Intro

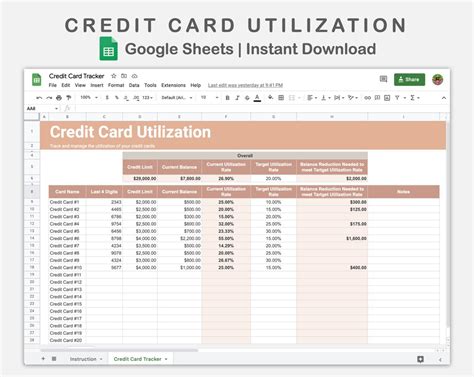

Managing credit card debt and understanding credit utilization are crucial for maintaining a healthy financial profile. A credit card utilization spreadsheet can be a powerful tool in this endeavor, helping individuals track their credit card balances, credit limits, and the all-important credit utilization ratio. This ratio, which compares the amount of credit being used to the total amount of credit available, is a significant factor in determining credit scores.

For those looking to improve their financial literacy and manage their credit more effectively, creating or using a credit card utilization spreadsheet can be a significant first step. It allows for a clear, organized view of one's credit situation, making it easier to identify areas for improvement. Whether the goal is to reduce debt, improve credit scores, or simply maintain a better grasp on personal finances, a well-designed spreadsheet can provide the necessary insights and tracking capabilities.

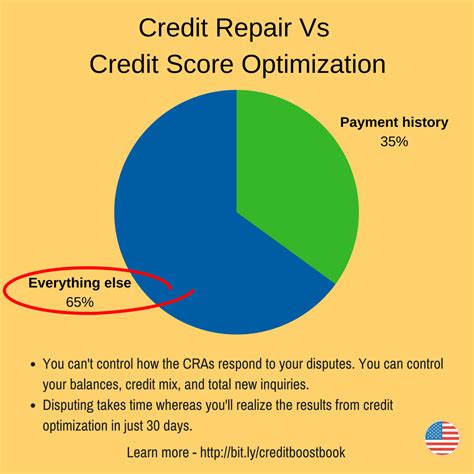

The importance of monitoring credit card utilization cannot be overstated. High credit utilization can negatively affect credit scores, as it may indicate to lenders that an individual is overly reliant on credit and potentially at risk of default. Conversely, maintaining low credit utilization demonstrates responsible credit management and can lead to better credit terms and lower interest rates over time. A spreadsheet designed to track credit card utilization can help individuals navigate these complexities, providing a personalized roadmap for achieving and maintaining optimal credit health.

Understanding Credit Utilization

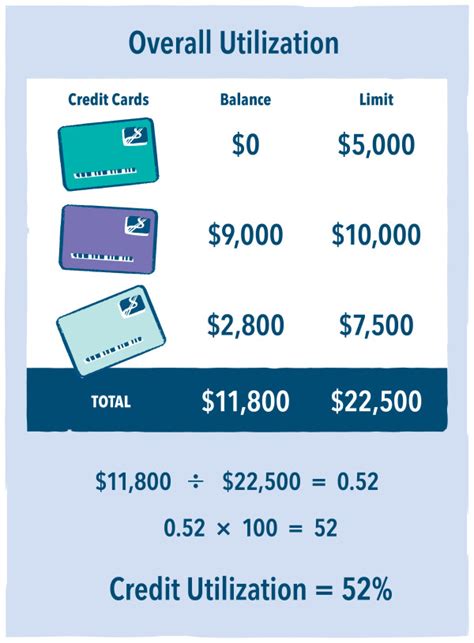

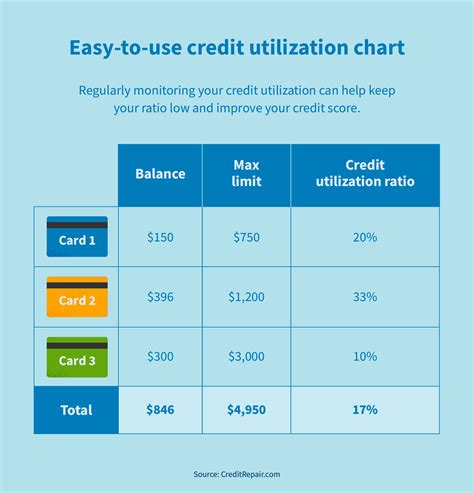

Understanding how credit utilization works is fundamental to using a credit card utilization spreadsheet effectively. Credit utilization is calculated by dividing the current balance of a credit card by its credit limit and then multiplying by 100 to get a percentage. For example, if a credit card has a balance of $500 and a credit limit of $2,000, the credit utilization ratio would be 25%. This ratio can significantly impact credit scores, with lower ratios generally being viewed more favorably by credit scoring models.

Benefits of a Credit Card Utilization Spreadsheet

A credit card utilization spreadsheet offers several benefits for individuals seeking to manage their credit more effectively. These benefits include:

- Improved Tracking: Allows for the easy tracking of credit card balances, limits, and utilization ratios across multiple cards.

- Enhanced Budgeting: By understanding where money is being spent and how credit is being utilized, individuals can make more informed budgeting decisions.

- Credit Score Optimization: Helps in maintaining low credit utilization ratios, which can lead to better credit scores over time.

