Intro

Boost retirement income with 5 ways to grow annuity, including strategic investments, tax optimization, and diversified portfolios, to maximize returns and secure financial futures through smart annuity growth strategies.

Growing an annuity requires a combination of strategic planning, financial discipline, and patience. Annuities are financial products that provide a guaranteed income stream for a set period or for life, making them an attractive option for individuals seeking predictable returns and security in their retirement years. Here are five ways to grow an annuity, each tailored to different financial goals and risk tolerances.

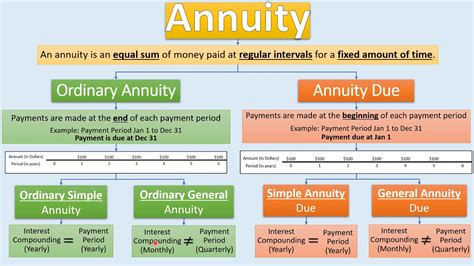

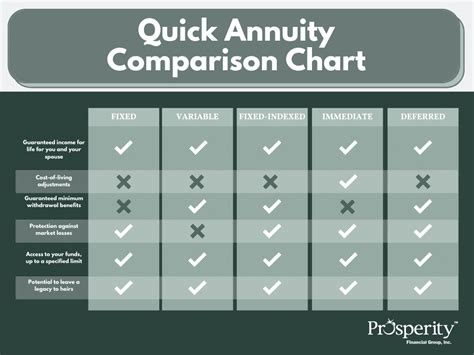

Annuities are designed to address various financial needs, including retirement savings, income generation, and legacy planning. They come in different types, such as fixed, variable, and indexed annuities, each offering unique benefits and growth potential. Understanding these types and how they work is crucial for making informed decisions about growing an annuity.

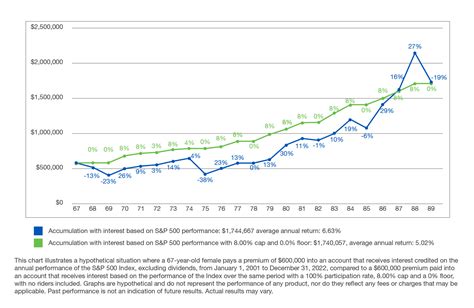

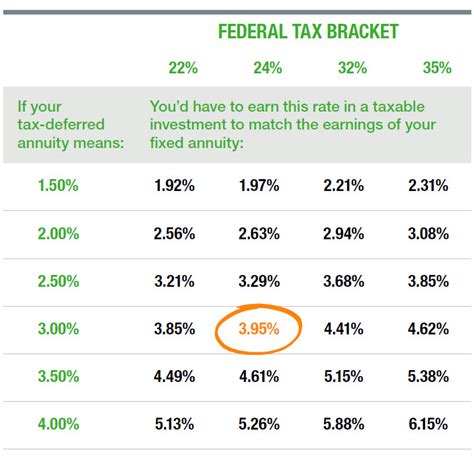

The importance of annuities in financial planning cannot be overstated. They offer a hedge against longevity risk, ensuring that retirees do not outlive their assets. Additionally, annuities can provide tax-deferred growth, meaning that the earnings on an annuity are not taxed until they are withdrawn, allowing the annuity to grow more rapidly than if taxes were paid annually.

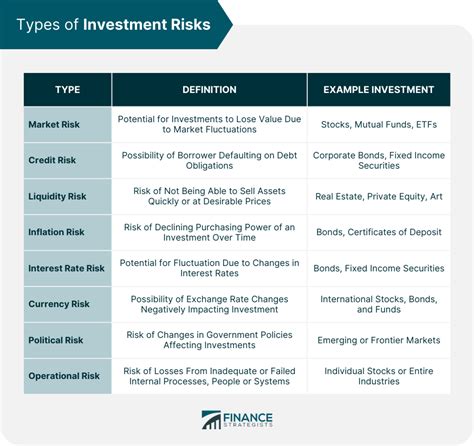

Before diving into the strategies for growing an annuity, it's essential to consider the current economic conditions and how they might impact annuity growth. Economic factors such as interest rates, inflation, and market performance can significantly influence the growth of an annuity. For instance, in a low-interest-rate environment, fixed annuities might offer less attractive returns compared to periods with higher interest rates.

