Intro

Copy car loan worksheet to new workbook easily. Manage auto loan calculations, payments, and amortization schedules with this template, utilizing financial modeling and spreadsheet analysis techniques.

The process of managing car loans often involves meticulous planning and tracking of financials. A car loan worksheet can be a crucial tool in this endeavor, helping individuals keep track of their payments, interest rates, and the overall balance of their loan. When it comes to copying a car loan worksheet to a new workbook, individuals may want to do so for a variety of reasons, such as starting a fresh tracking period, creating a backup, or sharing the worksheet with someone else. This process can be efficiently carried out using spreadsheet software like Microsoft Excel.

To begin with, understanding the importance of a car loan worksheet is essential. It not only helps in organizing financial data but also in making informed decisions regarding the loan. For instance, by tracking payments and interest rates, individuals can identify opportunities to save money by possibly refinancing their loan or making extra payments. Moreover, having a clear overview of one's financial obligations can reduce stress and improve financial planning.

The actual process of copying a car loan worksheet to a new workbook involves a few straightforward steps. First, one needs to open the workbook containing the original car loan worksheet. Then, select the worksheet that needs to be copied by clicking on its tab at the bottom of the Excel window. Once the worksheet is selected, go to the "Home" tab in the ribbon, find the "Cells" group, and click on "Format" to select "Move or Copy Sheet." In the dialog box that appears, check the box that says "Create a copy" and then choose where you want the copy to be placed, either within the same workbook or in a new workbook.

Alternatively, for a more direct approach, right-click on the tab of the worksheet you wish to copy and select "Move or Copy" from the context menu. This will open the same dialog box where you can choose to create a copy and decide its location.

Benefits of Using a Car Loan Worksheet

Utilizing a car loan worksheet offers numerous benefits, including better financial management, reduced stress, and the ability to make informed decisions about one's loan. By having all the relevant information in one place, individuals can easily track their progress, identify any discrepancies, and plan for the future. Moreover, a well-organized worksheet can serve as a valuable tool for budgeting, helping individuals allocate their income more effectively.

