Intro

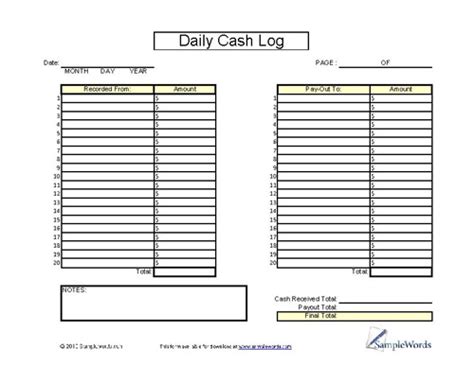

Effective cash management is crucial for any business, and using a daily cash count sheet template in Excel can help streamline this process. A daily cash count sheet is a tool used to track and record the amount of cash received and disbursed by a business on a daily basis. It helps in maintaining accurate financial records, preventing errors, and ensuring that all transactions are accounted for. In this article, we will delve into the importance of using a daily cash count sheet template in Excel, its benefits, and how to create and use one effectively.

The use of a daily cash count sheet template in Excel offers numerous benefits, including improved accuracy, enhanced security, and better financial management. By tracking cash transactions daily, businesses can quickly identify discrepancies or potential fraud, allowing for prompt action to be taken. Additionally, a daily cash count sheet helps in preparing for audits and financial reporting, as it provides a clear and detailed record of all cash transactions. This template can be customized to fit the specific needs of a business, making it a versatile tool for cash management.

Benefits of Using a Daily Cash Count Sheet Template in Excel

The benefits of using a daily cash count sheet template in Excel are multifaceted. Firstly, it enhances financial accuracy by ensuring that all cash transactions are recorded and accounted for. This accuracy is crucial for making informed business decisions and for financial reporting purposes. Secondly, it improves security by providing a transparent record of cash handling, which can help prevent theft or misappropriation of funds. Lastly, it aids in compliance with financial regulations and standards, making audits and financial examinations less cumbersome.

