Intro

Learn to calculate profit and loss in Excel with ease, using formulas and functions to analyze financial data, track revenue, and optimize business performance with accurate metrics and insights.

Calculating profit and loss is a crucial aspect of business and finance, as it helps individuals and organizations understand their financial performance and make informed decisions. Microsoft Excel is a powerful tool that can be used to calculate profit and loss with ease. In this article, we will explore the importance of calculating profit and loss, the benefits of using Excel for this purpose, and provide a step-by-step guide on how to calculate profit and loss in Excel.

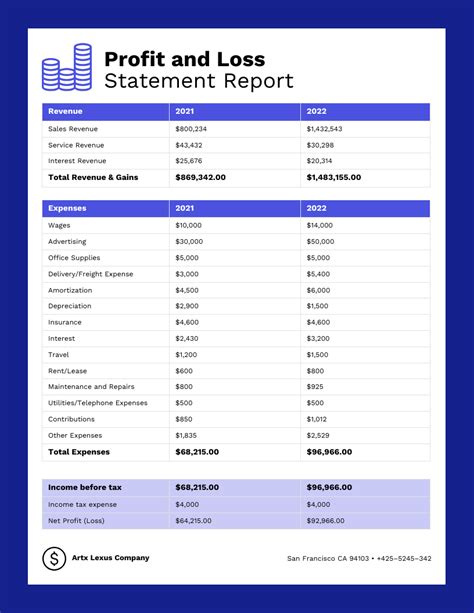

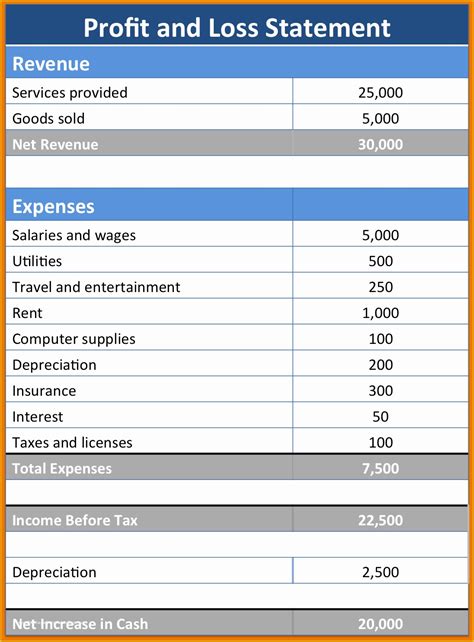

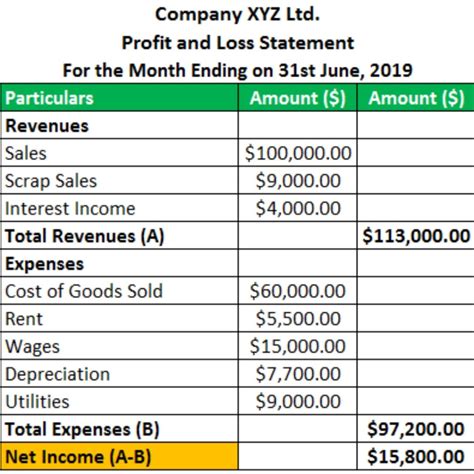

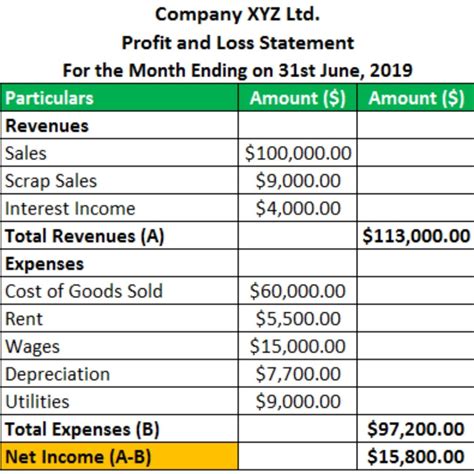

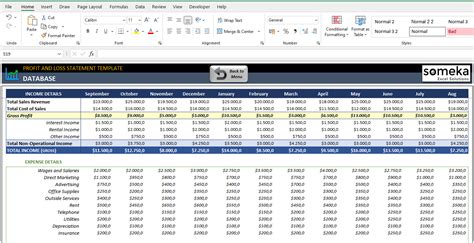

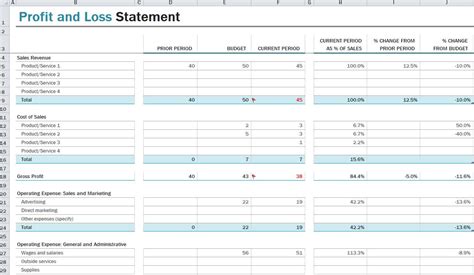

Calculating profit and loss is essential for businesses and individuals to evaluate their financial performance, identify areas of improvement, and make strategic decisions. Profit and loss statements provide a snapshot of a company's revenue, expenses, and net income, which can be used to assess its financial health and make informed decisions. With the help of Excel, users can easily create profit and loss statements, track changes in their financial performance over time, and identify trends and patterns that can inform their business strategy.

Using Excel to calculate profit and loss offers several benefits, including ease of use, accuracy, and flexibility. Excel provides a range of formulas and functions that can be used to calculate profit and loss, including the ability to create custom formulas and templates. Additionally, Excel allows users to easily import and export data, making it simple to share and collaborate on financial information.

