Intro

Managing invoices efficiently is crucial for any business, as it directly impacts cash flow and financial stability. One of the most effective and widely used tools for tracking invoices is Microsoft Excel. Excel offers a versatile platform that can be tailored to meet the specific needs of your business, from creating simple invoice templates to developing complex invoice tracking systems. In this article, we will delve into the importance of invoice tracking, the benefits of using Excel for this purpose, and provide a step-by-step guide on how to create an invoice tracker in Excel.

The ability to track invoices accurately is vital for maintaining a healthy financial status. It helps in identifying overdue payments, managing cash flow, and making informed decisions about investments and expenditures. Moreover, an efficient invoice tracking system can significantly reduce the time spent on manual tracking, minimize errors, and enhance overall productivity. With the increasing complexity of business operations, relying on manual methods or basic tools can lead to inefficiencies and potential losses.

Excel, with its powerful features and user-friendly interface, stands out as an ideal solution for creating and managing invoice trackers. Its flexibility allows users to design custom templates that fit their specific requirements, including the type of business, the volume of invoices, and the desired level of detail. Furthermore, Excel's analytical capabilities enable users to generate reports, track trends, and forecast future financial scenarios based on historical data.

Benefits of Using Excel for Invoice Tracking

The benefits of utilizing Excel for invoice tracking are multifaceted. Firstly, it provides a centralized platform where all invoices can be recorded, updated, and accessed easily. This centralization enhances organization and reduces the likelihood of losing track of invoices. Secondly, Excel's automation capabilities can significantly streamline the invoicing process, from generating invoices to sending reminders for overdue payments. This automation not only saves time but also minimizes the risk of human error, which can lead to delayed payments or incorrect invoicing.

Another significant advantage of using Excel for invoice tracking is its scalability. Whether you are a small business with a handful of clients or a large corporation with thousands of customers, Excel can be adapted to meet your needs. Its templates can be customized to include as much or as little detail as required, and its formulas can be set up to perform complex calculations automatically.

Creating an Invoice Tracker in Excel

Creating an invoice tracker in Excel involves several steps, from setting up the basic structure to automating tasks and analyzing data. Here is a simplified guide to get you started:

-

Setting Up the Workbook: Begin by opening a new Excel workbook. It's a good practice to create a separate worksheet for each month or quarter, depending on the volume of your invoices.

-

Designing the Invoice Template: On your first worksheet, design a template that includes all the necessary fields for an invoice, such as invoice number, date, client name, amount, due date, and payment status.

-

Entering Data: Start entering your invoice data into the template. Ensure that each invoice is listed on a separate row.

-

Using Formulas for Calculations: Excel's formulas can be used to calculate totals, determine overdue invoices, and perform other tasks automatically. For example, you can use the

SUMfunction to calculate the total amount of all invoices or theTODAYfunction to identify overdue payments. -

Conditional Formatting: Apply conditional formatting to highlight invoices that are overdue or pending. This visual cue makes it easier to identify invoices that require immediate attention.

-

Automating Tasks: For repetitive tasks, such as sending reminders, you can use Excel's macros or integrate it with other Microsoft tools like Outlook.

Advanced Features for Invoice Tracking

For more advanced users, Excel offers a range of features that can further enhance the invoice tracking process. These include:

- PivotTables: Useful for summarizing large datasets and creating custom reports.

- Charts and Graphs: Help in visualizing data, making it easier to understand trends and patterns.

- Macros: Enable automation of repetitive tasks, such as data entry or report generation.

- Data Validation: Ensures that data entered into the invoice tracker meets certain criteria, reducing errors.

Best Practices for Managing Your Invoice Tracker

To get the most out of your Excel invoice tracker, it's essential to follow some best practices:

- Regular Updates: Ensure that your tracker is updated regularly to reflect the current status of all invoices.

- Backup: Regularly backup your Excel file to prevent data loss in case of a system failure or accidental deletion.

- Security: Protect your workbook with a password, especially if it contains sensitive financial information.

- Simplification: Keep your tracker simple and intuitive. Avoid overly complex formulas or layouts that might confuse other users.

Common Challenges and Solutions

Despite the benefits of using Excel for invoice tracking, users may encounter several challenges. These can include data management issues, difficulties in scaling the tracker as the business grows, and challenges in integrating the tracker with other financial systems. Solutions to these challenges often involve streamlining data entry processes, utilizing more advanced Excel features, and potentially integrating the Excel tracker with other software solutions.

Future of Invoice Tracking

The future of invoice tracking is likely to be shaped by technological advancements, including the adoption of cloud-based solutions, artificial intelligence, and blockchain technology. These technologies promise to make invoice tracking more efficient, secure, and automated. However, for many businesses, especially small and medium-sized enterprises, Excel will continue to be a viable and preferred option due to its familiarity, flexibility, and cost-effectiveness.

