Intro

Master Excel with 5 expert tips from Michael Blank, covering data analysis, formula shortcuts, and visualization techniques, to boost productivity and financial modeling skills.

Real estate investing can be a lucrative venture, but it requires careful planning, analysis, and management. One of the key tools used by real estate investors is Microsoft Excel, which can help with everything from tracking expenses to analyzing investment opportunities. Michael Blank, a well-known real estate investor and educator, has shared several tips on how to use Excel to streamline real estate investing. In this article, we will explore five of Michael Blank's Excel tips and how they can be applied to real estate investing.

The importance of using Excel in real estate investing cannot be overstated. By leveraging the power of Excel, investors can make more informed decisions, reduce errors, and increase their overall returns. Whether you are a seasoned investor or just starting out, learning how to use Excel effectively is crucial to your success. Michael Blank's Excel tips are designed to help investors of all levels improve their skills and achieve their goals.

From creating custom templates to using advanced formulas, Michael Blank's Excel tips cover a wide range of topics. By following these tips, investors can create customized spreadsheets that meet their specific needs, automate routine tasks, and gain valuable insights into their investments. In the following sections, we will delve into each of Michael Blank's Excel tips and provide examples of how they can be applied to real estate investing.

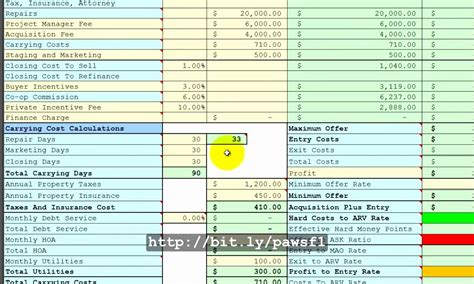

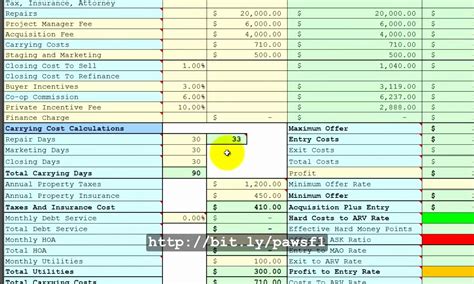

Tip 1: Creating Custom Templates

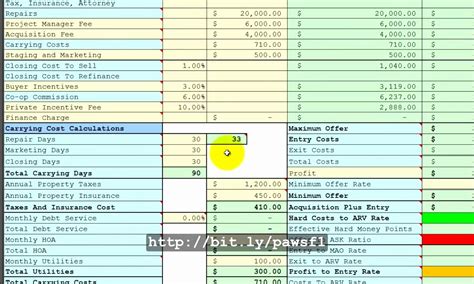

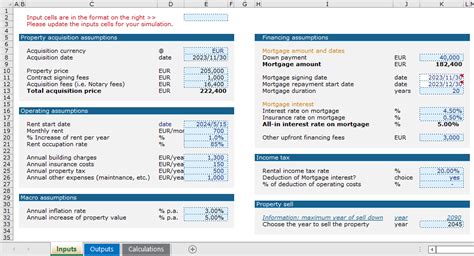

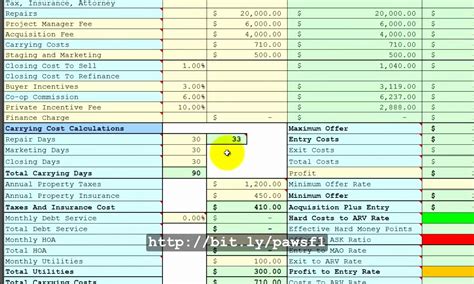

To create a custom template, investors can start by identifying the key data points they need to track for each investment. They can then create a spreadsheet with columns for each of these data points and add formulas and formatting as needed. Once the template is complete, it can be saved and reused for future investments, saving time and reducing errors.

