Intro

Learn to create a cash flow diagram in Excel, simplifying financial analysis with visual representations, forecasts, and budgeting tools, enhancing cash management and investment decisions.

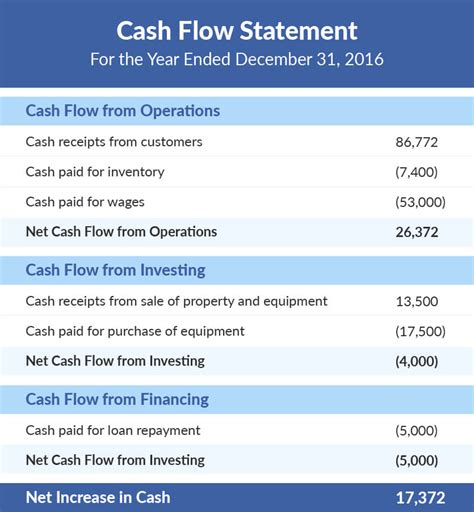

Creating a cash flow diagram in Excel is an essential skill for anyone involved in financial planning, analysis, or management. A cash flow diagram, also known as a cash flow chart or cash flow graph, is a visual representation of the inflows and outflows of cash over a specific period. It helps to identify the timing and magnitude of cash flows, making it easier to manage liquidity, plan investments, and make informed financial decisions. In this article, we will guide you through the process of creating a cash flow diagram in Excel, step by step.

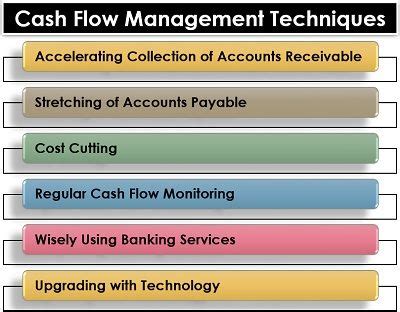

To start, it's essential to understand the importance of cash flow diagrams in financial planning. Cash flow diagrams provide a clear and concise visual representation of an organization's cash inflows and outflows, enabling stakeholders to quickly identify areas of strength and weakness. By analyzing cash flow diagrams, businesses can optimize their financial performance, reduce the risk of insolvency, and make informed decisions about investments and funding.

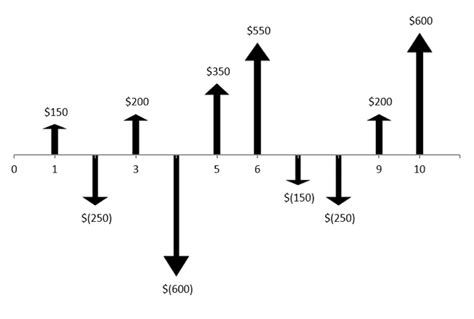

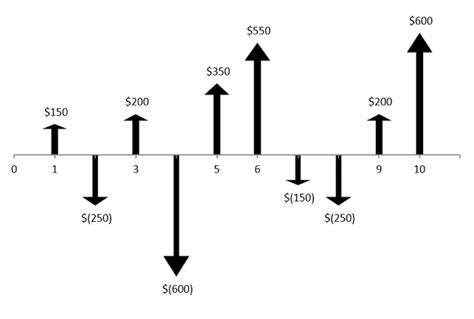

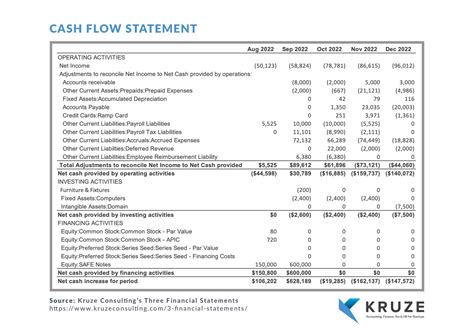

Before diving into the creation of a cash flow diagram, let's define what a cash flow diagram is and its key components. A cash flow diagram typically consists of a timeline, cash inflows, and cash outflows. The timeline represents the period over which the cash flows are being analyzed, while the cash inflows and outflows represent the movement of cash into and out of the organization.

Understanding Cash Flow Diagrams

To create a cash flow diagram in Excel, you will need to gather historical or projected cash flow data, including the dates and amounts of cash inflows and outflows. This data can be obtained from financial statements, such as the statement of cash flows, or from accounting records.

Step 1: Gather Cash Flow Data

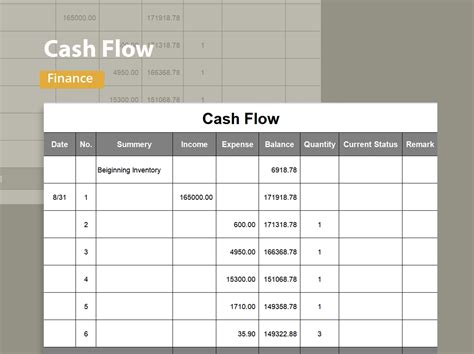

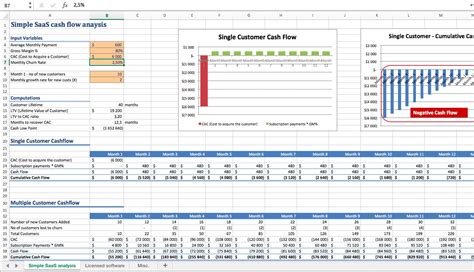

Once you have gathered the necessary data, you can start creating the cash flow diagram in Excel. The first step is to set up a table with the following columns: Date, Cash Inflow, and Cash Outflow. You can use the following formula to calculate the net cash flow: Net Cash Flow = Cash Inflow - Cash Outflow.

