Intro

Create a customized Bond Payment Schedule in Excel, tracking interest, principal, and amortization. Optimize bond investments with accurate calculations and schedules, utilizing Excel templates and formulas for efficient bond portfolio management.

Bond payment schedules are crucial for investors and financial institutions to track and manage their bond investments effectively. Creating a bond payment schedule in Excel can be a straightforward process, allowing users to organize and analyze their bond payments with ease. In this article, we will delve into the importance of bond payment schedules, how to create one in Excel, and provide tips for managing bond investments.

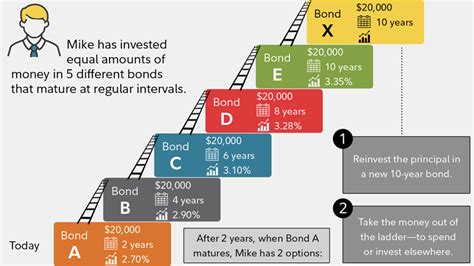

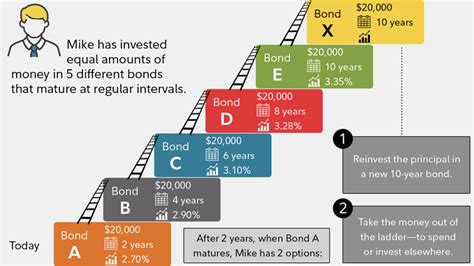

The bond market is a significant component of the global financial system, with various types of bonds offering different yields, maturities, and risk levels. Investors, whether individual or institutional, rely on bond payments to generate regular income or achieve long-term financial goals. A bond payment schedule helps investors keep track of upcoming payments, interest rates, and maturity dates, enabling them to make informed decisions about their investments.

