Intro

Unlock financial insights with 5 essential Excel ratio formulas, including profitability, liquidity, and efficiency metrics, to analyze business performance and make data-driven decisions.

The world of finance and accounting is filled with complex calculations and metrics that help professionals make informed decisions. One of the most powerful tools in this domain is Microsoft Excel, which offers a wide range of functions and formulas to simplify and streamline financial analysis. Among these, ratio formulas are particularly useful for evaluating a company's performance, profitability, and financial health. In this article, we will delve into the world of Excel ratio formulas, exploring five essential ratios that every financial analyst should know.

Ratio analysis is a crucial component of financial statement analysis, allowing users to assess a company's liquidity, efficiency, profitability, and solvency. By calculating and interpreting various ratios, financial professionals can identify trends, strengths, and weaknesses, making it easier to develop strategies for improvement. Excel, with its extensive library of functions and formulas, is the perfect platform for performing these calculations.

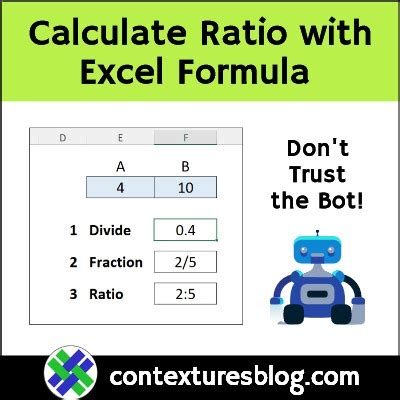

Introduction to Excel Ratio Formulas

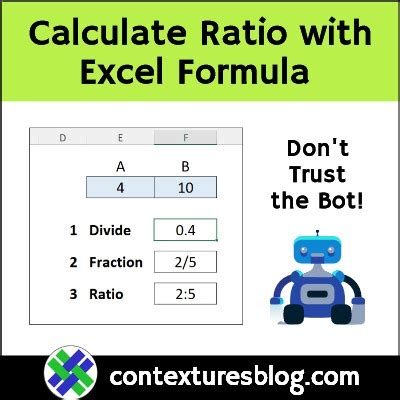

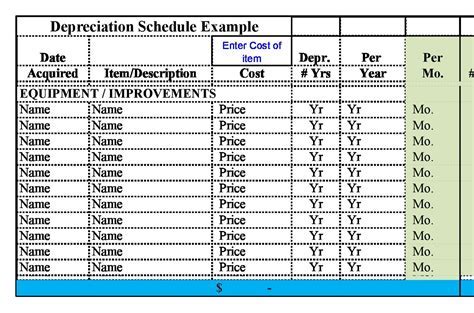

Excel ratio formulas are used to calculate different financial metrics, such as liquidity ratios, profitability ratios, and efficiency ratios. These formulas can be applied to various financial statements, including balance sheets and income statements. By using Excel to calculate these ratios, financial analysts can quickly and accurately assess a company's financial position and performance.

Calculating Financial Ratios in Excel

To calculate financial ratios in Excel, users need to understand the underlying formulas and how to apply them to real-world data. The following sections will explore five essential Excel ratio formulas, including their applications and interpretations.

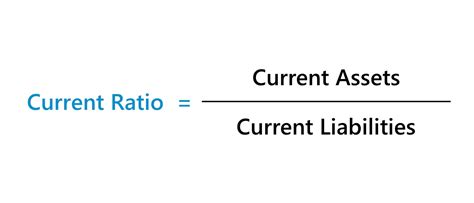

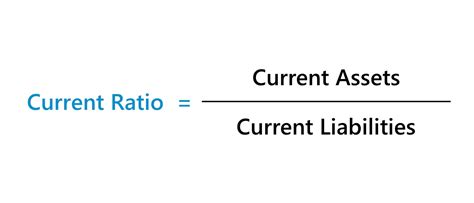

1. Current Ratio Formula

The current ratio is a liquidity ratio that measures a company's ability to pay its short-term debts using its current assets. The formula for the current ratio is:

Current Ratio = Current Assets / Current Liabilities

In Excel, this formula can be implemented as follows:

=SUM(B2:B10)/SUM(C2:C10)

Assuming the current assets are listed in cells B2:B10 and the current liabilities are listed in cells C2:C10.

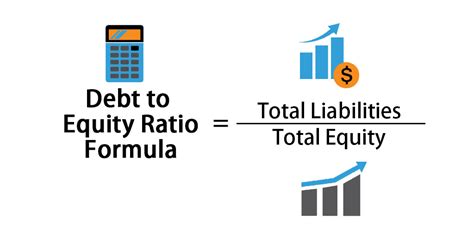

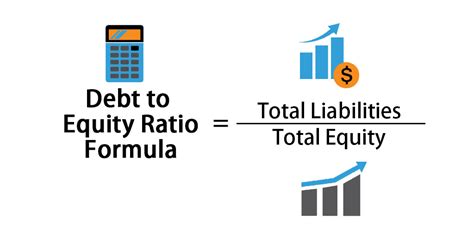

2. Debt-to-Equity Ratio Formula

The debt-to-equity ratio is a solvency ratio that measures a company's level of indebtedness by comparing its total liabilities to its total equity. The formula for the debt-to-equity ratio is:

Debt-to-Equity Ratio = Total Liabilities / Total Equity

In Excel, this formula can be implemented as follows:

=SUM(D2:D10)/SUM(E2:E10)

Assuming the total liabilities are listed in cells D2:D10 and the total equity is listed in cells E2:E10.