Understanding Profit And Loss

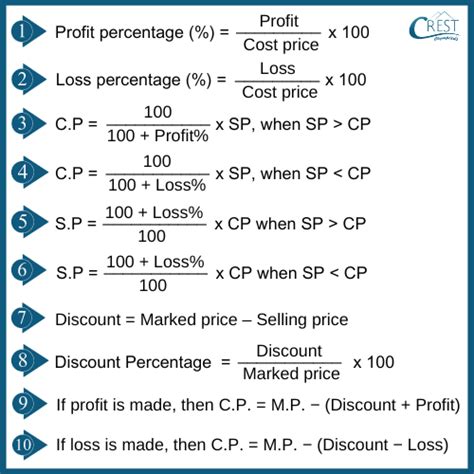

Before we dive into the steps to calculate profit and loss in Excel, it's essential to understand the basics of profit and loss. Profit refers to the amount of money earned by a business or individual after deducting all expenses from revenue. Loss, on the other hand, occurs when expenses exceed revenue. The profit and loss statement is a financial statement that summarizes a company's revenue, expenses, and net income over a specific period.

Calculating Profit And Loss In Excel

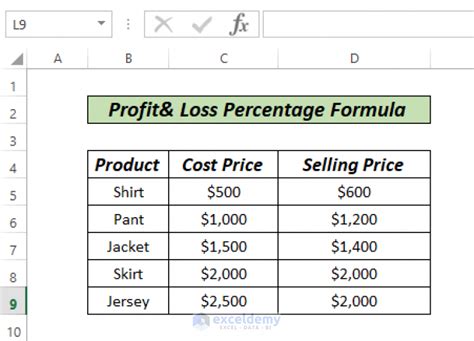

To calculate profit and loss in Excel, follow these steps:

- Create a new Excel spreadsheet and set up a table with the following columns: Revenue, Cost of Goods Sold, Gross Profit, Operating Expenses, Net Income.

- Enter the revenue data into the Revenue column.

- Enter the cost of goods sold data into the Cost of Goods Sold column.

- Calculate the gross profit by subtracting the cost of goods sold from revenue.

- Enter the operating expenses data into the Operating Expenses column.

- Calculate the net income by subtracting the operating expenses from the gross profit.

Step-By-Step Guide

Here's a step-by-step guide to calculating profit and loss in Excel:- Step 1: Create a new Excel spreadsheet and set up a table with the required columns.

- Step 2: Enter the revenue data into the Revenue column.

- Step 3: Enter the cost of goods sold data into the Cost of Goods Sold column.

