Intro

Managing payments and financial planning is crucial for both individuals and businesses. A prepayment schedule template in Excel can be a valuable tool for organizing and tracking payments over time. This template can help in creating a structured plan for making payments, whether it's for a loan, a mortgage, or any other financial obligation. The importance of having a clear and manageable payment schedule cannot be overstated, as it helps in avoiding late payment fees, reducing debt, and improving credit scores.

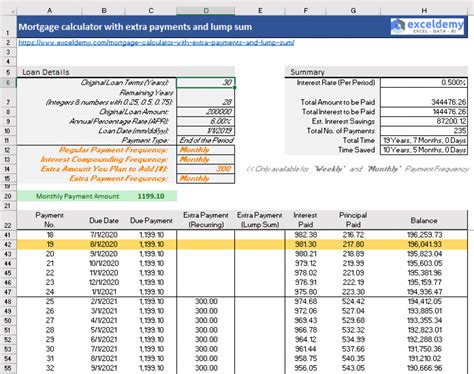

In today's financial landscape, being proactive about financial planning is key to stability and growth. A prepayment schedule template in Excel offers a flexible and customizable solution that can be adapted to various financial situations. It allows users to input specific details about their financial obligations, such as the principal amount, interest rate, and payment frequency, to generate a personalized payment plan. This level of customization ensures that the template can cater to a wide range of financial needs, from personal loans to business investments.

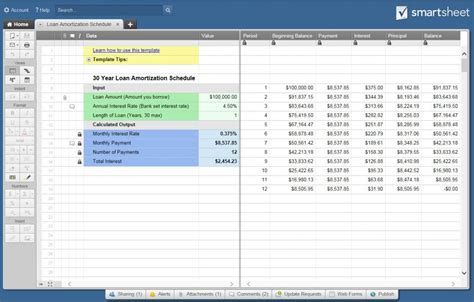

The benefits of using a prepayment schedule template in Excel are multifaceted. Not only does it provide a clear overview of upcoming payments, but it also helps in budgeting and forecasting. By having a detailed plan, individuals and businesses can better allocate their financial resources, make informed decisions about future investments, and work towards achieving long-term financial goals. Furthermore, the template can be easily shared among stakeholders, such as financial advisors or partners, to ensure everyone is on the same page regarding financial obligations and plans.

