Intro

Master sales tax with 5 expert tips, covering tax compliance, audit preparation, and exemption rules to minimize liability and maximize savings, including nexus, registration, and filing requirements.

Understanding sales tax is crucial for businesses and individuals alike, as it directly impacts financial planning, budgeting, and compliance with legal requirements. Sales tax, a form of consumption tax, is levied on the sale of goods and services. It is a significant source of revenue for governments, but navigating its complexities can be challenging. Here, we delve into the world of sales tax, exploring its intricacies and providing valuable insights to help manage its implications effectively.

The importance of grasping sales tax concepts cannot be overstated. It affects not only businesses' bottom line but also influences consumer purchasing decisions. For companies, especially those operating in multiple states or countries, understanding sales tax laws is essential to avoid legal issues and financial penalties. Individuals, too, benefit from knowledge about sales tax, as it helps them make informed decisions about their purchases and potentially save money.

In the realm of sales tax, there are numerous considerations, from determining what products are taxable to understanding the rates applied in different jurisdictions. The digital age has further complicated sales tax, with online transactions raising questions about where tax should be applied. As governments continue to update and refine sales tax laws, staying informed is key to compliance and financial health. Whether you are a business owner, an accountant, or simply a consumer, having a solid grasp of sales tax principles can make a significant difference in navigating the complex world of taxation.

Understanding Sales Tax Basics

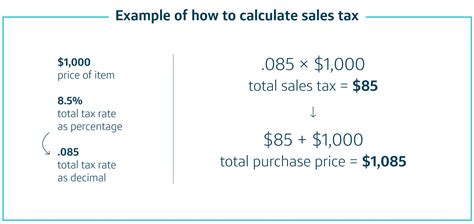

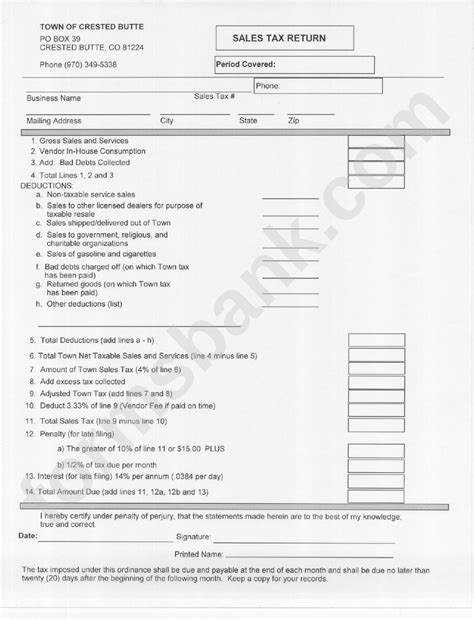

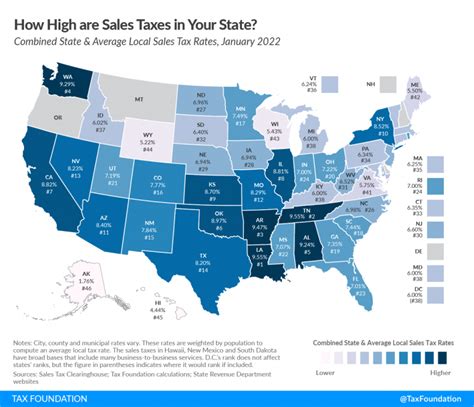

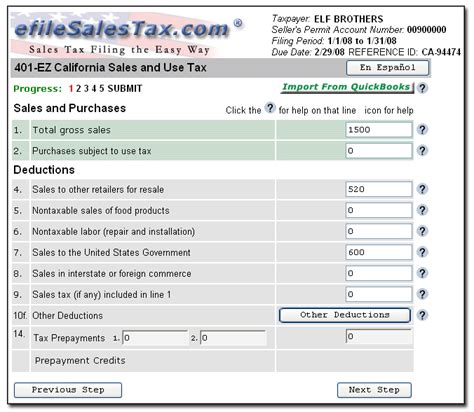

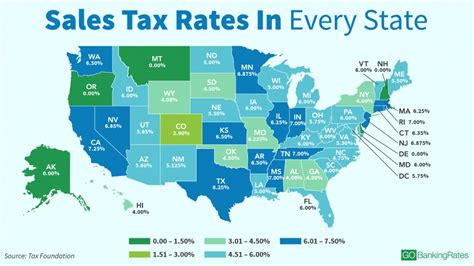

To effectively manage sales tax, it's essential to start with the basics. Sales tax is generally imposed on the retail sale of tangible personal property and certain services. The tax rate varies by location, with some areas having higher rates than others. Businesses must collect sales tax from customers and remit it to the appropriate taxing authority. Understanding what is taxable and what is exempt is crucial, as is knowledge of how to calculate and report sales tax accurately.

