Intro

Master Excel paycheck management with 5 expert tips, including payroll templates, budgeting formulas, and tax calculation tools to streamline financial planning and salary tracking.

Managing finances effectively is crucial for both individuals and businesses. One of the most important aspects of financial management is handling paychecks. Microsoft Excel, with its powerful features and flexibility, offers an excellent platform for managing and analyzing paycheck data. Here are some tips on how to use Excel for paycheck management, making it easier to track, calculate, and analyze your income.

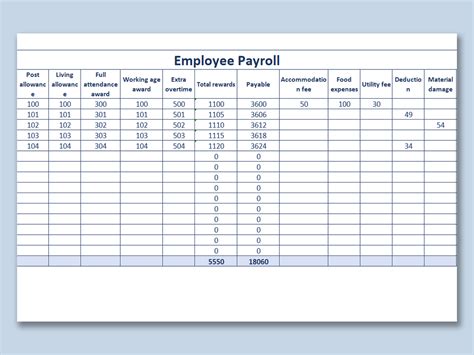

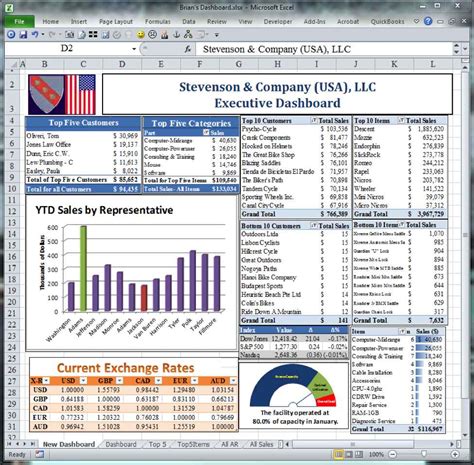

Excel is widely used for its ability to organize, calculate, and visualize data. When it comes to managing paychecks, Excel can help in creating customized spreadsheets that cater to individual or business needs. Whether you're an employee looking to track your monthly income or an employer managing payroll for your employees, Excel provides the tools to make the process efficient and accurate.

The importance of accurately managing paychecks cannot be overstated. It helps in planning expenses, saving for the future, and making informed financial decisions. With Excel, you can create a paycheck calculator that takes into account various factors such as gross income, deductions, and taxes, providing a clear picture of your take-home pay. Moreover, Excel's formulas and functions enable you to perform complex calculations with ease, reducing the likelihood of errors and saving time.

Understanding Excel for Paycheck Management

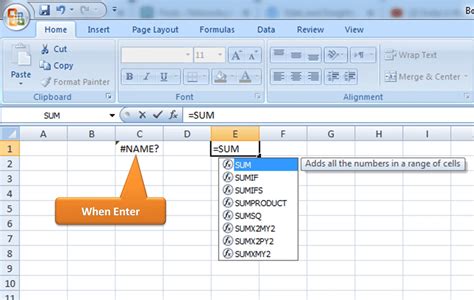

To effectively use Excel for paycheck management, it's essential to understand the basics of how Excel works. This includes knowledge of formulas, functions, and data formatting. Excel formulas allow you to perform calculations on data, while functions provide predefined formulas for specific tasks, such as calculating the sum of a range of cells or determining the date of the next payday. Understanding how to apply these tools is crucial for creating an effective paycheck management system.

