Intro

Calculate bond prices with ease using the Bond Price Excel function, incorporating yield to maturity, coupon rates, and face value, for accurate investment analysis and valuation.

The bond price excel function is a crucial tool for investors and financial analysts to calculate the price of a bond. Bonds are debt securities issued by corporations or governments to raise capital, and their prices fluctuate based on various market and economic factors. Understanding how to calculate bond prices using Excel functions can help investors make informed decisions about their investments.

In the world of finance, bonds are a popular investment option due to their relatively low risk and fixed income streams. However, calculating the price of a bond can be complex, involving various factors such as the bond's face value, coupon rate, yield to maturity, and time to maturity. Fortunately, Excel provides several functions that can simplify this process, including the bond price function.

To calculate the price of a bond in Excel, you can use the PRICE function, which takes into account the bond's settlement date, maturity date, coupon rate, yield to maturity, and redemption value. The PRICE function returns the price of the bond per $100 of face value, which can then be multiplied by the face value to get the total price.

The bond price excel function is essential for investors who want to determine the current market value of their bond holdings. By using this function, investors can calculate the price of their bonds and make informed decisions about whether to buy, sell, or hold their investments. Additionally, financial analysts can use the bond price function to analyze the performance of bonds and make recommendations to clients.

In the following sections, we will delve deeper into the world of bond pricing and explore the various Excel functions that can be used to calculate bond prices. We will also provide examples and illustrations to help readers understand how to use these functions in practice.

Understanding Bond Pricing

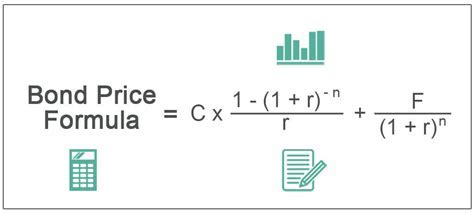

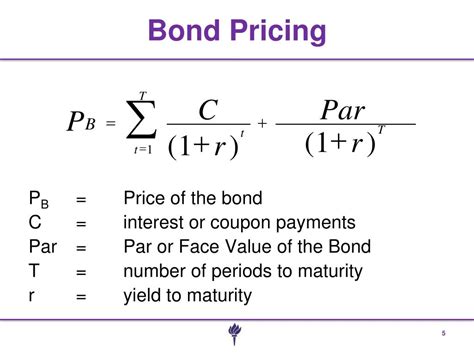

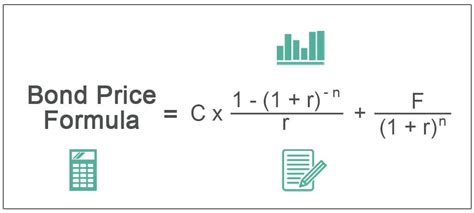

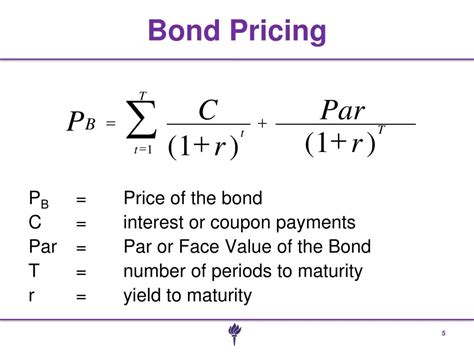

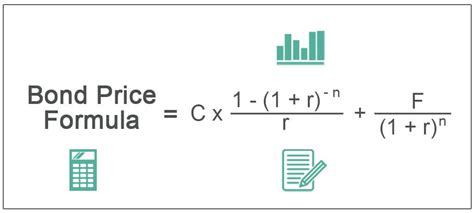

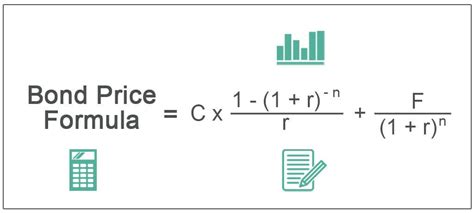

Bond pricing involves calculating the present value of a bond's future cash flows, including the coupon payments and the return of the principal at maturity. The bond price excel function takes into account several factors, including the bond's face value, coupon rate, yield to maturity, and time to maturity. The face value, also known as the par value, is the amount that the bondholder will receive at maturity. The coupon rate is the interest rate that the bond pays periodically, usually semiannually or annually. The yield to maturity is the rate of return that an investor can expect to earn from the bond, taking into account the bond's current market price and its future cash flows.

