Intro

Calculating commissions is a crucial aspect of many businesses, and using Excel can make this process efficient and accurate. The commission formula in Excel can be applied in various scenarios, depending on the structure of the commission plan. Whether you're calculating sales commissions, affiliate commissions, or any other type of commission, Excel provides the flexibility and functionality to handle complex calculations.

The importance of accurately calculating commissions cannot be overstated. It directly affects the morale and motivation of sales teams and the financial health of a company. Underpaid or overpaid commissions can lead to dissatisfaction and mistrust among employees, while also impacting the company's bottom line. Therefore, understanding how to set up and use commission formulas in Excel is essential for businesses that rely on commission-based sales incentives.

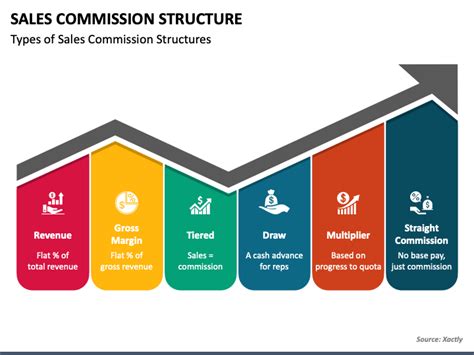

Commission structures can vary widely. Some common structures include flat rate commissions, where a fixed percentage of the sale amount is paid as commission; tiered commissions, where the commission rate increases as sales targets are met or exceeded; and draw against commissions, where a salesperson receives a guaranteed minimum payment, with the potential to earn more based on performance. Each of these structures requires a slightly different approach when setting up the commission formula in Excel.

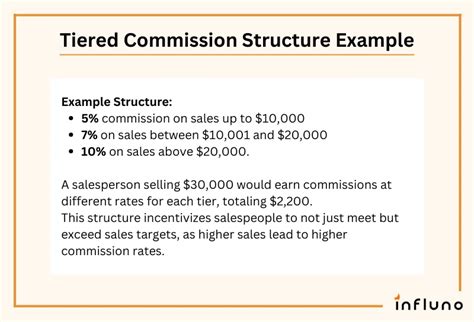

To entice readers to continue reading, let's consider a real-world scenario. Suppose you're a sales manager at a company that sells software solutions. Your sales team is motivated by a tiered commission structure, where they earn 5% on the first $10,000 of sales, 7% on the next $10,001 to $20,000, and 10% on any sales above $20,000. You need to calculate the commission for each salesperson at the end of the month. This is where Excel's commission formula comes into play, providing a quick, accurate, and transparent way to perform these calculations.

Understanding Commission Structures

Before diving into the specifics of the commission formula in Excel, it's essential to understand the different types of commission structures that businesses use. Each structure has its advantages and is suited to different types of sales environments. For instance, a flat rate commission is simple to calculate and understand but may not provide the same level of motivation as a tiered system. On the other hand, tiered commissions can be more complex to administer but offer a clear incentive for sales teams to strive for higher sales targets.

Flat Rate Commissions

Flat rate commissions involve paying a salesperson a fixed percentage of their sales. This structure is straightforward and easy to administer, making it a popular choice for many businesses. However, it may not provide the incremental motivation that tiered systems offer.Tiered Commissions

Tiered commissions offer different commission rates based on the level of sales achieved. This structure can be more motivating for sales teams, as it provides clear targets and rewards for exceeding those targets. However, it can also be more complex to manage, especially if the tiers and rates are frequently adjusted.Draw Against Commissions

Draw against commissions involve paying a salesperson a guaranteed minimum amount (the draw) against which their commissions are applied. This structure provides a safety net for salespeople, ensuring they receive a minimum payment regardless of their sales performance. It's particularly useful in industries where sales can be unpredictable or where building a client base takes time.Setting Up Commission Formulas in Excel

