. They are considered to be one of the safest investments, as they are backed by the full faith and credit of the issuing government. However, to make informed investment decisions, it is crucial to understand the return on investment for these securities. This is where a T-bill calculator comes into play, and when combined with the power of Excel, it becomes an indispensable tool for investors.

The use of a T-bill calculator in Excel provides a straightforward and efficient way to calculate the return on investment for treasury bills. By inputting a few key pieces of information, such as the face value of the T-bill, the purchase price, and the number of days until maturity, the calculator can provide the investor with a clear picture of their potential return. This information is vital for making informed investment decisions and can help investors to maximize their returns.

In addition to its practical applications, a T-bill calculator in Excel also offers a range of benefits for investors. For one, it allows for quick and easy calculations, eliminating the need for manual calculations that can be time-consuming and prone to error. Furthermore, the calculator can be easily customized to meet the specific needs of the investor, allowing for a range of different scenarios to be modeled and analyzed. This flexibility makes the T-bill calculator an essential tool for anyone looking to invest in treasury bills.

Understanding T-Bill Calculators

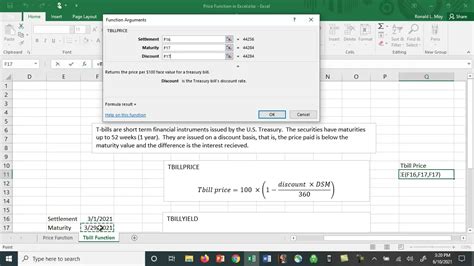

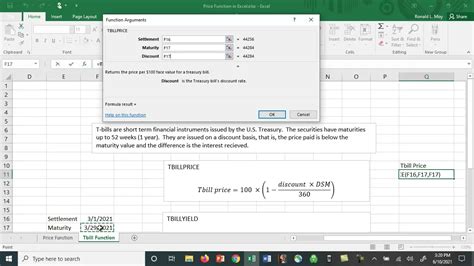

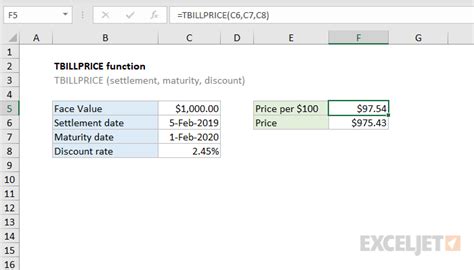

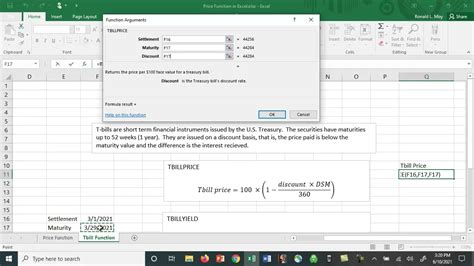

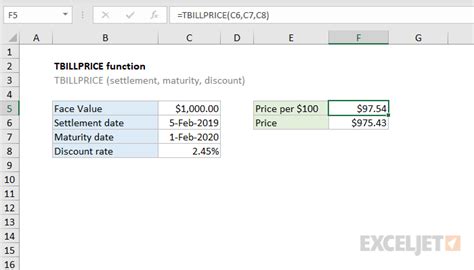

To understand how a T-bill calculator works in Excel, it is first necessary to grasp the basic principles of treasury bill investing. T-bills are issued with a face value, which is the amount that will be paid to the investor at maturity. However, they are typically sold at a discount to their face value, with the difference between the purchase price and the face value representing the return on investment. The calculator takes this information and uses it to calculate the return on investment, providing the investor with a clear picture of their potential earnings.

