Intro

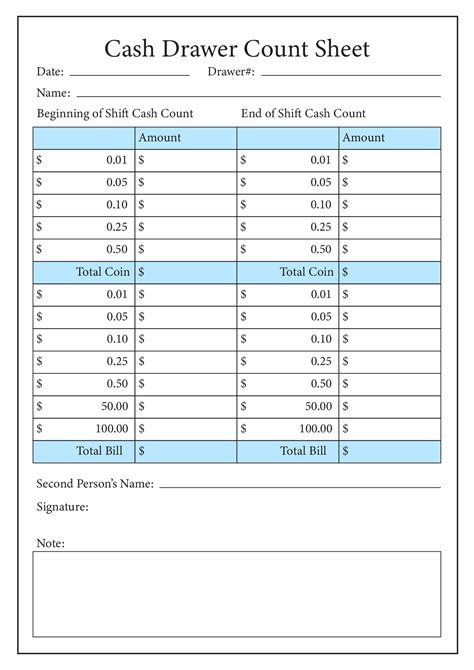

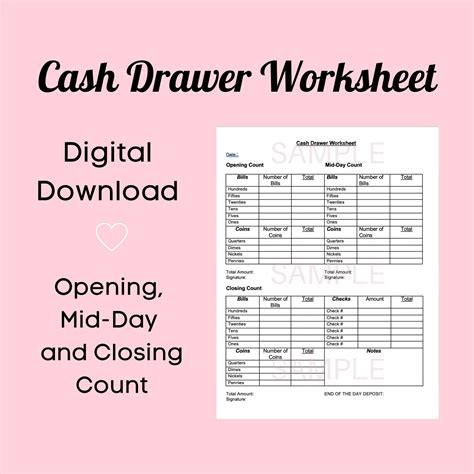

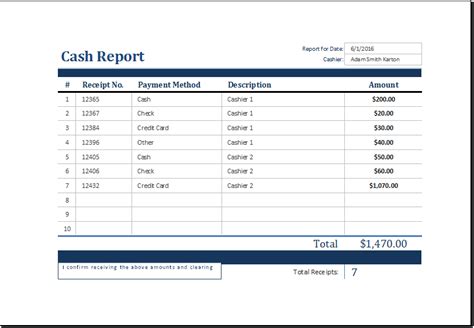

Streamline cash management with a Cash Drawer Count Sheet Template, featuring receipt tracking, deposit logs, and balance reconciliation to ensure accurate financial reporting and minimize discrepancies.

The importance of accurately managing cash transactions cannot be overstated, especially in retail environments where cash handling is a daily occurrence. One of the key tools that businesses use to ensure the integrity of their cash handling processes is the cash drawer count sheet template. This template is crucial for maintaining accountability, preventing theft, and ensuring that all cash transactions are properly recorded and reconciled. In this article, we will delve into the world of cash management, exploring the benefits, working mechanisms, and steps involved in utilizing a cash drawer count sheet template effectively.

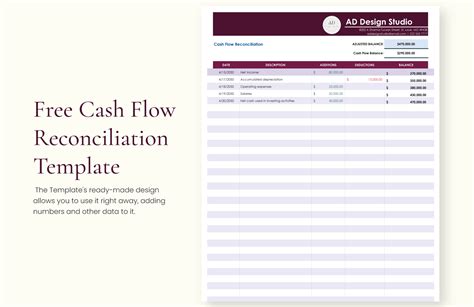

Effective cash management is the backbone of any successful retail operation. It involves not only the handling of cash transactions but also the reconciliation of these transactions to ensure that the business's financial records are accurate and up-to-date. A cash drawer count sheet template is a simple yet powerful tool that helps in achieving this goal. By providing a structured format for counting and recording cash, it minimizes the risk of errors and discrepancies, thereby protecting the business from potential losses.

