Intro

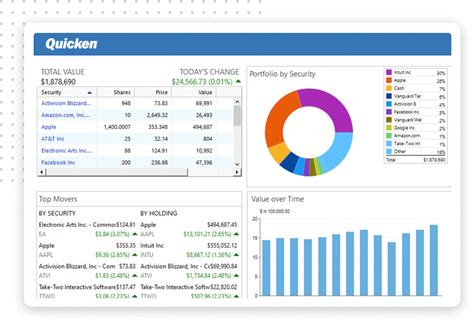

Boost efficiency with 5 ways to export Quicken data, simplifying accounting, budgeting, and financial management tasks, using export tools and techniques.

Exporting data from Quicken can be a crucial step for various purposes, such as switching to a new financial management tool, creating backups, or analyzing data in a different application. Quicken, a popular personal finance management software, allows users to export their data in several formats, making it easier to manage and utilize their financial information across different platforms. Understanding the ways to export data from Quicken can help users make the most out of their financial data.

The process of exporting data from Quicken is relatively straightforward and can be completed in a few steps. However, the specific method may vary depending on the version of Quicken being used and the type of data being exported. It's essential for users to familiarize themselves with the export options available in their version of Quicken to ensure a smooth transition of their financial data.

Quicken offers various export options, including exporting to spreadsheet programs like Microsoft Excel, to other financial software, or even to a format that can be easily imported into tax preparation software. Each of these options serves a different purpose and can be beneficial in different scenarios. For instance, exporting data to a spreadsheet can be useful for creating custom reports or performing detailed analyses, while exporting data to another financial software can simplify the process of switching to a new financial management tool.

Given the importance of data export in managing personal finances effectively, it's crucial to explore the different methods available for exporting data from Quicken. This not only enhances the flexibility of using Quicken but also ensures that users can make informed decisions about their financial data.

Understanding Quicken Export Options

Quicken provides users with several export options, each designed to cater to different needs. These options include exporting data to a CSV file, to Excel, or directly to other financial management software. Understanding these options is key to effectively managing and utilizing financial data.

Exporting to CSV

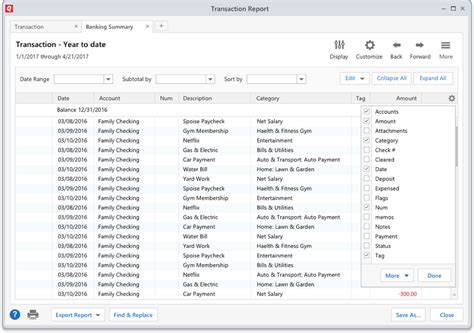

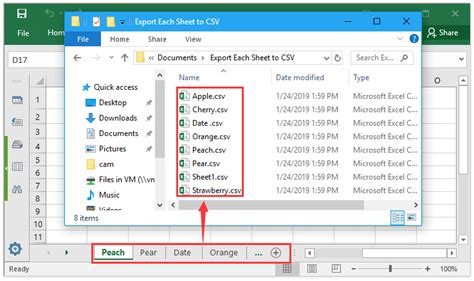

Exporting data to a CSV (Comma Separated Values) file is one of the most common methods used in Quicken. This format is widely supported by most spreadsheet programs and can be easily imported into other financial software. The process involves selecting the data range and type that need to be exported and then choosing the CSV format as the export option.Exporting to Excel

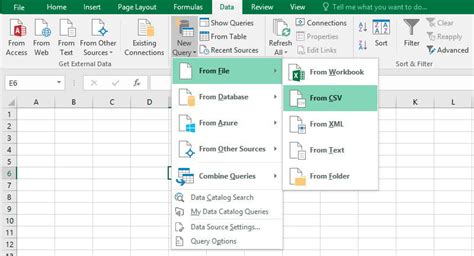

For users who prefer to work with Microsoft Excel or similar spreadsheet programs, Quicken offers the option to export data directly to these applications. This method is particularly useful for creating detailed financial reports or performing complex data analyses. The export process is similar to exporting to a CSV file, with the main difference being the selection of the Excel format as the export option.Step-by-Step Guide to Exporting Quicken Data

Exporting data from Quicken involves a series of steps that ensure the data is correctly exported in the desired format. Here’s a general step-by-step guide:

- Open Quicken: Start by opening Quicken on your computer.

- Select the Data: Choose the specific data or accounts you wish to export. This could be transactions from a particular account or all data within a specified date range.

