Intro

Calculating the payback period is a crucial step in evaluating the feasibility of an investment or project. The payback period is the time it takes for an investment to generate cash flows that equal its initial cost, thereby "paying back" the investment. In this article, we will delve into the importance of calculating the payback period, its benefits, and how to calculate it using Excel.

The payback period is an essential metric because it helps investors and businesses understand the risk associated with an investment. A shorter payback period indicates lower risk, as the investment is expected to generate returns more quickly. Conversely, a longer payback period suggests higher risk, as it may take more time for the investment to yield returns. Understanding the payback period is vital for making informed investment decisions.

Calculating the payback period can be done using various methods, including the simple payback period, discounted payback period, and payback period with uneven cash flows. The simple payback period is the most straightforward method, which calculates the payback period based on the initial investment and expected cash flows. The discounted payback period takes into account the time value of money, providing a more accurate calculation. The payback period with uneven cash flows is used when the cash flows are not uniform over the years.

Benefits of Calculating Payback Period

Calculating the payback period offers several benefits, including:

- Evaluating investment risk: The payback period helps investors understand the risk associated with an investment, enabling them to make informed decisions.

- Comparing investments: The payback period allows investors to compare different investment opportunities and choose the one with the shortest payback period.

- Identifying cash flow: The payback period calculation helps identify the cash flows generated by an investment, which is essential for evaluating its viability.

- Simplifying investment decisions: The payback period provides a simple and straightforward metric for evaluating investments, making it easier for investors to make decisions.