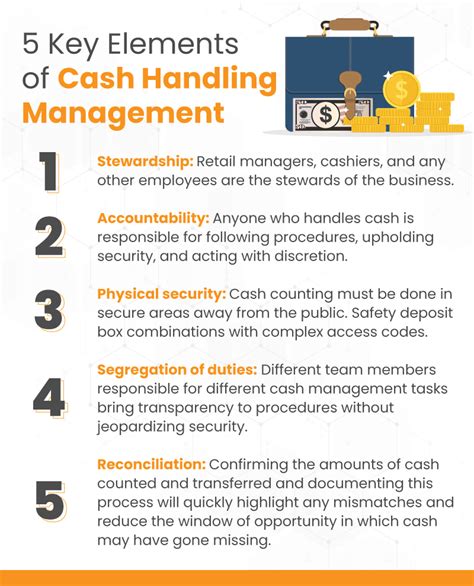

The use of a cash drawer count sheet template is particularly beneficial in environments where multiple cash handlers are involved. It ensures that each transaction is accounted for, and any discrepancies can be quickly identified and addressed. This not only enhances the security of cash transactions but also promotes a culture of transparency and accountability among staff members. Furthermore, by streamlining the cash counting and reconciliation process, businesses can save time and reduce the administrative burden associated with cash management.

Understanding the Cash Drawer Count Sheet Template

A cash drawer count sheet template typically includes several key components, each designed to facilitate the accurate counting and recording of cash. These components may vary depending on the specific needs of the business, but they generally include spaces for recording the date, the name of the cash handler, the starting and ending cash balances, and the details of any transactions that have taken place during the shift. The template may also include columns for calculating the total cash received, the total cash paid out, and any discrepancies that may have been identified during the counting process.

Benefits of Using a Cash Drawer Count Sheet Template

The benefits of using a cash drawer count sheet template are numerous and significant. Firstly, it enhances the accuracy of cash transactions by providing a structured format for counting and recording cash. This reduces the risk of human error, which is a common cause of discrepancies in cash handling. Secondly, it promotes accountability among cash handlers, as each transaction is documented and can be traced back to the individual responsible for it. This not only deters potential theft but also encourages staff members to be more vigilant in their cash handling practices.Furthermore, a cash drawer count sheet template helps in identifying and resolving discrepancies quickly. By comparing the actual cash count with the expected cash balance, businesses can pinpoint any discrepancies and take corrective action. This might involve investigating potential theft, correcting errors in cash handling, or adjusting the business's financial records to reflect the true cash position.

Implementing a Cash Drawer Count Sheet Template

Implementing a cash drawer count sheet template involves several steps, each designed to ensure that the template is used effectively and efficiently. The first step is to design the template itself, taking into account the specific needs and requirements of the business. This might involve consulting with staff members, reviewing existing cash handling procedures, and identifying areas where the template can add value.

Once the template has been designed, the next step is to train staff members on its use. This is crucial, as the template is only effective if it is used correctly and consistently. Training should cover not only the completion of the template but also the importance of accuracy, the procedures for identifying and resolving discrepancies, and the role of the template in promoting accountability and transparency.

Best Practices for Using a Cash Drawer Count Sheet Template

There are several best practices that businesses should follow when using a cash drawer count sheet template. Firstly, the template should be completed accurately and in full, with all relevant information recorded. This includes the date, the name of the cash handler, the starting and ending cash balances, and the details of any transactions that have taken place.Secondly, the template should be reviewed and reconciled regularly, ideally at the end of each shift or day. This involves comparing the actual cash count with the expected cash balance and investigating any discrepancies that may have been identified. Regular reconciliation helps to identify and address potential issues early, reducing the risk of significant discrepancies or losses.

Thirdly, businesses should maintain a record of all completed templates, as these can provide valuable insights into cash handling practices and help to identify trends or patterns that may indicate potential issues. These records can also be used for auditing purposes, providing a clear and transparent record of all cash transactions.

