Intro

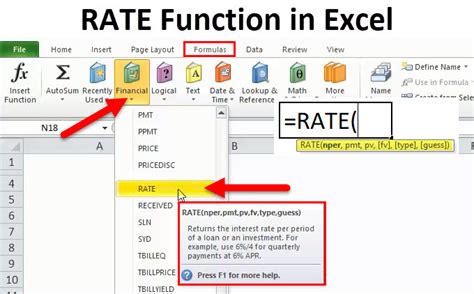

Learn the Rate Function Formula in Cell C6, using Excel formulas and functions like IPMT, PPMT, and XNPV to calculate interest rates and payments, with step-by-step examples and financial modeling techniques.

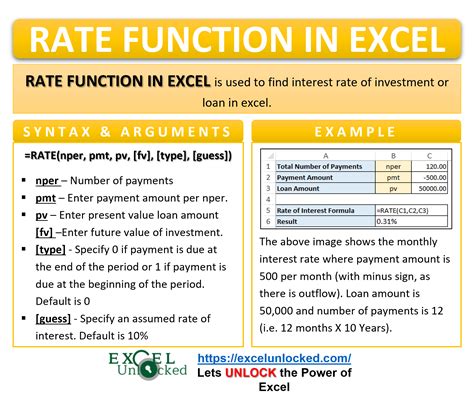

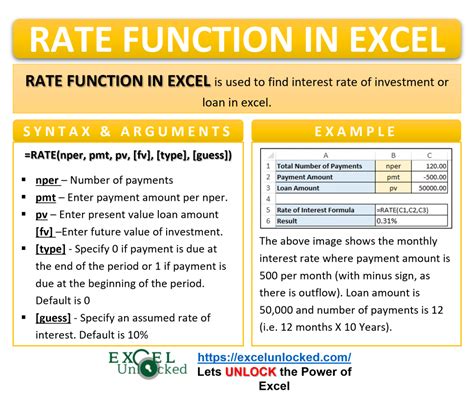

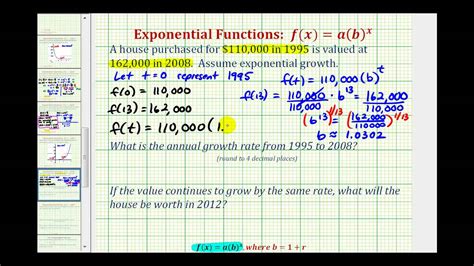

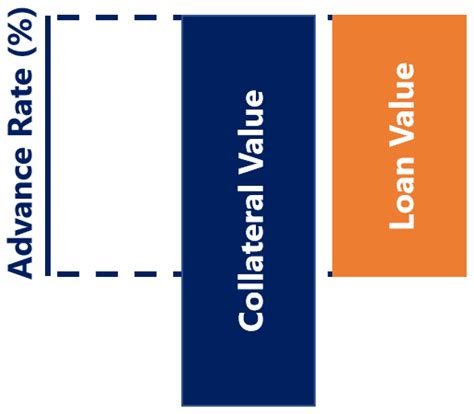

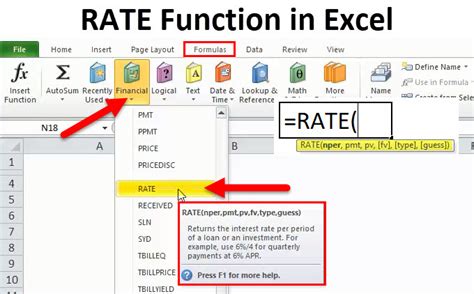

The rate function formula is a crucial tool in financial calculations, particularly when determining the interest rate of an investment or loan. To understand how to use the rate function formula in cell C6, we first need to grasp what the rate function does. The rate function, often represented as RATE in Excel, calculates the interest rate per period of an investment or loan, given the number of periods, the present value, the future value, and any periodic payments.

The syntax for the RATE function in Excel is: =RATE(nper, pmt, pv, [fv], [type], [guess])

Where:

- nper is the total number of payment periods.

- pmt is the payment made each period. If there are no payments, use 0.

- pv is the present value.

- [fv] is the future value. If omitted, it defaults to 0.

- [type] indicates when payments are due: 0 for end of period, 1 for beginning of period. If omitted, it defaults to 0.

- [guess] is your guess for the interest rate. If omitted, it defaults to 10%.

To apply this formula in cell C6, assuming we have the following values:

- The total number of periods (nper) is in cell A1.

- The periodic payment (pmt) is in cell B1.

- The present value (pv) is in cell A2.

- The future value (fv) is in cell B2.

