Intro

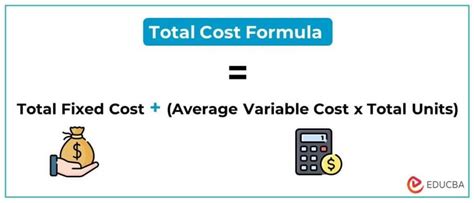

Calculating the cost of a formula can be a complex task, as it involves considering various factors such as the cost of ingredients, labor, overheads, and packaging. However, there are several ways to calculate the cost of a formula, and in this article, we will explore five of them. Whether you are a manufacturer, a supplier, or a consumer, understanding the cost of a formula is crucial to making informed decisions.

The cost of a formula can have a significant impact on the profitability of a business, and it is essential to calculate it accurately. A formula can be a recipe, a mixture of ingredients, or a set of instructions used to produce a product. The cost of a formula can vary depending on the type of product, the quantity produced, and the location of production. In this article, we will delve into the details of calculating the cost of a formula and explore the different methods used to do so.

Calculating the cost of a formula is not just about adding up the cost of ingredients; it involves considering various other factors such as labor costs, overheads, and packaging costs. The cost of a formula can also vary depending on the scale of production, with larger quantities often resulting in lower costs per unit. Understanding the cost of a formula is essential for businesses to determine their pricing strategy, manage their inventory, and optimize their production processes.

Introduction to Formula Cost Calculation

The cost of a formula is a critical component of the overall cost of a product, and it is essential to calculate it accurately. The cost of a formula can be calculated using various methods, including the absorption costing method, the marginal costing method, the standard costing method, the activity-based costing method, and the target costing method. Each of these methods has its advantages and disadvantages, and the choice of method depends on the specific needs of the business.

Understanding the Importance of Formula Cost Calculation

The cost of a formula is a critical component of the overall cost of a product, and it is essential to calculate it accurately. The cost of a formula can have a significant impact on the profitability of a business, and it is crucial to understand the different methods used to calculate it. The cost of a formula can vary depending on the type of product, the quantity produced, and the location of production. Understanding the cost of a formula is essential for businesses to determine their pricing strategy, manage their inventory, and optimize their production processes.Method 1: Absorption Costing Method

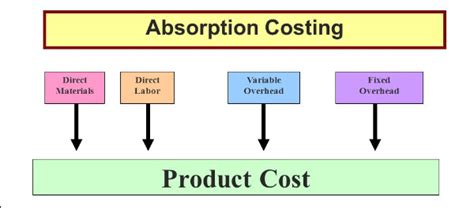

The absorption costing method is a traditional method of calculating the cost of a formula. This method involves assigning all the costs associated with the production of a product to the product itself. The absorption costing method includes the cost of ingredients, labor, overheads, and packaging. This method is simple to use and provides a clear picture of the total cost of a product. However, it can be misleading, as it does not distinguish between fixed and variable costs.

The absorption costing method is widely used in industries where the production process is complex, and it is difficult to separate the costs of different products. This method is also useful for businesses that produce a small number of products, as it provides a clear picture of the total cost of each product. However, the absorption costing method can be limiting, as it does not provide a detailed analysis of the costs associated with each product.

Advantages and Disadvantages of the Absorption Costing Method

The absorption costing method has several advantages, including its simplicity and ease of use. This method provides a clear picture of the total cost of a product and is widely used in industries where the production process is complex. However, the absorption costing method also has several disadvantages, including its inability to distinguish between fixed and variable costs. This method can be misleading, as it assigns all the costs associated with the production of a product to the product itself.Method 2: Marginal Costing Method

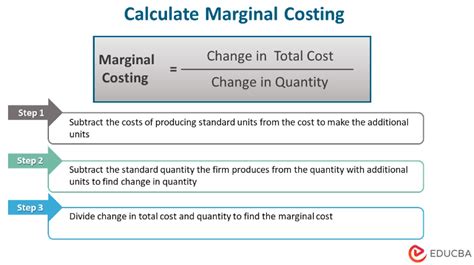

The marginal costing method is a modern method of calculating the cost of a formula. This method involves assigning only the variable costs associated with the production of a product to the product itself. The marginal costing method includes the cost of ingredients, labor, and packaging, but excludes overheads. This method is useful for businesses that produce a large number of products, as it provides a detailed analysis of the costs associated with each product.

The marginal costing method is widely used in industries where the production process is simple, and it is easy to separate the costs of different products. This method is also useful for businesses that want to optimize their production processes, as it provides a clear picture of the variable costs associated with each product. However, the marginal costing method can be limiting, as it does not provide a clear picture of the total cost of a product.

Advantages and Disadvantages of the Marginal Costing Method

The marginal costing method has several advantages, including its ability to distinguish between fixed and variable costs. This method provides a detailed analysis of the costs associated with each product and is useful for businesses that produce a large number of products. However, the marginal costing method also has several disadvantages, including its inability to provide a clear picture of the total cost of a product. This method can be misleading, as it excludes overheads, which are an essential component of the total cost of a product.Method 3: Standard Costing Method

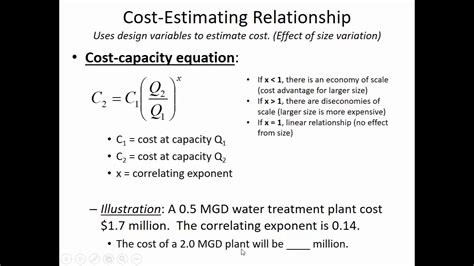

The standard costing method is a method of calculating the cost of a formula that involves assigning a standard cost to each product. This method involves estimating the cost of ingredients, labor, and overheads, and assigning a standard cost to each product based on these estimates. The standard costing method is useful for businesses that produce a large number of products, as it provides a clear picture of the total cost of each product.

