Intro

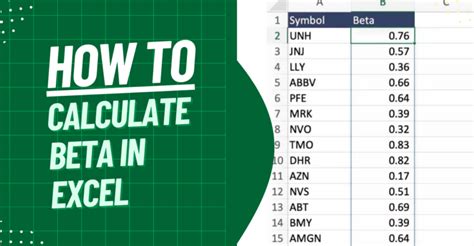

Calculating beta in Excel is a crucial step for investors and financial analysts to measure the volatility of a stock or portfolio relative to the overall market. Beta is a key component in the Capital Asset Pricing Model (CAPM), which helps in understanding the relationship between risk and expected return. In this article, we will delve into the importance of beta, its calculation, and how to compute it using Excel.

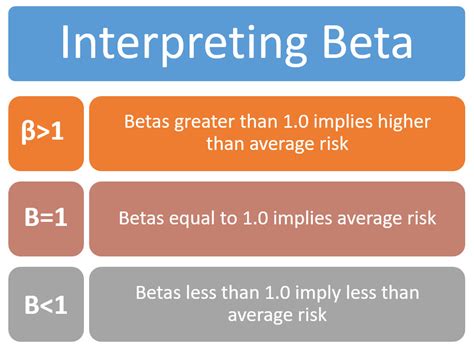

The concept of beta is fundamental in finance as it provides a quantitative measure of the systematic risk or volatility of an asset or portfolio. A beta of 1 indicates that the stock or portfolio moves in tandem with the market. A beta greater than 1 signifies higher volatility than the market, while a beta less than 1 indicates lower volatility. Understanding beta is essential for making informed investment decisions, as it helps investors to assess the potential risk and return of their investments.

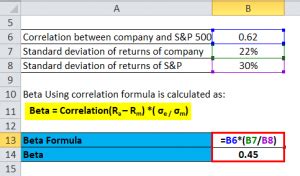

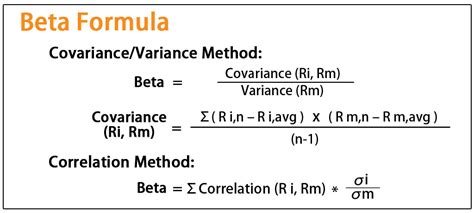

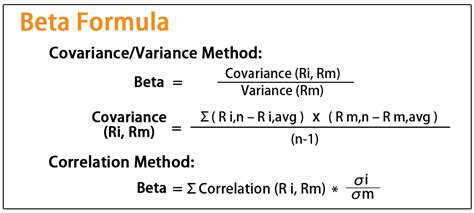

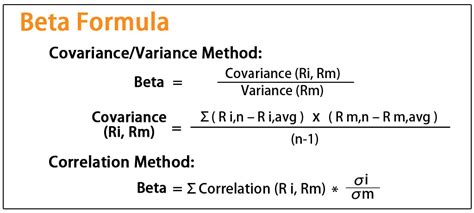

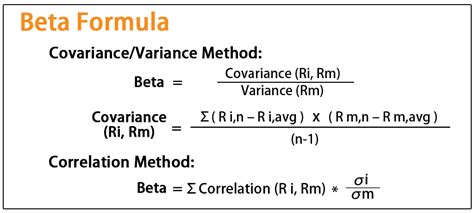

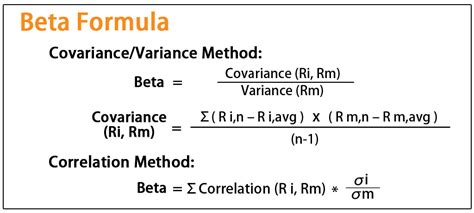

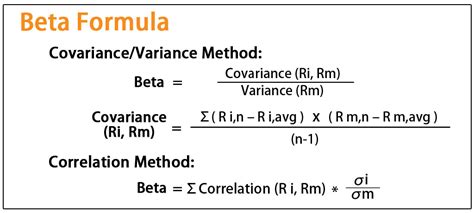

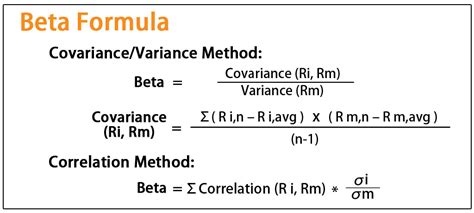

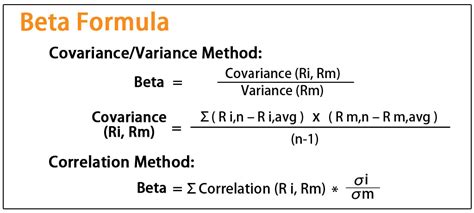

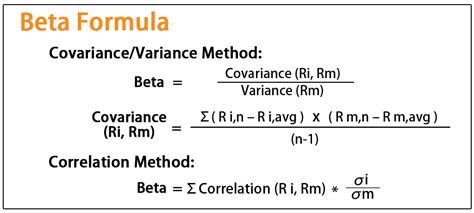

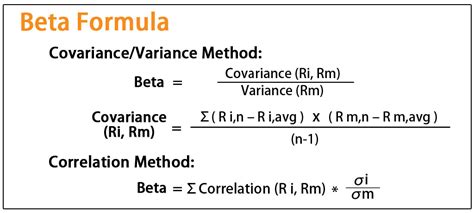

To calculate beta, one needs historical stock prices and the corresponding market index prices. The formula for beta involves the covariance of the stock's returns with the market's returns, divided by the variance of the market's returns. This calculation can be complex and time-consuming without the aid of a spreadsheet program like Excel. Excel offers various functions and tools that simplify the calculation of beta, making it an indispensable tool for financial analysis.

Introduction to Beta Calculation

Understanding Beta

Calculating Beta in Excel

Step-by-Step Guide

Using Excel Functions for Beta Calculation

Excel Functions

Practical Example of Beta Calculation

Case Study

Interpreting Beta Values

Understanding Beta Values

Limitations and Considerations

Limitations of Beta

Gallery of Beta Calculation Examples

Beta Calculation Examples

FAQs

What is beta in finance?

+Beta is a measure of the systematic risk or volatility of an asset or portfolio relative to the overall market.

How do you calculate beta in Excel?

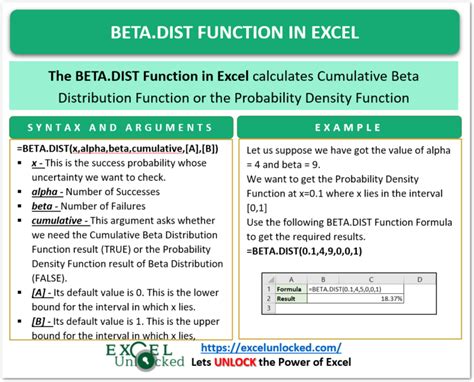

+Beta can be calculated in Excel by using the formula: beta = COVAR(stock returns, market returns) / VAR(market returns), where COVAR and VAR are Excel functions for covariance and variance, respectively.

What does a beta of 1 mean?

+A beta of 1 indicates that the stock or portfolio moves in tandem with the market, suggesting similar volatility.

In conclusion, calculating beta in Excel is a straightforward process that involves understanding the concept of beta, collecting the necessary data, and applying the beta formula using Excel's functions. Beta is a valuable tool for investors and financial analysts, providing insights into the systematic risk of investments. By following the steps and guidelines outlined in this article, individuals can effectively calculate and interpret beta values, making more informed investment decisions. We invite readers to share their experiences with beta calculation and its application in investment strategies, and to explore further the nuances of risk management in finance.