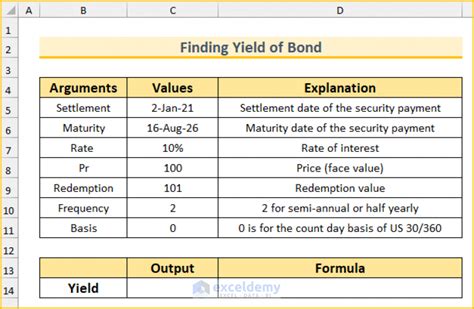

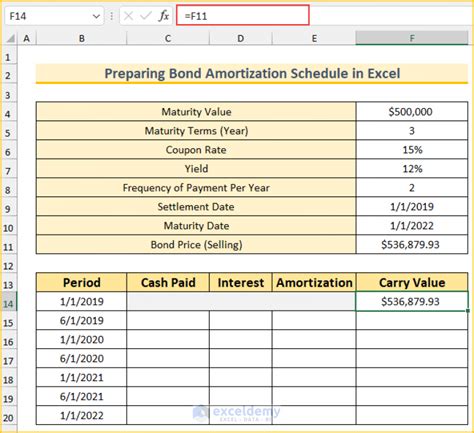

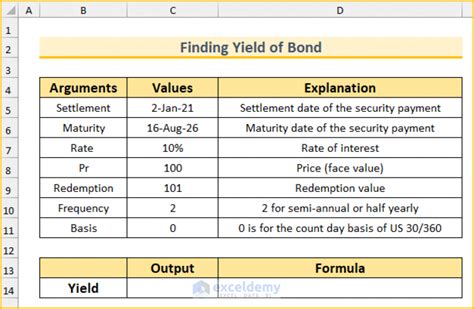

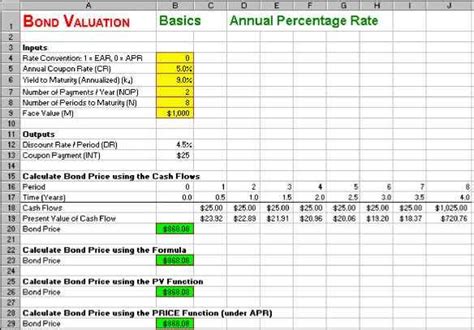

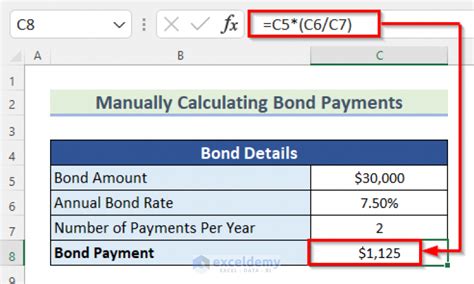

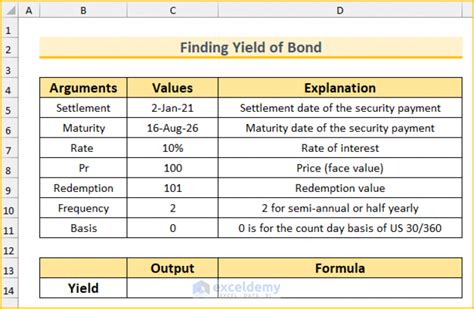

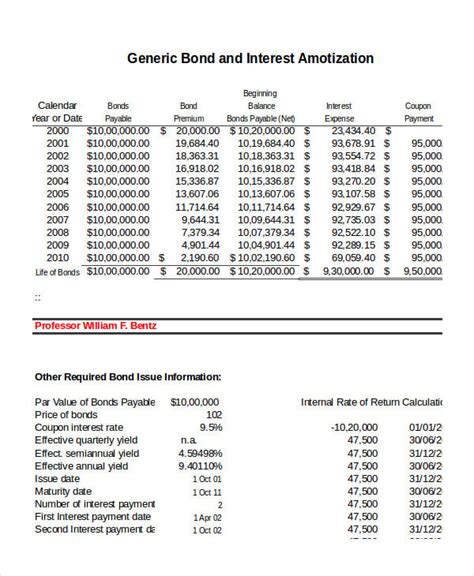

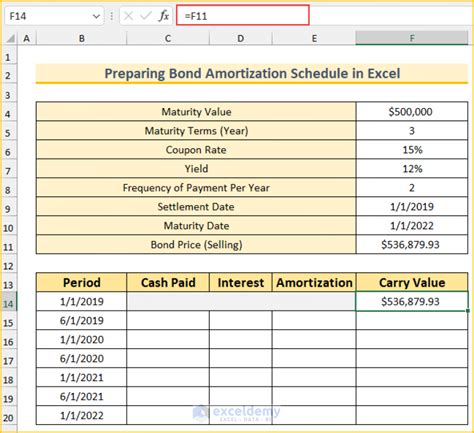

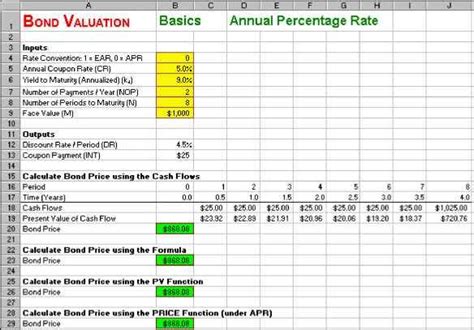

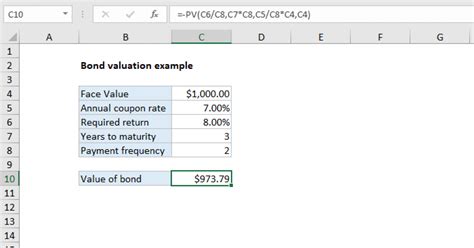

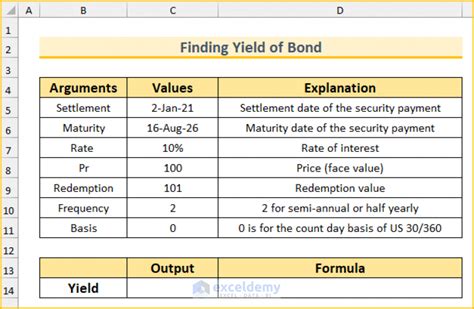

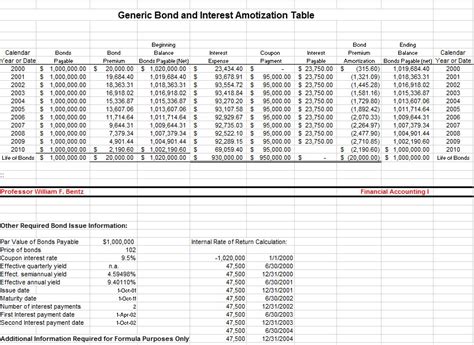

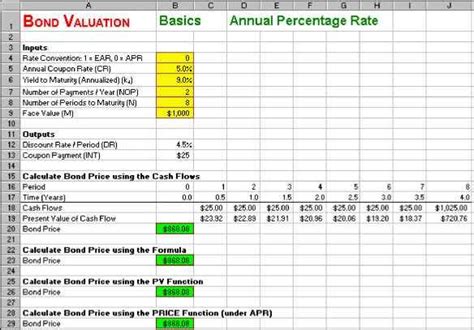

To create a bond payment schedule in Excel, users can start by setting up a basic template with columns for essential information such as bond name, issue date, maturity date, coupon rate, and payment frequency. The next step involves calculating the interest payments and principal repayments using formulas and functions in Excel. By using the PV, PMT, and IPMT functions, users can calculate the present value, periodic payments, and interest portions of each payment.

One of the primary benefits of using Excel for bond payment schedules is the ability to easily update and modify the template as needed. Users can add or remove columns, adjust formulas, and format the data to suit their specific requirements. Additionally, Excel's built-in functions and formulas enable users to perform complex calculations and analysis, such as calculating yield to maturity or determining the impact of interest rate changes on bond prices.

Creating a Bond Payment Schedule in Excel

To create a bond payment schedule in Excel, follow these steps:- Set up a basic template with columns for bond name, issue date, maturity date, coupon rate, and payment frequency.

- Calculate the interest payments and principal repayments using formulas and functions in Excel.

- Use the PV, PMT, and IPMT functions to calculate the present value, periodic payments, and interest portions of each payment.

- Format the data to display the payment schedule in a clear and organized manner.

Benefits of Using Excel for Bond Payment Schedules

Using Excel for bond payment schedules offers several benefits, including:- Easy updates and modifications to the template

- Ability to perform complex calculations and analysis

- Customizable formatting and display options

- Integration with other Excel functions and tools

Managing Bond Investments with Excel

In addition to creating a bond payment schedule, Excel can be used to manage bond investments in various ways, such as:- Tracking bond prices and yields

- Calculating returns and performance

- Analyzing interest rate risk and credit risk