How to Calculate Payback Period in Excel

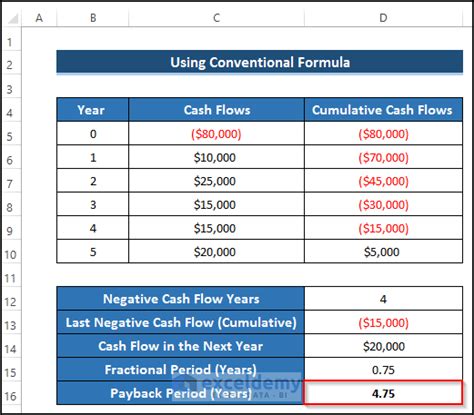

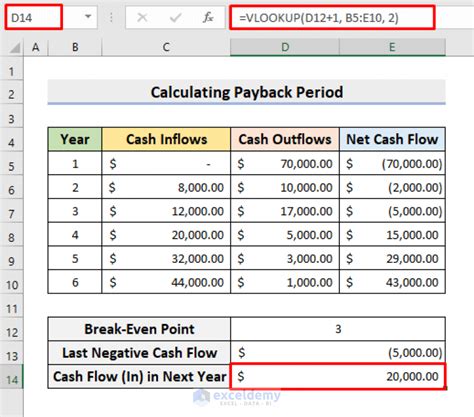

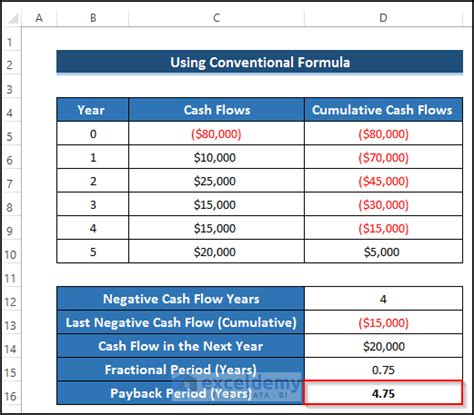

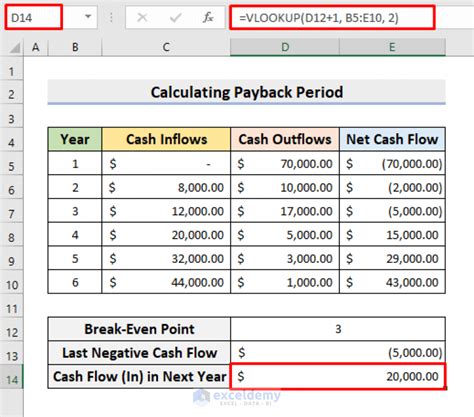

Calculating the payback period in Excel is a straightforward process that involves using formulas and functions. Here's a step-by-step guide: 1. Enter the initial investment: Start by entering the initial investment amount in a cell. 2. Enter the expected cash flows: Enter the expected cash flows for each year in separate cells. 3. Calculate the cumulative cash flows: Use the formula `=SUM(B2:B5)` to calculate the cumulative cash flows, where B2:B5 represents the range of cells containing the cash flows. 4. Determine the payback period: Use the formula `=YEARFRAC(A2,A3)` to calculate the payback period, where A2 represents the initial investment and A3 represents the cumulative cash flows.Using Excel Formulas to Calculate Payback Period

Excel provides various formulas and functions that can be used to calculate the payback period, including:

YEARFRAC: This function calculates the fraction of a year, which can be used to determine the payback period.SUM: This function calculates the sum of a range of cells, which can be used to calculate the cumulative cash flows.IF: This function is used to test a condition and return a value if true or false, which can be used to determine the payback period.

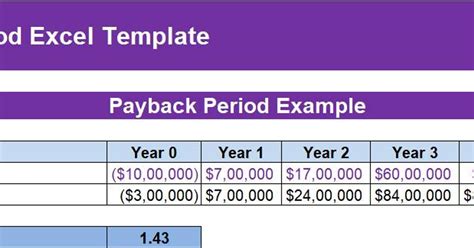

Example of Calculating Payback Period in Excel

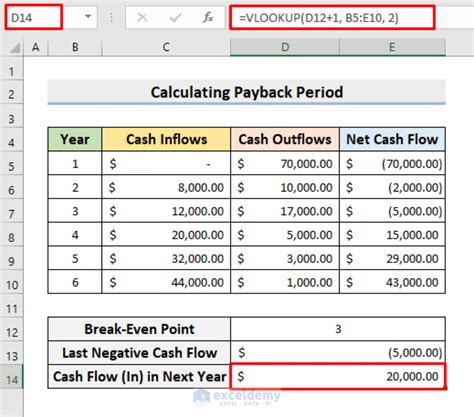

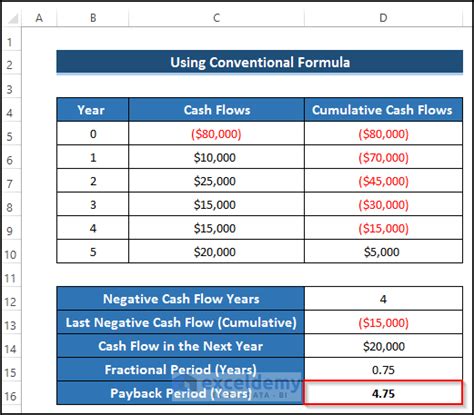

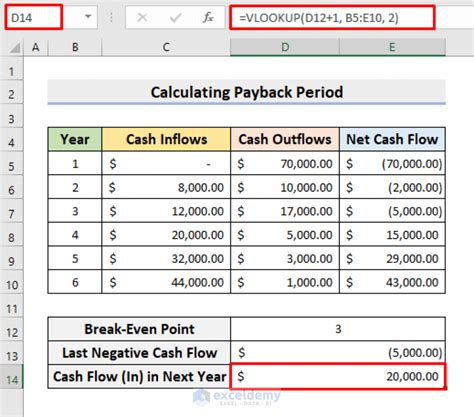

Suppose an investor wants to calculate the payback period for an investment with an initial cost of $100,000 and expected cash flows of $20,000, $30,000, $40,000, and $50,000 for the next four years. Using the steps outlined above, the investor can calculate the payback period as follows: 1. Enter the initial investment: $100,000 2. Enter the expected cash flows: $20,000, $30,000, $40,000, $50,000 3. Calculate the cumulative cash flows: $20,000, $50,000, $90,000, $140,000 4. Determine the payback period: 2.5 yearsCalculating Payback Period with Uneven Cash Flows