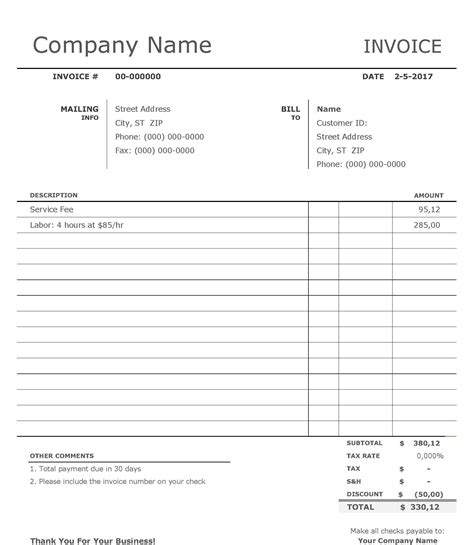

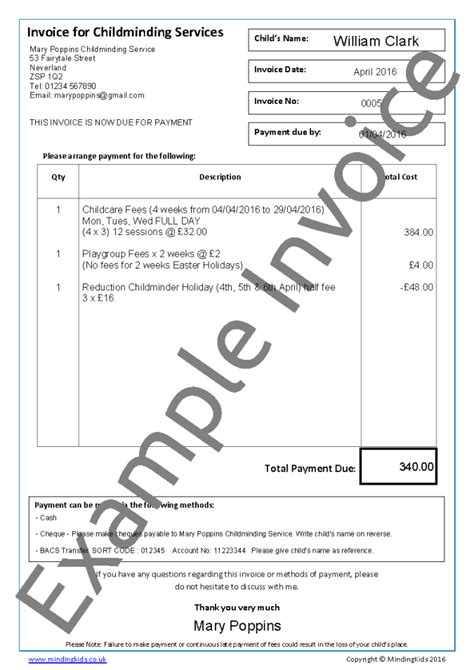

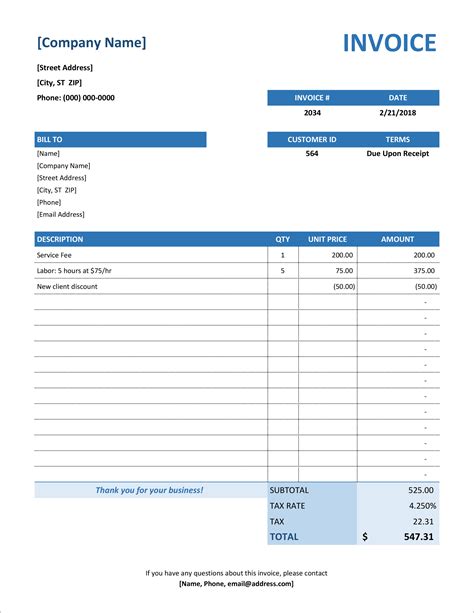

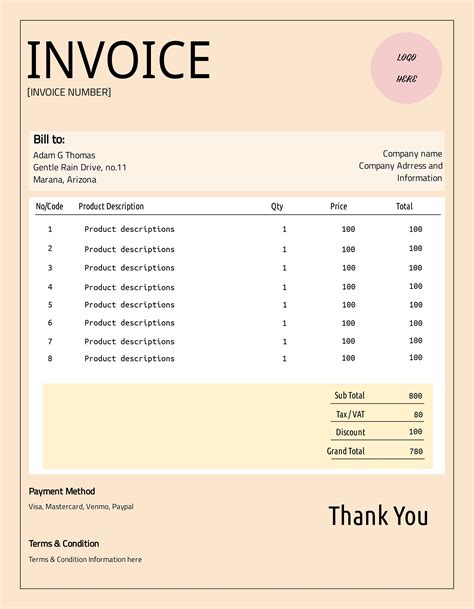

Gallery of Invoice Tracking Templates

Invoice Tracking Templates Gallery

What is the best way to track invoices in Excel?

+The best way to track invoices in Excel is by creating a customized template that includes all necessary fields such as invoice number, date, client name, amount, due date, and payment status. Utilizing formulas for calculations and conditional formatting for visual cues can also enhance the tracking process.

How do I automate invoice tracking in Excel?

+Automation in Excel can be achieved through the use of macros, which can perform repetitive tasks such as data entry, report generation, and even sending reminders for overdue payments. Additionally, integrating Excel with other Microsoft tools can further enhance automation capabilities.

What are the benefits of using Excel for invoice tracking compared to other software?

+Excel offers flexibility, scalability, and familiarity, making it an ideal choice for many businesses. Its ability to be customized to meet specific needs, along with its powerful analytical capabilities, sets it apart from other invoice tracking software. Moreover, its cost-effectiveness and integration with other Microsoft tools are significant advantages.

In conclusion, creating and managing an invoice tracker in Excel can significantly improve the efficiency and accuracy of your business's financial operations. By understanding the benefits, creating a well-structured template, and utilizing advanced features, businesses can streamline their invoicing process, reduce errors, and make informed financial decisions. Whether you are just starting out or looking to upgrade your current system, Excel's versatility and power make it an excellent choice for invoice tracking. We invite you to share your experiences with Excel invoice tracking, ask questions, or explore more topics related to financial management and Excel applications.