Intro

Discover 5 ways Excel calculates fiscal year, including date functions, financial formulas, and calendar settings, to master financial reporting and analysis with ease.

Calculating the fiscal year in Excel can be a bit tricky, but it's a crucial task for many businesses and organizations. The fiscal year is the accounting period used by a company, which may not necessarily align with the calendar year. In this article, we'll explore five ways to calculate the fiscal year in Excel, making it easier for you to manage your financial data.

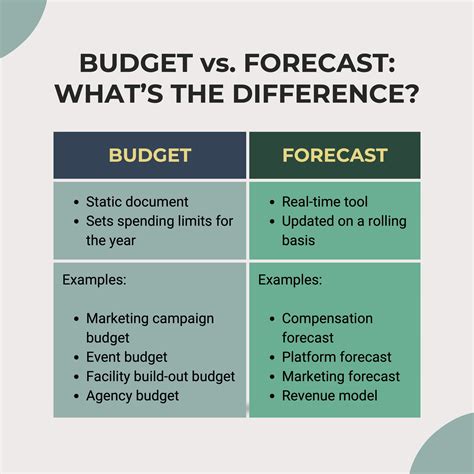

The importance of accurately calculating the fiscal year cannot be overstated. It affects everything from budgeting and forecasting to financial reporting and tax planning. With Excel, you can create custom formulas and functions to calculate the fiscal year, taking into account your company's specific start date and accounting period. Whether you're a financial analyst, accountant, or business owner, mastering these techniques will help you make informed decisions and stay on top of your financial game.

In today's fast-paced business environment, flexibility and adaptability are key. Companies may need to adjust their fiscal year to align with industry trends, regulatory requirements, or changes in their business model. Excel provides the perfect platform to respond to these changes, allowing you to create dynamic and responsive fiscal year calculations that adapt to your evolving needs. By the end of this article, you'll be equipped with the knowledge and skills to tackle even the most complex fiscal year calculations, giving you a competitive edge in the market.

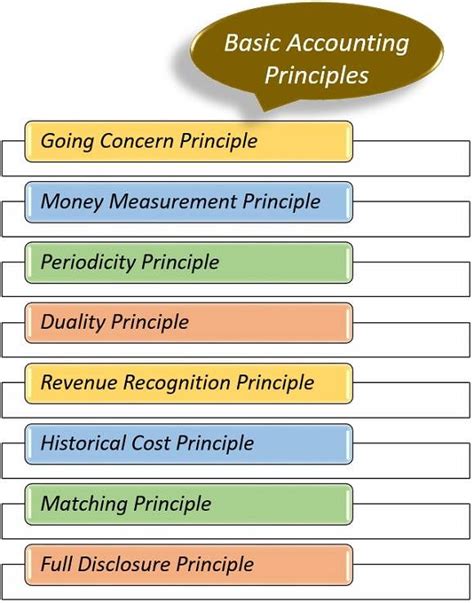

Understanding Fiscal Year Calculations

Before diving into the five ways to calculate the fiscal year, it's essential to understand the basics of fiscal year calculations. The fiscal year is typically a 12-month period, but it may not start on January 1st. For example, a company's fiscal year might start on April 1st and end on March 31st of the following year. To calculate the fiscal year, you need to consider the start date, end date, and the current date.

Key Concepts

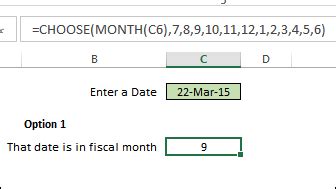

To calculate the fiscal year, you'll need to understand the following key concepts: * Start date: The first day of the fiscal year * End date: The last day of the fiscal year * Current date: The date for which you want to calculate the fiscal year * Fiscal year format: The format in which you want to display the fiscal year (e.g., FY2022, 2022-2023)Method 1: Using the YEAR Function

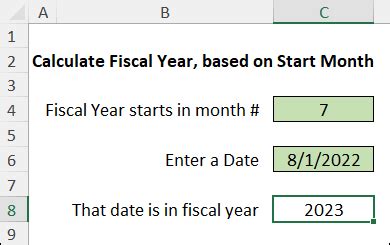

The YEAR function in Excel returns the year of a given date. You can use this function to calculate the fiscal year by subtracting the start month from the current month. If the result is less than 0, you'll need to subtract 1 from the year.