Step 2: Set Up the Cash Flow Table

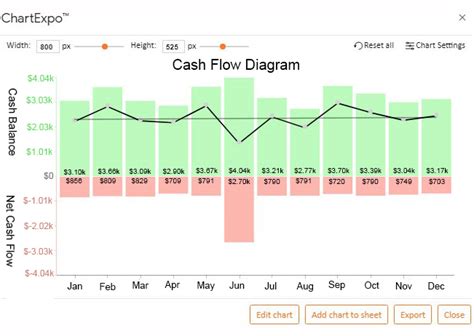

Next, you can use Excel's built-in charting tools to create a line graph or area chart to visualize the cash flows. To do this, select the data range, go to the "Insert" tab, and click on the "Line" or "Area" chart button. You can customize the chart as needed to make it more informative and engaging.

Step 3: Create the Cash Flow Chart

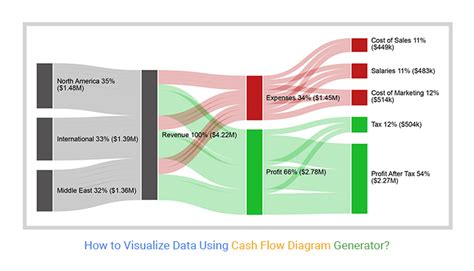

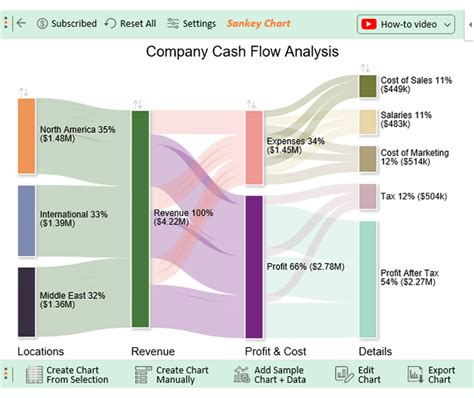

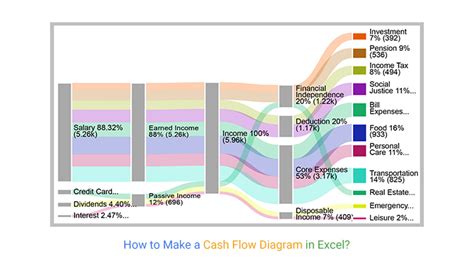

In addition to the basic cash flow diagram, you can also create more advanced visualizations, such as a stacked column chart or a waterfall chart, to show the cumulative effect of cash flows over time.

Advanced Cash Flow Visualizations

To make the cash flow diagram more interactive and dynamic, you can use Excel's pivot table and slicer tools. These tools enable you to filter and analyze the data by different dimensions, such as time period, category, or location.

Interactive Cash Flow Diagrams

When creating a cash flow diagram, it's essential to consider the following best practices: use a clear and concise title, label the axes and data series, and use colors and formatting to make the chart more engaging and easy to read.

Best Practices for Cash Flow Diagrams

In conclusion, creating a cash flow diagram in Excel is a straightforward process that requires some basic knowledge of Excel and financial analysis. By following the steps outlined in this article, you can create a clear and informative cash flow diagram that helps you to analyze and manage cash flows effectively.

Gallery of Cash Flow Diagrams

Cash Flow Diagrams Image Gallery

What is a cash flow diagram?

+A cash flow diagram is a visual representation of the inflows and outflows of cash over a specific period.

How do I create a cash flow diagram in Excel?

+To create a cash flow diagram in Excel, gather historical or projected cash flow data, set up a table with the necessary columns, and use Excel's built-in charting tools to create a line graph or area chart.

What are the benefits of using a cash flow diagram?

+The benefits of using a cash flow diagram include identifying the timing and magnitude of cash flows, managing liquidity, planning investments, and making informed financial decisions.

Can I use a cash flow diagram for personal finance?

+Yes, a cash flow diagram can be used for personal finance to track income and expenses, manage debt, and plan for long-term financial goals.

How often should I update my cash flow diagram?

+You should update your cash flow diagram regularly, such as monthly or quarterly, to reflect changes in your financial situation and ensure that your financial plans are on track.

We hope this article has provided you with a comprehensive guide to creating a cash flow diagram in Excel. Whether you're a financial analyst, business owner, or individual looking to manage your personal finances, a cash flow diagram is an essential tool for making informed financial decisions. If you have any questions or comments, please feel free to share them below. Additionally, if you found this article helpful, please share it with others who may benefit from learning about cash flow diagrams.