Intro

Unlock investment insights with 5 key Irr vs Xirr differences, exploring internal rate of return, modified internal rate of return, and cash flow metrics for informed financial decisions.

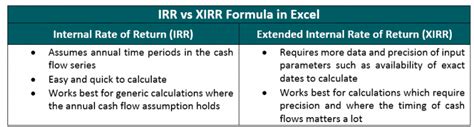

When it comes to evaluating the performance of investments, two commonly used metrics are the Internal Rate of Return (IRR) and the Extended Internal Rate of Return (XIRR). While both metrics are used to calculate the rate of return on an investment, there are significant differences between them. Understanding these differences is crucial for making informed investment decisions. In this article, we will delve into the 5 main differences between IRR and XIRR, exploring their definitions, calculations, and applications.

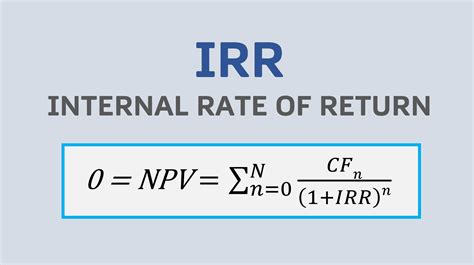

The Internal Rate of Return (IRR) is a widely used metric that calculates the rate of return on an investment based on the initial investment, cash inflows, and cash outflows. It is an essential tool for evaluating the viability of a project or investment opportunity. On the other hand, the Extended Internal Rate of Return (XIRR) is a more advanced metric that takes into account the timing and amount of cash flows, providing a more accurate picture of an investment's performance.

Definition and Calculation

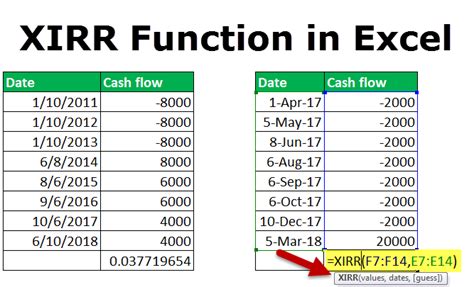

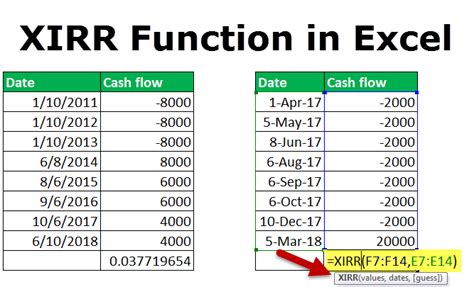

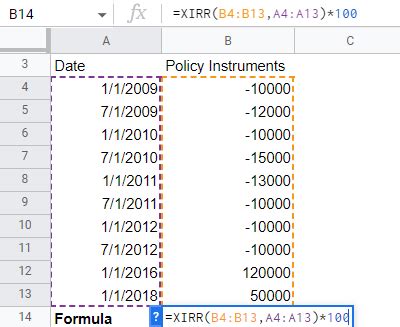

The IRR is calculated using the following formula: IRR = (Initial Investment + Cash Inflows - Cash Outflows) / Initial Investment. This formula provides a simple and straightforward way to calculate the rate of return on an investment. However, it has its limitations, as it assumes that cash flows occur at the end of each period. In contrast, the XIRR takes into account the actual timing of cash flows, providing a more accurate calculation of the rate of return.

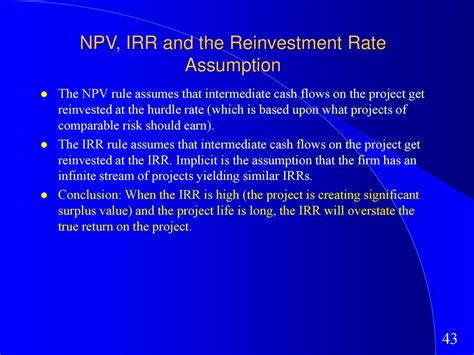

Assumptions and Limitations

One of the primary differences between IRR and XIRR is the assumptions they make about cash flows. IRR assumes that cash flows occur at the end of each period, whereas XIRR takes into account the actual timing of cash flows. This difference is significant, as it can greatly impact the accuracy of the calculated rate of return. Additionally, IRR assumes that the rate of return remains constant over the life of the investment, whereas XIRR can handle varying rates of return.

