Intro

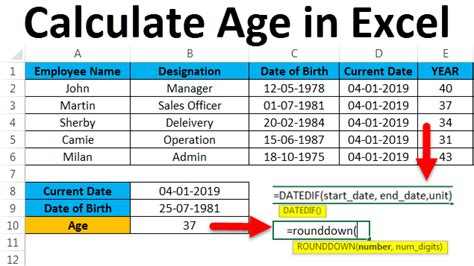

Calculate age in Excel with the Aging Formula 30, 60, 90 days. Determine days overdue, track invoice aging, and manage debtors with ease using Excel formulas and aging reports.

The Excel aging formula is a crucial tool for businesses and individuals to manage their accounts receivable and payable. It helps to track the outstanding invoices and payments, categorizing them into different age groups, such as 30, 60, and 90 days. This allows for a clear understanding of the financial situation and enables informed decisions to be made.

The importance of using the Excel aging formula lies in its ability to provide a snapshot of the current financial status. By categorizing outstanding invoices and payments into different age groups, businesses can identify potential issues, such as delayed payments or cash flow problems. This information can be used to take proactive measures, such as sending reminders or negotiating payment terms, to minimize the risk of bad debts and maintain a healthy cash flow.

In today's fast-paced business environment, it is essential to have a reliable and efficient system in place to manage finances. The Excel aging formula is a simple yet effective tool that can be used to streamline financial management. By using this formula, businesses can save time and resources, reduce errors, and make informed decisions to drive growth and profitability.

