Intro

Calculate investment returns with Excels payback period formula, analyzing cash flows, ROI, and break-even points to make informed decisions.

The payback period is a crucial metric in finance and investing that helps individuals and businesses determine the amount of time it takes for an investment to generate returns equal to its initial cost. In other words, it's the time it takes for an investment to "pay for itself." Calculating the payback period can be done manually, but using Excel can simplify the process and provide more accurate results. In this article, we will delve into the importance of calculating the payback period, its benefits, and provide a step-by-step guide on how to find the payback period in Excel.

Calculating the payback period is essential for investors, entrepreneurs, and businesses as it helps them evaluate the feasibility of a project or investment. A shorter payback period indicates a more attractive investment opportunity, as it suggests that the investment will generate returns quickly. On the other hand, a longer payback period may indicate a higher level of risk or a less desirable investment. Understanding the payback period can also help investors compare different investment opportunities and make informed decisions.

The benefits of calculating the payback period are numerous. For one, it provides a clear understanding of the investment's potential returns and helps investors set realistic expectations. Additionally, it allows investors to evaluate the level of risk associated with an investment and make adjustments accordingly. By calculating the payback period, investors can also identify potential cash flow issues and develop strategies to mitigate them.

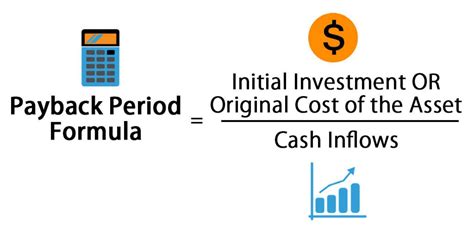

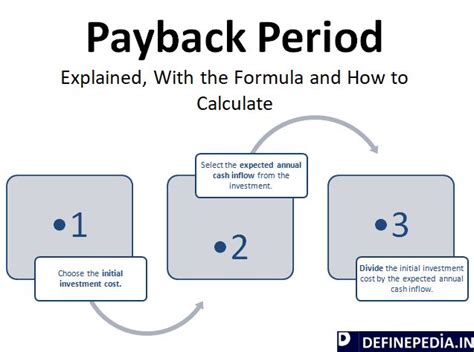

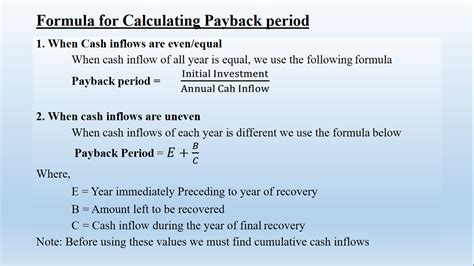

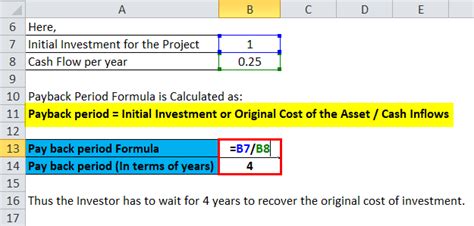

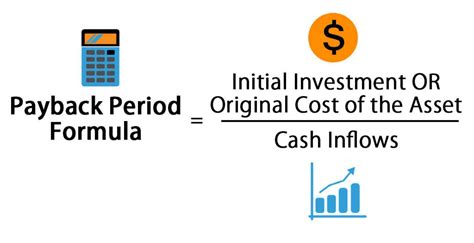

Understanding the Payback Period Formula

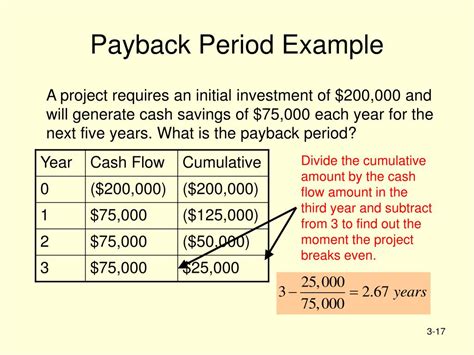

The payback period formula is relatively simple: Payback Period = Initial Investment / Annual Cash Flow. However, this formula assumes that the annual cash flow is constant, which is not always the case. In reality, cash flows can vary from year to year, and the payback period calculation must take this into account. To calculate the payback period in Excel, we can use a more complex formula that takes into account the initial investment and the annual cash flows.

