Intro

The Relative Strength Index (RSI) is a widely used technical indicator in financial markets, helping traders and investors gauge the strength of a security's recent price action. Developed by J. Welles Wilder Jr., the RSI is calculated based on the magnitude of recent price changes to determine overbought or oversold conditions. Understanding the RSI indicator formulas is crucial for applying this tool effectively in trading strategies. Here, we delve into the core formulas and concepts surrounding the RSI, exploring its application and interpretation in financial markets.

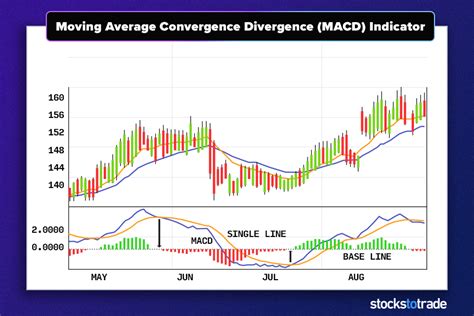

The RSI is typically calculated over a 14-period timeframe, though this can be adjusted based on the trader's preferences and the specific market conditions. The basic idea behind the RSI is to compare the average gain of up days to the average loss of down days over a given period, which provides insight into the stock's recent price action and potential future movements.

To calculate the RSI, one must first determine the average gain and average loss over the specified period. This involves several steps, including identifying up days and down days, calculating the gains and losses for each, and then finding the average gain and average loss over the 14-day period. The RSI is then calculated using these averages.

Understanding the RSI Calculation

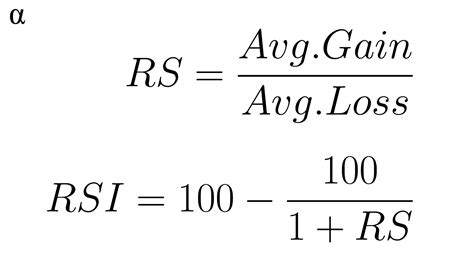

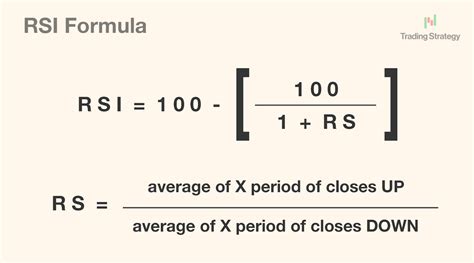

The calculation of the RSI involves several key steps and formulas. Initially, the average gain and average loss over the specified period are calculated. The formula for the average gain is the sum of all gains over the period divided by the number of periods. Similarly, the average loss is calculated by summing all losses and dividing by the number of periods. These values are then used to calculate the Relative Strength (RS), which is the average gain divided by the average loss. The RSI is derived from the RS by using the following formula: RSI = 100 - (100 / (1 + RS)).

RSI Indicator Formulas

-

Average Gain and Average Loss Calculation: The first step in calculating the RSI is to determine the gain and loss for each period. The gain is the difference between the current closing price and the previous closing price if the result is positive (indicating an up day). Conversely, the loss is the absolute value of the difference if the result is negative (indicating a down day). Once all gains and losses over the specified period are calculated, the average gain and average loss are determined by summing these values and dividing by the number of periods.

-

Relative Strength (RS) Calculation: After obtaining the average gain and average loss, the Relative Strength (RS) is calculated by dividing the average gain by the average loss. This ratio provides a quantitative measure of the stock's recent price strength.

-

RSI Calculation: The final step is to calculate the RSI using the RS. The formula for the RSI is: RSI = 100 - (100 / (1 + RS)). This calculation normalizes the RS into a value between 0 and 100, which can be used to identify overbought and oversold conditions.

Interpreting RSI Values

-

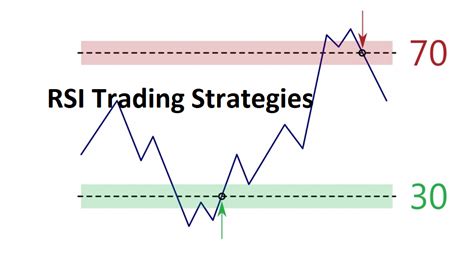

Overbought Conditions: An RSI value above 70 typically indicates that a security is overbought, suggesting that the price may be due for a pullback. This does not necessarily mean the price will fall, but rather that the upward momentum may slow.

-

Oversold Conditions: Conversely, an RSI value below 30 indicates that a security is oversold, suggesting potential for a rebound. Like overbought conditions, this is not a guarantee of a price increase but rather an indication that the downward momentum may reverse.

-

Bullish and Bearish Divergences: One of the most powerful uses of the RSI is in identifying divergences between the RSI and the price action. A bullish divergence occurs when the RSI makes a higher low while the price makes a lower low, indicating potential for an upward move. A bearish divergence happens when the RSI makes a lower high while the price makes a higher high, suggesting a potential downward move.

Applying RSI in Trading Strategies

The RSI can be integrated into various trading strategies, either as a standalone indicator or in conjunction with other technical and fundamental analysis tools. Traders may use the RSI to:

-

Identify Entry and Exit Points: Overbought and oversold conditions can signal potential entry or exit points. For example, a long position might be entered when the RSI falls below 30 and then moves back above it, indicating a potential reversal.

-

Confirm Trends: The RSI can be used to confirm the strength of a trend. For instance, if the price is making higher highs and the RSI is also making higher highs, it confirms the upward trend.

-

Spot Divergences: As mentioned, divergences between the RSI and price action can be powerful signals for potential reversals.

Limitations and Considerations

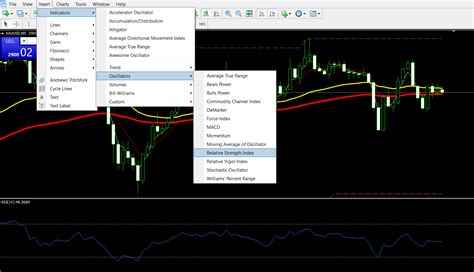

While the RSI is a valuable tool, it is not without its limitations. The RSI can be influenced by the chosen period, with shorter periods making the RSI more sensitive and longer periods making it less sensitive. Additionally, the RSI does not account for the overall trend of the market, and false signals can occur during strong trends. It's also worth noting that the RSI should be used in conjunction with other forms of analysis to form a complete view of the market.

Gallery of RSI Indicator Applications

RSI Indicator Image Gallery

Frequently Asked Questions

What is the RSI indicator used for?

+The RSI indicator is used to measure the magnitude of recent price changes to determine overbought or oversold conditions.

How is the RSI calculated?

+The RSI is calculated by comparing the average gain of up days to the average loss of down days over a given period, typically 14 days.

What are the main limitations of the RSI?

+The RSI can be influenced by the chosen period, and it does not account for the overall trend of the market, leading to potential false signals during strong trends.

Can the RSI be used in conjunction with other indicators?

+Yes, the RSI can be effectively used in combination with other technical and fundamental analysis tools to form a more comprehensive view of the market.

What does an RSI value of 70 indicate?

+An RSI value above 70 typically indicates that a security is overbought, suggesting potential for a pullback.

In conclusion, mastering the RSI indicator formulas and understanding their applications can significantly enhance a trader's ability to navigate financial markets. By recognizing the strengths and limitations of the RSI, traders can integrate this powerful tool into their strategies, potentially leading to more informed and effective trading decisions. Whether you're a seasoned trader or just beginning your journey, the RSI is an indispensable resource for anyone seeking to better understand market dynamics and make data-driven decisions. We encourage you to share your experiences with the RSI and explore how it can be tailored to fit your unique trading approach.