Intro

Master 5 essential Excel tax bracket formulas to calculate income tax, deductions, and exemptions, utilizing IF, VLOOKUP, and INDEX functions for accurate tax calculations and financial planning.

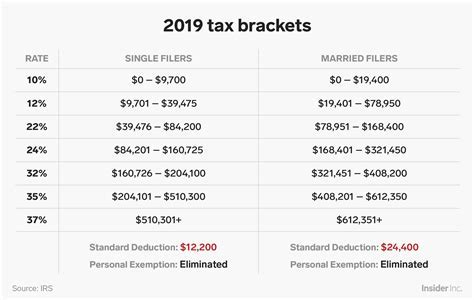

The importance of understanding tax brackets cannot be overstated, especially for individuals and businesses looking to maximize their financial efficiency. Tax brackets are the ranges of income that are subject to different tax rates, and they can significantly impact one's financial planning and decision-making. With the ever-changing landscape of tax laws and regulations, staying informed about the latest tax brackets and how to calculate them is crucial. In this article, we will delve into the world of Excel tax bracket formulas, exploring how to use these powerful tools to simplify tax calculations and make more informed financial decisions.

Understanding tax brackets is not just about knowing the tax rates; it's also about understanding how these rates apply to different levels of income. The progressive tax system means that as income increases, the tax rate applied to the last dollar earned is higher than the rate applied to the first dollar. This is where Excel tax bracket formulas come into play, offering a straightforward and efficient way to calculate taxes based on income and tax brackets. Whether you're a financial professional or an individual looking to better manage your finances, mastering these formulas can be incredibly beneficial.

The use of Excel for tax calculations is widespread due to its flexibility, accuracy, and the ability to handle complex formulas with ease. Excel tax bracket formulas are designed to simplify the process of calculating taxes, allowing users to input their income and the relevant tax brackets to get an accurate calculation of their tax liability. These formulas can be tailored to accommodate different tax scenarios, making them a valuable resource for anyone dealing with tax planning and financial analysis.

Introduction to Excel Tax Bracket Formulas

Excel tax bracket formulas are essentially mathematical expressions that calculate tax based on income and predefined tax brackets. These formulas can be simple or complex, depending on the number of tax brackets and the specific tax rates applied to each bracket. The basic principle behind these formulas is to apply the appropriate tax rate to each dollar within a given tax bracket, summing up the taxes from all brackets to find the total tax liability.

Basic Components of Excel Tax Bracket Formulas

To work with Excel tax bracket formulas, it's essential to understand their basic components: - Income: The total amount of money earned, which will be subject to taxation. - Tax Brackets: The ranges of income to which different tax rates are applied. - Tax Rates: The percentages of income that are paid in taxes for each tax bracket.Calculating Taxes with Excel Formulas

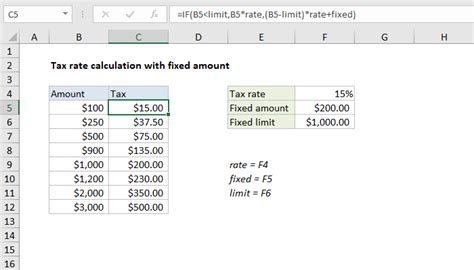

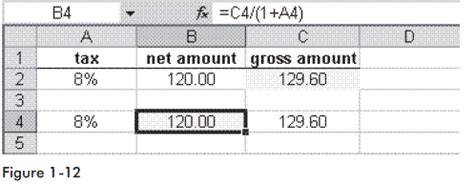

Calculating taxes using Excel formulas involves several steps, including defining the income, identifying the applicable tax brackets, and applying the relevant tax rates. Here's a simplified example of how to calculate taxes for a single tax bracket:

- Define Income and Tax Bracket: Input the income and the tax bracket details into Excel cells.

- Apply Tax Rate: Use a formula to calculate the tax, such as

=A1*B1, whereA1is the income andB1is the tax rate.