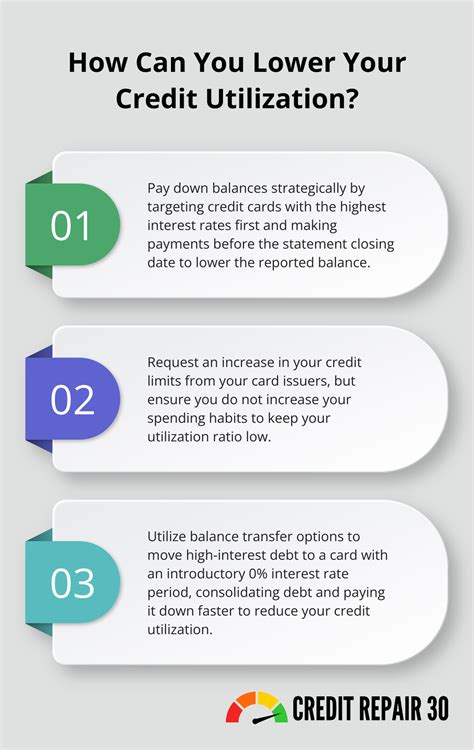

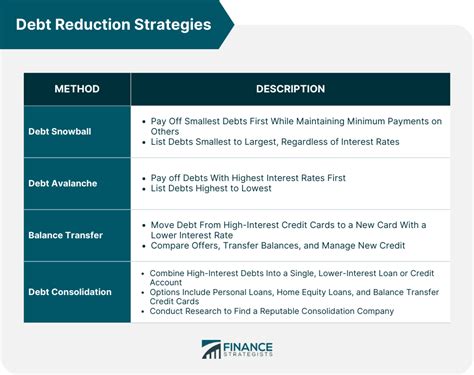

- Debt Reduction Strategies: Enables the development of targeted strategies for reducing debt, such as focusing on high-interest cards first or implementing a debt snowball method.

Creating a Credit Card Utilization Spreadsheet

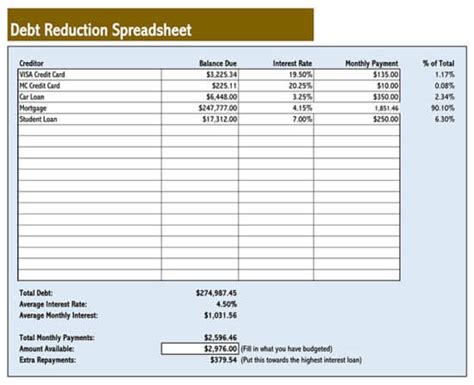

Creating a credit card utilization spreadsheet can be a straightforward process, even for those without extensive experience with spreadsheet software. The key components to include are:

- Credit Card List: A list of all credit cards, including their names, current balances, and credit limits.

- Utilization Ratio Calculator: A formula or function that calculates the credit utilization ratio for each card based on the balance and limit.

- Total Credit and Total Utilization: Fields to calculate the total credit available and the total credit utilization across all cards.

- Monthly Payment Tracker: A section to track monthly payments, helping to monitor progress towards debt reduction goals.

Using the Spreadsheet for Debt Reduction

The credit card utilization spreadsheet is not just a tool for tracking; it's also a powerful ally in the quest to reduce debt. By regularly updating the spreadsheet with new balances, payments, and credit limit changes, individuals can:

- Identify High-Interest Debt: Focus on paying off credit cards with the highest interest rates first to save money on interest over time.

- Monitor Progress: See the tangible results of debt reduction efforts, which can be a significant motivator.

- Adjust Strategies: Based on the data in the spreadsheet, adjust debt repayment strategies as needed to optimize progress.

Best Practices for Credit Utilization

Maintaining good credit utilization practices is essential for a healthy financial profile. Some best practices include:

- Keep Utilization Low: Aim for a credit utilization ratio of 30% or less for each card and overall.

- Make Timely Payments: Paying bills on time helps maintain a good credit score and avoids late fees.

- Avoid New Credit: Limit applications for new credit, as too many inquiries can negatively affect credit scores.

- Monitor Credit Reports: Regularly check credit reports for errors or signs of identity theft.

Common Mistakes to Avoid

When managing credit card utilization, there are several common mistakes to be aware of and avoid:

- High Credit Utilization: Letting credit utilization ratios get too high can significantly lower credit scores.

- Missing Payments: Failing to make payments on time can lead to late fees, interest rate increases, and credit score damage.

- Applying for Too Much Credit: Submitting multiple credit applications in a short period can negatively impact credit scores.

- Not Monitoring Credit Reports: Failing to check credit reports regularly can lead to unnoticed errors or identity theft.

Conclusion and Next Steps

In conclusion, a credit card utilization spreadsheet is a versatile and essential tool for anyone looking to manage their credit effectively, reduce debt, and improve their financial health. By understanding how credit utilization works, creating a comprehensive spreadsheet, and following best practices, individuals can take significant steps towards achieving their financial goals. Whether the aim is to improve credit scores, pay off debt, or simply better understand personal finances, the insights and tracking capabilities provided by a credit card utilization spreadsheet make it an indispensable resource.

Credit Card Utilization Image Gallery

What is credit utilization, and why is it important?

+Credit utilization refers to the percentage of available credit being used. It's crucial because it significantly impacts credit scores, with lower ratios generally being more favorable.

How can a credit card utilization spreadsheet help with debt reduction?

+A spreadsheet helps track balances, limits, and utilization ratios, allowing for targeted debt reduction strategies and monitoring of progress over time.

What are some best practices for maintaining good credit utilization?

+Best practices include keeping utilization low (below 30%), making timely payments, avoiding excessive new credit applications, and regularly monitoring credit reports.

We hope this comprehensive guide to credit card utilization spreadsheets has provided valuable insights and practical advice for managing your credit effectively. Whether you're looking to improve your credit score, reduce debt, or simply gain a better understanding of your financial situation, the tools and strategies outlined here can be instrumental in achieving your goals. Feel free to share your thoughts, experiences, or questions in the comments below, and don't hesitate to reach out for further guidance on creating and using a credit card utilization spreadsheet to enhance your financial health.