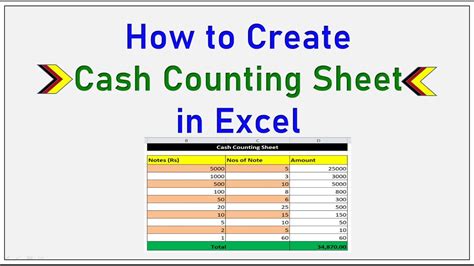

Creating a Daily Cash Count Sheet Template in Excel

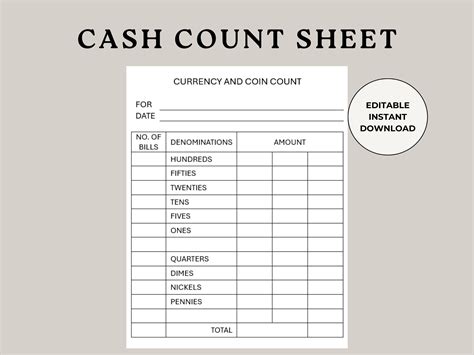

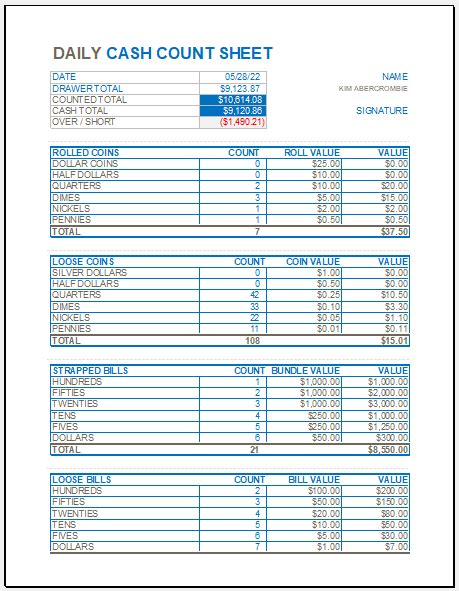

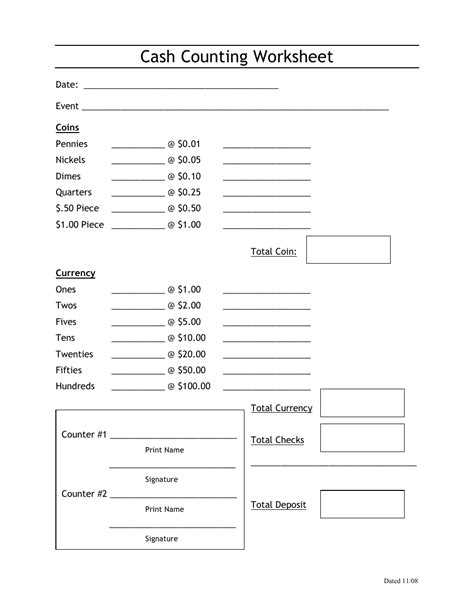

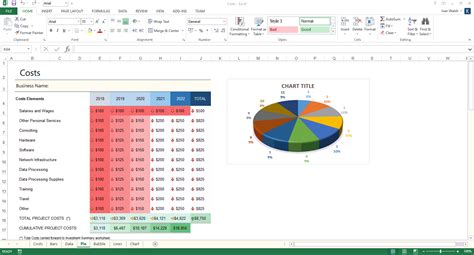

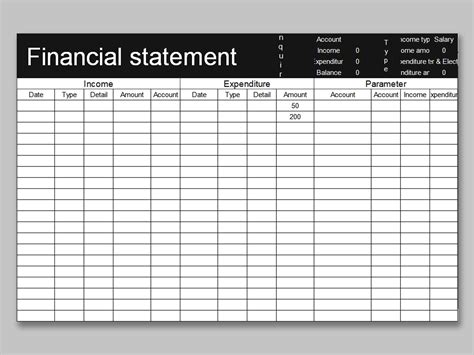

To create a daily cash count sheet template in Excel, one needs to consider the specific requirements of the business. The template should include columns for the date, description of the transaction, cash received, cash disbursed, and the balance. It may also be beneficial to include columns for tracking the method of payment (e.g., cash, credit card, check) and any relevant transaction IDs or references. The template should be easy to navigate and understand, with clear headings and formatting that facilitates quick data entry and analysis.Steps to Implement a Daily Cash Count Sheet Template

Implementing a daily cash count sheet template involves several steps. Firstly, the template needs to be designed or downloaded from a reliable source. If designing, one should ensure that it includes all necessary fields for comprehensive cash tracking. Secondly, the template should be tested to ensure it meets the business's specific needs and is user-friendly. Training may be necessary for staff members who will be using the template to ensure consistency and accuracy in data entry. Finally, the template should be regularly reviewed and updated to reflect any changes in the business's cash handling procedures or financial regulations.

Practical Examples of Daily Cash Count Sheets

Practical examples of daily cash count sheets can be found in various business settings. For instance, a retail store might use a daily cash count sheet to track sales, refunds, and employee cash handling. A restaurant could use it to monitor cash sales, tips, and petty cash expenditures. In each case, the daily cash count sheet is tailored to the specific cash handling needs of the business, providing a customized solution for cash management.Customizing Your Daily Cash Count Sheet Template

Customizing a daily cash count sheet template in Excel to fit the specific needs of a business is relatively straightforward. Excel offers a range of tools and features that can be used to modify the template. For example, columns can be added or removed as necessary, and formulas can be used to automate calculations such as totals and balances. Conditional formatting can also be applied to highlight important information, such as discrepancies in cash counts or transactions that exceed a certain amount.

