Intro

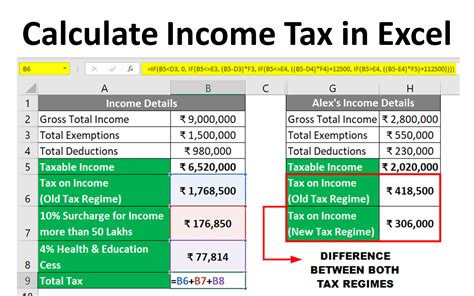

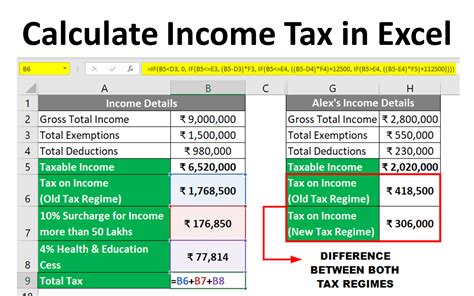

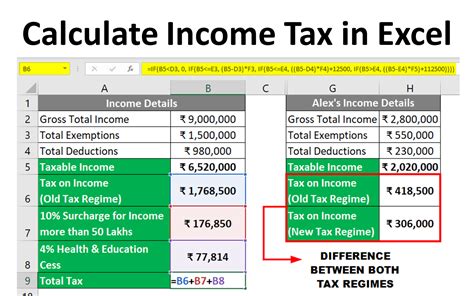

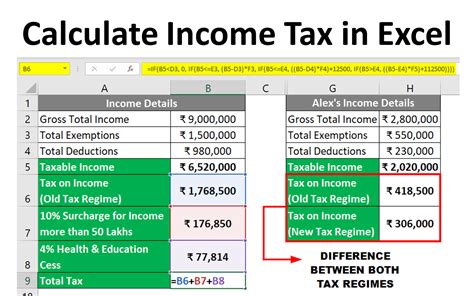

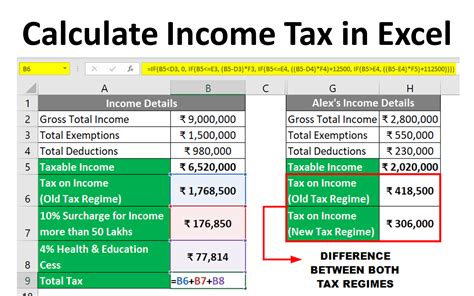

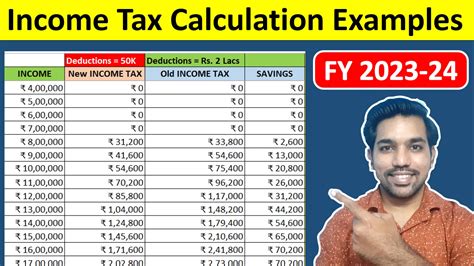

Calculate income tax easily with Excels formula, using variables like taxable income, deductions, and exemptions to determine tax liability, and learn how to create a tax calculator spreadsheet.

Calculating income tax can be a complex and time-consuming process, but with the help of Excel, it can be simplified and made more efficient. In this article, we will explore the formula for income tax in Excel and provide a step-by-step guide on how to use it.

Income tax is a tax levied by the government on an individual's income, and it is typically calculated based on the individual's taxable income. The taxable income is calculated by subtracting deductions and exemptions from the individual's gross income. The income tax formula in Excel can be used to calculate the income tax liability of an individual based on their taxable income.

The formula for income tax in Excel is as follows:

=IF(A1<10000,0,IF(A1<20000,0.1*(A1-10000),IF(A1<50000,0.2*(A1-20000)+1000,IF(A1<100000,0.3*(A1-50000)+5000,0.4*(A1-100000)+15000))))

Where A1 is the taxable income of the individual.

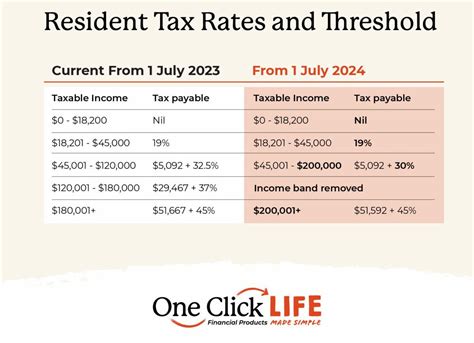

This formula uses the IF function to apply different tax rates to different ranges of taxable income. The tax rates and ranges are as follows:

- 0% on the first $10,000 of taxable income

- 10% on taxable income between $10,001 and $20,000

- 20% on taxable income between $20,001 and $50,000

- 30% on taxable income between $50,001 and $100,000

- 40% on taxable income above $100,000

How to Use the Formula for Income Tax in Excel

To use the formula for income tax in Excel, follow these steps:

- Open a new Excel spreadsheet and enter the taxable income of the individual in cell A1.