Factors Affecting Bond Prices

The price of a bond is affected by several factors, including: * Changes in interest rates: When interest rates rise, the price of existing bonds with lower coupon rates tends to fall, and vice versa. * Changes in credit risk: If the creditworthiness of the bond issuer improves or deteriorates, the bond price will adjust accordingly. * Time to maturity: The longer the time to maturity, the more sensitive the bond price is to changes in interest rates. * Coupon rate: The higher the coupon rate, the higher the bond price, all else being equal.Bond Price Excel Function

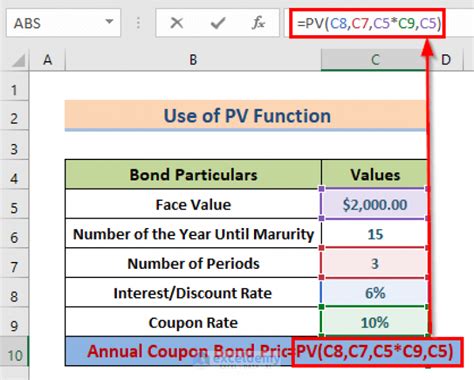

The bond price excel function is PRICE(settlement, maturity, rate, yld, redemption, frequency, [basis]), where:

settlementis the settlement date of the bond.maturityis the maturity date of the bond.rateis the annual coupon rate.yldis the annual yield to maturity.redemptionis the redemption value per $100 of face value.frequencyis the number of coupon payments per year.[basis]is an optional argument that specifies the day count basis to use.

The PRICE function returns the price of the bond per $100 of face value, which can then be multiplied by the face value to get the total price.

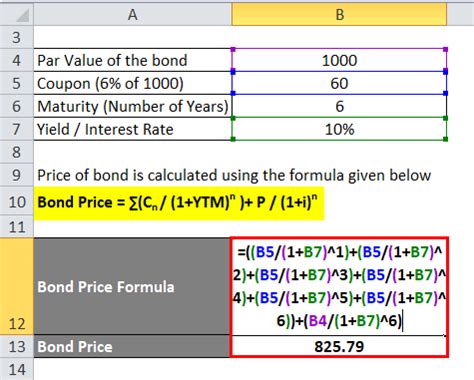

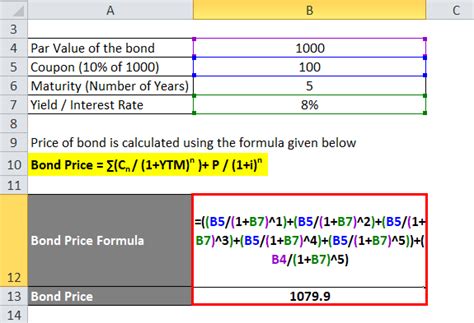

Example of Bond Price Calculation

Suppose we want to calculate the price of a bond with the following characteristics: * Face value: $1,000 * Coupon rate: 5% * Yield to maturity: 6% * Time to maturity: 5 years * Settlement date: January 1, 2023 * Maturity date: January 1, 2028 * Redemption value: $100Using the PRICE function, we can calculate the bond price as follows:

PRICE(A1, A2, 0.05, 0.06, 100, 2, 0), where A1 is the settlement date and A2 is the maturity date.

The result is the price of the bond per $100 of face value, which can then be multiplied by the face value to get the total price.

Other Excel Functions for Bond Pricing

In addition to the PRICE function, Excel provides several other functions that can be used for bond pricing, including:

YIELD: Returns the yield to maturity of a bond.DURATION: Returns the duration of a bond, which is a measure of its sensitivity to changes in interest rates.MDURATION: Returns the modified duration of a bond, which is a measure of its sensitivity to changes in interest rates.

These functions can be used to analyze the performance of bonds and make informed decisions about investments.

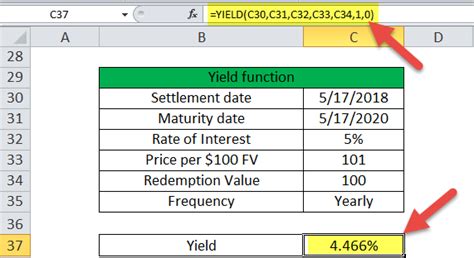

Example of Bond Yield Calculation

Suppose we want to calculate the yield to maturity of a bond with the following characteristics: * Face value: $1,000 * Coupon rate: 5% * Price: $950 * Time to maturity: 5 years * Settlement date: January 1, 2023 * Maturity date: January 1, 2028Using the YIELD function, we can calculate the yield to maturity as follows:

YIELD(A1, A2, 0.05, 950, 100, 2, 0), where A1 is the settlement date and A2 is the maturity date.

The result is the yield to maturity of the bond.

Gallery of Bond Pricing Formulas

Bond Pricing Formulas

Frequently Asked Questions

What is the bond price excel function?

+The bond price excel function is `PRICE(settlement, maturity, rate, yld, redemption, frequency, [basis])`, which returns the price of a bond per $100 of face value.

How do I calculate the yield to maturity of a bond in Excel?

+You can use the `YIELD` function in Excel to calculate the yield to maturity of a bond. The syntax is `YIELD(settlement, maturity, rate, price, redemption, frequency, [basis])`.

What is the difference between the `PRICE` and `YIELD` functions in Excel?

+The `PRICE` function returns the price of a bond per $100 of face value, while the `YIELD` function returns the yield to maturity of a bond.

In conclusion, the bond price excel function is a powerful tool for investors and financial analysts to calculate the price of a bond. By understanding how to use this function, investors can make informed decisions about their investments and analyze the performance of bonds. With the help of Excel functions, bond pricing can be simplified, and investors can gain a deeper understanding of the bond market. We encourage readers to share their experiences and tips on using the bond price excel function in the comments section below.