The formula in cell C6 would look like this: =C6: =RATE(A1, B1, A2, B2)

However, this is a simplified example. In real-world scenarios, you might need to adjust the formula based on whether payments are made at the beginning or end of each period, or if you have a guess for the interest rate.

Let's delve deeper into how the RATE function works and its applications in financial analysis.

Understanding the RATE Function

The RATE function is versatile and can be used in various financial calculations, from determining the interest rate of a savings account to finding the cost of borrowing. Its ability to handle different types of financial transactions makes it a powerful tool in Excel.

Applications of the RATE Function

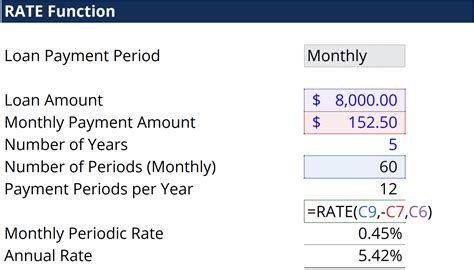

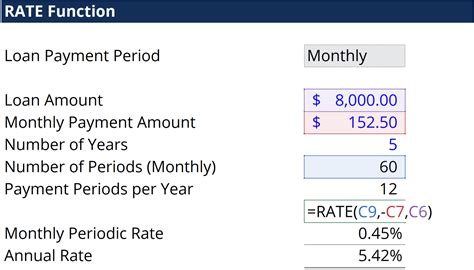

The RATE function has several applications, including: - Calculating the interest rate of investments to understand the return on investment. - Determining the cost of loans to compare different lending options. - Analyzing the impact of different payment schedules on the interest rate.For instance, if you're considering a loan with a 5-year term, and you want to know the interest rate based on the loan amount, payments, and any fees, you can use the RATE function to calculate this.

Steps to Use the RATE Function in Excel

- Identify Your Values: Determine the number of periods (nper), the payment per period (pmt), the present value (pv), and the future value (fv) if applicable.

- Choose Your Cell: Decide where you want the result to appear, in this case, cell C6.

- Enter the Formula: Type

=RATE(and then select the cells containing your values, or type them in directly. - Close the Formula: Close the parenthesis and press Enter.

Tips for Using the RATE Function

- Ensure your units are consistent. If your periods are in years, your rate will be annual. - Use the [guess] argument if the function is having trouble converging on a solution. - Be mindful of the [type] argument, as it can significantly affect your result.Common Errors with the RATE Function

- #NUM! Error: This can occur if the formula cannot find a rate that satisfies the input values. Check your inputs for errors or inconsistencies.

- #VALUE! Error: Ensure that all arguments are numeric and that the formula is correctly entered.

Resolving Errors

- Double-check your inputs for accuracy. - Adjust the [guess] argument if necessary. - Verify that your payments and values are correctly signed (e.g., payments are negative, income is positive).Advanced Uses of the RATE Function

The RATE function can be combined with other Excel functions to perform more complex financial analyses. For example, using it with the NPER function can help in determining the number of periods based on the interest rate, or with the PV function to calculate the present value based on the interest rate and future value.

Combining Functions

- **RATE and NPER**: Useful for calculating the term of a loan based on the interest rate and payments. - **RATE and PV**: Helpful for determining the present value of an investment based on the expected interest rate and future value.Conclusion and Next Steps

In conclusion, the RATE function in Excel is a powerful tool for financial analysis, offering insights into the interest rates of investments and loans. By understanding how to use the RATE function effectively, individuals and businesses can make more informed financial decisions.

For further learning, consider exploring other financial functions in Excel, such as the PMT function for calculating payments or the IPMT and PPMT functions for separating interest and principal payments.

Rate Function Image Gallery

What is the RATE function used for in Excel?

+The RATE function in Excel is used to calculate the interest rate per period of an investment or loan, based on the number of periods, the present value, the future value, and any periodic payments.

How do I use the RATE function in cell C6?

+To use the RATE function in cell C6, you would enter the formula =RATE(nper, pmt, pv, [fv], [type], [guess]), replacing the arguments with the appropriate values or cell references.

What are common errors when using the RATE function?

+Common errors include the #NUM! error, which can occur if the formula cannot find a rate that satisfies the input values, and the #VALUE! error, which can happen if the arguments are not numeric or if the formula is incorrectly entered.

We hope this comprehensive guide to the RATE function in Excel has been informative and helpful. Whether you're a financial analyst, a business owner, or an individual looking to understand your financial options better, mastering the RATE function can provide valuable insights into the world of finance. Feel free to share your experiences or ask questions about using the RATE function in the comments below.