Intro

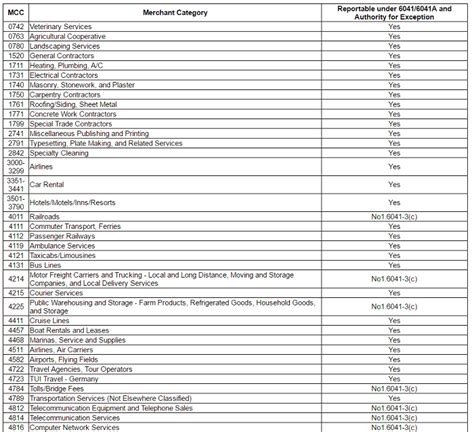

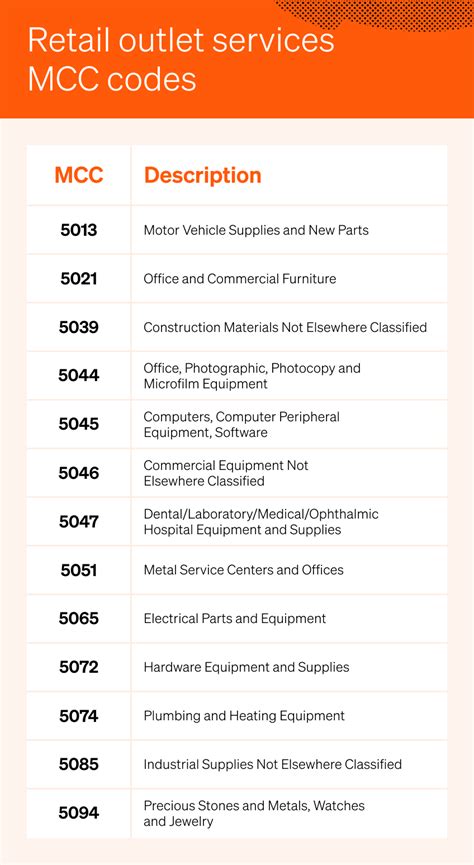

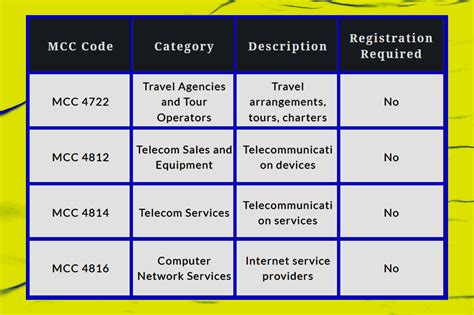

The MCC code list is a crucial component for businesses, particularly those involved in e-commerce, finance, and banking, as it helps in categorizing and tracking transactions based on the type of merchant or service provider. MCC stands for Merchant Category Code, and it's a four-digit number assigned to a business by a credit card company (like Visa or Mastercard) when the business first starts accepting credit cards as a form of payment. This code is used to identify the type of business or industry the merchant operates in.

Understanding the MCC code is essential for several reasons, including merchant account setup, transaction tracking, and for consumers, it can affect how rewards points are earned on their credit cards. Given the complexity and the vast number of MCC codes, having a comprehensive list in a format like Excel can be incredibly useful for quick reference and analysis.

Importance of MCC Codes

MCC codes are vital for various stakeholders:

- Merchants: They help in setting up merchant accounts and in understanding the fees associated with different types of transactions.

- Banks and Financial Institutions: MCC codes assist in monitoring transactions for suspicious activity and in applying the correct interchange fees.

- Consumers: Knowing the MCC code of a purchase can help in maximizing rewards, as some credit cards offer bonus points or cashback in specific categories (e.g., dining, travel).

Accessing an MCC Code List in Excel

For those looking to access or create an MCC code list in Excel, there are a few approaches:

- Directly from Payment Processors: Many payment processors and banks provide lists of MCC codes that they use. These can often be downloaded in CSV format and easily imported into Excel.

- Industry Associations: Some industry associations related to finance and e-commerce may offer MCC code lists as a resource for their members.

- Online Resources: There are several online resources and databases that list MCC codes. These can be manually entered into an Excel spreadsheet or, in some cases, downloaded directly.

