Intro

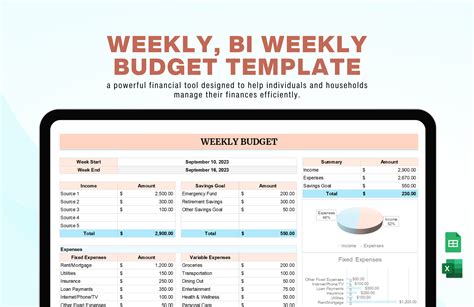

Manage finances with a bi-weekly budget template in Google Sheets, featuring expense tracking, income management, and financial planning tools for effective budgeting and money management.

Creating a budget is an essential step in managing one's finances effectively. A bi-weekly budget template can help individuals track their income and expenses over a two-week period, making it easier to stay on top of their financial situation. Google Sheets is a popular platform for creating and managing budgets due to its accessibility, flexibility, and collaboration features. Here, we'll explore the importance of budgeting, how to create a bi-weekly budget template in Google Sheets, and provide tips on using it effectively.

Budgeting is crucial for achieving financial stability and reaching long-term financial goals. It helps in understanding where your money is going, identifying areas for cost-cutting, and making informed financial decisions. A bi-weekly budget is particularly useful for individuals who receive their income on a bi-weekly basis, as it aligns with their pay schedule and can help in managing cash flow more efficiently.

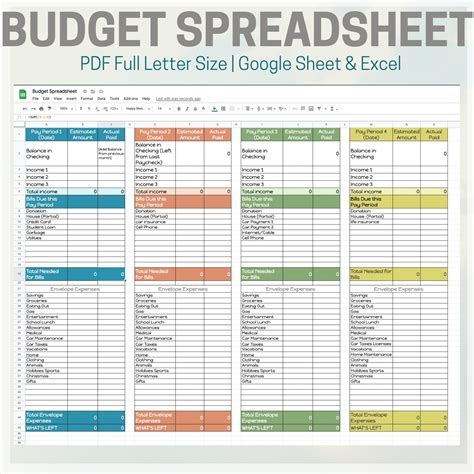

To start creating a bi-weekly budget template in Google Sheets, you'll first need to set up a new spreadsheet. Google Sheets offers a variety of templates to get you started, but for a bi-weekly budget, you might want to begin with a blank sheet to customize it according to your needs. Here’s a basic outline to follow:

- Income Section: Start by listing all your income sources for the bi-weekly period. This could include your salary, any freelance work, investments, or other regular income.

- Fixed Expenses: Next, list your fixed expenses. These are expenses that remain the same each month, such as rent/mortgage, car payments, insurance, and minimum credit card payments.

- Variable Expenses: After fixed expenses, list your variable expenses. These can include groceries, entertainment, gas for your car, and any other expenses that can change from month to month.

- Savings and Debt Repayment: Include sections for savings goals and debt repayment. It’s essential to prioritize saving and paying off high-interest debts.

- Total Income vs. Total Expenses: Calculate the total income and total expenses for the bi-weekly period to ensure you're not overspending.

Setting Up Your Bi-Weekly Budget Template in Google Sheets

Setting up a bi-weekly budget template in Google Sheets involves creating tables for income, fixed expenses, variable expenses, savings, and debt repayment. You can use formulas to automatically calculate totals and percentages, making it easier to analyze your budget. For example, you can use the =SUM() function to add up all your income or expenses in a particular category.

Using Formulas for Automatic Calculations

Google Sheets offers a range of formulas that can simplify your budgeting process. For instance, you can use the `=AVERAGE()` function to find the average of a range of numbers, which can be useful for tracking expenses over time. Conditional formatting can also be applied to highlight cells that exceed a certain budget threshold, helping you quickly identify areas where you need to cut back.Benefits of Using Google Sheets for Budgeting

Google Sheets offers several benefits for budgeting, including accessibility, real-time collaboration, and automatic saving. Since Google Sheets is cloud-based, you can access your budget from anywhere, at any time, and share it with a financial advisor or partner for collaborative budgeting. The automatic saving feature ensures that your data is safe, and you can easily track changes made to your budget over time.

Customizing Your Budget Template

Customization is key to making your bi-weekly budget template effective. Consider adding columns for budgeted amounts versus actual spending to track your progress. You can also include a section for notes to jot down financial decisions, reminders for bill payments, or inspirations for saving money.Practical Tips for Effective Budgeting

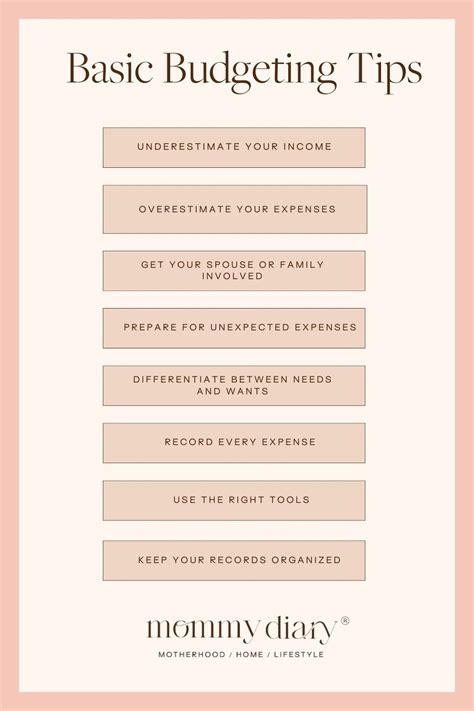

Effective budgeting involves more than just creating a template; it requires discipline and regular monitoring. Here are some practical tips:

- Track Every Expense: For one month, write down every single transaction, no matter how small. This will give you a clear picture of your spending habits.

- Prioritize Needs Over Wants: Distinguish between essential expenses (needs) and discretionary spending (wants).

- Use the 50/30/20 Rule: Allocate 50% of your income towards necessary expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment.

- Review and Adjust: Regularly review your budget to identify areas for improvement and make adjustments as needed.

Common Budgeting Mistakes to Avoid

Avoiding common budgeting mistakes can help you stay on track with your financial goals. These mistakes include not accounting for irregular expenses, failing to prioritize emergency savings, and not regularly reviewing your budget. By being aware of these potential pitfalls, you can take proactive steps to avoid them.Gallery of Budgeting Templates and Tips

Budgeting Templates and Tips Image Gallery

Frequently Asked Questions

What is the best way to start budgeting?

+Start by tracking your income and expenses to understand where your money is going. Then, create a budget that allocates your income into different categories.

How often should I review my budget?

+It's a good idea to review your budget regularly, ideally once a month, to ensure you're on track with your financial goals and to make any necessary adjustments.

What are some common budgeting mistakes to avoid?

+Common budgeting mistakes include not accounting for irregular expenses, failing to prioritize emergency savings, and not regularly reviewing your budget.

In conclusion, creating a bi-weekly budget template in Google Sheets is a straightforward and effective way to manage your finances. By following the steps outlined above and customizing your template to fit your needs, you can gain better control over your income and expenses. Remember, budgeting is a process, and it may take some time to find a rhythm that works for you. Stay committed, and with the right tools and mindset, you'll be on your way to achieving financial stability and success. We invite you to share your budgeting tips and experiences in the comments below, and don't forget to share this article with anyone who might benefit from learning more about bi-weekly budgeting with Google Sheets.