Key Components of a Car Loan Worksheet

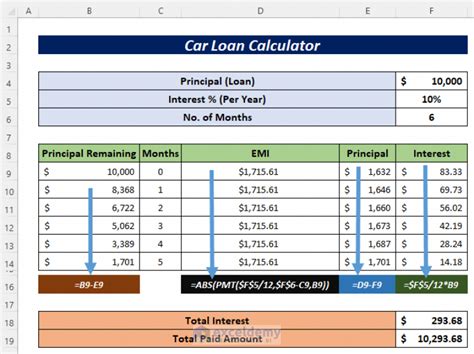

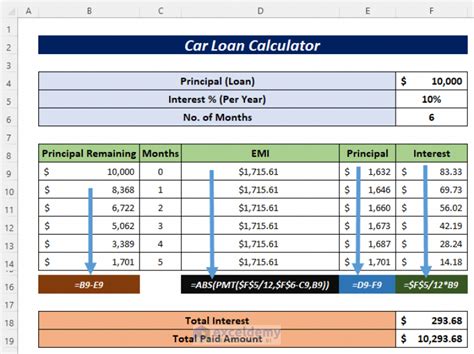

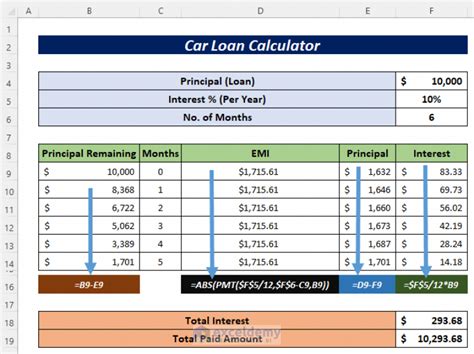

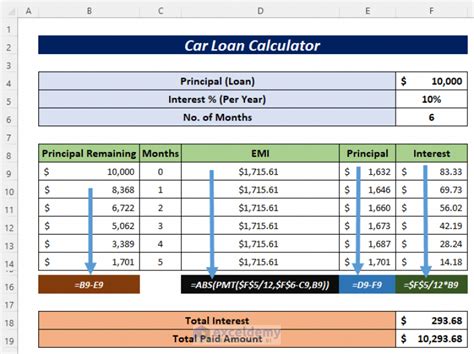

A comprehensive car loan worksheet should include several key components: - Loan details: This includes the loan amount, interest rate, loan term, and monthly payment. - Payment schedule: A table or calendar that outlines each payment, including the date, amount, and any additional payments made. - Balance tracker: A section that shows the current balance of the loan after each payment. - Interest paid: A running total of the interest paid over the life of the loan. - Extra payments: A section to track any extra payments made towards the loan.Creating a Car Loan Worksheet from Scratch

For those who do not have a car loan worksheet and wish to create one from scratch, the process is relatively straightforward. Start by opening a new workbook in your spreadsheet software and giving it a relevant title, such as "Car Loan Tracker." Then, create a new worksheet within this workbook for your car loan details.

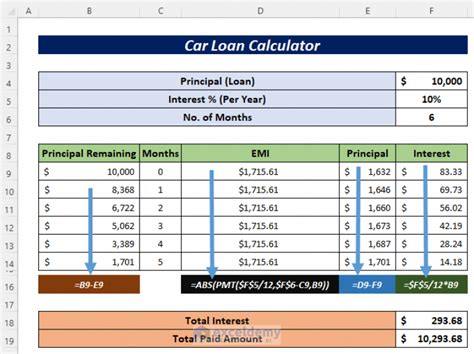

Begin by setting up the key components mentioned earlier. Use formulas to calculate the monthly payment, total interest paid, and the remaining balance after each payment. Utilize tables or charts to visualize the payment schedule and balance over time, making it easier to understand and track progress.

Using Formulas in a Car Loan Worksheet

Formulas play a crucial role in making a car loan worksheet dynamic and useful. For example, the formula for calculating the monthly payment (M) on a loan is M = P[r(1+r)^n]/[(1+r)^n – 1], where P is the principal loan amount, r is the monthly interest rate, and n is the number of payments. By inputting this formula into your worksheet, you can easily calculate your monthly payment based on your loan's specifics.Customizing Your Car Loan Worksheet