Creating and Managing an MCC Code List in Excel

Once you have access to an MCC code list, managing it in Excel can be straightforward:

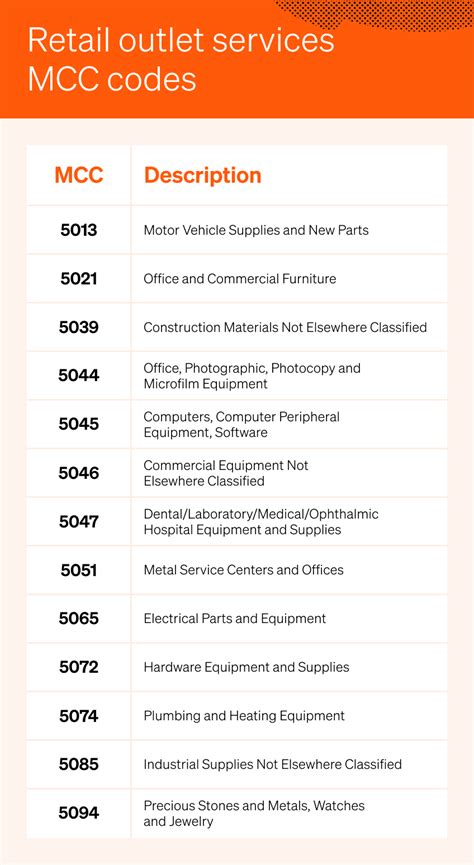

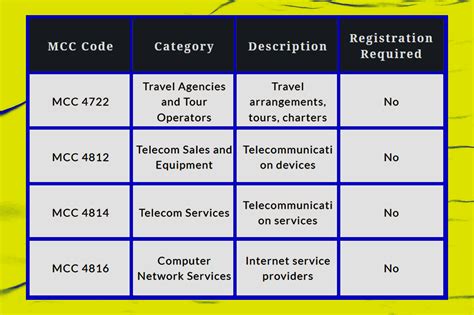

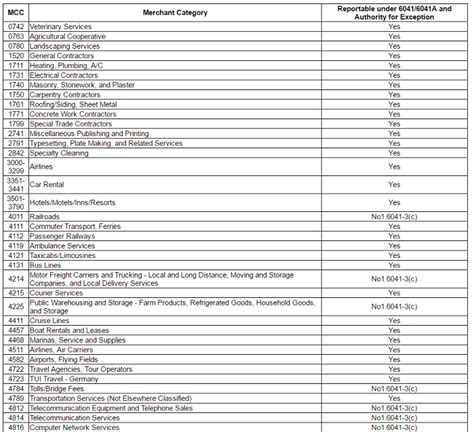

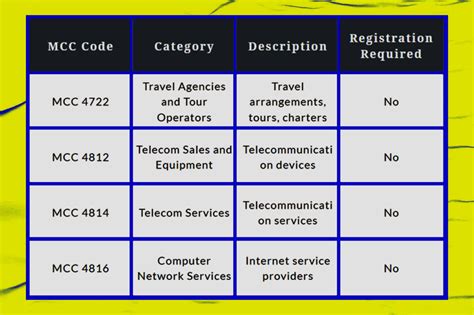

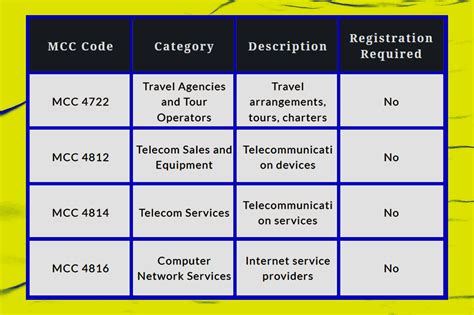

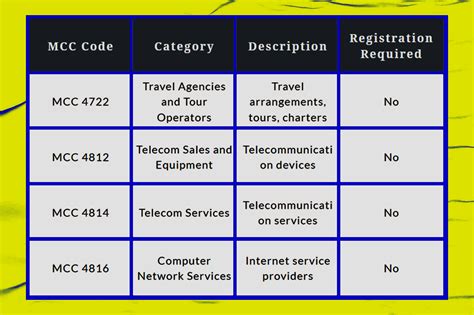

- Organization: Use columns to separate the MCC code, category description, and any additional relevant details such as associated industries or subcategories.

- Filtering and Sorting: Excel's filtering and sorting functions can help in quickly finding specific MCC codes or categories.

- Updates: Regularly update your list as MCC codes can change, and new codes are added.

Practical Applications

Having an MCC code list in Excel can facilitate several tasks:

- Transaction Analysis: By categorizing transactions based on MCC codes, businesses can better understand their spending patterns and optimize their financial operations.

- Compliance: For businesses that need to comply with specific regulations related to certain types of transactions, an MCC code list can help in identifying and segregating those transactions.

- Marketing and Customer Insights: Analyzing MCC codes can provide insights into customer spending habits, helping businesses to tailor their marketing strategies more effectively.