The standard costing method is widely used in industries where the production process is complex, and it is difficult to separate the costs of different products. This method is also useful for businesses that want to optimize their production processes, as it provides a clear picture of the costs associated with each product. However, the standard costing method can be limiting, as it does not provide a detailed analysis of the costs associated with each product.

Advantages and Disadvantages of the Standard Costing Method

The standard costing method has several advantages, including its ability to provide a clear picture of the total cost of a product. This method is useful for businesses that produce a large number of products, as it provides a standard cost for each product. However, the standard costing method also has several disadvantages, including its inability to provide a detailed analysis of the costs associated with each product. This method can be misleading, as it assigns a standard cost to each product, which may not reflect the actual cost of the product.Method 4: Activity-Based Costing Method

The activity-based costing method is a modern method of calculating the cost of a formula that involves assigning costs to products based on the activities involved in their production. This method involves identifying the activities involved in the production of a product, estimating the cost of these activities, and assigning these costs to the product. The activity-based costing method is useful for businesses that produce a large number of products, as it provides a detailed analysis of the costs associated with each product.

The activity-based costing method is widely used in industries where the production process is complex, and it is difficult to separate the costs of different products. This method is also useful for businesses that want to optimize their production processes, as it provides a clear picture of the costs associated with each product. However, the activity-based costing method can be limiting, as it requires a detailed analysis of the activities involved in the production of each product.

Advantages and Disadvantages of the Activity-Based Costing Method

The activity-based costing method has several advantages, including its ability to provide a detailed analysis of the costs associated with each product. This method is useful for businesses that produce a large number of products, as it provides a clear picture of the costs associated with each product. However, the activity-based costing method also has several disadvantages, including its complexity and the need for a detailed analysis of the activities involved in the production of each product.Method 5: Target Costing Method

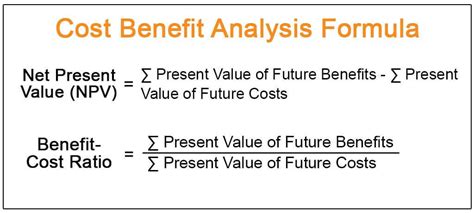

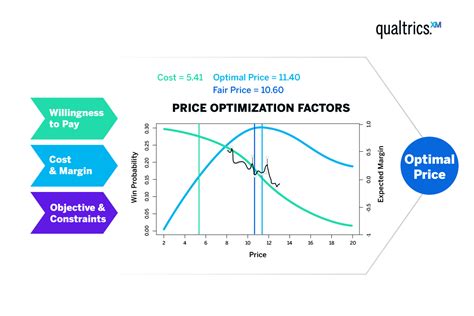

The target costing method is a method of calculating the cost of a formula that involves setting a target cost for a product and then working backwards to determine the costs associated with its production. This method involves estimating the cost of ingredients, labor, and overheads, and then assigning these costs to the product based on the target cost. The target costing method is useful for businesses that want to optimize their production processes, as it provides a clear picture of the costs associated with each product.

The target costing method is widely used in industries where the production process is complex, and it is difficult to separate the costs of different products. This method is also useful for businesses that produce a large number of products, as it provides a clear picture of the total cost of each product. However, the target costing method can be limiting, as it requires a detailed analysis of the costs associated with each product.

Advantages and Disadvantages of the Target Costing Method

The target costing method has several advantages, including its ability to provide a clear picture of the total cost of a product. This method is useful for businesses that want to optimize their production processes, as it provides a clear picture of the costs associated with each product. However, the target costing method also has several disadvantages, including its complexity and the need for a detailed analysis of the costs associated with each product.Gallery of Formula Cost Calculation Methods

Formula Cost Calculation Methods Image Gallery

What is the importance of calculating the cost of a formula?

+Calculating the cost of a formula is essential to determine the profitability of a business, manage inventory, and optimize production processes.

What are the different methods of calculating the cost of a formula?

+The different methods of calculating the cost of a formula include the absorption costing method, the marginal costing method, the standard costing method, the activity-based costing method, and the target costing method.

Which method of calculating the cost of a formula is the most accurate?

+The most accurate method of calculating the cost of a formula depends on the specific needs of the business and the complexity of the production process. However, the activity-based costing method is widely considered to be the most accurate method, as it provides a detailed analysis of the costs associated with each product.

How can businesses optimize their production processes using the cost of a formula?

+Businesses can optimize their production processes using the cost of a formula by identifying areas where costs can be reduced, improving efficiency, and streamlining production processes.

What are the benefits of calculating the cost of a formula?

+The benefits of calculating the cost of a formula include improved profitability, better inventory management, and optimized production processes.

In conclusion, calculating the cost of a formula is a critical component of the overall cost of a product, and it is essential to calculate it accurately. The different methods of calculating the cost of a formula, including the absorption costing method, the marginal costing method, the standard costing method, the activity-based costing method, and the target costing method, each have their advantages and disadvantages. By understanding the different methods of calculating the cost of a formula, businesses can optimize their production processes, improve profitability, and make informed decisions. We invite you to share your thoughts and experiences on calculating the cost of a formula in the comments section below.