3. Return on Equity (ROE) Formula

The return on equity (ROE) is a profitability ratio that measures a company's net income in relation to its total equity. The formula for ROE is:

ROE = Net Income / Total Equity

In Excel, this formula can be implemented as follows:

=B20/SUM(E2:E10)

Assuming the net income is listed in cell B20 and the total equity is listed in cells E2:E10.

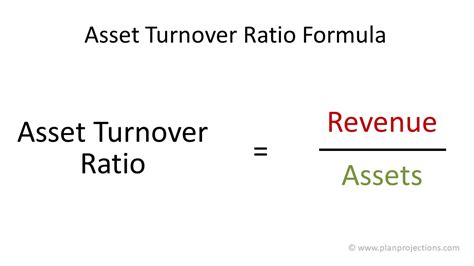

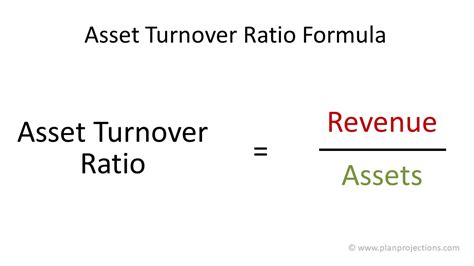

4. Asset Turnover Ratio Formula

The asset turnover ratio is an efficiency ratio that measures a company's ability to generate sales from its assets. The formula for the asset turnover ratio is:

Asset Turnover Ratio = Total Revenue / Total Assets

In Excel, this formula can be implemented as follows:

=B10/SUM(A2:A10)

Assuming the total revenue is listed in cell B10 and the total assets are listed in cells A2:A10.

5. Gross Margin Ratio Formula

The gross margin ratio is a profitability ratio that measures a company's gross profit in relation to its total revenue. The formula for the gross margin ratio is:

Gross Margin Ratio = Gross Profit / Total Revenue

In Excel, this formula can be implemented as follows:

=(B10-B20)/B10

Assuming the total revenue is listed in cell B10 and the cost of goods sold is listed in cell B20.

Practical Applications of Excel Ratio Formulas

Excel ratio formulas have numerous practical applications in finance and accounting. By using these formulas, financial analysts can:

- Evaluate a company's financial performance and position

- Identify trends and patterns in financial data

- Develop strategies for improvement and growth

- Compare a company's performance to industry benchmarks

- Make informed investment decisions

Gallery of Excel Ratio Formulas

Excel Ratio Formulas Image Gallery

FAQs

What is the purpose of using Excel ratio formulas?

+The purpose of using Excel ratio formulas is to simplify and streamline financial analysis, allowing users to evaluate a company's performance, profitability, and financial health.

How do I calculate the current ratio in Excel?

+To calculate the current ratio in Excel, use the formula: Current Ratio = Current Assets / Current Liabilities.

What is the debt-to-equity ratio, and how is it calculated in Excel?

+The debt-to-equity ratio is a solvency ratio that measures a company's level of indebtedness. It is calculated in Excel using the formula: Debt-to-Equity Ratio = Total Liabilities / Total Equity.

How do I use Excel ratio formulas to evaluate a company's financial performance?

+To evaluate a company's financial performance using Excel ratio formulas, calculate various ratios such as the current ratio, debt-to-equity ratio, return on equity, asset turnover ratio, and gross margin ratio. Then, interpret the results and compare them to industry benchmarks.

What are some practical applications of Excel ratio formulas in finance and accounting?

+Some practical applications of Excel ratio formulas include evaluating a company's financial performance and position, identifying trends and patterns in financial data, developing strategies for improvement and growth, comparing a company's performance to industry benchmarks, and making informed investment decisions.

In conclusion, Excel ratio formulas are powerful tools for financial analysis, allowing users to evaluate a company's performance, profitability, and financial health. By mastering these formulas and applying them to real-world data, financial professionals can make informed decisions and drive business growth. Whether you are a seasoned financial analyst or just starting out, Excel ratio formulas are an essential part of your toolkit. So why not start exploring the world of Excel ratio formulas today and discover the insights and opportunities they can bring to your financial analysis? Share your thoughts and experiences with Excel ratio formulas in the comments below, and don't forget to share this article with your colleagues and friends who may benefit from this valuable information.