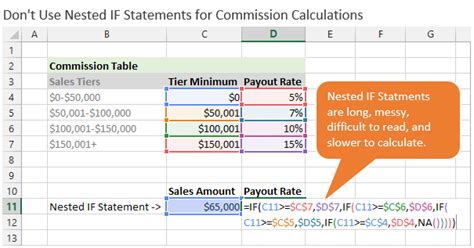

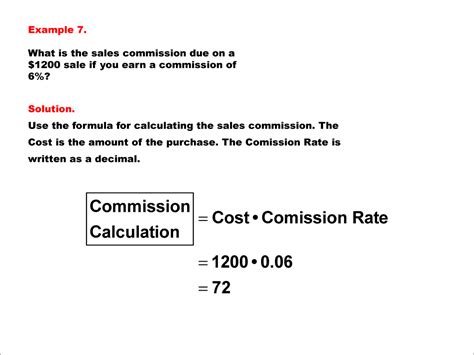

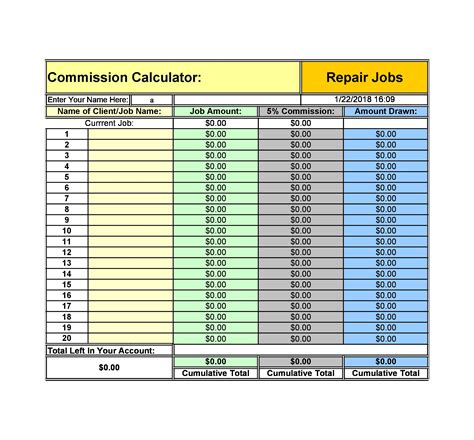

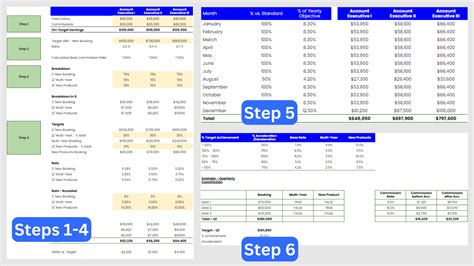

Setting up commission formulas in Excel involves several steps, including defining the commission structure, inputting sales data, and applying the appropriate formula to calculate the commission. For a flat rate commission, the formula is straightforward: Commission = Sales Amount * Commission Rate. For tiered commissions, the formula can be more complex, often involving IF statements or lookup tables to determine the applicable commission rate based on the sales amount.

To illustrate, let's consider a simple tiered commission structure:

- 5% on the first $10,000

- 7% on the next $10,001 to $20,000

- 10% on any sales above $20,000

The formula to calculate the commission in Excel might look like this:

=IF(A1<=10000, A1*0.05, IF(A1<=20000, 10000*0.05 + (A1-10000)*0.07, 10000*0.05 + 10000*0.07 + (A1-20000)*0.10))

This formula assumes the sales amount is in cell A1. It first checks if the sales amount is less than or equal to $10,000, and if so, applies a 5% commission rate. If the sales amount is between $10,001 and $20,000, it calculates the commission as 5% on the first $10,000 plus 7% on the amount above $10,000. For sales amounts above $20,000, it adds a 10% commission on the amount above $20,000 to the previously calculated commissions.

Using IF Statements for Tiered Commissions

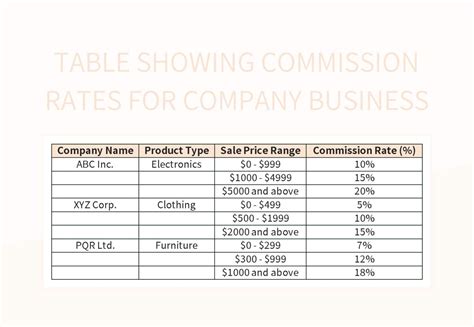

IF statements are powerful tools in Excel for handling conditional logic, such as tiered commission structures. They allow you to apply different commission rates based on specific conditions, making them ideal for complex commission calculations.Lookup Tables for Commission Rates

Another approach to calculating tiered commissions involves using lookup tables. This method can be more intuitive and easier to manage, especially when dealing with multiple tiers and rates. By setting up a table with the sales tiers and corresponding commission rates, you can use Excel's lookup functions (such as VLOOKUP or INDEX/MATCH) to find the applicable commission rate for a given sales amount.Practical Examples and Statistical Data