Understanding the Prepayment Schedule Template Excel

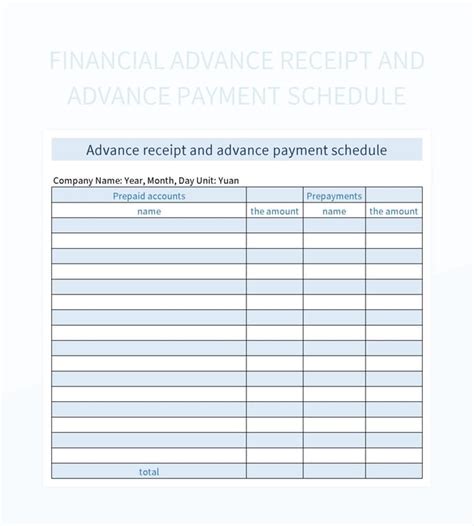

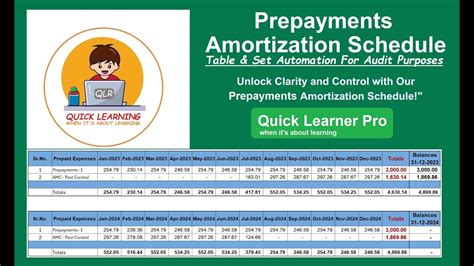

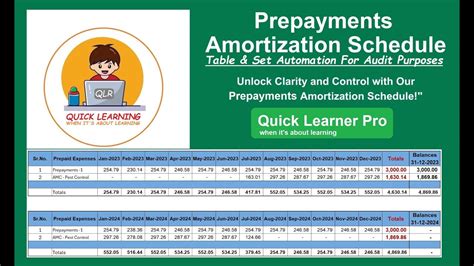

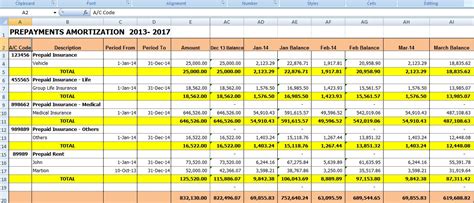

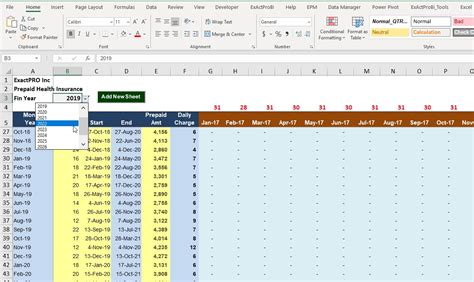

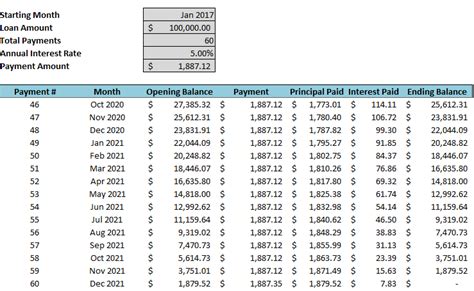

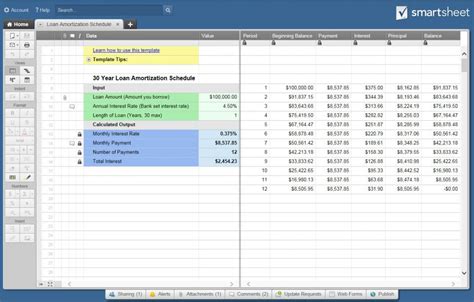

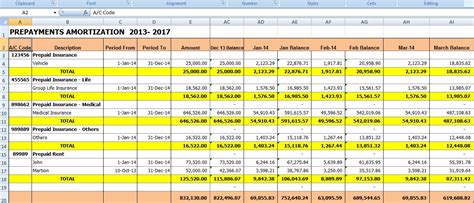

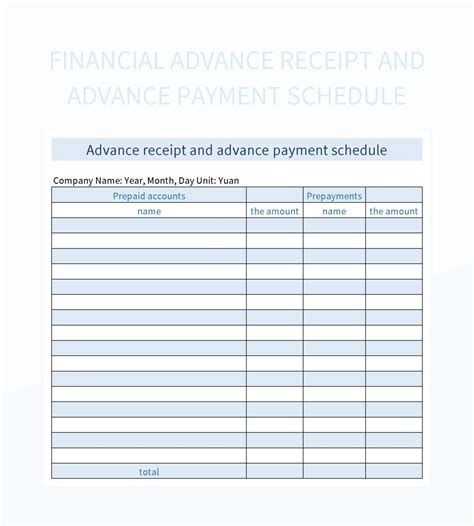

To maximize the benefits of a prepayment schedule template in Excel, it's essential to understand its components and how to use them effectively. The template typically includes columns for the payment date, payment amount, interest paid, principal paid, and the outstanding balance. Users can input their financial data into these columns to generate a schedule that outlines each payment over the life of the loan or financial obligation.

Key Components of the Template

The template's key components are designed to provide a comprehensive view of the payment schedule. These include: - **Payment Date**: The date on which each payment is due. - **Payment Amount**: The total amount to be paid, including both interest and principal. - **Interest Paid**: The portion of the payment that goes towards interest. - **Principal Paid**: The portion of the payment that reduces the outstanding balance. - **Outstanding Balance**: The remaining balance after each payment.Benefits of Using a Prepayment Schedule Template

The benefits of utilizing a prepayment schedule template are numerous. It not only aids in financial planning but also provides a structured approach to debt management. Some of the key benefits include:

- Improved Financial Visibility: Offers a clear and detailed overview of all payments.

- Enhanced Budgeting: Helps in allocating financial resources more effectively.

- Reduced Stress: Provides a sense of control over financial obligations.

- Customization: Can be tailored to fit specific financial needs and goals.

Steps to Create a Prepayment Schedule Template

Creating a prepayment schedule template in Excel involves several steps: 1. **Open Excel**: Start by opening a new Excel spreadsheet. 2. **Set Up Columns**: Create columns for payment date, payment amount, interest paid, principal paid, and outstanding balance. 3. **Input Formula**: Use Excel formulas to calculate interest paid, principal paid, and the outstanding balance for each payment period. 4. **Customize**: Adjust the template as needed to fit your specific financial situation.Practical Applications of the Prepayment Schedule Template

The prepayment schedule template has various practical applications, making it a versatile tool for financial management. Some of its applications include:

- Loan Payments: Useful for planning and tracking payments on personal loans, mortgages, and car loans.

- Business Finance: Can be used by businesses to manage loan repayments and cash flow.

- Investment Planning: Helps in planning investments by providing a clear picture of future financial obligations.

Common Challenges and Solutions

While using a prepayment schedule template, users may encounter challenges such as difficulty in understanding Excel formulas or managing variable payment amounts. Solutions to these challenges include: - **Seeking Tutorial Help**: Utilizing online resources and tutorials to learn more about Excel formulas. - **Consulting a Financial Advisor**: For complex financial situations, consulting a professional can provide personalized advice.Gallery of Prepayment Schedule Templates

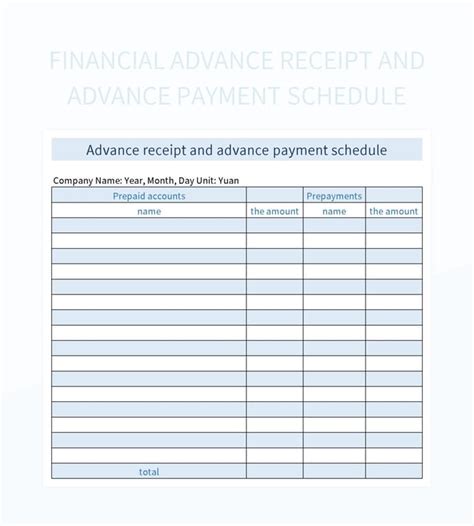

Prepayment Schedule Image Gallery

Frequently Asked Questions

What is a prepayment schedule template?

+A prepayment schedule template is a tool used to plan and track payments over time, typically for loans or mortgages.

How do I create a prepayment schedule in Excel?

+To create a prepayment schedule in Excel, set up columns for payment details, input your financial data, and use Excel formulas to calculate interest and principal payments.

What are the benefits of using a prepayment schedule template?

+The benefits include improved financial visibility, enhanced budgeting, reduced stress, and customization to fit specific financial needs.

In conclusion, a prepayment schedule template in Excel is a powerful tool for managing financial obligations and planning for the future. By understanding its components, benefits, and applications, individuals and businesses can leverage this template to achieve greater financial stability and success. Whether you're looking to pay off a loan, invest in your future, or simply get a better handle on your finances, this template can provide the clarity and structure you need. We invite you to share your experiences with prepayment schedule templates, ask questions, or explore how this tool can be tailored to meet your specific financial goals. Your feedback and insights are invaluable in helping others navigate the world of financial planning.