Intro

Calculate investment returns with the Xirr formula in Excel, using internal rate of return, cash flows, and dates to determine profitability and ROI.

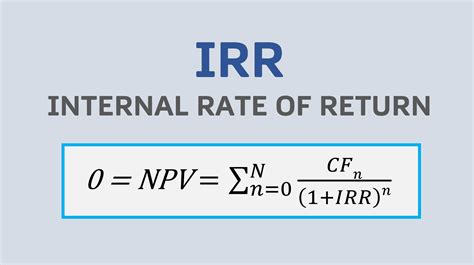

The XIRR formula in Excel is a powerful tool for calculating the internal rate of return (IRR) of a series of cash flows that are not periodic. Unlike the traditional IRR formula, which assumes that cash flows occur at regular intervals, the XIRR formula allows you to specify the exact dates of each cash flow. This makes it particularly useful for investments or projects where the timing of cash flows is irregular or unpredictable.

The importance of understanding and using the XIRR formula lies in its ability to provide a more accurate picture of an investment's performance. Traditional IRR calculations can be misleading if the cash flows are not periodic, as they assume a uniform time interval between each cash flow. The XIRR formula overcomes this limitation by taking into account the actual dates of each cash flow, thereby providing a more precise measure of an investment's return.

For individuals and businesses alike, being able to accurately assess the return on investment (ROI) is crucial for making informed decisions. Whether it's evaluating the performance of a portfolio, comparing different investment opportunities, or assessing the viability of a project, the XIRR formula is an invaluable tool. Its application extends across various fields, including finance, real estate, and entrepreneurship, where the ability to calculate returns accurately can significantly impact strategic planning and decision-making.

Understanding the XIRR Formula

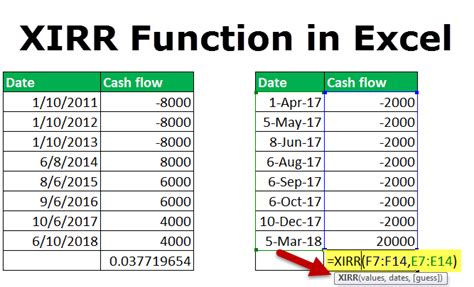

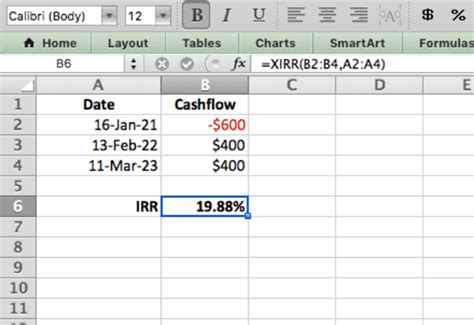

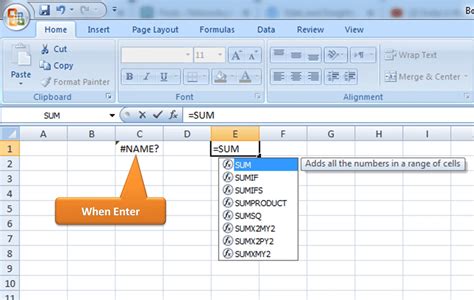

The XIRR formula in Excel is calculated using the following syntax: XIRR(values, dates, [guess]). Here, values represents the series of cash flows, dates represents the corresponding dates of these cash flows, and [guess] is an optional argument that specifies an initial estimate for the internal rate of return. If the [guess] argument is omitted, Excel uses a default value of 0.1 (or 10%).

To apply the XIRR formula, you first need to set up your data in Excel, with one column for the cash flows and another for the corresponding dates. It's essential that the dates are in a format that Excel recognizes as dates. Then, you can use the formula by selecting the cell where you want the result to appear, typing =XIRR(, and then selecting the range of cash flows and the range of dates, separated by a comma.

Benefits of Using the XIRR Formula

The XIRR formula offers several benefits over traditional IRR calculations, particularly in scenarios where cash flows are irregular. One of the primary advantages is its ability to handle non-periodic cash flows, making it more versatile and applicable to a wider range of investment and project scenarios. Additionally, the XIRR formula provides a more accurate calculation of the internal rate of return, which is essential for evaluating the true performance of an investment or project.

Another significant benefit of the XIRR formula is its ease of use in Excel. Once the data is properly set up, applying the formula is straightforward, and Excel handles the complex calculations behind the scenes. This makes it accessible to users who may not have an extensive background in finance or advanced mathematical concepts.

Steps to Apply the XIRR Formula

To apply the XIRR formula in Excel, follow these steps: 1. **Set Up Your Data**: Ensure your cash flows and dates are in separate columns. The cash flows should be in one column, with positive values representing inflows and negative values representing outflows. The dates should be in a format that Excel recognizes. 2. **Select the Formula**: Go to the cell where you want to display the XIRR result and type `=XIRR(`. 3. **Select the Cash Flows**: Select the range of cells containing your cash flows. 4. **Select the Dates**: Type a comma and then select the range of cells containing the dates corresponding to the cash flows. 5. **Optional Guess**: If you want to specify an initial guess, type a comma after selecting the dates and enter your guess. 6. **Close the Formula**: Close the parenthesis and press Enter to calculate the XIRR.Practical Examples and Statistical Data

To illustrate the application and benefits of the XIRR formula, consider a scenario where an investor makes an initial investment of $10,000 on January 1, 2020, and then receives $5,000 on June 30, 2020, and another $7,000 on December 31, 2021. Using the XIRR formula, we can calculate the internal rate of return for this investment.

Assuming the cash flows are as follows:

- -$10,000 on January 1, 2020

- $5,000 on June 30, 2020

- $7,000 on December 31, 2021

And the corresponding dates are:

- January 1, 2020

- June 30, 2020

- December 31, 2021

Using the XIRR formula in Excel: =XIRR(A1:A3, B1:B3), where A1:A3 contains the cash flows and B1:B3 contains the dates, we can calculate the internal rate of return for this investment.

Key Considerations

When using the XIRR formula, it's essential to consider a few key points: - **Date Format**: Ensure that Excel recognizes your dates. If necessary, convert them to a standard date format. - **Cash Flow Signs**: Remember that inflows are positive, and outflows are negative. - **Guess Value**: If the formula does not converge to a solution, try entering a guess value.Gallery of XIRR Formula Applications

XIRR Formula Image Gallery

Frequently Asked Questions

What is the XIRR formula used for?

+The XIRR formula is used to calculate the internal rate of return for a series of cash flows that are not periodic, providing a more accurate measure of an investment's performance.

How does the XIRR formula differ from the IRR formula?

+The XIRR formula differs from the IRR formula in that it takes into account the exact dates of each cash flow, allowing for the calculation of the internal rate of return for non-periodic cash flows.

What are the benefits of using the XIRR formula in Excel?

+The benefits include the ability to handle non-periodic cash flows, providing a more accurate calculation of the internal rate of return, and ease of use in Excel, making it accessible to a wide range of users.

In conclusion, the XIRR formula is a powerful and versatile tool in Excel for calculating the internal rate of return of investments or projects with non-periodic cash flows. Its ability to provide accurate calculations, combined with its ease of use, makes it an essential formula for anyone involved in financial analysis, investment decisions, or project evaluations. Whether you're an investor looking to assess the performance of your portfolio, a business owner evaluating the viability of a project, or a financial analyst seeking to provide accurate advice, the XIRR formula is an indispensable resource. We invite you to share your experiences with the XIRR formula, ask questions, or explore how it can be applied in different scenarios to enhance your understanding and use of this valuable financial tool.