Intro

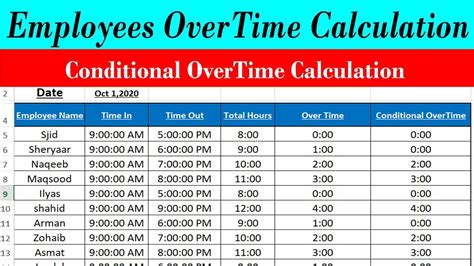

Calculating overtime pay is a crucial aspect of managing employee compensation, especially for those who work beyond the standard 40-hour workweek. Excel, with its robust formula capabilities, provides an efficient way to calculate overtime pay. Understanding the formula for overtime pay in Excel can help HR professionals, payroll managers, and business owners accurately compensate their employees for the extra hours worked.

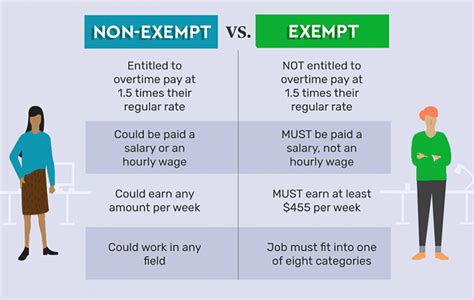

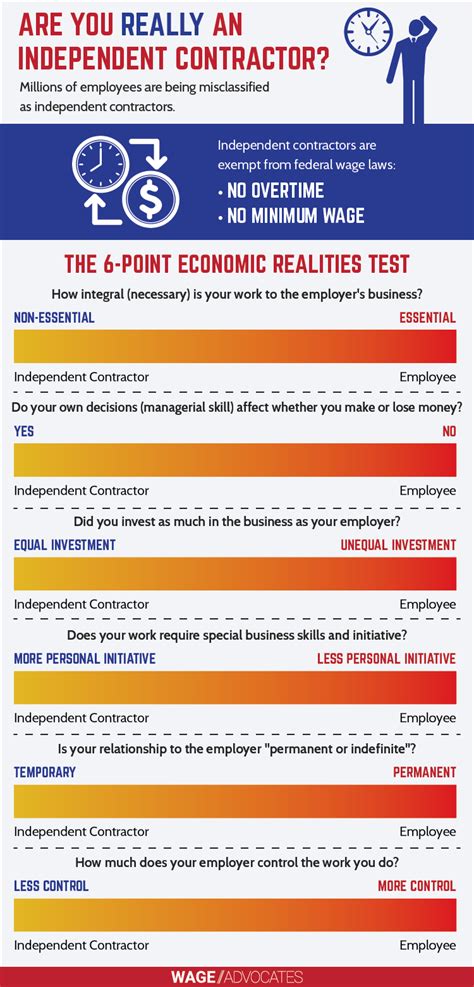

The importance of accurate overtime pay calculation cannot be overstated. It not only ensures fairness and transparency in employee compensation but also helps businesses comply with labor laws and regulations. In the United States, for example, the Fair Labor Standards Act (FLSA) requires employers to pay overtime to eligible employees who work more than 40 hours in a workweek. Failure to comply can result in significant fines and legal repercussions.

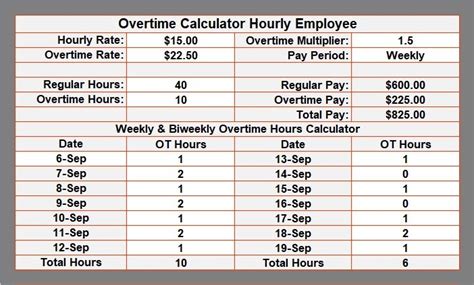

To calculate overtime pay in Excel, you need to understand the basic components involved: regular hours, overtime hours, regular pay rate, and overtime pay rate. The regular pay rate is the employee's standard hourly wage, while the overtime pay rate is typically 1.5 times the regular pay rate for hours worked beyond 40 in a week.

