Intro

Calculate RSI in Excel with ease. Learn Relative Strength Index formula, indicators, and stock analysis techniques using Excel spreadsheet, technical analysis, and trading tools.

Calculating the Relative Strength Index (RSI) in Excel is a straightforward process that can help traders and investors analyze market trends and make informed decisions. The RSI is a momentum indicator that measures the magnitude of recent price changes to determine overbought or oversold conditions. Here's a step-by-step guide on how to calculate RSI in Excel.

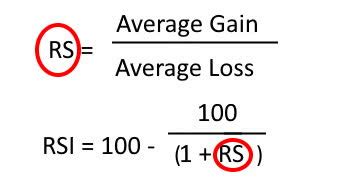

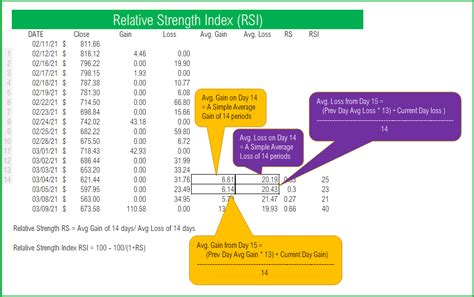

The RSI is typically calculated over a 14-period range, but this can be adjusted based on personal preference or market conditions. The formula for RSI is:

RSI = 100 - (100 / (1 + RS))

Where RS (Relative Strength) is the average gain of up days during the specified period divided by the average loss of down days.

To calculate RSI in Excel, follow these steps:

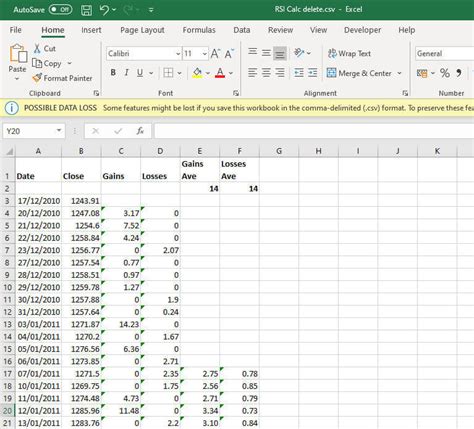

First, you need to prepare your data. Assume you have a list of closing prices for a stock or asset in column A, starting from A2.

-

Calculate the difference between consecutive closing prices in column B. The formula for cell B2 would be =A2-A1. Drag this formula down for all your data points.

-

In column C, calculate the gain (up days). If the difference is positive, use the formula =B2, otherwise, use 0. The formula for cell C2 can be written as =IF(B2>0, B2, 0).

-

In column D, calculate the loss (down days). If the difference is negative, use the absolute value of the difference, otherwise, use 0. The formula for cell D2 can be written as =IF(B2<0, ABS(B2), 0).

-

Calculate the average gain over the last 14 periods. In a new column (let's say E), starting from the 15th row (since you need at least 14 data points to calculate the first RSI value), use the formula =AVERAGE(C2:C15). Drag this formula down for the rest of your data points.

-

Similarly, calculate the average loss over the last 14 periods in another column (let's say F), starting from the 15th row, using the formula =AVERAGE(D2:D15). Drag this formula down.

-

Calculate the Relative Strength (RS) in another column (let's say G), starting from the 15th row, using the formula =E15/F15. Drag this formula down.

-

Finally, calculate the RSI in column H, starting from the 15th row, using the formula =100-(100/(1+G15)). Drag this formula down for all your data points.

This method provides a basic calculation of RSI. However, Excel also offers more advanced functions and add-ins, such as the Analysis ToolPak, that can simplify this process and provide more sophisticated analysis tools.

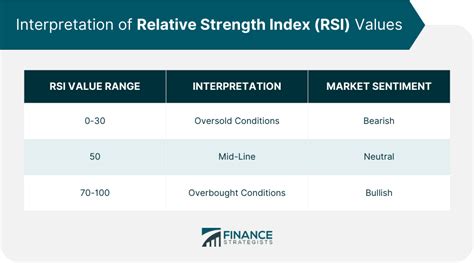

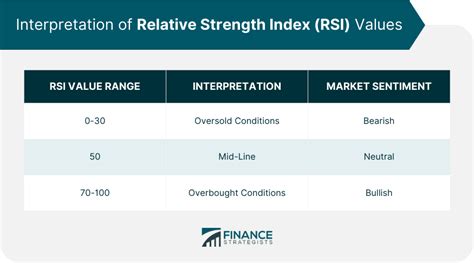

Understanding RSI Values

RSI values range from 0 to 100. An RSI of 100 would indicate that the asset has had only positive price changes during the specified period, which is highly unlikely. Conversely, an RSI of 0 would indicate that the asset has had only negative price changes.