Setting Up Your Paycheck Spreadsheet

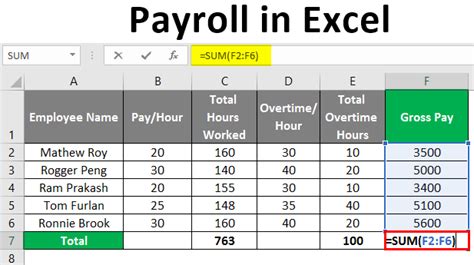

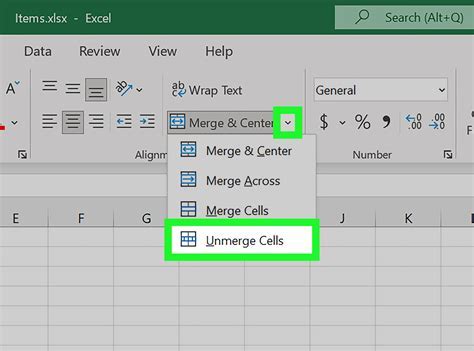

When setting up your paycheck spreadsheet, consider what information you need to track. This might include your hourly wage, number of hours worked, deductions, and taxes. Organizing this information into separate columns or sheets can help keep your data tidy and make it easier to analyze. For example, you might have one sheet for income, another for expenses, and a third for savings goals.Creating a Paycheck Calculator

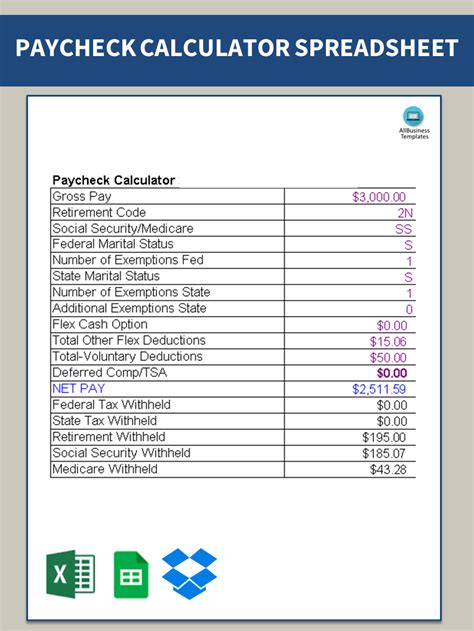

A paycheck calculator is a useful tool for determining your take-home pay. By inputting your gross income and deductions into an Excel spreadsheet, you can calculate your net income. This can be particularly useful for understanding how changes in income or deductions might affect your take-home pay. Excel's IF function, for example, can be used to apply different tax rates based on income levels, making your calculator more accurate.

Using Formulas and Functions

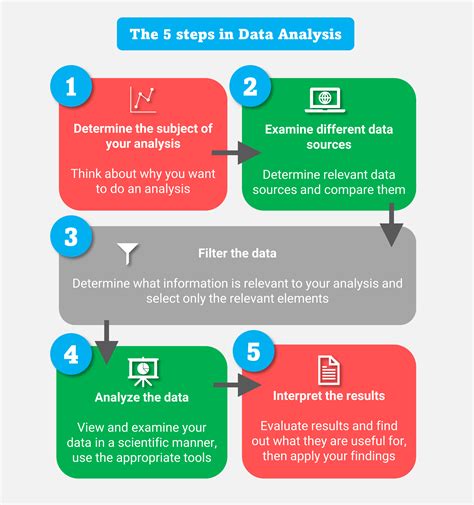

Excel's formulas and functions are powerful tools for managing paycheck data. The SUM function can be used to add up all your income or expenses for the month, while the AVERAGE function can help you understand your average monthly income over time. Conditional formatting can also be used to highlight cells that meet certain conditions, such as income above a certain threshold or expenses that exceed budget.Analyzing Your Paycheck Data

Analyzing your paycheck data is crucial for making informed financial decisions. Excel's chart and graph tools can help visualize your data, making it easier to spot trends and patterns. For example, a line graph can show how your income has changed over time, while a pie chart can illustrate how your income is distributed among different categories of expenses.