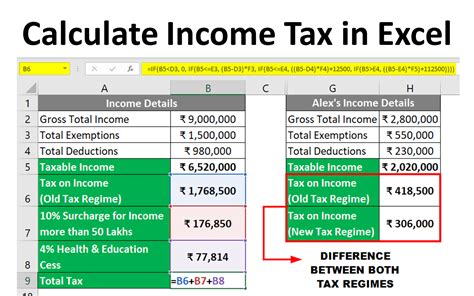

For multiple tax brackets, the process is more complex and involves calculating the tax for each bracket and then summing these amounts. This can be achieved using nested IF functions or more complex formulas that account for each tax bracket.

Example of a Multi-Bracket Tax Calculation

Consider a scenario with three tax brackets: 10% on the first $10,000, 20% on income between $10,001 and $20,000, and 30% on income above $20,000. To calculate the tax on an income of $25,000, you would:- Calculate the tax on the first $10,000 at 10%.

- Calculate the tax on the next $10,000 at 20%.

- Calculate the tax on the last $5,000 at 30%.

- Sum these taxes to find the total tax liability.

This can be represented in Excel using a formula that applies the appropriate tax rate to each portion of the income and sums the results.

Advanced Excel Tax Bracket Formulas

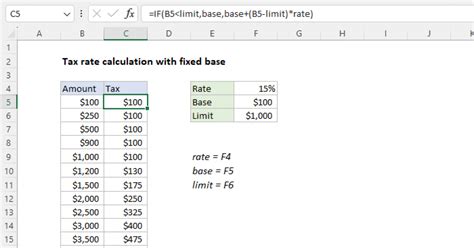

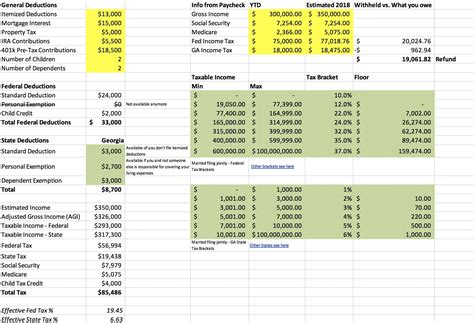

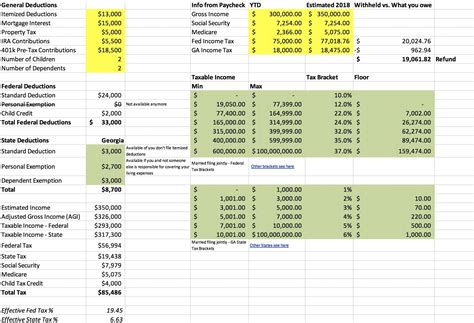

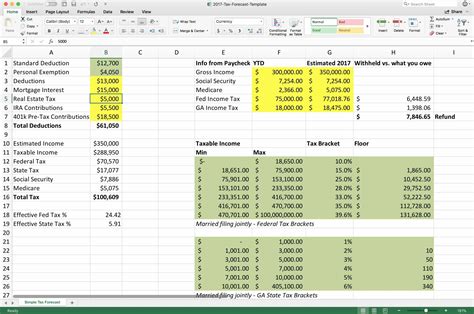

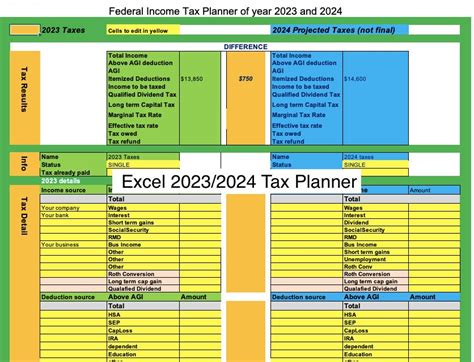

Advanced Excel tax bracket formulas involve more complex calculations, often incorporating multiple IF statements, nested functions, and sometimes even macros for automation. These formulas are designed to handle a variety of tax scenarios, including deductions, exemptions, and multiple income sources.

One example of an advanced formula is the use of the IF function to apply different tax rates based on the income level. For instance, =IF(A1<10000, A1*0.10, IF(A1<20000, 1000+(A1-10000)*0.20, 3000+(A1-20000)*0.30)), which calculates the tax based on a progressive tax system with three brackets.

