Intro

Unlock stock market insights with the Fibonacci Retracement Formula in Excel, using technical analysis, chart patterns, and trading strategies to predict price movements and identify support levels.

The Fibonacci sequence has been a subject of interest in various fields, including mathematics, finance, and biology. In finance, the Fibonacci sequence is used to predict price movements and identify potential support and resistance levels. One of the most popular applications of the Fibonacci sequence in finance is the Fibonacci retracement formula. In this article, we will discuss how to calculate the Fibonacci retracement formula in Excel.

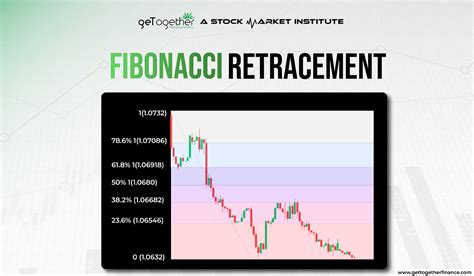

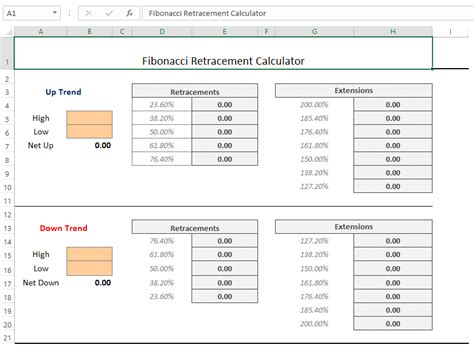

The Fibonacci retracement formula is based on the idea that prices tend to retrace a predictable portion of a move before continuing in the original direction. The formula uses the Fibonacci sequence to identify the retracement levels, which are typically 23.6%, 38.2%, 50%, 61.8%, and 76.4%. These levels are calculated by dividing the distance between the high and low points of a price move by the Fibonacci ratios.

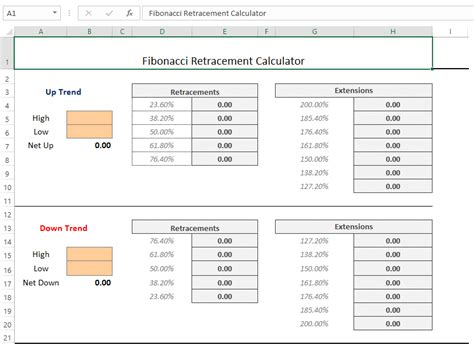

To calculate the Fibonacci retracement formula in Excel, you need to follow these steps:

First, identify the high and low points of the price move you want to analyze. Let's assume the high point is 100 and the low point is 50. Next, calculate the distance between the high and low points, which is 50. Then, calculate the Fibonacci retracement levels by dividing the distance by the Fibonacci ratios.

For example, to calculate the 23.6% retracement level, you would divide the distance (50) by 4.236 (1/0.236). This gives you a retracement level of 11.79. To calculate the 38.2% retracement level, you would divide the distance (50) by 2.618 (1/0.382). This gives you a retracement level of 19.11.

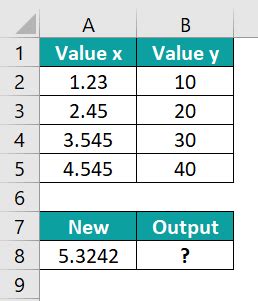

You can use the following formulas in Excel to calculate the Fibonacci retracement levels:

- 23.6% retracement level: =(High-Low)*0.236+Low

- 38.2% retracement level: =(High-Low)*0.382+Low

- 50% retracement level: =(High-Low)*0.5+Low

- 61.8% retracement level: =(High-Low)*0.618+Low

- 76.4% retracement level: =(High-Low)*0.764+Low

Where High is the high point, Low is the low point, and the result is the retracement level.

Fibonacci Retracement Formula Calculation

To make it easier to calculate the Fibonacci retracement levels, you can create a table in Excel with the following columns: High, Low, 23.6% Retracement, 38.2% Retracement, 50% Retracement, 61.8% Retracement, and 76.4% Retracement. Then, use the formulas above to calculate the retracement levels for each row in the table.