- Creating scenarios and forecasts for different market conditions

Tips for Managing Bond Investments

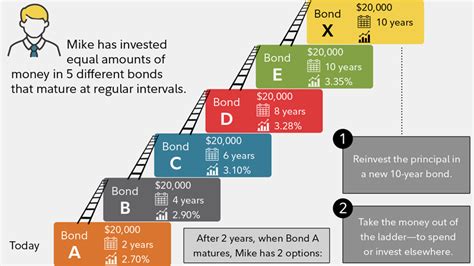

When managing bond investments, consider the following tips:- Diversify your portfolio to minimize risk

- Monitor interest rates and market conditions

- Rebalance your portfolio regularly

- Consider tax implications and optimize your strategy

Common Bond Payment Schedule Formulas in Excel

When creating a bond payment schedule in Excel, you may need to use various formulas and functions, such as:- PV: calculates the present value of a bond

- PMT: calculates the periodic payment of a bond

- IPMT: calculates the interest portion of a bond payment

- PPMT: calculates the principal portion of a bond payment

Best Practices for Bond Payment Schedules in Excel

To ensure accuracy and efficiency when creating bond payment schedules in Excel, follow these best practices:- Use clear and concise column headers

- Format data consistently throughout the template

- Use formulas and functions to automate calculations

- Regularly update and review the template

Bond Payment Schedule Image Gallery

What is a bond payment schedule?

+A bond payment schedule is a table or chart that outlines the payments made by a bond issuer to the bondholder, including the payment dates, amounts, and interest rates.

How do I create a bond payment schedule in Excel?

+To create a bond payment schedule in Excel, set up a basic template with columns for essential information, calculate interest payments and principal repayments using formulas and functions, and format the data to display the payment schedule clearly.

What are the benefits of using Excel for bond payment schedules?

+The benefits of using Excel for bond payment schedules include easy updates and modifications, ability to perform complex calculations and analysis, customizable formatting and display options, and integration with other Excel functions and tools.

In conclusion, creating a bond payment schedule in Excel is a valuable tool for investors and financial institutions to manage their bond investments effectively. By following the steps outlined in this article, users can create a comprehensive bond payment schedule that meets their specific needs. Remember to regularly update and review the template, and consider using additional Excel functions and tools to enhance your bond investment management strategy. If you have any questions or need further assistance, please don't hesitate to comment below or share this article with others who may find it helpful.