Intro

Master options pricing with our Excel Black Scholes Formula Guide, featuring volatility, risk-free rates, and dividend yields calculations for precise valuation and trading strategies.

The Black Scholes formula is a widely used mathematical model in finance that estimates the value of a call option or a put option. The formula is named after Fischer Black and Myron Scholes, who first introduced it in their 1973 paper "The Pricing of Options and Corporate Liabilities." The Black Scholes formula is a complex mathematical equation that takes into account various factors such as the underlying stock price, strike price, time to expiration, risk-free interest rate, and volatility.

The importance of the Black Scholes formula cannot be overstated. It has revolutionized the field of finance and has become a cornerstone of options pricing. The formula is widely used by investors, traders, and financial institutions to estimate the value of options and to make informed investment decisions. In this article, we will provide a comprehensive guide to the Black Scholes formula, including its history, components, and applications.

The Black Scholes formula is a complex mathematical equation that requires a deep understanding of finance, mathematics, and statistics. However, with the advent of computer technology and software, it has become easier to implement the formula and estimate the value of options. One of the most popular software programs used to implement the Black Scholes formula is Microsoft Excel. Excel provides a user-friendly interface and a range of built-in functions that make it easy to calculate the value of options using the Black Scholes formula.

Introduction to the Black Scholes Formula

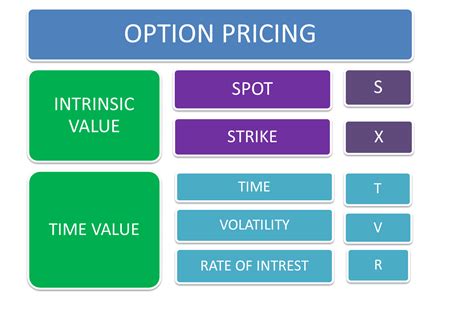

Components of the Black Scholes Formula

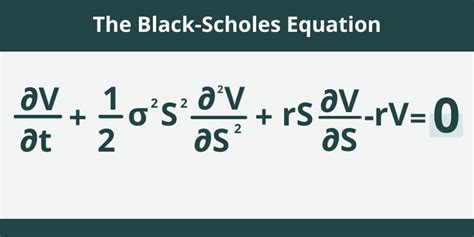

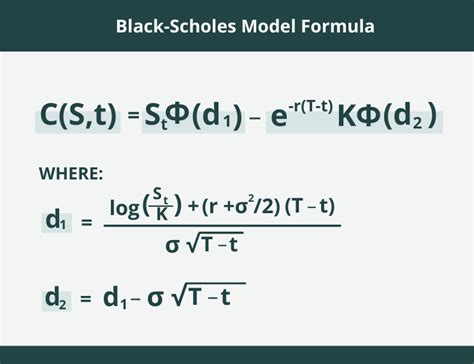

The Black Scholes formula has several components, including: * Underlying stock price (S) * Strike price (K) * Time to expiration (T) * Risk-free interest rate (r) * Volatility (σ)These components are used to estimate the value of a call option or a put option. The formula is as follows:

C(S, t) = S N(d1) - K e^(-rT) N(d2)

where:

- C(S, t) is the value of the call option

- S is the underlying stock price

- K is the strike price

- T is the time to expiration

- r is the risk-free interest rate

- σ is the volatility

- N(d1) and N(d2) are the cumulative distribution functions of the standard normal distribution

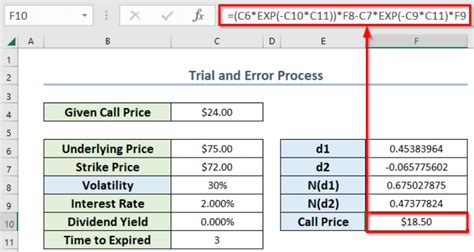

Implementing the Black Scholes Formula in Excel

- Input the underlying stock price, strike price, time to expiration, risk-free interest rate, and volatility into separate cells.

- Use the NORM.S.DIST function to calculate the cumulative distribution functions of the standard normal distribution.

- Use the EXP function to calculate the exponential term.

- Use the formula to calculate the value of the call option or put option.

For example, suppose we want to estimate the value of a call option with the following parameters:

- Underlying stock price: $100

- Strike price: $105

- Time to expiration: 1 year

- Risk-free interest rate: 5%

- Volatility: 20%

We can implement the Black Scholes formula in Excel as follows:

| A | B | |

|---|---|---|

| 1 | S | 100 |

| 2 | K | 105 |

| 3 | T | 1 |

| 4 | r | 0.05 |

| 5 | σ | 0.2 |

| 6 | d1 | =(LN(B1/B2)+(B4+B5^2/2)B3)/(B5SQRT(B3)) |

| 7 | d2 | =B6-B5*SQRT(B3) |

| 8 | N(d1) | =NORM.S.DIST(B6,TRUE) |

| 9 | N(d2) | =NORM.S.DIST(B7,TRUE) |

| 10 | C(S, t) | =B1B8-B2EXP(-B4*B3)*B9 |

The value of the call option is estimated to be $10.23.

Applications of the Black Scholes Formula

The Black Scholes formula has a wide range of applications in finance, including:- Options pricing: The formula is used to estimate the value of call options and put options.

- Risk management: The formula is used to estimate the value of options and to manage risk.

- Portfolio optimization: The formula is used to optimize portfolios and to maximize returns.

The Black Scholes formula is also used in other fields, such as:

- Economics: The formula is used to estimate the value of options and to study the behavior of financial markets.

- Mathematics: The formula is used to study the properties of stochastic processes and to develop new mathematical models.

Limitations of the Black Scholes Formula

- Assumptions: The formula is based on several assumptions, such as the assumption that the underlying stock price follows a geometric Brownian motion and that the risk-free interest rate is constant.

- Volatility: The formula assumes that volatility is constant, which is not always the case.

- Time to expiration: The formula assumes that the time to expiration is known, which is not always the case.

These limitations can affect the accuracy of the formula and can lead to errors in estimating the value of options.

Alternatives to the Black Scholes Formula

There are several alternatives to the Black Scholes formula, including:- Binomial model: The binomial model is a discrete-time model that estimates the value of options.

- Finite difference model: The finite difference model is a numerical method that estimates the value of options.

- Monte Carlo simulation: The Monte Carlo simulation is a numerical method that estimates the value of options.

These alternatives can provide more accurate estimates of the value of options, but they can also be more complex and require more computational power.

Gallery of Black Scholes Formula Images

Black Scholes Formula Image Gallery

Frequently Asked Questions

What is the Black Scholes formula?

+The Black Scholes formula is a mathematical model that estimates the value of a call option or a put option.

What are the components of the Black Scholes formula?

+The components of the Black Scholes formula include the underlying stock price, strike price, time to expiration, risk-free interest rate, and volatility.

How is the Black Scholes formula implemented in Excel?

+The Black Scholes formula can be implemented in Excel using the NORM.S.DIST function and the EXP function.

In conclusion, the Black Scholes formula is a powerful tool for estimating the value of options. It has a wide range of applications in finance and is widely used by investors, traders, and financial institutions. However, the formula has several limitations, including assumptions about the underlying stock price and volatility. Despite these limitations, the Black Scholes formula remains a cornerstone of options pricing and is an essential tool for anyone involved in finance. We hope this guide has provided a comprehensive overview of the Black Scholes formula and its applications. If you have any questions or comments, please feel free to share them with us.