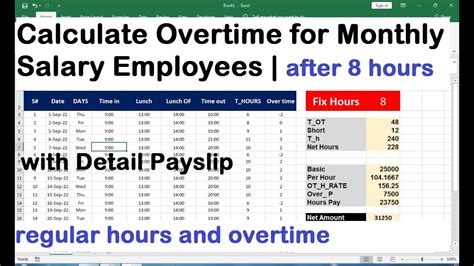

The formula for calculating overtime pay involves determining the number of regular hours and overtime hours worked, then applying the respective pay rates to these hours. For employees who work a fixed schedule, this calculation can be straightforward. However, for those with variable schedules, the calculation can become more complex, necessitating the use of Excel formulas to streamline the process.

Understanding Overtime Pay Calculation

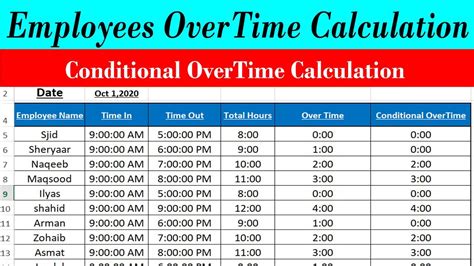

Calculating overtime pay involves several steps: determining the total hours worked, identifying the threshold beyond which overtime kicks in (typically 40 hours), calculating regular and overtime hours, and then applying the respective pay rates. Excel formulas can automate these steps, making it easier to manage payroll for businesses of all sizes.

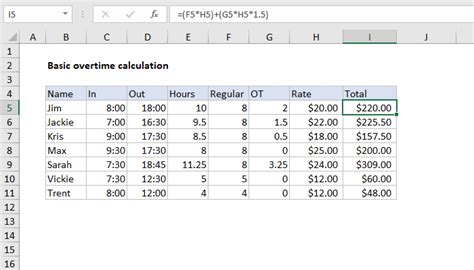

Basic Overtime Pay Formula in Excel

The basic formula for overtime pay in Excel can be broken down as follows:

- Calculate total hours worked.

- Determine regular hours (up to 40 hours) and overtime hours (beyond 40 hours).

- Apply the regular pay rate to regular hours and the overtime pay rate to overtime hours.

- Sum the regular pay and overtime pay to get the total pay.

For example, if an employee works 45 hours in a week, and their regular pay rate is $20/hour, the calculation would be:

- Regular hours: 40 hours

- Overtime hours: 5 hours

- Regular pay: 40 hours * $20/hour = $800

- Overtime pay: 5 hours * $30/hour (1.5 * $20) = $150

- Total pay: $800 + $150 = $950

Excel Formula for Overtime Pay

The Excel formula to calculate overtime pay, assuming the total hours worked is in cell A1, the regular pay rate is in cell B1, and the overtime threshold is 40 hours, could be: =IF(A1>40, (40*B1) + ((A1-40)*(B1*1.5)), A1*B1)This formula checks if the total hours worked exceeds 40. If it does, it calculates the regular pay for the first 40 hours and the overtime pay for the hours beyond 40, then sums these two amounts. If the total hours worked is 40 or less, it simply calculates the regular pay.

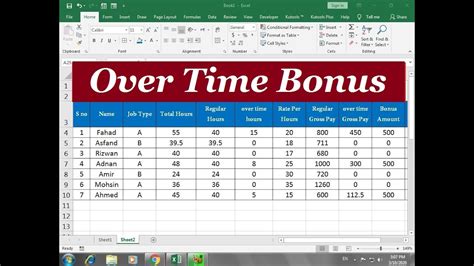

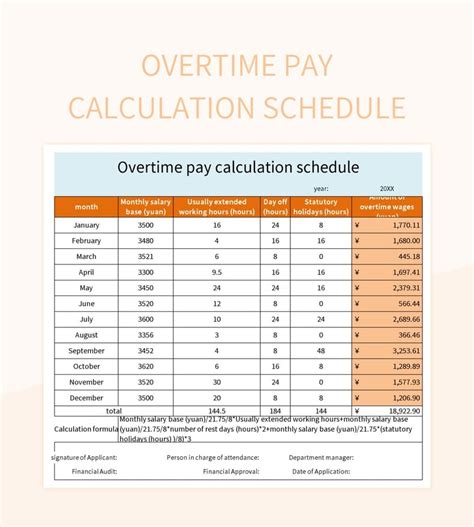

Advanced Overtime Pay Calculations

In more complex scenarios, such as when the overtime pay rate varies or when there are different pay rates for different types of work, the formula can be adjusted accordingly. For instance, if an employee has a different pay rate for weekend work, you would need to calculate the hours worked on weekends separately and apply the appropriate pay rate.

