Intro

Calculate bond prices with Excels Bond Price Function, using yield, maturity, and face value to determine returns, incorporating financial modeling and valuation techniques.

The Excel Bond Price function is a powerful tool used to calculate the price of a bond. Bonds are debt securities issued by companies or governments to raise capital, and they offer regular interest payments to investors. Understanding how to calculate the price of a bond is essential for investors, financial analysts, and anyone involved in the bond market. In this article, we will delve into the details of the Excel Bond Price function, its importance, and how to use it effectively.

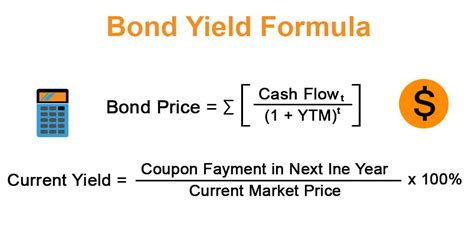

The bond market is a significant component of the financial system, providing a platform for entities to raise funds and for investors to earn returns. The price of a bond is determined by several factors, including the face value, coupon rate, yield to maturity, and time to maturity. The Excel Bond Price function, also known as the PRICE function, is designed to calculate the price of a bond given these parameters.

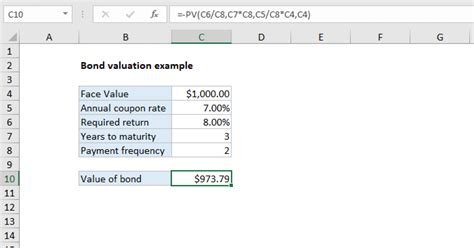

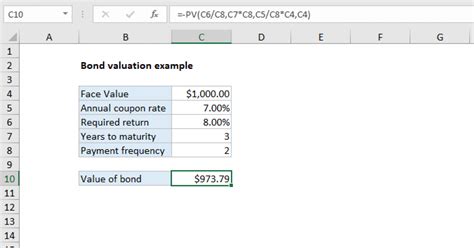

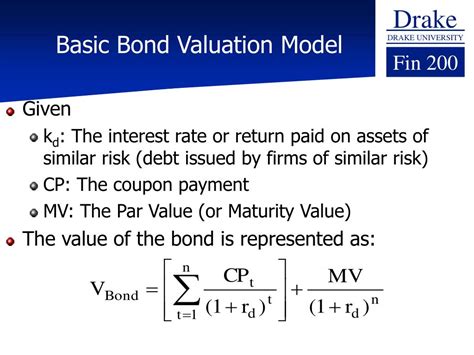

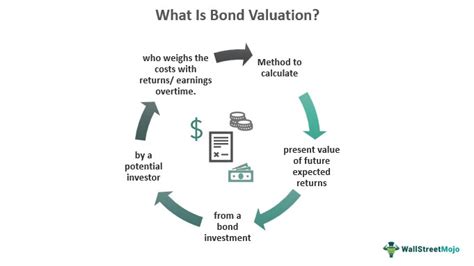

To understand the importance of the Excel Bond Price function, it's essential to consider the bond valuation process. Bond valuation involves calculating the present value of the bond's future cash flows, which include the periodic interest payments and the return of the principal amount at maturity. The Excel Bond Price function simplifies this process by providing a straightforward formula to calculate the bond price.

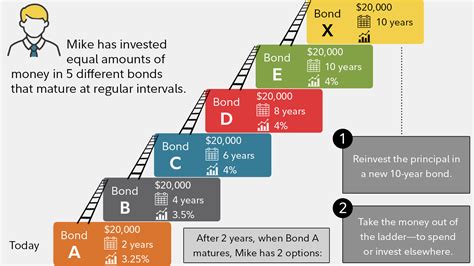

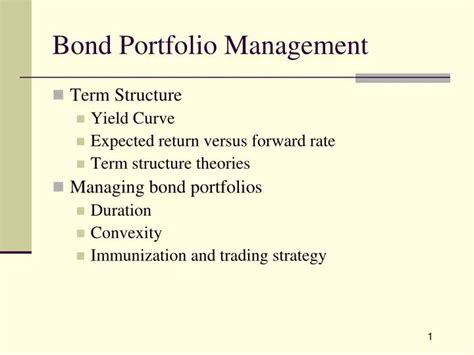

The Excel Bond Price function is particularly useful for investors and financial analysts who need to evaluate the performance of their bond portfolios. By using the PRICE function, they can quickly calculate the price of a bond and determine its yield to maturity, which is a critical metric for assessing the bond's return on investment. Additionally, the function can be used to compare the prices of different bonds with varying characteristics, such as coupon rates and maturity dates.

