Intro

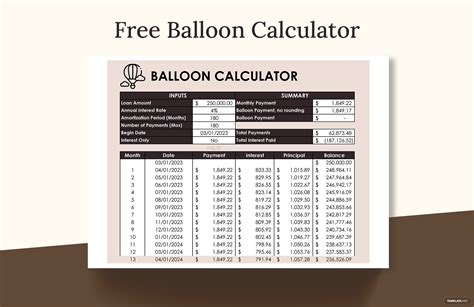

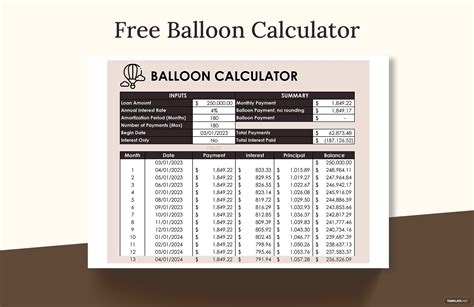

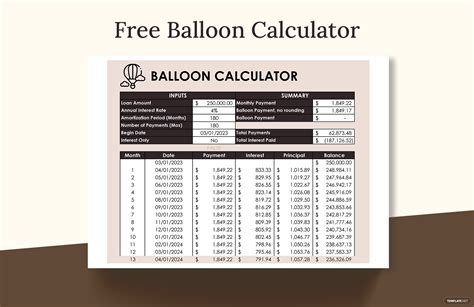

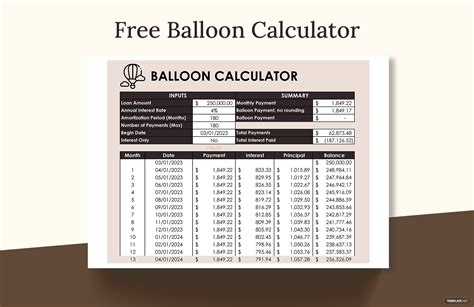

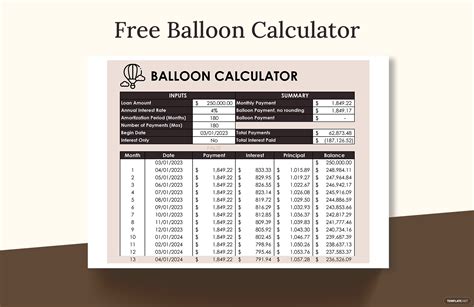

Calculate balloon loan payments with ease using our Excel calculator, featuring amortization schedules, interest rates, and loan terms to help you manage debt and plan finances effectively.

Balloon loans are a type of loan that requires a large payment at the end of the loan term, known as a balloon payment. This type of loan is often used for short-term financing needs, such as purchasing a car or a house. To calculate the monthly payments and the balloon payment, you can use a balloon loan calculator in Excel. In this article, we will discuss the importance of using a balloon loan calculator and provide a step-by-step guide on how to create one in Excel.

The use of a balloon loan calculator is essential for individuals and businesses that need to determine the monthly payments and the balloon payment for a loan. This calculator can help you understand the terms of the loan and make informed decisions about your financing options. With a balloon loan calculator, you can input the loan amount, interest rate, loan term, and other variables to calculate the monthly payments and the balloon payment.

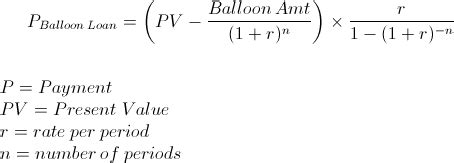

To create a balloon loan calculator in Excel, you will need to use the following formulas and functions: PMT, IPMT, and PPMT. The PMT function calculates the monthly payment, while the IPMT and PPMT functions calculate the interest and principal components of the monthly payment, respectively. By using these formulas and functions, you can create a comprehensive balloon loan calculator that provides accurate and reliable results.

How to Create a Balloon Loan Calculator in Excel

To create a balloon loan calculator in Excel, follow these steps:

- Open a new Excel worksheet and create a table with the following columns: Loan Amount, Interest Rate, Loan Term, Monthly Payment, and Balloon Payment.

- Input the loan amount, interest rate, and loan term into the corresponding cells.

- Use the PMT function to calculate the monthly payment. The formula is: =PMT(Interest Rate, Loan Term, Loan Amount).

- Use the IPMT and PPMT functions to calculate the interest and principal components of the monthly payment. The formulas are: =IPMT(Interest Rate, Loan Term, Loan Amount) and =PPMT(Interest Rate, Loan Term, Loan Amount).

- Calculate the balloon payment by subtracting the total principal paid from the loan amount. The formula is: =Loan Amount - SUM(PPMT(Interest Rate, Loan Term, Loan Amount)).

Benefits of Using a Balloon Loan Calculator

Using a balloon loan calculator provides several benefits, including:

- Accurate calculations: A balloon loan calculator ensures that your calculations are accurate and reliable, reducing the risk of errors and miscalculations.