Challenges and Considerations

While an MCC code list can be a powerful tool, there are challenges and considerations:

- Complexity: The sheer number of MCC codes and the specificity of some categories can make managing and updating a list challenging.

- Variability: Different payment processors and banks might use slightly different codes or categorizations, which can lead to inconsistencies.

- Privacy and Security: When handling transaction data, including MCC codes, ensuring the privacy and security of the information is paramount.

Future Developments

As the financial and e-commerce landscapes continue to evolve, the role and structure of MCC codes may also change. Emerging technologies like blockchain and advancements in data analytics may lead to more sophisticated and detailed categorization systems. Staying informed about these developments will be crucial for businesses and individuals relying on MCC codes for their operations.

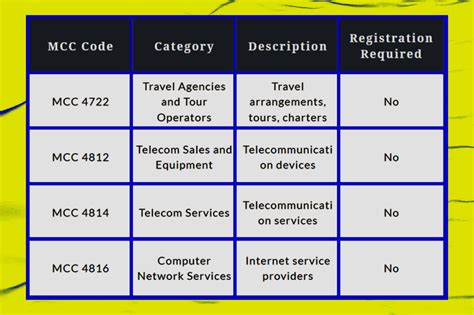

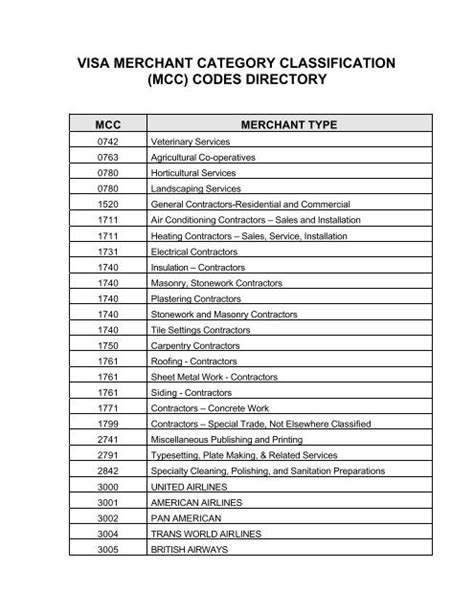

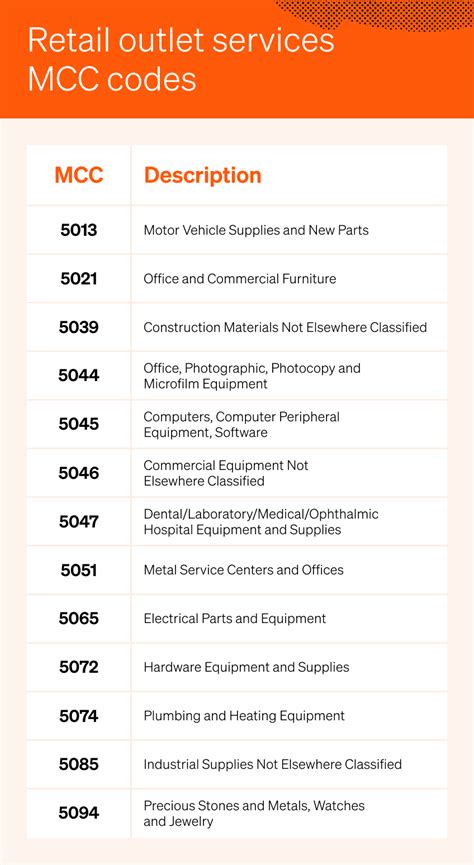

Gallery of MCC Code Lists

MCC Code List Management

MCC Code Categories

MCC Code Updates

MCC Code Analysis

MCC Code Security

MCC Code Lists for E-commerce

MCC Code Lists for Financial Institutions

MCC Code List Gallery

MCC Code Image Gallery

FAQs

What is an MCC code?

+An MCC code, or Merchant Category Code, is a four-digit number assigned to a business by a credit card company to categorize the type of goods or services the business provides.

Why are MCC codes important?

+MCC codes are crucial for merchant account setup, transaction tracking, and for consumers, they can affect how rewards points are earned on credit cards.

How can I access an MCC code list?

+MCC code lists can be accessed directly from payment processors, industry associations, or online resources. They can often be downloaded in CSV format and imported into Excel for easy management.

In conclusion, having a comprehensive MCC code list in Excel can be a valuable resource for businesses and individuals looking to understand, manage, and analyze transactions based on merchant categories. By leveraging this tool, stakeholders can optimize operations, enhance compliance, and make more informed decisions. As the financial landscape continues to evolve, the importance of MCC codes and the need for accessible, manageable lists will only continue to grow.