Understanding Annuity Types

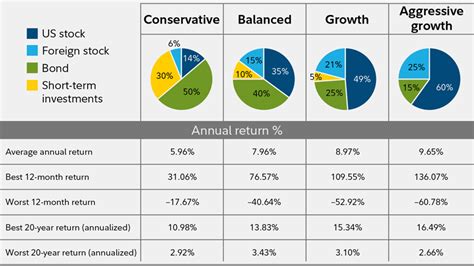

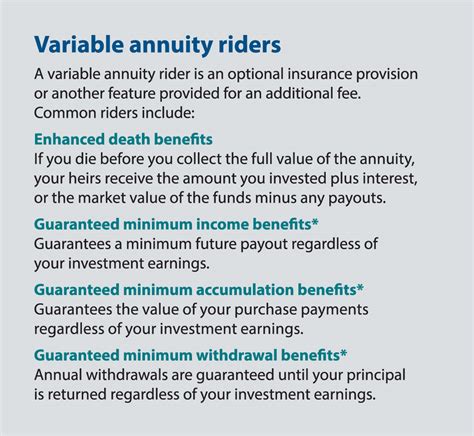

To grow an annuity effectively, one must first understand the different types of annuities available. Each type has its own set of features, benefits, and potential for growth. Fixed annuities, for example, offer a fixed rate of return, making them a low-risk option. Variable annuities, on the other hand, allow investors to allocate their premium among various investment portfolios, offering the potential for higher returns but also exposing them to market risks. Indexed annuities combine elements of both, offering returns tied to the performance of a specific market index, such as the S&P 500, while typically providing a floor to protect against losses.

Strategic Investment

Investing strategically in an annuity involves selecting the right type of annuity that aligns with your financial goals and risk tolerance. For those seeking predictable income, a fixed annuity might be the best choice. However, for individuals willing to take on more risk in pursuit of higher returns, a variable or indexed annuity could be more suitable. It's also crucial to consider the fees associated with each type of annuity, as higher fees can erode the potential for growth.

Benefits of Strategic Investment

- Predictable Income: Fixed annuities provide a guaranteed income stream, which can be invaluable in retirement.

- Potential for Higher Returns: Variable and indexed annuities offer the potential for higher returns, although they come with higher risks.

- Tax-Deferred Growth: Annuities allow for tax-deferred growth, which can help the annuity grow more rapidly.

Maximizing Contributions

Maximizing contributions to an annuity is another way to grow its value. The more funds contributed, especially in the early years, the more potential for growth due to compound interest. It's essential to understand the contribution limits and any penalties for early withdrawals. Contributing the maximum allowable amount each year can significantly impact the annuity's growth over time.

Considerations for Maximizing Contributions

- Contribution Limits: Understand the annual contribution limits to avoid penalties.

- Compound Interest: The power of compound interest can greatly enhance the annuity's growth.

- Penalties for Early Withdrawal: Be aware of the penalties for withdrawing funds before the stipulated age to avoid unnecessary losses.

Diversification

Diversifying an annuity portfolio can help mitigate risks and potentially increase returns. This can be achieved by allocating funds across different types of annuities or by investing in annuities with different features, such as varying surrender periods or riders that offer additional benefits like long-term care coverage. Diversification is key to managing risk and ensuring that the annuity grows steadily over time.

Benefits of Diversification

- Risk Management: Spreads risk across different investments, reducing the impact of any one investment's performance.

- Potential for Higher Returns: A diversified portfolio can potentially earn higher returns than any single investment.

- Flexibility: Offers flexibility in managing the annuity portfolio, allowing for adjustments based on changing financial goals or market conditions.

Professional Guidance

Seeking professional guidance is crucial for growing an annuity effectively. Financial advisors can provide personalized advice based on an individual's financial situation, goals, and risk tolerance. They can help in selecting the right type of annuity, maximizing contributions, and diversifying the portfolio. Professional guidance can also help in navigating complex annuity features and riders, ensuring that the annuity is aligned with the individual's overall financial strategy.

Benefits of Professional Guidance

- Personalized Advice: Tailored advice based on individual financial circumstances.

- Expert Knowledge: Access to in-depth knowledge of annuity products and market trends.

- Strategy Alignment: Ensures that the annuity strategy aligns with overall financial goals and risk tolerance.

Annuity Growth Strategies Image Gallery

What are the main types of annuities?

+The main types of annuities are fixed, variable, and indexed annuities, each offering different features and potential for growth.

How do I choose the right annuity for my needs?

+Choosing the right annuity involves considering your financial goals, risk tolerance, and time horizon. It's often beneficial to consult with a financial advisor.

Can I withdraw money from my annuity at any time?

+Withdrawing money from an annuity can result in penalties and taxes if done before a certain age or within a specified surrender period. It's essential to understand the terms of your annuity contract.

How does tax-deferred growth benefit my annuity?

+Tax-deferred growth allows your annuity to grow faster because you don't pay taxes on the earnings until you withdraw them, potentially leading to a larger accumulation of funds over time.

Is it wise to invest in an annuity for retirement?

+Annuities can be a wise investment for retirement as they provide a guaranteed income stream, helping to ensure that you do not outlive your assets. However, it's crucial to consider your overall financial situation and goals.

In conclusion, growing an annuity requires careful planning, a deep understanding of the different types of annuities, and a strategic approach to investment and management. By maximizing contributions, diversifying the portfolio, seeking professional guidance, and understanding the benefits and risks associated with annuities, individuals can effectively grow their annuity and secure a more stable financial future. We invite readers to share their experiences and insights on growing annuities, and to explore the various strategies and products available in the market today. Whether you're nearing retirement or just starting to plan for your financial future, understanding how to grow an annuity can be a crucial step in achieving your long-term financial goals.