- Step 4: Calculate the gross profit using the formula: Gross Profit = Revenue - Cost of Goods Sold.

- Step 5: Enter the operating expenses data into the Operating Expenses column.

- Step 6: Calculate the net income using the formula: Net Income = Gross Profit - Operating Expenses.

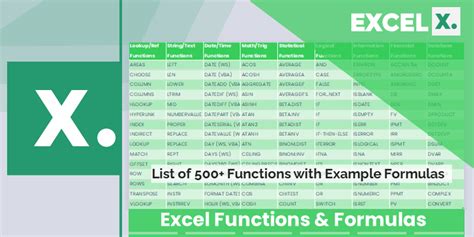

Using Formulas And Functions In Excel

Excel provides a range of formulas and functions that can be used to calculate profit and loss. Some of the most commonly used formulas and functions include:

- SUM: used to calculate the total revenue or expenses.

- AVERAGE: used to calculate the average revenue or expenses.

- IF: used to create conditional statements, such as "if revenue is greater than expenses, then net income is positive".

- VLOOKUP: used to look up data in a table and return a value.

Examples Of Formulas And Functions

Here are some examples of formulas and functions that can be used to calculate profit and loss in Excel:- =SUM(B2:B10) to calculate the total revenue.

- =AVERAGE(C2:C10) to calculate the average cost of goods sold.

- =IF(B2>C2, "Net Income is Positive", "Net Income is Negative") to create a conditional statement.

- =VLOOKUP(A2, B:C, 2, FALSE) to look up the cost of goods sold for a specific product.

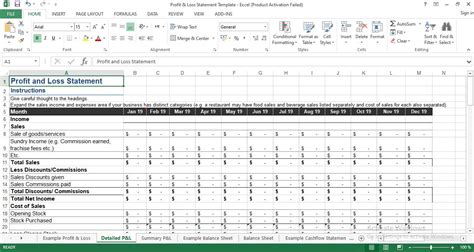

Creating A Profit And Loss Statement In Excel

To create a profit and loss statement in Excel, follow these steps:

- Set up a table with the required columns: Revenue, Cost of Goods Sold, Gross Profit, Operating Expenses, Net Income.

- Enter the revenue data into the Revenue column.

- Enter the cost of goods sold data into the Cost of Goods Sold column.

- Calculate the gross profit using the formula: Gross Profit = Revenue - Cost of Goods Sold.

- Enter the operating expenses data into the Operating Expenses column.

- Calculate the net income using the formula: Net Income = Gross Profit - Operating Expenses.

- Format the table to make it easy to read and understand.

Tips For Creating A Profit And Loss Statement

Here are some tips for creating a profit and loss statement in Excel:- Use clear and concise headings and labels.

- Use formulas and functions to calculate the gross profit and net income.

- Use conditional formatting to highlight important information, such as net income.

- Use charts and graphs to visualize the data and make it easier to understand.

Gallery of Profit And Loss Calculations

Profit And Loss Calculations Image Gallery

Frequently Asked Questions

What is the formula for calculating profit and loss in Excel?

+The formula for calculating profit and loss in Excel is: Profit = Revenue - Expenses, and Loss = Expenses - Revenue.

How do I create a profit and loss statement in Excel?

+To create a profit and loss statement in Excel, set up a table with the required columns, enter the revenue and expenses data, and use formulas and functions to calculate the gross profit and net income.

What are some common formulas and functions used in profit and loss calculations in Excel?

+Some common formulas and functions used in profit and loss calculations in Excel include SUM, AVERAGE, IF, and VLOOKUP.

In conclusion, calculating profit and loss in Excel is a straightforward process that can be done using formulas and functions. By following the steps outlined in this article, users can easily create a profit and loss statement and calculate their net income. We encourage readers to share their experiences and tips for calculating profit and loss in Excel, and to ask any questions they may have about the process. Additionally, we invite readers to explore our other articles and resources on Excel and finance to learn more about how to use Excel to manage their finances and make informed business decisions.