Using Excel Functions for Overtime Pay

Excel offers various functions that can be used to calculate overtime pay, including IF, IFERROR, and VLOOKUP, among others. The choice of function depends on the specifics of the calculation, such as whether the overtime threshold or pay rates vary.For example, the VLOOKUP function can be useful if you have a table that outlines different pay rates for different ranges of hours worked. The formula might look something like this: =VLOOKUP(A1, payrates, 2, FALSE)

Where A1 is the total hours worked, "payrates" is the range of the table containing the pay rates, 2 specifies that you want to return the value in the second column of the table, and FALSE specifies an exact match.

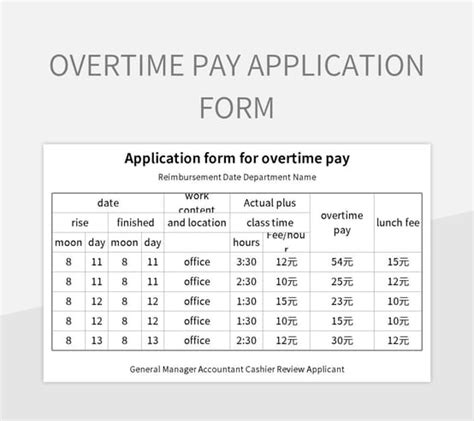

Practical Applications of Overtime Pay Formulas

The practical applications of overtime pay formulas in Excel are numerous. They can be used to create payroll templates that automatically calculate employee compensation based on hours worked, to analyze labor costs and optimize staffing levels, and to ensure compliance with labor regulations by accurately tracking and compensating overtime.

Moreover, by automating the overtime pay calculation process, businesses can reduce the risk of human error, streamline their payroll operations, and improve employee satisfaction by ensuring timely and accurate payment for all hours worked.

Benefits of Using Excel for Overtime Pay Calculation

Using Excel for overtime pay calculation offers several benefits, including: - Accuracy: Excel formulas minimize the chance of human error, ensuring that overtime pay is calculated correctly every time. - Efficiency: Automated calculations save time and effort, allowing payroll managers to focus on other tasks. - Flexibility: Excel formulas can be easily adjusted to accommodate different pay rates, thresholds, and other variables. - Scalability: Whether you have a few employees or hundreds, Excel can handle the calculations with ease.Gallery of Overtime Pay Calculation Examples

Overtime Pay Calculation Examples

Frequently Asked Questions About Overtime Pay Calculation

What is the standard overtime pay rate?

+The standard overtime pay rate is 1.5 times the regular pay rate for hours worked beyond 40 in a workweek.

How do I calculate overtime pay in Excel?

+To calculate overtime pay in Excel, use the formula =IF(A1>40, (40*B1) + ((A1-40)*(B1*1.5)), A1*B1), where A1 is the total hours worked and B1 is the regular pay rate.

What is the difference between regular and overtime hours?

+Regular hours refer to the standard 40 hours worked in a week, while overtime hours are those worked beyond the 40-hour threshold.

Can I use Excel to calculate overtime pay for employees with variable schedules?

+Yes, Excel can be used to calculate overtime pay for employees with variable schedules by adjusting the formula to account for the specific hours worked and pay rates.

Is overtime pay required for all employees?

+No, overtime pay is not required for all employees. Certain categories of employees, such as executives, managers, and some professionals, are exempt from overtime pay under the FLSA.

In conclusion, calculating overtime pay in Excel is a straightforward process that can be tailored to meet the specific needs of your business. By understanding the basic formula for overtime pay and how to apply it in Excel, you can ensure that your employees are fairly compensated for their work and that your business remains compliant with labor laws. Whether you're managing a small team or a large workforce, Excel provides the tools you need to streamline your payroll operations and focus on what matters most - growing your business and supporting your employees. We invite you to share your experiences with calculating overtime pay in Excel and any tips you might have for simplifying the process. Your insights can help others navigate the complexities of payroll management and ensure that everyone gets paid fairly for their hard work.