Intro

As a business owner or manager, understanding the total cost of employing staff is crucial for making informed decisions about your workforce and budget. Employee costs can be complex, encompassing not just salaries but also benefits, taxes, and other expenses. An Employee Cost Calculator Excel template can be a valuable tool in calculating these costs accurately. In this article, we will delve into the importance of understanding employee costs, how to create or use an Employee Cost Calculator in Excel, and the benefits of utilizing such a tool for your business operations.

Calculating employee costs is not just about adding up salaries; it involves considering a wide range of factors including health insurance, retirement plans, payroll taxes, and other benefits. These costs can significantly impact your business's bottom line, and having a clear, comprehensive view of them is essential for strategic planning, budgeting, and decision-making. Whether you are looking to hire new staff, adjust compensation packages, or simply understand where your money is going, an Employee Cost Calculator can provide the insights you need.

The process of manually calculating employee costs can be time-consuming and prone to errors, especially in larger organizations with many employees. This is where an Excel-based calculator comes into play. Excel, with its powerful calculation capabilities and ease of use, is an ideal platform for creating such a tool. An Employee Cost Calculator Excel template can be designed to automatically calculate total employee costs based on inputted data such as salary, benefits, and taxes, making the process efficient and reducing the likelihood of human error.

Understanding Employee Costs

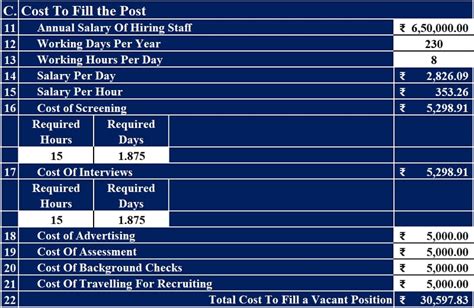

Understanding the components of employee costs is the first step in creating an effective calculator. These components can vary by country, state, or even industry but generally include direct costs like salaries and wages, and indirect costs such as benefits, payroll taxes, and workers' compensation insurance. Direct costs are straightforward and include the basic compensation that employees receive for their work. Indirect costs, on the other hand, are additional expenses associated with employing staff and can significantly add to the total cost of an employee.

Direct Costs

Direct costs are the most visible expenses related to employees. They include: - Salaries and wages: The basic compensation that employees receive. - Bonuses and incentives: Additional payments made to motivate employees or reward performance. - Overtime pay: Compensation for work done beyond regular working hours.Indirect Costs

Indirect costs are less obvious but equally important. They include: - Health insurance: Medical coverage provided to employees. - Retirement plans: Contributions made towards employees' retirement savings. - Payroll taxes: Taxes paid by the employer on behalf of the employees. - Workers' compensation insurance: Insurance that covers employees in case of work-related injuries. - Training and development: Costs associated with improving employees' skills and knowledge.Creating an Employee Cost Calculator in Excel

Creating an Employee Cost Calculator in Excel involves several steps:

- Identify Costs: List all the direct and indirect costs associated with employing staff in your organization.

- Design the Template: Set up an Excel spreadsheet with separate columns for each type of cost. Include fields for employee details such as name, position, and salary.

- Formulas and Calculations: Use Excel formulas to calculate total costs. For example, you can use the SUM function to add up all the costs for an individual employee or the entire workforce.

- Input Data: Enter the relevant data into the template. This could include salary rates, benefits costs, tax rates, etc.

- Test and Refine: Test the calculator with sample data to ensure it works correctly and refine it as necessary.

Benefits of Using an Employee Cost Calculator

Using an Employee Cost Calculator Excel template offers several benefits: - **Accuracy**: Reduces the chance of human error in calculations. - **Efficiency**: Saves time by automating the calculation process. - **Clarity**: Provides a clear and comprehensive view of employee costs. - **Decision Making**: Aids in making informed decisions about staffing, budgeting, and compensation.Implementing and Maintaining the Calculator

Implementing and maintaining an Employee Cost Calculator involves:

- Regular Updates: Ensure that the calculator is updated regularly to reflect changes in costs, laws, or company policies.

- Training: Provide training to HR and finance staff on how to use the calculator effectively.

- Review and Audit: Periodically review and audit the calculator to ensure its accuracy and relevance.

Best Practices for Calculator Maintenance

Best practices include: - Keeping the template simple and easy to understand. - Documenting all formulas and calculations for transparency and ease of maintenance. - Using protective measures such as password protection to prevent unauthorized changes.Gallery of Employee Cost Calculators

Employee Cost Calculator Image Gallery

Frequently Asked Questions

What is an Employee Cost Calculator?

+An Employee Cost Calculator is a tool used to calculate the total cost of employing staff, including direct and indirect costs.

Why is it important to understand employee costs?

+Understanding employee costs is crucial for making informed decisions about workforce and budget, as it impacts the business's bottom line.

How do I create an Employee Cost Calculator in Excel?

+To create an Employee Cost Calculator in Excel, identify all relevant costs, design a template, input formulas and data, and test the calculator.

In conclusion, an Employee Cost Calculator Excel template is a powerful tool for businesses looking to understand and manage their employee-related expenses effectively. By following the steps outlined in this article, businesses can create a customized calculator that meets their specific needs, ensuring accuracy, efficiency, and informed decision-making. Whether you are a small startup or a large corporation, leveraging technology like Excel to streamline HR and finance functions can have a significant impact on your operational efficiency and bottom line. We invite you to share your experiences with employee cost calculators, ask questions, or provide feedback on how this article has helped you in your business endeavors. Your input is invaluable in helping us create more relevant and useful content for our readers.