Fibonacci Retracement Levels Table

You can also use Excel's built-in functions, such as the TREND function, to calculate the Fibonacci retracement levels. However, this method requires more advanced knowledge of Excel and may not be as straightforward as using the formulas above.

Using Excel's TREND Function

In addition to calculating the Fibonacci retracement levels, you can also use Excel to visualize the levels on a chart. This can help you identify potential support and resistance levels and make more informed trading decisions.

Visualizing Fibonacci Retracement Levels

To visualize the Fibonacci retracement levels on a chart, you can use Excel's built-in charting tools. First, create a line chart of the price data, and then add a series of horizontal lines to represent the retracement levels. You can use the LINE function to create the horizontal lines.

Creating a Fibonacci Retracement Chart

Once you have created the chart, you can adjust the appearance of the retracement levels by changing the line color, style, and width. You can also add labels to the chart to identify the retracement levels.

Customizing the Fibonacci Retracement Chart

In conclusion, calculating the Fibonacci retracement formula in Excel is a relatively straightforward process that can be done using simple formulas or Excel's built-in functions. By visualizing the retracement levels on a chart, you can gain a better understanding of potential support and resistance levels and make more informed trading decisions.

Fibonacci Retracement Formula Applications

The Fibonacci retracement formula has a wide range of applications in finance, including identifying potential support and resistance levels, predicting price movements, and optimizing trading strategies. By using the Fibonacci retracement formula in combination with other technical analysis tools, you can gain a more complete understanding of market trends and make more informed investment decisions.

Fibonacci Retracement Formula Limitations

While the Fibonacci retracement formula can be a powerful tool for predicting price movements, it is not without its limitations. One of the main limitations of the formula is that it is based on historical price data and may not accurately predict future price movements. Additionally, the formula can be sensitive to the choice of high and low points, and small changes in these points can result in significantly different retracement levels.

Fibonacci Retracement Formula Best Practices

To get the most out of the Fibonacci retracement formula, it is essential to follow best practices when applying the formula. This includes using high-quality price data, carefully selecting the high and low points, and combining the formula with other technical analysis tools. By following these best practices, you can increase the accuracy of the formula and make more informed investment decisions.

Fibonacci Retracement Formula Image Gallery

What is the Fibonacci retracement formula?

+The Fibonacci retracement formula is a technical analysis tool used to predict price movements and identify potential support and resistance levels. The formula is based on the Fibonacci sequence and uses the ratios of 23.6%, 38.2%, 50%, 61.8%, and 76.4% to calculate the retracement levels.

How do I calculate the Fibonacci retracement formula in Excel?

+To calculate the Fibonacci retracement formula in Excel, you can use the formulas =(High-Low)*0.236+Low, =(High-Low)*0.382+Low, =(High-Low)*0.5+Low, =(High-Low)*0.618+Low, and =(High-Low)*0.764+Low, where High is the high point and Low is the low point.

What are the limitations of the Fibonacci retracement formula?

+The Fibonacci retracement formula has several limitations, including its reliance on historical price data and its sensitivity to the choice of high and low points. Additionally, the formula may not accurately predict future price movements and should be used in combination with other technical analysis tools.

How do I visualize the Fibonacci retracement levels on a chart?

+To visualize the Fibonacci retracement levels on a chart, you can use Excel's built-in charting tools to create a line chart of the price data and add a series of horizontal lines to represent the retracement levels. You can also use the `LINE` function to create the horizontal lines.

What are the best practices for using the Fibonacci retracement formula?

+To get the most out of the Fibonacci retracement formula, it is essential to follow best practices, including using high-quality price data, carefully selecting the high and low points, and combining the formula with other technical analysis tools. By following these best practices, you can increase the accuracy of the formula and make more informed investment decisions.

We hope this article has provided you with a comprehensive understanding of the Fibonacci retracement formula and how to calculate it in Excel. Whether you are a seasoned trader or just starting out, the Fibonacci retracement formula can be a powerful tool for predicting price movements and identifying potential support and resistance levels. We encourage you to try out the formula and see how it can help you make more informed investment decisions. If you have any questions or comments, please don't hesitate to reach out. Share this article with your friends and colleagues who may be interested in learning more about the Fibonacci retracement formula.