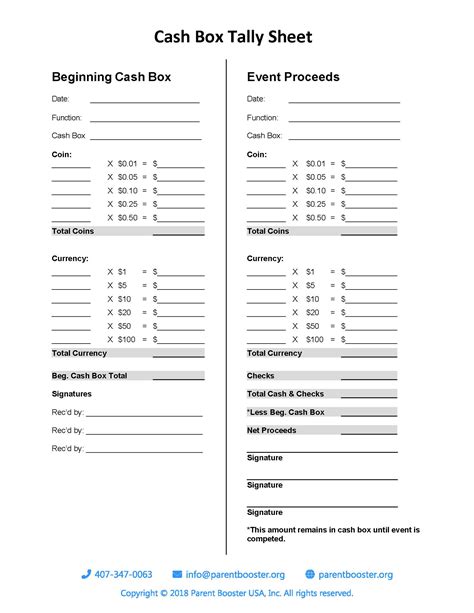

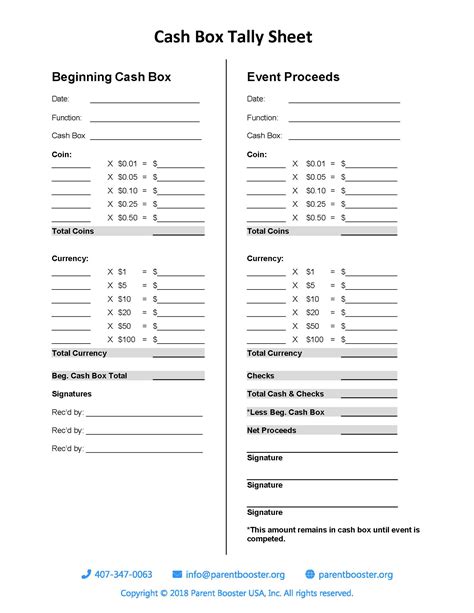

Customizing a Cash Drawer Count Sheet Template

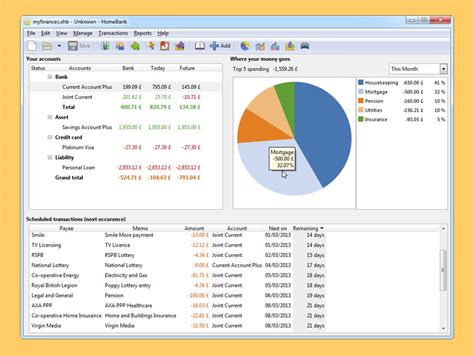

Every business is unique, with its own set of needs and requirements when it comes to cash management. For this reason, it is often necessary to customize a cash drawer count sheet template to fit the specific needs of the business. This might involve adding or removing columns, modifying the layout, or incorporating additional features such as barcode scanning or electronic signature capture.

Customization can be achieved through a variety of means, including the use of spreadsheet software or specialized cash management applications. These tools provide a high degree of flexibility, allowing businesses to design and implement a template that meets their exact needs.

Common Mistakes to Avoid

When using a cash drawer count sheet template, there are several common mistakes that businesses should avoid. Firstly, failure to complete the template accurately and in full can lead to discrepancies and errors, undermining the effectiveness of the template.Secondly, neglecting to review and reconcile the template regularly can result in potential issues going unnoticed, leading to significant losses or discrepancies over time. Regular reconciliation is essential for maintaining the integrity of cash transactions and ensuring that any issues are identified and addressed promptly.

Lastly, failing to maintain a record of completed templates can make it difficult to track cash handling practices over time, identify trends or patterns, and conduct audits or investigations as needed.

Gallery of Cash Management Tools

Cash Management Image Gallery

Frequently Asked Questions

What is a cash drawer count sheet template?

+A cash drawer count sheet template is a tool used to record and reconcile cash transactions, helping businesses to manage their cash effectively and prevent discrepancies.

Why is it important to use a cash drawer count sheet template?

+Using a cash drawer count sheet template is important because it helps to ensure the accuracy of cash transactions, promotes accountability among staff members, and facilitates the identification and resolution of discrepancies.

How do I customize a cash drawer count sheet template for my business?

+You can customize a cash drawer count sheet template by using spreadsheet software or specialized cash management applications, allowing you to add or remove columns, modify the layout, and incorporate additional features as needed.

What are some common mistakes to avoid when using a cash drawer count sheet template?

+Common mistakes to avoid include failure to complete the template accurately and in full, neglecting to review and reconcile the template regularly, and failing to maintain a record of completed templates.

How often should I review and reconcile my cash drawer count sheet template?

+You should review and reconcile your cash drawer count sheet template at the end of each shift or day, depending on the volume of cash transactions and the specific needs of your business.

In conclusion, a cash drawer count sheet template is a vital tool for businesses that handle cash transactions. By providing a structured format for counting and recording cash, it enhances the accuracy of cash transactions, promotes accountability among staff members, and facilitates the identification and resolution of discrepancies. Whether you are a small retail operation or a large enterprise, implementing a cash drawer count sheet template can help you to manage your cash more effectively, reduce the risk of discrepancies and losses, and maintain the integrity of your financial records. We invite you to share your experiences with cash management and explore how a cash drawer count sheet template can benefit your business. Feel free to comment, share this article, or take the first step towards implementing a cash drawer count sheet template in your business today.