Tips for Effective Use of a Daily Cash Count Sheet

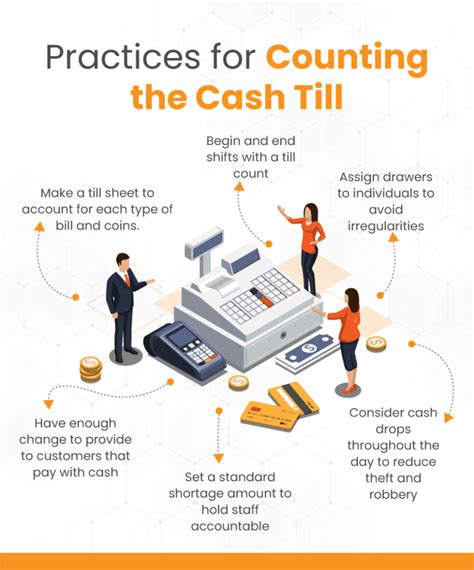

For the effective use of a daily cash count sheet, several tips should be considered. Firstly, it is essential to ensure that the sheet is completed accurately and consistently. This may involve setting aside a specific time each day for cash counting and recording. Secondly, the sheet should be reviewed regularly to identify any trends or discrepancies in cash handling. Finally, it should be stored securely, either physically or digitally, to prevent loss or unauthorized access.Security and Backup of Daily Cash Count Sheets

The security and backup of daily cash count sheets are critical aspects of cash management. Physically, sheets should be stored in a secure location such as a safe or a locked cabinet. Digitally, Excel files should be password-protected and backed up regularly to an external drive or cloud storage service. Regular backups ensure that data is not lost in the event of a computer failure or other disaster, and password protection prevents unauthorized access to sensitive financial information.

Common Mistakes to Avoid

When using a daily cash count sheet template, there are several common mistakes to avoid. One of the most significant is inconsistency in data entry, which can lead to inaccuracies and discrepancies in cash records. Another mistake is failing to review and reconcile the daily cash count with other financial records, such as sales reports and bank statements. This reconciliation is essential for identifying and addressing any discrepancies or issues with cash handling.Best Practices for Daily Cash Counting

Best practices for daily cash counting include ensuring that more than one person is involved in the counting and recording process to provide a check and balance. It is also advisable to count cash in a secure and private area to prevent theft or tampering. Additionally, any discrepancies found during the counting process should be investigated and resolved promptly to maintain the integrity of financial records.

Future of Daily Cash Count Sheets

The future of daily cash count sheets is likely to involve increased use of technology and automation. Digital cash counting machines and software can streamline the process, reducing the risk of human error and increasing efficiency. Furthermore, the integration of daily cash count sheets with other financial management tools and systems can provide a more comprehensive view of a business's financial situation, enabling better decision-making and financial planning.Gallery of Daily Cash Count Sheet Templates

Daily Cash Count Sheet Templates Gallery

What is a daily cash count sheet?

+A daily cash count sheet is a tool used to track and record the amount of cash received and disbursed by a business on a daily basis.

Why is using a daily cash count sheet important?

+It helps in maintaining accurate financial records, preventing errors, and ensuring that all transactions are accounted for, which is crucial for financial management and decision-making.

How can I create a daily cash count sheet template in Excel?

+To create a daily cash count sheet template in Excel, design a table with columns for date, transaction description, cash received, cash disbursed, and balance. You can also add formulas for automatic calculations and use conditional formatting for highlighting important information.

In conclusion, a daily cash count sheet template in Excel is a valuable tool for businesses looking to improve their cash management practices. By understanding the benefits, creating a tailored template, and implementing best practices for daily cash counting, businesses can enhance their financial accuracy, security, and compliance. Whether you are a small retail store, a restaurant, or a large corporation, incorporating a daily cash count sheet into your financial routines can have a significant positive impact on your overall financial health and decision-making capabilities. We invite you to share your experiences with daily cash count sheets, ask questions, or provide feedback on how this article has helped you in managing your business's cash more effectively.