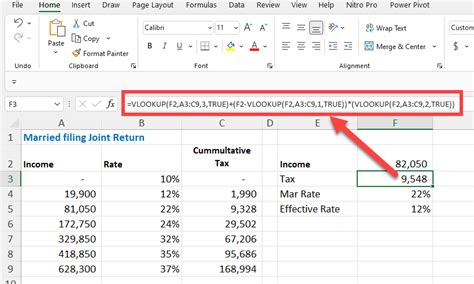

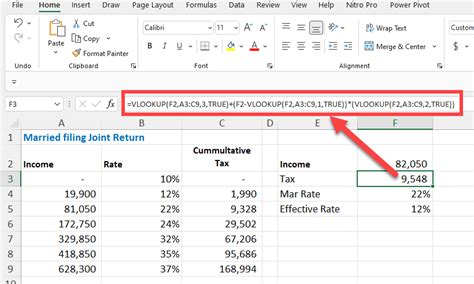

Using VLOOKUP for Tax Calculations

Another approach to calculating taxes in Excel is to use the VLOOKUP function, especially when dealing with a table of tax brackets and rates. This function allows you to look up the tax rate based on the income and then calculate the tax accordingly.Practical Applications of Excel Tax Bracket Formulas

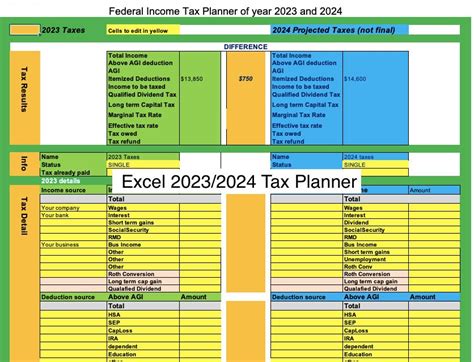

The practical applications of Excel tax bracket formulas are vast, ranging from personal finance management to complex corporate tax planning. These formulas can be used to:

- Plan Financial Decisions: By accurately calculating tax liabilities, individuals and businesses can make informed decisions about investments, savings, and expenditure.

- Prepare Tax Returns: Excel tax bracket formulas can simplify the process of preparing tax returns by automatically calculating taxes based on income and deductions.

- Analyze Tax Scenarios: These formulas enable the analysis of different tax scenarios, helping in the identification of the most tax-efficient strategies.

Benefits of Using Excel for Tax Calculations

The benefits of using Excel for tax calculations include: - **Accuracy**: Excel formulas reduce the chance of human error in tax calculations. - **Efficiency**: Once set up, Excel formulas can quickly calculate taxes for different scenarios. - **Flexibility**: Excel allows for easy adjustment of formulas to accommodate changes in tax laws or personal financial situations.Gallery of Excel Tax Bracket Formulas

Excel Tax Bracket Formulas Gallery

Frequently Asked Questions

What are Excel tax bracket formulas used for?

+Excel tax bracket formulas are used to calculate taxes based on income and predefined tax brackets, helping in financial planning and decision-making.

How do I calculate taxes using Excel formulas?

+To calculate taxes, define your income and tax brackets in Excel, and then use formulas to apply the appropriate tax rates to each portion of your income.

What are the benefits of using Excel for tax calculations?

+The benefits include accuracy, efficiency, and flexibility in calculating taxes, allowing for better financial planning and decision-making.

In conclusion, mastering Excel tax bracket formulas is a valuable skill for anyone looking to manage their finances effectively. By understanding how to calculate taxes using Excel, individuals and businesses can make informed decisions, plan for the future, and navigate the complexities of the tax system with confidence. Whether you're a seasoned financial professional or just starting to explore the world of personal finance, the power of Excel tax bracket formulas can be a game-changer. So, take the first step today, and discover how these formulas can help you achieve your financial goals. Feel free to share your thoughts, ask questions, or explore more topics related to Excel and tax calculations in the comments below.