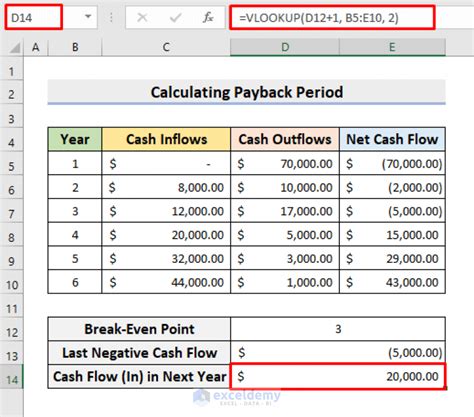

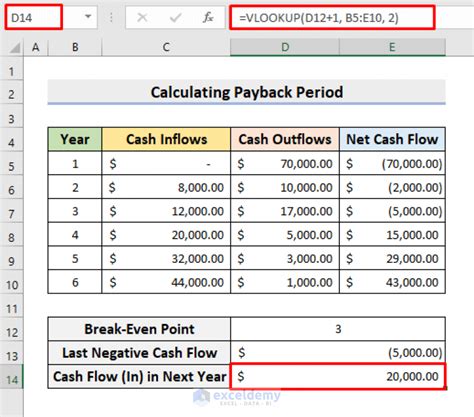

Calculating the payback period with uneven cash flows requires a more complex approach. Here's a step-by-step guide:

- Enter the initial investment: Start by entering the initial investment amount in a cell.

- Enter the expected cash flows: Enter the expected cash flows for each year in separate cells.

- Calculate the cumulative cash flows: Use the formula

=SUM(B2:B5)to calculate the cumulative cash flows, where B2:B5 represents the range of cells containing the cash flows. - Determine the payback period: Use the formula

=INDEX(A2:A5,MATCH(TRUE,INDEX((B2:B5>=A1),0),0))to calculate the payback period, where A2:A5 represents the range of cells containing the cumulative cash flows, A1 represents the initial investment, and B2:B5 represents the range of cells containing the cash flows.

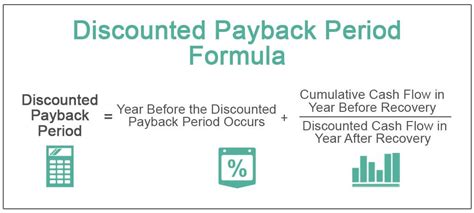

Discounted Payback Period

The discounted payback period takes into account the time value of money, providing a more accurate calculation. Here's a step-by-step guide: 1. Enter the initial investment: Start by entering the initial investment amount in a cell. 2. Enter the expected cash flows: Enter the expected cash flows for each year in separate cells. 3. Calculate the present value of cash flows: Use the formula `=PV(RATE,NPER,PMT,FV)` to calculate the present value of cash flows, where RATE represents the discount rate, NPER represents the number of periods, PMT represents the cash flows, and FV represents the future value. 4. Determine the payback period: Use the formula `=YEARFRAC(A2,A3)` to calculate the payback period, where A2 represents the initial investment and A3 represents the cumulative present value of cash flows.Gallery of Payback Period Calculations

Payback Period Image Gallery

Frequently Asked Questions

What is the payback period?

+The payback period is the time it takes for an investment to generate cash flows that equal its initial cost.

How do I calculate the payback period in Excel?

+To calculate the payback period in Excel, enter the initial investment, expected cash flows, and use the formula =YEARFRAC(A2,A3) to determine the payback period.

What is the discounted payback period?

+The discounted payback period takes into account the time value of money, providing a more accurate calculation of the payback period.

How do I calculate the payback period with uneven cash flows?

+To calculate the payback period with uneven cash flows, enter the initial investment, expected cash flows, and use the formula =INDEX(A2:A5,MATCH(TRUE,INDEX((B2:B5>=A1),0),0)) to determine the payback period.

What are the benefits of calculating the payback period?

+The benefits of calculating the payback period include evaluating investment risk, comparing investments, identifying cash flow, and simplifying investment decisions.

In conclusion, calculating the payback period is a crucial step in evaluating the feasibility of an investment or project. By understanding the payback period, investors and businesses can make informed decisions and minimize risk. Using Excel to calculate the payback period provides a straightforward and efficient method for evaluating investments. We hope this article has provided you with a comprehensive understanding of the payback period and its calculation in Excel. If you have any further questions or would like to share your experiences with calculating the payback period, please comment below.