Key Components of a T-Bill Calculator

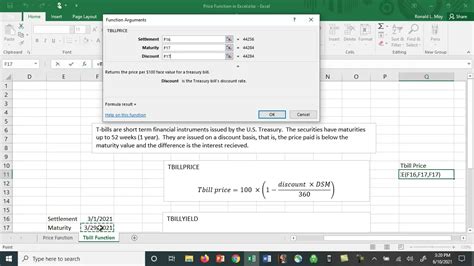

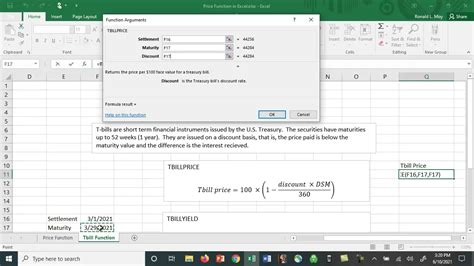

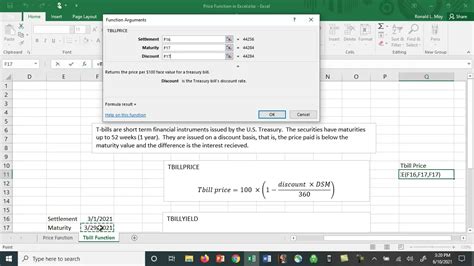

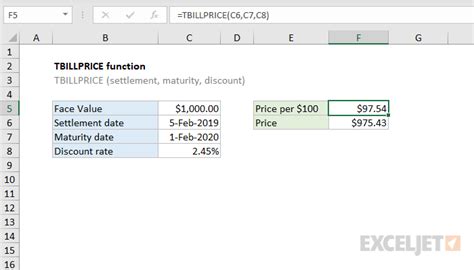

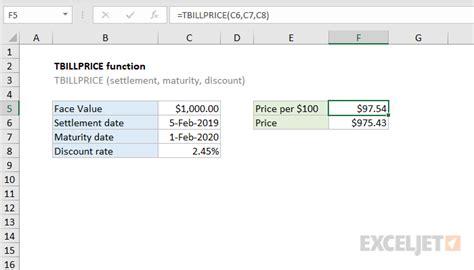

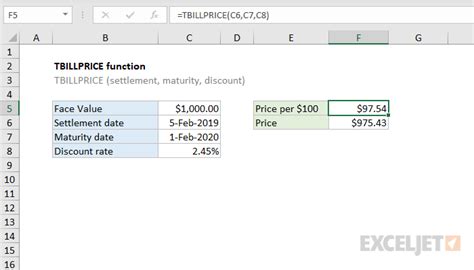

The key components of a T-bill calculator in Excel include the face value of the T-bill, the purchase price, and the number of days until maturity. By inputting these values into the calculator, the investor can quickly and easily determine their potential return on investment. The calculator can also be customized to include additional information, such as the interest rate and the compounding frequency, allowing for a more detailed analysis of the investment.Creating a T-Bill Calculator in Excel

Creating a T-bill calculator in Excel is a relatively straightforward process. The first step is to set up a spreadsheet with the necessary columns, including the face value, purchase price, and number of days until maturity. The next step is to create formulas that will calculate the return on investment, using the input values to determine the potential earnings. This can be done using a range of different formulas, including the formula for simple interest and the formula for compound interest.

Using Formulas to Calculate Return on Investment

The formulas used to calculate the return on investment for a T-bill will depend on the specific characteristics of the investment. For example, if the T-bill is issued with a fixed interest rate, the formula for simple interest can be used to calculate the return on investment. This formula is as follows: Interest = Principal x Rate x Time. By plugging in the values for the principal, rate, and time, the investor can quickly and easily determine their potential earnings.5 Ways to Use a T-Bill Calculator in Excel

There are a range of different ways to use a T-bill calculator in Excel, depending on the specific needs and goals of the investor. Here are five ways to use a T-bill calculator:

- Calculating Return on Investment: The most basic use of a T-bill calculator is to calculate the return on investment for a given T-bill. By inputting the face value, purchase price, and number of days until maturity, the calculator can provide the investor with a clear picture of their potential earnings.

- Comparing Different Investment Options: A T-bill calculator can also be used to compare different investment options. By inputting the characteristics of different T-bills, the investor can quickly and easily determine which investment offers the highest return on investment.

- Analyzing the Impact of Interest Rates: The calculator can also be used to analyze the impact of interest rates on the return on investment. By inputting different interest rates, the investor can see how changes in interest rates will affect their potential earnings.

- Determining the Optimal Investment Strategy: A T-bill calculator can also be used to determine the optimal investment strategy. By inputting different investment scenarios, the investor can see which strategy offers the highest return on investment.

- Monitoring Investment Performance: Finally, a T-bill calculator can be used to monitor investment performance over time. By tracking the return on investment for a given T-bill, the investor can see how their investment is performing and make adjustments as necessary.

Benefits of Using a T-Bill Calculator

The benefits of using a T-bill calculator in Excel are numerous. For one, it allows for quick and easy calculations, eliminating the need for manual calculations that can be time-consuming and prone to error. Furthermore, the calculator can be easily customized to meet the specific needs of the investor, allowing for a range of different scenarios to be modeled and analyzed.Gallery of T-Bill Calculators

T-Bill Calculator Image Gallery

Frequently Asked Questions

What is a T-bill calculator?

+A T-bill calculator is a tool used to calculate the return on investment for treasury bills.

How do I use a T-bill calculator in Excel?

+To use a T-bill calculator in Excel, simply input the face value, purchase price, and number of days until maturity, and the calculator will provide the return on investment.

What are the benefits of using a T-bill calculator?

+The benefits of using a T-bill calculator include quick and easy calculations, customization, and the ability to compare different investment options.

Can I use a T-bill calculator to compare different investment options?

+Yes, a T-bill calculator can be used to compare different investment options by inputting the characteristics of different T-bills and comparing the returns on investment.

Is a T-bill calculator available for free?

+Yes, there are many free T-bill calculators available online, including templates and software that can be downloaded and used in Excel.

In conclusion, a T-bill calculator is a valuable tool for anyone looking to invest in treasury bills. By providing a quick and easy way to calculate the return on investment, the calculator can help investors to make informed decisions and maximize their returns. Whether you are a seasoned investor or just starting out, a T-bill calculator is an essential tool to have in your investment arsenal. We invite you to share your thoughts and experiences with T-bill calculators in the comments below, and to share this article with anyone who may be interested in learning more about this valuable investment tool.