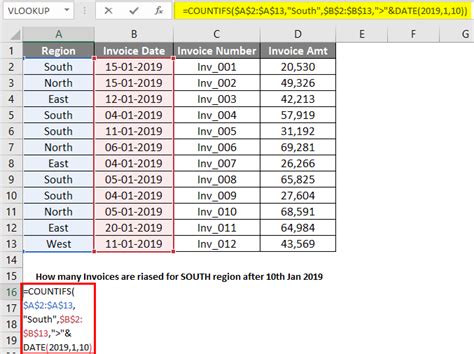

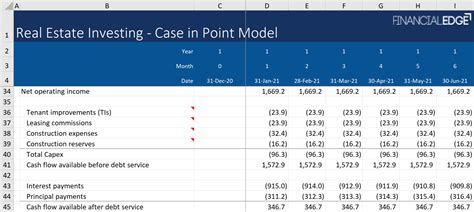

Tip 2: Using Advanced Formulas

To use advanced formulas, investors can start by identifying the tasks they want to automate or the insights they want to gain. They can then research the formulas that can be used to achieve these goals and practice using them in their spreadsheets. With practice and experience, investors can become proficient in using advanced formulas and take their Excel skills to the next level.

Tip 3: Automating Routine Tasks

To automate routine tasks, investors can start by identifying the tasks they want to automate and researching the automation features that can be used to achieve these goals. They can then create macros and apply conditional formatting as needed to automate these tasks and save time.

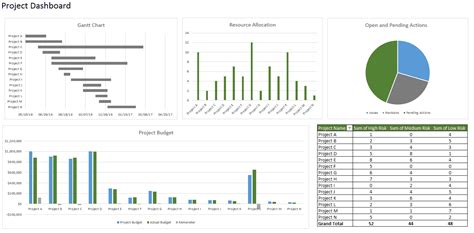

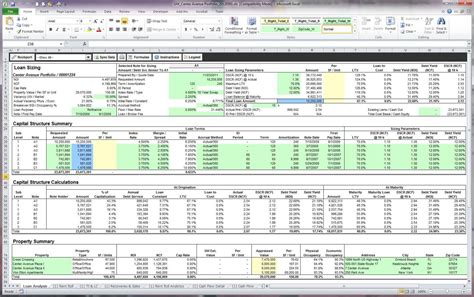

Tip 4: Creating Dashboards

To create a dashboard, investors can start by identifying the key metrics they want to track and creating a spreadsheet with columns for each of these metrics. They can then use Excel's formatting and visualization features, such as charts and graphs, to create a visual representation of these metrics.

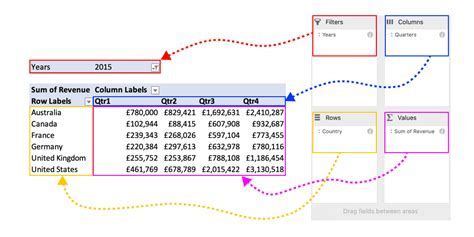

Tip 5: Using PivotTables

To use PivotTables, investors can start by creating a spreadsheet with a large dataset, such as a list of income and expenses. They can then create a PivotTable by selecting the data range and using the PivotTable feature in Excel. Once the PivotTable is created, investors can use it to analyze and summarize the data, and to identify trends and patterns.

Gallery of Excel Tips for Real Estate Investing

Excel Tips Image Gallery

What is the best way to learn Excel for real estate investing?

+The best way to learn Excel for real estate investing is to start with the basics and gradually build your skills. You can find many online resources, including tutorials and videos, that can help you learn Excel. It's also a good idea to practice using Excel with sample data to get a feel for how it works.

What are some common mistakes to avoid when using Excel for real estate investing?

+Some common mistakes to avoid when using Excel for real estate investing include not using formulas correctly, not formatting cells properly, and not using PivotTables to analyze data. It's also important to double-check your data and formulas to ensure accuracy.

How can I use Excel to track my real estate investments?

+You can use Excel to track your real estate investments by creating a spreadsheet with columns for income, expenses, and cash flow. You can also use formulas to calculate key metrics such as net operating income and capitalization rate. Additionally, you can use PivotTables to analyze and summarize your data.

By following Michael Blank's Excel tips, real estate investors can streamline their investment analysis and management, make more informed decisions, and increase their overall returns. Whether you are a seasoned investor or just starting out, learning how to use Excel effectively is crucial to your success. We encourage you to try out these tips and see how they can help you achieve your real estate investing goals. If you have any questions or comments, please don't hesitate to reach out. Share this article with your friends and colleagues who may be interested in learning more about using Excel for real estate investing.