Understanding the Excel Bond Price Function

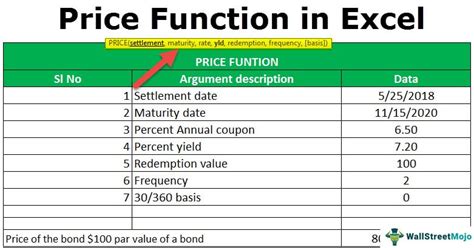

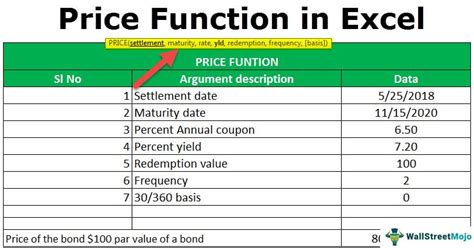

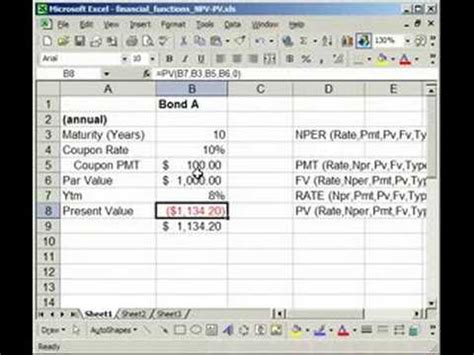

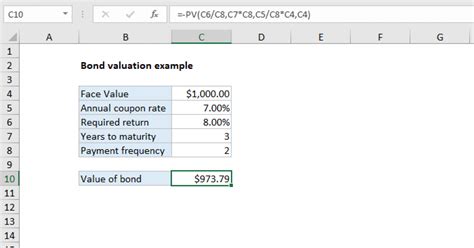

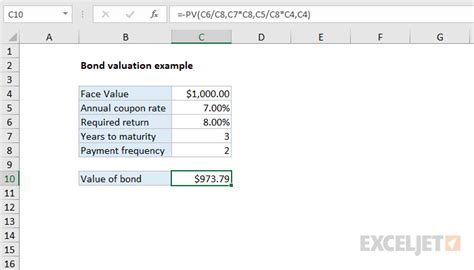

The Excel Bond Price function is represented by the formula PRICE(settlement, maturity, rate, yld, redemption, frequency, [basis]). Each argument in the formula represents a specific parameter that affects the bond price calculation. The settlement argument is the date when the bond is purchased, and the maturity argument is the date when the bond expires. The rate argument is the annual coupon rate, and the yld argument is the annual yield of the bond. The redemption argument is the redemption value of the bond per $100 face value, and the frequency argument is the number of coupon payments per year. The [basis] argument is optional and specifies the day count basis to use.

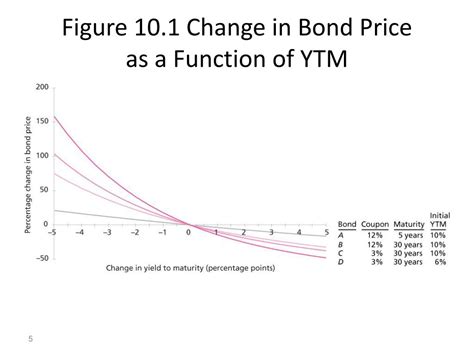

To use the Excel Bond Price function effectively, it's crucial to understand the input parameters and how they impact the bond price calculation. For example, the coupon rate and yield to maturity are critical determinants of the bond price. A higher coupon rate generally results in a higher bond price, while a higher yield to maturity results in a lower bond price. The time to maturity also affects the bond price, as bonds with longer maturities tend to be more sensitive to changes in interest rates.

Step-by-Step Guide to Using the Excel Bond Price Function

To calculate the price of a bond using the Excel Bond Price function, follow these steps:

- Determine the settlement date and maturity date of the bond.

- Enter the annual coupon rate and yield to maturity of the bond.

- Specify the redemption value of the bond per $100 face value.

- Choose the frequency of coupon payments per year.

- Optionally, select the day count basis to use.

- Use the

PRICEfunction formula to calculate the bond price.