Application and Usage

IRR is commonly used to evaluate the performance of investments with regular cash flows, such as bonds or stocks. However, it may not be suitable for investments with irregular cash flows, such as real estate or private equity. In contrast, XIRR is more versatile and can handle investments with irregular cash flows, making it a more suitable choice for evaluating the performance of complex investments.

Interpretation and Decision-Making

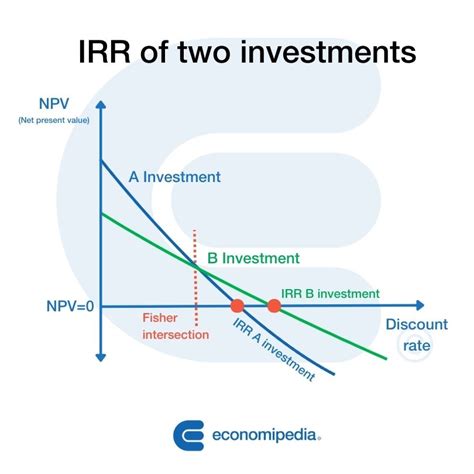

When interpreting IRR and XIRR results, it's essential to consider the context and limitations of each metric. IRR provides a general idea of an investment's performance, but it may not capture the nuances of complex investments. XIRR, on the other hand, provides a more detailed picture of an investment's performance, taking into account the timing and amount of cash flows. By understanding the differences between IRR and XIRR, investors can make more informed decisions about their investments.

Conclusion and Recommendations

In conclusion, while both IRR and XIRR are useful metrics for evaluating the performance of investments, they have distinct differences in terms of their definitions, calculations, and applications. IRR is a simple and widely used metric, but it has its limitations, particularly when dealing with complex investments. XIRR, on the other hand, provides a more accurate and detailed picture of an investment's performance, making it a more suitable choice for evaluating complex investments. By understanding the differences between IRR and XIRR, investors can make more informed decisions about their investments and achieve their financial goals.

IRR and XIRR Image Gallery

What is the main difference between IRR and XIRR?

+The main difference between IRR and XIRR is the way they handle cash flows. IRR assumes that cash flows occur at the end of each period, whereas XIRR takes into account the actual timing of cash flows.

When should I use IRR and when should I use XIRR?

+IRR is suitable for investments with regular cash flows, such as bonds or stocks. XIRR is more suitable for investments with irregular cash flows, such as real estate or private equity.

How do I interpret IRR and XIRR results?

+When interpreting IRR and XIRR results, it's essential to consider the context and limitations of each metric. IRR provides a general idea of an investment's performance, but it may not capture the nuances of complex investments. XIRR provides a more detailed picture of an investment's performance, taking into account the timing and amount of cash flows.

Can I use IRR and XIRR for personal finance decisions?

+Yes, IRR and XIRR can be used for personal finance decisions, such as evaluating the performance of a retirement account or a savings plan. However, it's essential to understand the limitations and assumptions of each metric to make informed decisions.

Are there any alternative metrics to IRR and XIRR?

+Yes, there are alternative metrics to IRR and XIRR, such as the Modified Internal Rate of Return (MIRR) and the Net Present Value (NPV). These metrics can provide additional insights into an investment's performance and help investors make more informed decisions.

We hope this article has provided you with a comprehensive understanding of the differences between IRR and XIRR. Whether you're an experienced investor or just starting to explore the world of finance, it's essential to understand the metrics used to evaluate investment performance. By sharing this article with others, you can help spread knowledge and promote informed decision-making. If you have any questions or comments, please don't hesitate to reach out. Let's work together to create a community of informed and savvy investors.