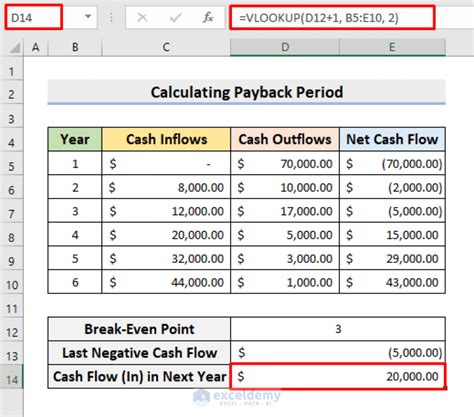

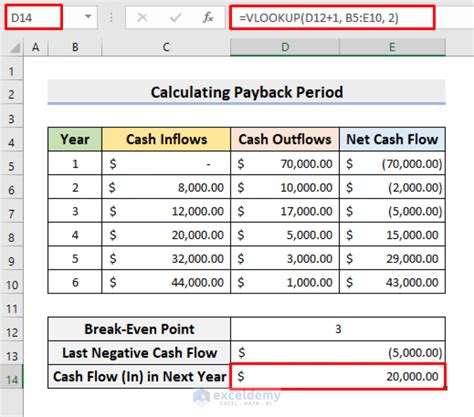

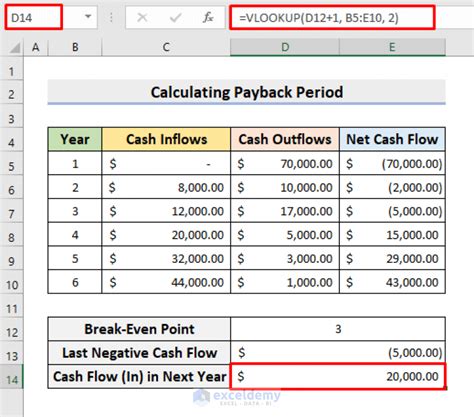

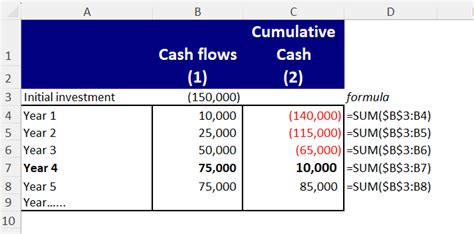

Calculating Payback Period in Excel

To calculate the payback period in Excel, follow these steps:

- Enter the initial investment and annual cash flows into separate cells.

- Calculate the cumulative cash flow by adding the annual cash flows to the previous year's cumulative cash flow.

- Use the XNPV function to calculate the present value of the cash flows.

- Use the XIRR function to calculate the internal rate of return (IRR) of the investment.

- Calculate the payback period by dividing the initial investment by the IRR.

Here's an example of how to calculate the payback period in Excel:

| Year | Cash Flow |

|---|---|

| 0 | -$100,000 |

| 1 | $20,000 |

| 2 | $30,000 |

| 3 | $40,000 |

| 4 | $50,000 |

Using the XNPV function, we can calculate the present value of the cash flows:

=XNPV(0.1, A2:A6, B2:B6)

Where A2:A6 represents the years and B2:B6 represents the cash flows.

Using the XIRR function, we can calculate the IRR of the investment:

=XIRR(B2:B6, A2:A6)

Where B2:B6 represents the cash flows and A2:A6 represents the years.

Finally, we can calculate the payback period by dividing the initial investment by the IRR:

= -$100,000 / XIRR(B2:B6, A2:A6)

Using the Payback Period Formula in Excel

Alternatively, we can use a formula to calculate the payback period in Excel. The formula is:

=YEAR(OFFSET(A2, MATCH(-A2, B:B, 0)-1, 0))

Where A2 represents the initial investment and B:B represents the cumulative cash flows.

This formula uses the OFFSET function to find the year in which the cumulative cash flow equals or exceeds the initial investment. The MATCH function is used to find the relative position of the cumulative cash flow that equals or exceeds the initial investment.

Interpreting the Results

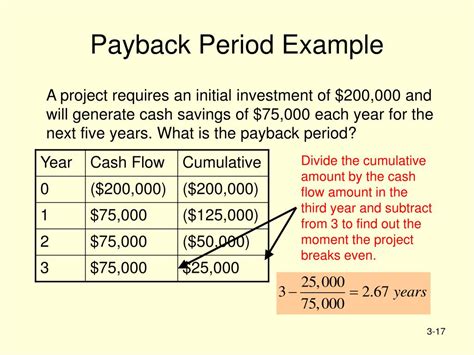

Once we have calculated the payback period, we can interpret the results to determine the feasibility of the investment. A shorter payback period indicates a more attractive investment opportunity, while a longer payback period may indicate a higher level of risk or a less desirable investment.

For example, if the payback period is 3 years, it means that the investment will generate returns equal to its initial cost within 3 years. If the payback period is 10 years, it may indicate that the investment is riskier or less desirable.

Using the Payback Period to Evaluate Investments

The payback period can be used to evaluate different investment opportunities and make informed decisions. By calculating the payback period for each investment, we can compare the results and determine which investment is more attractive.

For example, let's say we have two investment opportunities:

Investment A: Initial investment of $100,000, annual cash flow of $20,000, and a payback period of 5 years. Investment B: Initial investment of $50,000, annual cash flow of $15,000, and a payback period of 3 years.

Based on the payback period, Investment B is more attractive because it has a shorter payback period.

Gallery of Payback Period Examples

Payback Period Image Gallery

Frequently Asked Questions

What is the payback period?

+The payback period is the amount of time it takes for an investment to generate returns equal to its initial cost.

How do I calculate the payback period in Excel?

+To calculate the payback period in Excel, use the XNPV function to calculate the present value of the cash flows, and then use the XIRR function to calculate the internal rate of return (IRR) of the investment. Finally, divide the initial investment by the IRR to get the payback period.

What is the significance of the payback period?

+The payback period is significant because it helps investors evaluate the feasibility of an investment and make informed decisions. A shorter payback period indicates a more attractive investment opportunity, while a longer payback period may indicate a higher level of risk or a less desirable investment.

Can I use the payback period to compare different investment opportunities?

+Yes, the payback period can be used to compare different investment opportunities. By calculating the payback period for each investment, you can determine which investment is more attractive and make informed decisions.

What are the limitations of the payback period?

+The payback period has several limitations, including the assumption that cash flows are constant, and it does not take into account the time value of money. Additionally, it does not provide a complete picture of an investment's potential returns or risks.

In conclusion, calculating the payback period is an essential step in evaluating investment opportunities. By using Excel to calculate the payback period, investors can make informed decisions and determine the feasibility of an investment. We hope this article has provided you with a comprehensive understanding of the payback period and how to calculate it in Excel. If you have any further questions or would like to share your experiences with calculating the payback period, please don't hesitate to comment below. Additionally, if you found this article helpful, please share it with others who may benefit from this information.