For example, suppose your company's fiscal year starts on April 1st, and you want to calculate the fiscal year for the date August 15, 2022. You can use the following formula: =IF(MONTH(A1)<4,YEAR(A1)-1,YEAR(A1))

Where A1 is the cell containing the date August 15, 2022.

Advantages and Limitations

The YEAR function method is simple and easy to understand. However, it has some limitations. For example, it doesn't take into account the day of the month, so you may get incorrect results if the current date is near the end of the month.Method 2: Using the EOMONTH Function

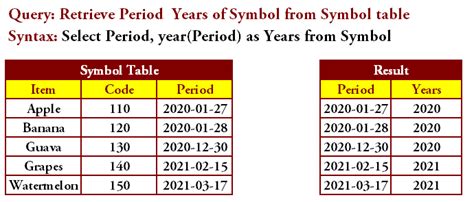

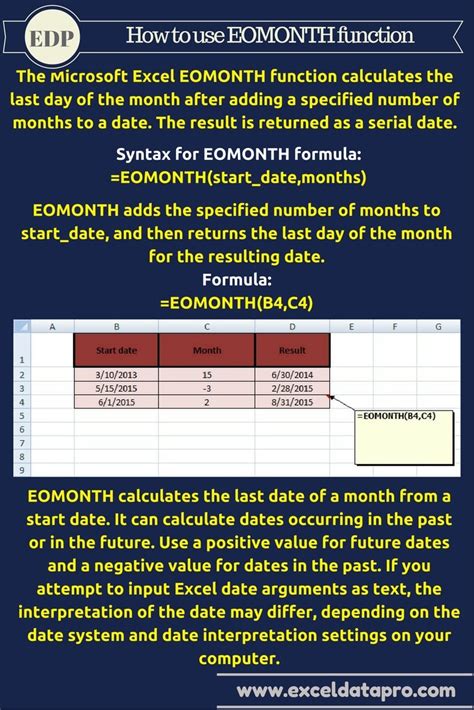

The EOMONTH function returns the last day of the month that is a specified number of months before or after a given date. You can use this function to calculate the fiscal year by finding the last day of the month that is 12 months before the current date.

For example, suppose your company's fiscal year starts on April 1st, and you want to calculate the fiscal year for the date August 15, 2022. You can use the following formula: =YEAR(EOMONTH(A1,-12))

Where A1 is the cell containing the date August 15, 2022.

Advantages and Limitations

The EOMONTH function method is more accurate than the YEAR function method, as it takes into account the day of the month. However, it can be more complex to understand and use, especially for those who are new to Excel.Method 3: Using the DATE Function

The DATE function returns a date that is a specified number of years, months, and days before or after a given date. You can use this function to calculate the fiscal year by finding the date that is 12 months before the current date.

For example, suppose your company's fiscal year starts on April 1st, and you want to calculate the fiscal year for the date August 15, 2022. You can use the following formula: =YEAR(DATE(YEAR(A1),MONTH(A1)-12,DAY(A1)))

Where A1 is the cell containing the date August 15, 2022.