Key Concepts in Sales Tax

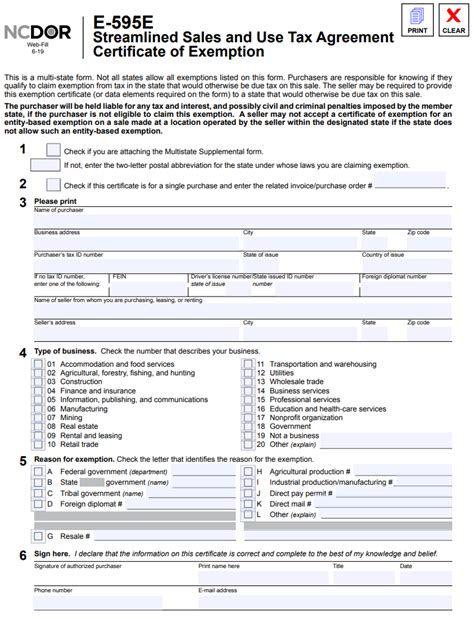

- **Taxable Items**: These include most tangible personal property and certain services. The specific items that are taxable can vary significantly from one jurisdiction to another. - **Exemptions**: Some items and services are exempt from sales tax. Common exemptions include food, clothing, and prescription medications, though these can vary by state. - **Tax Rates**: Sales tax rates differ by location. Some areas have a single, statewide rate, while others have rates that vary by county or city.Navigating Sales Tax Laws

Navigating sales tax laws requires a deep understanding of the regulations in each jurisdiction where a business operates. This includes knowing the tax rates, what items are taxable, and how to handle exemptions. For businesses operating in multiple locations, this can become particularly complex, as laws and rates can vary significantly.

Multi-State Operations

- **Nexus**: This refers to the connection between a business and a state that allows the state to impose taxes. Having a physical presence in a state, such as a store or warehouse, creates a nexus. - **Remote Sellers**: With the rise of online shopping, many businesses sell products across state lines. Understanding remote seller laws, which dictate when out-of-state sellers must collect sales tax, is critical.Managing Sales Tax Compliance

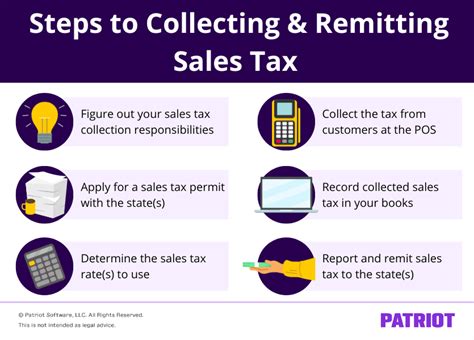

Compliance with sales tax laws is essential to avoid penalties and audits. This involves accurately collecting and remitting sales tax, as well as maintaining detailed records. Businesses must also stay up-to-date with changes in sales tax laws and rates.

Best Practices for Compliance

- **Regularly Update Tax Rates**: Ensure that your business is using the most current tax rates for each jurisdiction. - **Accurate Record Keeping**: Maintain detailed records of sales, including the amount of sales tax collected and remitted. - **Conduct Regular Audits**: Periodically review your sales tax practices to ensure compliance and identify any areas for improvement.Utilizing Sales Tax Software

Given the complexity of sales tax laws, especially for businesses operating in multiple jurisdictions, utilizing sales tax software can be highly beneficial. This software can automate many tasks related to sales tax, including calculating tax rates, preparing returns, and filing with the appropriate authorities.

Benefits of Sales Tax Software

- **Accuracy**: Reduces the risk of human error in calculating and remitting sales tax. - **Efficiency**: Automates many tasks, saving time and resources. - **Compliance**: Helps ensure that businesses are compliant with all relevant sales tax laws and regulations.Strategies for Minimizing Sales Tax Liability

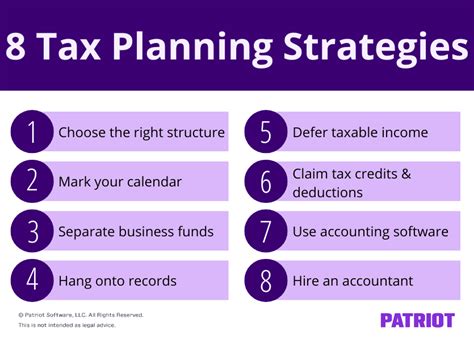

While sales tax is a necessary part of doing business, there are strategies that companies can employ to minimize their sales tax liability. This includes taking advantage of exemptions, using tax planning strategies, and ensuring that all eligible deductions are claimed.

Tax Planning Strategies

- **Exemption Analysis**: Regularly review products and services to identify any that may be exempt from sales tax. - **Nexus Study**: Conduct a nexus study to understand where your business has a tax obligation and to identify opportunities to reduce liability. - **Audit Protection**: Implement practices that protect against audit risks, such as maintaining thorough records and ensuring compliance with all sales tax laws.Sales Tax Image Gallery

What is sales tax and how does it work?

+Sales tax is a consumption tax imposed on the sale of goods and services. Businesses collect sales tax from customers and remit it to the government. The tax rate varies by location and type of product or service.

How do I determine if my business needs to collect sales tax?

+Your business needs to collect sales tax if it has a nexus in a state and sells taxable products or services. Nexus can be established through a physical presence, employees, or significant economic activity in a state.

What are some common sales tax exemptions?

+Common exemptions include food, clothing, prescription medications, and certain services. However, exemptions vary by state, so it's essential to check the specific laws in your jurisdiction.

In conclusion, navigating the world of sales tax requires a combination of understanding the basics, staying compliant with laws and regulations, and utilizing strategies to minimize liability. By grasping these concepts and applying them effectively, businesses can ensure they are meeting their sales tax obligations while also optimizing their financial positions. As sales tax laws continue to evolve, ongoing education and adaptation will be key to success. We invite readers to share their experiences and insights on managing sales tax, and we look forward to continuing the conversation on this critical aspect of business operations.