Intro

The fiscal year is a crucial concept in finance and accounting, as it defines the period used for budgeting, reporting, and taxation purposes. In many organizations, the fiscal year does not align with the calendar year, which can create complexity when analyzing financial data. Microsoft Excel is a powerful tool for managing and analyzing financial data, and it provides various formulas and functions to help users work with fiscal years. In this article, we will explore the Excel formulas and techniques used to calculate and manage fiscal year data.

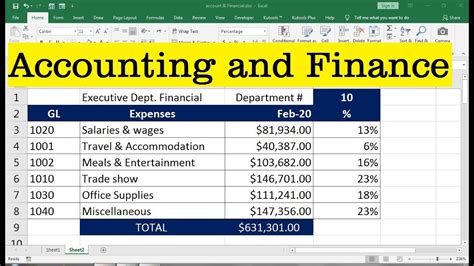

To begin with, understanding the fiscal year and its relevance to financial analysis is essential. The fiscal year is typically a 12-month period that may or may not align with the calendar year. For instance, a company's fiscal year might start on April 1 and end on March 31 of the following year. This means that any financial data, such as sales, expenses, or profits, needs to be analyzed and reported within the context of this fiscal year.

Understanding Fiscal Year Calculations

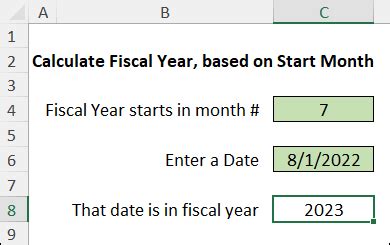

Calculating the fiscal year in Excel involves determining the starting month of the fiscal year and then applying this information to date-related calculations. One common approach is to use the MONTH and YEAR functions in combination with the IF function to adjust the fiscal year based on the month of the date being analyzed.

Fiscal Year Formula

The basic formula for calculating the fiscal year, assuming the fiscal year starts in April (4th month), is as follows: - If the month of the date is January, February, or March, the fiscal year is the previous calendar year. - If the month is April or later, the fiscal year is the current calendar year.This logic can be implemented in Excel using the following formula:

=IF(MONTH(A1)<4,YEAR(A1)-1,YEAR(A1))

Assuming the date is in cell A1, this formula checks the month of the date. If the month is less than 4 (April), it subtracts 1 from the year; otherwise, it keeps the year as is.

Working with Fiscal Quarters

In addition to calculating the fiscal year, it's often necessary to determine the fiscal quarter. The fiscal quarter is important for reporting and analysis, as it allows companies to track progress and make adjustments on a quarterly basis. The formula for determining the fiscal quarter is similar to the fiscal year formula but considers the quarter instead:

=IF(MONTH(A1)<4,CEILING((MONTH(A1)+9)/3,1),CEILING((MONTH(A1)+3)/3,1))

This formula adjusts the quarter calculation based on whether the month falls before or after the start of the fiscal year.

Automating Fiscal Year and Quarter Calculations

For frequent use, it's beneficial to create a user-defined function (UDF) in VBA (Visual Basic for Applications) that calculates both the fiscal year and the fiscal quarter. This approach simplifies the process and reduces the chance of errors when applying the formulas across large datasets.Function FiscalYear(dDate As Date, Optional startMonth As Integer = 4) As Integer

If Month(dDate) < startMonth Then

FiscalYear = Year(dDate) - 1

Else

FiscalYear = Year(dDate)

End If

End Function

Function FiscalQuarter(dDate As Date, Optional startMonth As Integer = 4) As Integer

Dim adjustedMonth As Integer

If Month(dDate) < startMonth Then

adjustedMonth = Month(dDate) + 12 - startMonth + 1

Else

adjustedMonth = Month(dDate) - startMonth + 1

End If

FiscalQuarter = Int((adjustedMonth - 1) / 3) + 1

End Function

These UDFs can be used directly in Excel formulas, making it easier to work with fiscal years and quarters.

Practical Applications

Understanding and applying fiscal year calculations have numerous practical applications in financial analysis and reporting. Some key areas include:

- Budgeting: Accurate fiscal year calculations are essential for creating and managing budgets. By aligning expenses and revenues with the fiscal year, organizations can better plan and forecast their financial performance.

- Financial Reporting: Fiscal year calculations are critical for preparing financial statements, such as balance sheets and income statements, which are used by stakeholders to assess an organization's financial health and performance.

- Tax Planning: The fiscal year determines the tax year for many businesses, affecting when taxes are due and how income is reported to tax authorities.

Best Practices for Working with Fiscal Years in Excel

When working with fiscal years in Excel, several best practices can enhance accuracy and efficiency: - **Use Consistent Date Formats:** Ensure that all dates are in a consistent format to avoid errors in calculations. - **Document Assumptions:** Clearly document the assumptions made about the fiscal year start date and any adjustments made to calculations. - **Test Formulas:** Thoroughly test formulas with different dates to ensure they work as intended.Gallery of Fiscal Year Calculations

Fiscal Year Image Gallery

Frequently Asked Questions

What is the fiscal year, and why is it important?

+The fiscal year is a 12-month period used for budgeting, reporting, and taxation purposes. It's crucial for financial analysis and planning, as it helps organizations track their financial performance and make informed decisions.

How do I calculate the fiscal year in Excel?

+You can calculate the fiscal year using the formula =IF(MONTH(A1)<4,YEAR(A1)-1,YEAR(A1)), assuming the fiscal year starts in April. Adjust the month as needed based on your organization's fiscal year start date.

What are some best practices for working with fiscal years in Excel?

+Best practices include using consistent date formats, documenting assumptions, and thoroughly testing formulas. These practices help ensure accuracy and efficiency in financial analysis and reporting.

In conclusion, mastering Excel formulas for fiscal year calculations is a valuable skill for anyone involved in financial analysis, planning, or reporting. By understanding how to work with fiscal years in Excel, professionals can create more accurate and informative financial models, reports, and forecasts, ultimately contributing to better decision-making within their organizations. We invite you to share your experiences or ask questions about working with fiscal years in Excel, and we look forward to your feedback on this article. Whether you're a seasoned financial analyst or just starting to explore the capabilities of Excel, we hope this comprehensive guide has provided you with the insights and tools needed to excel in your financial endeavors.