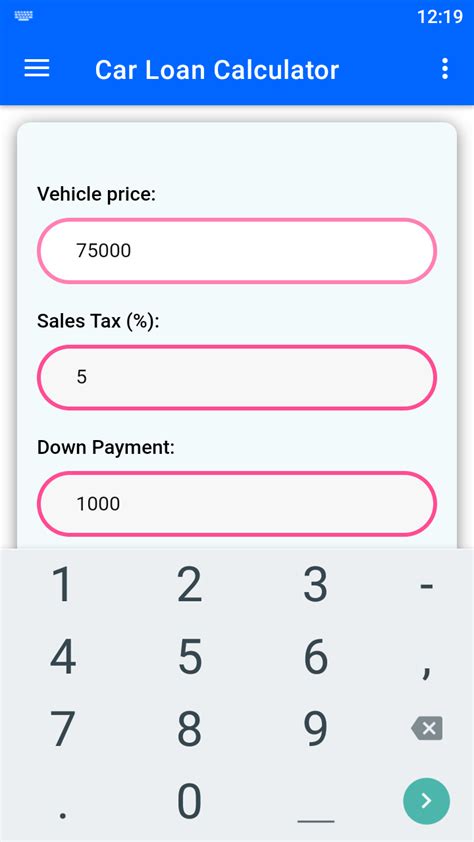

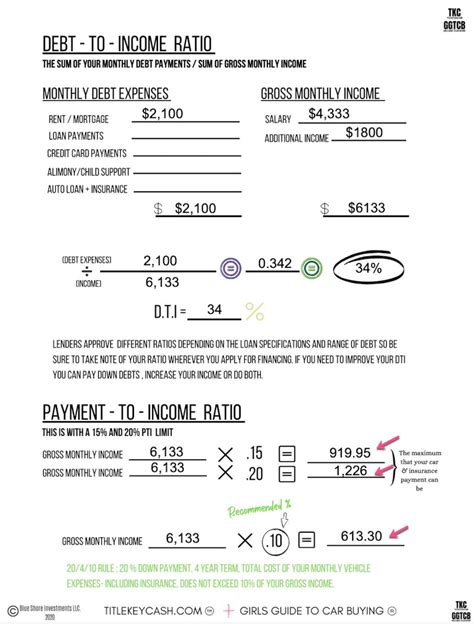

Every individual's financial situation is unique, and thus, a car loan worksheet should be customizable to fit specific needs. This could involve adding sections for tracking fuel efficiency, maintenance costs, or insurance premiums, all of which are related to car ownership and can impact one's overall financial health.

Additionally, customizing the appearance of the worksheet can make it more user-friendly. Using colors, borders, and clear headings can improve readability and make the worksheet more engaging. It's also beneficial to set up automatic calculations for totals and percentages to save time and reduce the chance of human error.

Sharing and Collaborating on a Car Loan Worksheet

In some cases, individuals may want to share their car loan worksheet with others, such as a spouse, financial advisor, or lender. This can be done by saving the workbook in a shared location, such as a cloud storage service, and granting access to the relevant parties. When sharing, it's a good idea to protect the worksheet with a password to prevent unauthorized changes.Gallery of Car Loan Worksheets

Car Loan Worksheet Examples

What is the main purpose of a car loan worksheet?

+The main purpose of a car loan worksheet is to help individuals track and manage their car loan payments, interest rates, and balance, facilitating better financial planning and decision-making.

How do I customize a car loan worksheet for my specific needs?

+You can customize a car loan worksheet by adding or removing sections, using formulas to automate calculations, and incorporating additional features such as budgeting tools or fuel efficiency trackers.

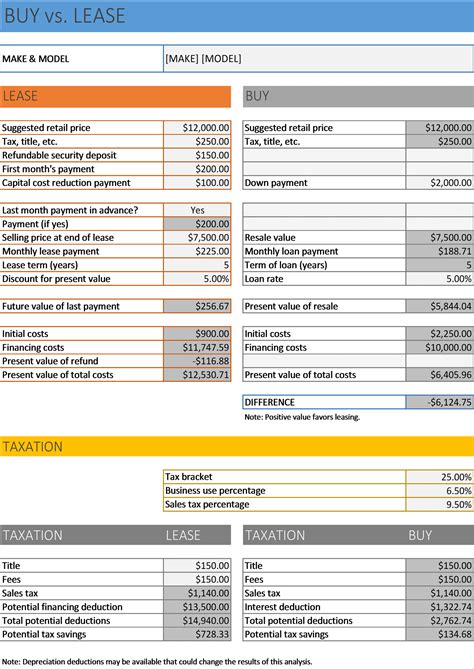

Can I use a car loan worksheet to compare different loan options?

+Yes, a car loan worksheet can be a valuable tool for comparing different loan options, including interest rates, monthly payments, and total costs over the life of the loan.

In conclusion, copying a car loan worksheet to a new workbook and utilizing it effectively can significantly enhance one's ability to manage car loan finances. By understanding the benefits, creating a comprehensive worksheet, and customizing it to fit specific needs, individuals can make the most out of this powerful financial tool. Whether you're looking to track payments, compare loan options, or simply get a better grasp of your financial obligations, a well-designed car loan worksheet is an indispensable resource. We invite you to share your experiences with car loan worksheets, ask questions, or provide tips on how you've customized your worksheet to better suit your financial management needs. Your input can help others navigate the complexities of car loan management and make informed decisions about their financial futures.