- Informed decisions: With a balloon loan calculator, you can input different scenarios and variables to determine the best financing option for your needs.

- Time-saving: A balloon loan calculator saves time and effort by automating the calculation process, allowing you to focus on other important tasks.

- Flexibility: A balloon loan calculator can be customized to fit your specific needs and requirements, providing flexibility and adaptability.

Types of Balloon Loans

There are several types of balloon loans, including:

- Fixed-rate balloon loan: This type of loan has a fixed interest rate and a fixed loan term.

- Adjustable-rate balloon loan: This type of loan has an adjustable interest rate that can change over time.

- Interest-only balloon loan: This type of loan requires interest-only payments for a specified period, followed by a balloon payment.

- Amortizing balloon loan: This type of loan requires monthly payments that include both interest and principal, with a balloon payment at the end of the loan term.

How to Use a Balloon Loan Calculator

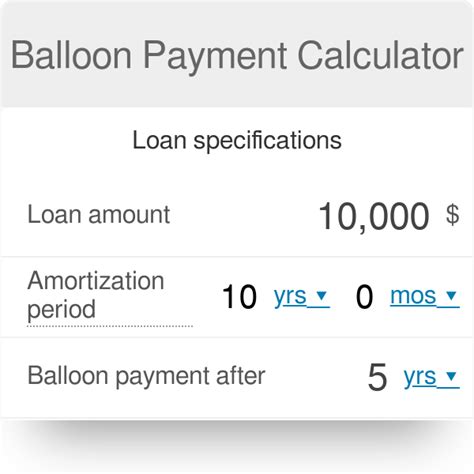

To use a balloon loan calculator, follow these steps:

- Input the loan amount, interest rate, and loan term into the calculator.

- Select the type of balloon loan and the payment frequency.

- Calculate the monthly payment and the balloon payment.

- Review the results and adjust the variables as needed to determine the best financing option for your needs.

Advantages and Disadvantages of Balloon Loans

Balloon loans have both advantages and disadvantages, including:

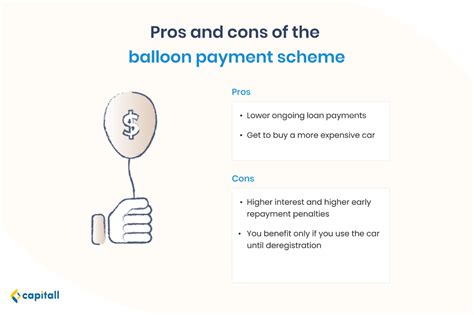

Advantages:

- Lower monthly payments: Balloon loans often have lower monthly payments than traditional loans, making them more affordable for borrowers.

- Flexibility: Balloon loans can be customized to fit the borrower's needs and requirements, providing flexibility and adaptability.

- Tax benefits: The interest on balloon loans may be tax-deductible, providing tax benefits for borrowers.

Disadvantages:

- Large balloon payment: The balloon payment at the end of the loan term can be large and unexpected, causing financial strain for borrowers.

- Risk of default: Borrowers may default on the loan if they are unable to make the balloon payment, resulting in negative credit consequences.

- Limited financing options: Balloon loans may have limited financing options, making it difficult for borrowers to refinance or modify the loan.

Common Uses of Balloon Loans

Balloon loans are commonly used for:

- Purchasing a car: Balloon loans are often used to finance the purchase of a car, providing lower monthly payments and a large balloon payment at the end of the loan term.

- Financing a business: Balloon loans can be used to finance a business, providing flexible repayment terms and a large balloon payment at the end of the loan term.

- Investing in real estate: Balloon loans can be used to invest in real estate, providing lower monthly payments and a large balloon payment at the end of the loan term.

Balloon Loan Calculator Image Gallery

What is a balloon loan calculator?

+A balloon loan calculator is a tool used to calculate the monthly payments and the balloon payment for a balloon loan.

How do I use a balloon loan calculator?

+To use a balloon loan calculator, input the loan amount, interest rate, and loan term into the calculator and select the type of balloon loan and the payment frequency.

What are the advantages and disadvantages of balloon loans?

+The advantages of balloon loans include lower monthly payments and flexibility, while the disadvantages include the risk of default and limited financing options.

In conclusion, a balloon loan calculator is a valuable tool for individuals and businesses that need to determine the monthly payments and the balloon payment for a loan. By using a balloon loan calculator, you can make informed decisions about your financing options and avoid the risks associated with balloon loans. Whether you are purchasing a car, financing a business, or investing in real estate, a balloon loan calculator can help you navigate the complex world of financing and make the best decision for your needs. We hope this article has provided you with a comprehensive understanding of balloon loan calculators and their uses. If you have any further questions or would like to share your experiences with balloon loans, please comment below.