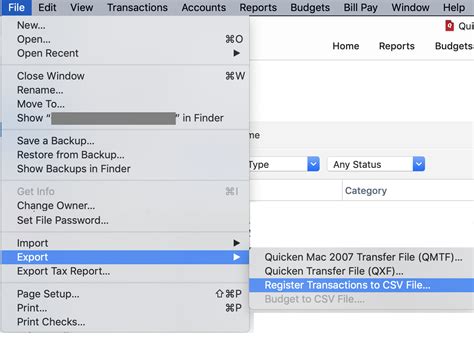

- Export Option: Navigate to the export option, usually found under the "File" menu. Select "Export" and then choose the type of export you want, such as "CSV" or "Excel".

- Select Format: If exporting to a CSV or Excel file, you will be prompted to select the format. Choose the appropriate format based on your needs.

- Save File: Finally, choose a location to save the exported file and give it a name. Make sure to note the file location for future reference.

Tips for Exporting Data

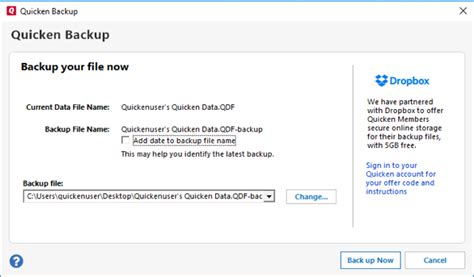

- **Backup Before Export**: Always backup your Quicken data before exporting to prevent any potential data loss. - **Choose the Right Format**: Select an export format that is compatible with the software you plan to import the data into. - **Test the Export**: After exporting, open the file in the intended software to ensure the data was exported correctly and is usable.Benefits of Exporting Quicken Data

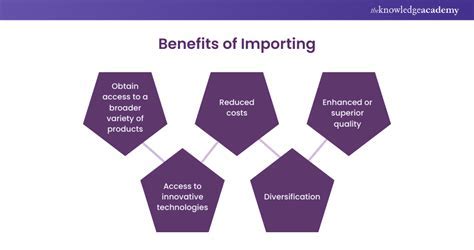

Exporting Quicken data offers several benefits, including increased flexibility in managing financial information and the ability to perform advanced analyses. Some key benefits include:

- Flexibility: Exporting data allows users to work with their financial information in different applications, depending on their specific needs.

- Analysis: By exporting data to spreadsheet programs, users can create custom reports and perform detailed analyses that might not be possible within Quicken itself.

- Backup: Exporting data can serve as a form of backup, ensuring that financial information is safe even if the original Quicken file becomes corrupted or lost.

Common Export Formats

- **CSV**: Comma Separated Values, a widely supported format ideal for importing into spreadsheet programs. - **Excel**: Directly exporting to Excel files for seamless integration with Microsoft Excel. - **QIF**: Quicken Interchange Format, useful for transferring data between different financial management software.Challenges and Considerations

While exporting data from Quicken can be beneficial, there are challenges and considerations that users should be aware of. These include:

- Data Integrity: Ensuring that the exported data is accurate and complete.

- Compatibility: Choosing an export format that is compatible with the intended software.

- Security: Protecting sensitive financial information during and after the export process.

Best Practices for Data Export

- **Regular Backups**: Regularly backup Quicken data to prevent loss. - **Verify Data**: Always verify the integrity of the exported data. - **Secure Files**: Keep exported files secure, especially if they contain sensitive financial information.Future of Quicken Data Export

The future of Quicken data export is likely to be shaped by advancements in technology and changes in user needs. As financial management becomes increasingly digital, the demand for flexible and secure data export options is expected to grow. Quicken and other financial software providers will need to adapt to these changes by offering more robust and user-friendly export options.

Trends in Financial Data Management

- **Cloud Integration**: Increased integration with cloud services for easier data access and sharing. - **Advanced Security**: Enhanced security measures to protect sensitive financial data. - **User-Friendly Interfaces**: More intuitive interfaces for exporting and managing financial data.Quicken Data Export Gallery

What are the benefits of exporting Quicken data?

+The benefits include increased flexibility, the ability to perform advanced analyses, and creating backups of financial data.

How do I export data from Quicken to Excel?

+To export data from Quicken to Excel, navigate to the export option, select the data you wish to export, choose Excel as the export format, and then save the file.

What are the common export formats supported by Quicken?

+Quicken supports several export formats, including CSV, Excel, and QIF.

In conclusion, exporting data from Quicken is a powerful feature that offers users flexibility and control over their financial information. By understanding the different export options and following the step-by-step guides, users can easily manage and analyze their financial data in various applications. Whether for creating detailed reports, switching to a new financial management tool, or simply as a backup measure, exporting Quicken data is an essential skill for anyone looking to make the most out of their financial management software. We invite you to share your experiences with exporting Quicken data and any tips you might have for our readers.