For example, suppose you want to calculate the price of a bond with a face value of $1,000, a coupon rate of 5%, and a yield to maturity of 4%. The bond has a maturity date of 5 years and makes annual coupon payments. Using the PRICE function, you can calculate the bond price as follows:

PRICE(A1, A2, 0.05, 0.04, 100, 1, 0)

Assuming the settlement date is in cell A1 and the maturity date is in cell A2, the formula returns the bond price per $100 face value.

Benefits and Limitations of the Excel Bond Price Function

The Excel Bond Price function offers several benefits, including:

- Simplifies bond price calculations: The

PRICEfunction provides a straightforward formula to calculate the bond price, eliminating the need for complex manual calculations. - Accurate results: The function takes into account various parameters that affect the bond price, ensuring accurate results.

- Flexibility: The function can be used to calculate the price of different types of bonds, including government and corporate bonds.

However, the Excel Bond Price function also has some limitations:

- Assumes a fixed yield to maturity: The function assumes that the yield to maturity remains constant over the life of the bond, which may not be the case in reality.

- Does not account for credit risk: The function does not consider the credit risk of the bond issuer, which can impact the bond price.

- Limited to basic bond calculations: The function is designed for basic bond price calculations and may not be suitable for more complex bond valuation models.

Real-World Applications of the Excel Bond Price Function

The Excel Bond Price function has numerous real-world applications, including:

- Bond portfolio management: Investors and financial analysts use the

PRICEfunction to evaluate the performance of their bond portfolios and make informed investment decisions. - Bond trading: The function is used to calculate the price of bonds in real-time, enabling traders to make quick and accurate trading decisions.

- Risk management: The function helps risk managers to assess the potential risks associated with bond investments and develop strategies to mitigate those risks.

In addition to these applications, the Excel Bond Price function can also be used in conjunction with other Excel functions, such as the YIELD function, to calculate the yield to maturity of a bond.

Best Practices for Using the Excel Bond Price Function

To get the most out of the Excel Bond Price function, follow these best practices:

- Use accurate input parameters: Ensure that the input parameters, such as the settlement date and maturity date, are accurate and up-to-date.

- Choose the correct day count basis: Select the appropriate day count basis to use, depending on the bond's characteristics and market conventions.

- Consider credit risk: Take into account the credit risk of the bond issuer, as it can impact the bond price.

- Use the function in conjunction with other Excel functions: Combine the

PRICEfunction with other Excel functions, such as theYIELDfunction, to gain a more comprehensive understanding of the bond's characteristics.

By following these best practices, you can ensure that you are using the Excel Bond Price function effectively and accurately.

Common Errors to Avoid When Using the Excel Bond Price Function

When using the Excel Bond Price function, be aware of the following common errors to avoid:

- Incorrect input parameters: Ensure that the input parameters are accurate and consistent with the bond's characteristics.

- Inconsistent day count basis: Use a consistent day count basis throughout the calculation to avoid errors.

- Ignoring credit risk: Consider the credit risk of the bond issuer, as it can significantly impact the bond price.

By being aware of these common errors, you can avoid mistakes and ensure that your bond price calculations are accurate and reliable.

Conclusion and Future Outlook

In conclusion, the Excel Bond Price function is a powerful tool for calculating the price of a bond. By understanding the input parameters and using the function effectively, you can make informed investment decisions and evaluate the performance of your bond portfolio. As the bond market continues to evolve, it's essential to stay up-to-date with the latest developments and best practices in bond valuation.

The future outlook for the Excel Bond Price function is promising, with ongoing advancements in technology and finance expected to enhance its capabilities and accuracy. As investors and financial analysts, it's crucial to stay ahead of the curve and leverage the latest tools and techniques to make informed decisions.

Bond Price Function Image Gallery

What is the Excel Bond Price function?

+The Excel Bond Price function, also known as the `PRICE` function, is a formula used to calculate the price of a bond given its characteristics, such as the face value, coupon rate, yield to maturity, and time to maturity.

How do I use the Excel Bond Price function?

+To use the Excel Bond Price function, enter the formula `PRICE(settlement, maturity, rate, yld, redemption, frequency, [basis])` and provide the required input parameters, such as the settlement date, maturity date, coupon rate, and yield to maturity.

What are the limitations of the Excel Bond Price function?

+The Excel Bond Price function assumes a fixed yield to maturity and does not account for credit risk. It is also limited to basic bond price calculations and may not be suitable for more complex bond valuation models.

We hope this article has provided you with a comprehensive understanding of the Excel Bond Price function and its applications. If you have any further questions or would like to share your experiences with using the PRICE function, please leave a comment below. Additionally, feel free to share this article with others who may find it useful.