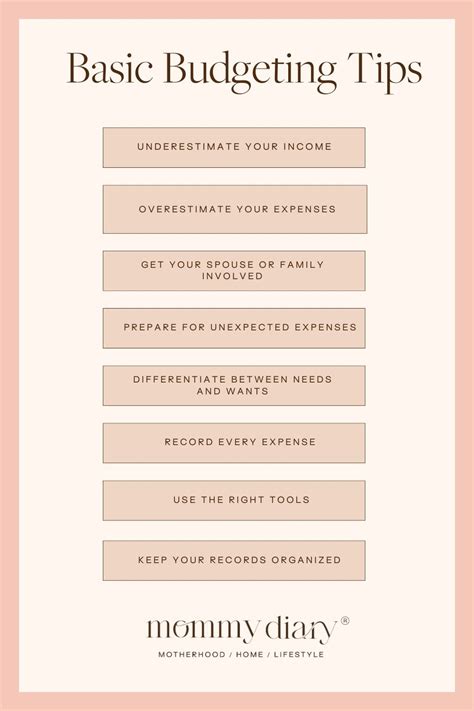

Tracking Expenses and Budgeting

In addition to managing income, Excel can also be used to track expenses and create a budget. By categorizing your expenses into different types (such as housing, food, and entertainment), you can see where your money is going and make adjustments as needed. The 50/30/20 rule, which allocates 50% of income towards necessary expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment, can be a useful guideline for budgeting.Security and Backup

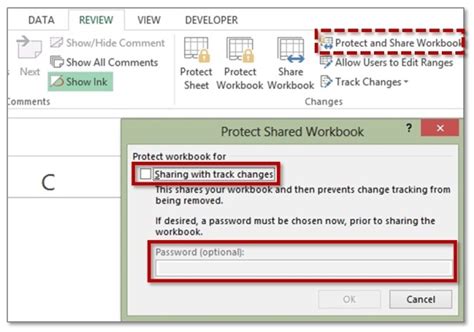

Finally, it's essential to ensure the security and integrity of your paycheck data. This includes protecting your Excel files with strong passwords and regularly backing up your data. Excel's built-in password protection can prevent unauthorized access to your files, while cloud storage services can provide a secure offsite backup of your data.

Best Practices for Excel Paycheck Management

To get the most out of using Excel for paycheck management, follow best practices such as regularly updating your data, using clear and descriptive column headers, and avoiding complex formulas when simpler ones will do. Additionally, consider using Excel templates designed specifically for paycheck management, which can provide a pre-organized structure for your data and save you time.Conclusion and Next Steps

In conclusion, Excel offers a powerful and flexible platform for managing paychecks. By understanding how to set up a paycheck spreadsheet, create a paycheck calculator, use formulas and functions, analyze data, and ensure security and backup, you can take control of your financial management. Whether you're looking to track your personal income or manage payroll for your business, Excel's tools and features can help you make informed financial decisions and achieve your goals.

Final Thoughts

As you begin to use Excel for paycheck management, remember that practice makes perfect. Don't be afraid to experiment with different formulas, functions, and tools to find what works best for you. With time and experience, you'll become more proficient in using Excel to manage your paychecks, leading to better financial management and a more secure financial future.Paycheck Management Image Gallery

What is the best way to manage paychecks in Excel?

+The best way to manage paychecks in Excel is to create a customized spreadsheet that includes columns for income, deductions, and net pay. Using formulas and functions can help automate calculations and make it easier to track changes over time.

How do I create a paycheck calculator in Excel?

+To create a paycheck calculator in Excel, start by inputting your gross income and deductions into separate cells. Then, use formulas to calculate your net income. You can also use conditional formatting to highlight cells based on certain conditions, such as income above a certain threshold.

What are some common Excel formulas used for paycheck management?

+Common Excel formulas used for paycheck management include the SUM function for adding up income or expenses, the AVERAGE function for calculating average monthly income, and the IF function for applying different tax rates based on income levels.

We hope this article has provided you with valuable insights and tips on how to use Excel for paycheck management. Whether you're just starting out or looking to improve your existing system, Excel's powerful tools and features can help you achieve your financial goals. Share your thoughts and experiences with using Excel for paycheck management in the comments below, and don't forget to share this article with anyone who might find it useful.