Advantages and Limitations

The DATE function method is more flexible than the YEAR function method, as it allows you to specify the day of the month. However, it can be more complex to understand and use, especially for those who are new to Excel.Method 4: Using VBA Macros

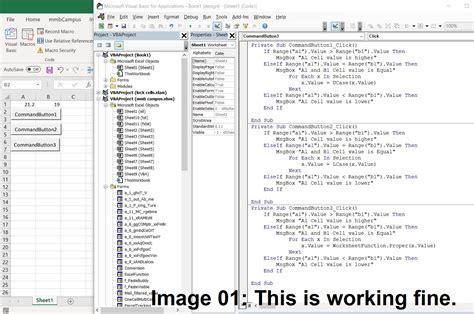

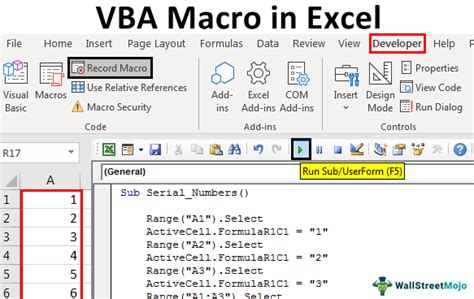

VBA macros are a powerful tool in Excel that allows you to automate repetitive tasks and create custom functions. You can use VBA macros to calculate the fiscal year by creating a custom function that takes into account the start date, end date, and current date.

For example, suppose your company's fiscal year starts on April 1st, and you want to calculate the fiscal year for the date August 15, 2022. You can create a VBA macro that uses the following code: Function FiscalYear(dateValue As Date) As Integer If Month(dateValue) < 4 Then FiscalYear = Year(dateValue) - 1 Else FiscalYear = Year(dateValue) End If End Function

Where dateValue is the cell containing the date August 15, 2022.

Advantages and Limitations

VBA macros offer a high degree of flexibility and customization, making them ideal for complex fiscal year calculations. However, they require programming knowledge and can be time-consuming to create and maintain.Method 5: Using Power Query

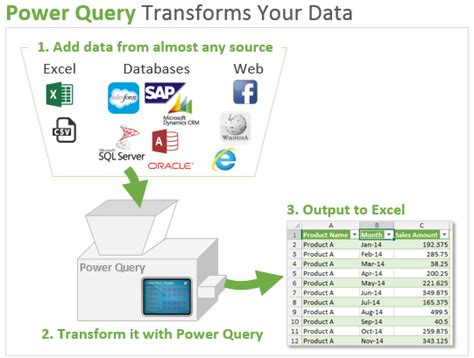

Power Query is a business intelligence tool in Excel that allows you to connect to various data sources, transform and shape data, and load it into a worksheet. You can use Power Query to calculate the fiscal year by creating a custom query that takes into account the start date, end date, and current date.

For example, suppose your company's fiscal year starts on April 1st, and you want to calculate the fiscal year for the date August 15, 2022. You can create a Power Query that uses the following formula: = Table.AddColumn(#"Previous Step", "Fiscal Year", each if Month([Date]) < 4 then Year([Date]) - 1 else Year([Date]))

Where [Date] is the column containing the date August 15, 2022.

Advantages and Limitations

Power Query offers a high degree of flexibility and customization, making it ideal for complex fiscal year calculations. However, it requires knowledge of the Power Query language and can be time-consuming to create and maintain.Fiscal Year Image Gallery

What is the fiscal year, and why is it important?

+The fiscal year is the accounting period used by a company, which may not necessarily align with the calendar year. It's essential for budgeting, forecasting, financial reporting, and tax planning.

How do I calculate the fiscal year in Excel?

+You can calculate the fiscal year in Excel using various methods, including the YEAR function, EOMONTH function, DATE function, VBA macros, and Power Query.

What are the advantages and limitations of each method?

+Each method has its advantages and limitations. The YEAR function method is simple but may not account for the day of the month. The EOMONTH function method is more accurate but can be complex to understand. VBA macros and Power Query offer high flexibility and customization but require programming knowledge and can be time-consuming to create and maintain.

How do I choose the best method for my needs?

+You should choose the method that best fits your needs based on the complexity of your fiscal year calculations, your level of expertise in Excel, and the resources available to you.

Can I use multiple methods to calculate the fiscal year?

+Yes, you can use multiple methods to calculate the fiscal year, depending on your specific needs and requirements.

In