Let's consider a practical example to illustrate how commission formulas work in real-world scenarios. Suppose a salesperson sells $25,000 worth of software solutions in a month. Using the tiered commission structure outlined earlier (5% on the first $10,000, 7% on the next $10,001 to $20,000, and 10% on any sales above $20,000), we can calculate their commission as follows:

- On the first $10,000: $10,000 * 0.05 = $500

- On the next $10,000: $10,000 * 0.07 = $700

- On the last $5,000: $5,000 * 0.10 = $500

Total commission: $500 + $700 + $500 = $1,700

This example demonstrates how tiered commissions can provide a higher total commission for sales amounts that exceed the initial tiers, motivating sales teams to achieve higher sales targets.

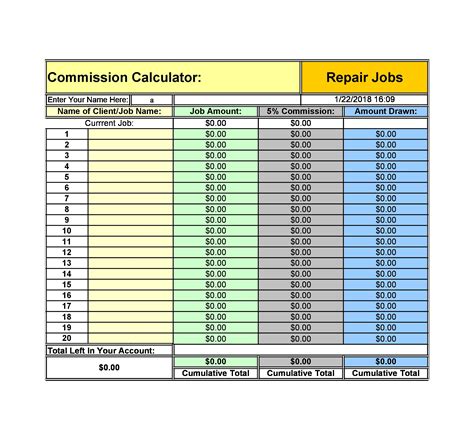

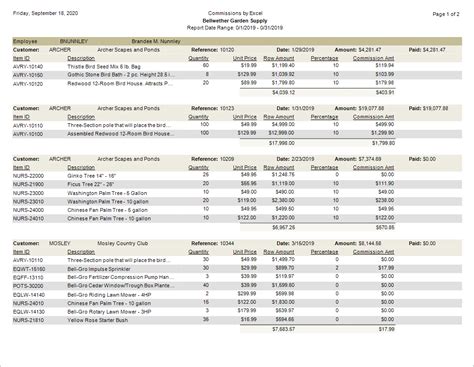

Benefits of Using Excel for Commission Calculations

Using Excel for commission calculations offers several benefits, including accuracy, efficiency, and transparency. Excel formulas can be set up to automatically calculate commissions based on sales data, reducing the risk of human error and saving time. Additionally, Excel worksheets can be shared and reviewed by relevant parties, providing a clear and transparent record of commission calculations.Common Challenges and Solutions

One common challenge in calculating commissions is dealing with complex or changing commission structures. To address this, it's essential to keep the commission formula flexible and easy to update. Using lookup tables or modular formulas can help simplify the process of adjusting commission rates or tiers.Another challenge is ensuring data accuracy and integrity. This can be mitigated by implementing data validation rules in Excel to restrict input to valid values and by regularly auditing the data for inconsistencies or errors.

Gallery of Commission Calculations

Commission Calculation Image Gallery

Frequently Asked Questions

What is a commission formula in Excel?

+A commission formula in Excel is a mathematical expression used to calculate commissions based on sales data and a defined commission structure.

How do I set up a tiered commission structure in Excel?

+To set up a tiered commission structure in Excel, define the tiers and corresponding commission rates, then use IF statements or lookup tables to apply the correct commission rate based on the sales amount.

What are the benefits of using Excel for commission calculations?

+The benefits include accuracy, efficiency, and transparency. Excel formulas can automate calculations, reduce errors, and provide a clear record of commission payments.

In conclusion, mastering the commission formula in Excel is a valuable skill for anyone involved in sales or commission-based incentives. By understanding how to set up and apply these formulas, businesses can ensure accurate and efficient commission calculations, motivating their sales teams and driving business growth. Whether you're dealing with flat rate, tiered, or draw against commissions, Excel provides the tools and flexibility to handle complex commission structures with ease. As you continue to explore and apply these concepts, remember to share your experiences and insights with others, contributing to a community that values knowledge sharing and collaboration.