- Enter the formula for income tax in cell B1.

- Press Enter to calculate the income tax liability.

- The formula will apply the different tax rates to the taxable income and calculate the income tax liability.

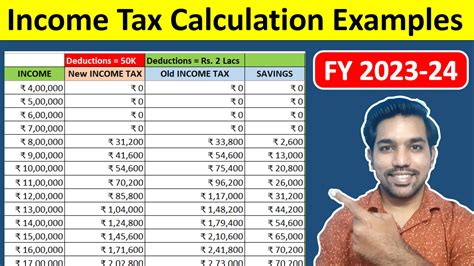

Example of Using the Formula for Income Tax in Excel

For example, if the taxable income of an individual is $75,000, the formula for income tax in Excel would calculate the income tax liability as follows:- The first $10,000 of taxable income is taxed at 0%, so the tax liability is $0.

- The next $10,000 of taxable income (from $10,001 to $20,000) is taxed at 10%, so the tax liability is $1,000.

- The next $30,000 of taxable income (from $20,001 to $50,000) is taxed at 20%, so the tax liability is $6,000.

- The next $25,000 of taxable income (from $50,001 to $75,000) is taxed at 30%, so the tax liability is $7,500.

- The total tax liability is $14,500.

Benefits of Using the Formula for Income Tax in Excel

There are several benefits of using the formula for income tax in Excel, including:

- Simplified calculation: The formula simplifies the calculation of income tax liability by applying different tax rates to different ranges of taxable income.

- Increased accuracy: The formula reduces the risk of errors in calculating income tax liability.

- Time-saving: The formula saves time by automating the calculation of income tax liability.

- Flexibility: The formula can be modified to accommodate changes in tax rates and ranges.

Common Errors to Avoid When Using the Formula for Income Tax in Excel

When using the formula for income tax in Excel, there are several common errors to avoid, including:- Entering incorrect values for taxable income

- Using incorrect tax rates and ranges

- Failing to update the formula for changes in tax rates and ranges

- Using the formula for incorrect types of income (e.g. using the formula for business income to calculate personal income tax liability)

Best Practices for Using the Formula for Income Tax in Excel

To get the most out of the formula for income tax in Excel, follow these best practices:

- Use the formula for the correct type of income (e.g. personal income tax liability or business income tax liability)

- Update the formula regularly to reflect changes in tax rates and ranges

- Use accurate values for taxable income

- Use the formula in conjunction with other financial planning tools to get a comprehensive picture of your financial situation

Advanced Techniques for Using the Formula for Income Tax in Excel

For advanced users, there are several techniques for using the formula for income tax in Excel, including:- Using multiple formulas to calculate income tax liability for different types of income

- Using conditional statements to apply different tax rates and ranges based on specific conditions

- Using macros to automate the calculation of income tax liability

Gallery of Income Tax Formulas

Income Tax Formula Gallery

What is the formula for income tax in Excel?

+The formula for income tax in Excel is =IF(A1<10000,0,IF(A1<20000,0.1*(A1-10000),IF(A1<50000,0.2*(A1-20000)+1000,IF(A1<100000,0.3*(A1-50000)+5000,0.4*(A1-100000)+15000))))

How do I use the formula for income tax in Excel?

+To use the formula for income tax in Excel, enter the taxable income in cell A1 and the formula in cell B1. Press Enter to calculate the income tax liability.

What are the benefits of using the formula for income tax in Excel?

+The benefits of using the formula for income tax in Excel include simplified calculation, increased accuracy, time-saving, and flexibility.

We hope this article has provided you with a comprehensive understanding of the formula for income tax in Excel. Whether you're a financial professional or an individual looking to simplify your tax calculations, this formula can be a valuable tool. If you have any questions or comments, please don't hesitate to reach out. Share this article with your friends and colleagues to help them simplify their tax calculations. Together, we can make tax season a little less stressful.