The most common interpretation of RSI values is as follows:

- RSI > 70: Overbought condition, potentially leading to a price reversal.

- RSI < 30: Oversold condition, potentially leading to a price rally.

- RSI between 30 and 70: Neutral zone, where the trend may continue or reverse based on other market factors.

Using RSI in Trading Strategies

The RSI can be a powerful tool in trading strategies, helping traders identify potential buy and sell signals. Here are a few strategies:

- Mean Reversion Strategy: Buy when RSI falls below 30, and sell when RSI rises above 70, anticipating a mean reversion.

- Trend Following: Use RSI to confirm the strength of a trend. A rising RSI during an uptrend or a falling RSI during a downtrend can indicate the trend's continuation.

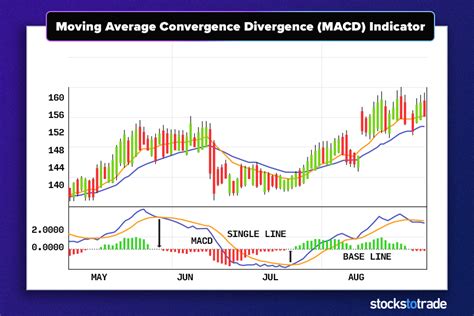

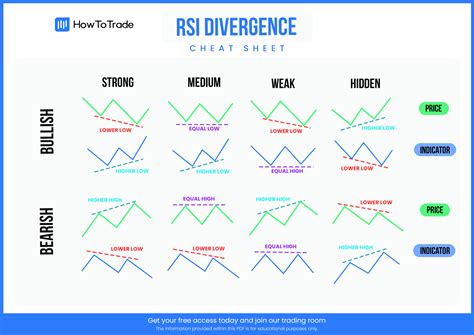

- Divergence Trading: Look for divergences between the RSI and the price action. A bullish divergence occurs when the RSI makes a higher low while the price makes a lower low, indicating a potential buy signal. A bearish divergence occurs when the RSI makes a lower high while the price makes a higher high, indicating a potential sell signal.

Limitations of RSI

While the RSI is a widely used and effective indicator, it has its limitations:

- False Signals: RSI can generate false buy and sell signals, especially during strong trends.

- Adjusting Parameters: The choice of the period (e.g., 14 days) can significantly affect the RSI's sensitivity and ability to generate signals.

- Combination with Other Indicators: RSI is often more effective when used in combination with other technical and fundamental analysis tools.

Advanced RSI Techniques

- RSI Divergences: As mentioned, looking for divergences between the RSI and price action can provide strong trading signals.

- RSI Swings: Buying when the RSI crosses above 50 from below and selling when it crosses below 50 from above can be a strategy to follow the trend.

- Multiple Time Frame Analysis: Using RSI on different time frames (e.g., 15-minute, hourly, daily charts) can provide a more comprehensive view of market conditions.

Conclusion and Next Steps

Calculating RSI in Excel is a practical skill for traders and investors looking to enhance their technical analysis capabilities. Understanding how to interpret RSI values and incorporating RSI into trading strategies can improve market analysis and decision-making. However, it's crucial to remember the limitations of the RSI and to combine it with other forms of analysis for a more robust trading plan.

For those looking to dive deeper, exploring advanced RSI techniques, such as divergences and multiple time frame analysis, can offer additional insights. Furthermore, integrating RSI with other technical indicators and fundamental analysis can lead to more effective trading strategies.

RSI Calculation Image Gallery

What is the Relative Strength Index (RSI)?

+The Relative Strength Index (RSI) is a momentum indicator that measures the magnitude of recent price changes to determine overbought or oversold conditions.

How do I calculate RSI in Excel?

+Calculate the difference between consecutive closing prices, then calculate the gain and loss. Use these to find the average gain and loss over a specified period (usually 14 days), and then calculate the Relative Strength (RS) and finally the RSI.

What are the common interpretations of RSI values?

+RSI values range from 0 to 100. Values above 70 indicate overbought conditions, values below 30 indicate oversold conditions, and values between 30 and 70 are considered neutral.

We hope this comprehensive guide to calculating RSI in Excel has been informative and helpful. Whether you're a seasoned trader or just starting out, understanding and applying RSI can enhance your market analysis and trading decisions. Feel free to share your experiences or ask questions about using RSI in your trading strategies.