Understanding the Excel Aging Formula

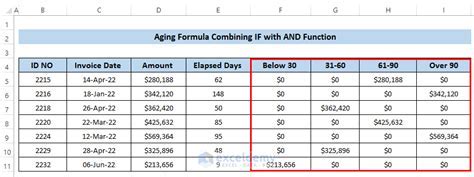

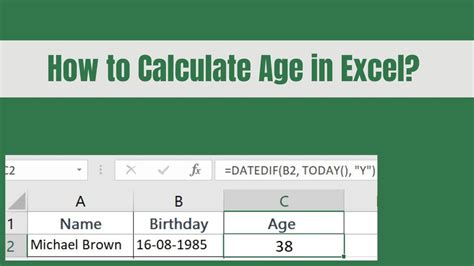

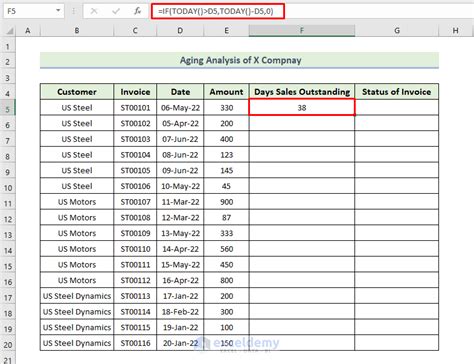

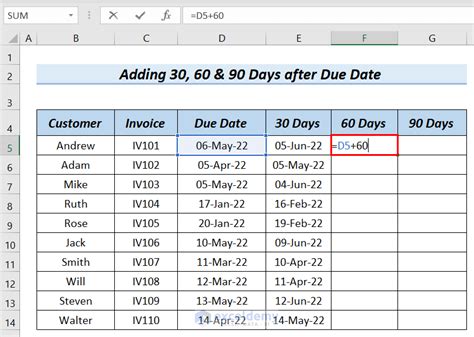

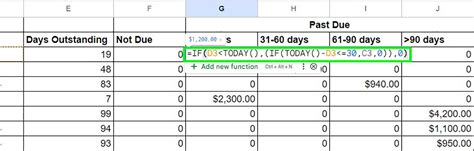

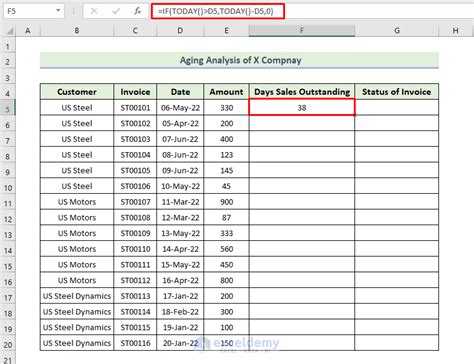

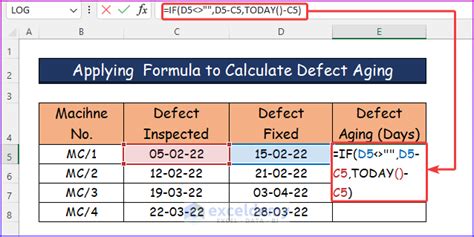

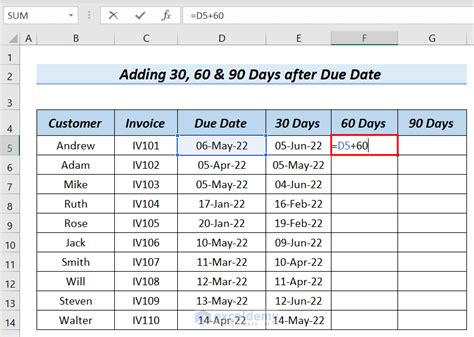

The Excel aging formula is a straightforward formula that uses the TODAY() function to calculate the number of days between the current date and the invoice date. The formula is as follows: =TODAY()-A2, where A2 is the cell containing the invoice date. This formula can be used to calculate the age of each invoice, which can then be categorized into different age groups, such as 30, 60, and 90 days.

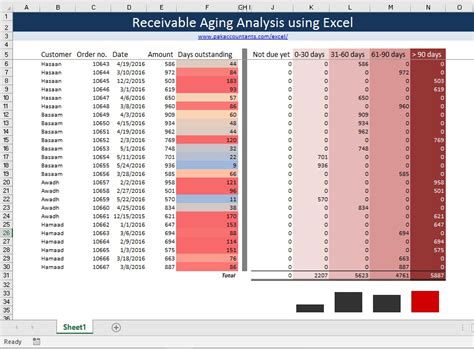

To create an aging report in Excel, you can use the following steps:

- Create a table with the following columns: Invoice Date, Due Date, Amount, and Age.

- Use the formula =TODAY()-A2 to calculate the age of each invoice.

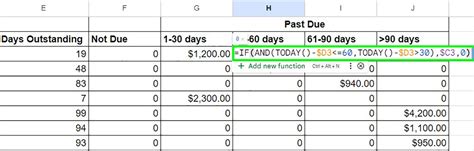

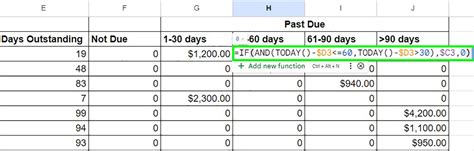

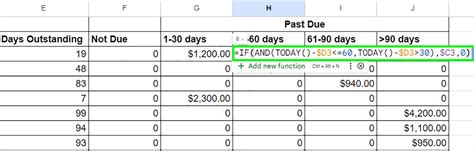

- Use the IF function to categorize the invoices into different age groups, such as 30, 60, and 90 days.

- Use the SUMIF function to calculate the total amount outstanding for each age group.

Benefits of Using the Excel Aging Formula

The Excel aging formula offers several benefits, including: * Improved cash flow management: By tracking outstanding invoices and payments, businesses can identify potential cash flow problems and take proactive measures to address them. * Reduced bad debts: By identifying delayed payments and taking action to recover them, businesses can minimize the risk of bad debts. * Increased efficiency: The Excel aging formula automates the process of tracking outstanding invoices and payments, saving time and resources. * Better decision-making: By providing a clear picture of the financial situation, the Excel aging formula enables businesses to make informed decisions to drive growth and profitability.Implementing the Excel Aging Formula

To implement the Excel aging formula, you can follow these steps:

- Create a table with the following columns: Invoice Date, Due Date, Amount, and Age.

- Use the formula =TODAY()-A2 to calculate the age of each invoice.

- Use the IF function to categorize the invoices into different age groups, such as 30, 60, and 90 days.

- Use the SUMIF function to calculate the total amount outstanding for each age group.

- Use the PivotTable function to create a summary report that shows the total amount outstanding for each age group.

Common Challenges and Solutions

When implementing the Excel aging formula, you may encounter some common challenges, such as: * Inaccurate data: Ensure that the data is accurate and up-to-date to get reliable results. * Formula errors: Double-check the formulas to ensure that they are correct and functioning as expected. * Data management: Use PivotTables and other data management tools to manage large datasets and create summary reports.Best Practices for Using the Excel Aging Formula

To get the most out of the Excel aging formula, follow these best practices:

- Use accurate and up-to-date data to get reliable results.

- Regularly review and update the formulas to ensure that they are functioning as expected.

- Use PivotTables and other data management tools to manage large datasets and create summary reports.

- Use the Excel aging formula in conjunction with other financial management tools, such as budgeting and forecasting, to get a complete picture of the financial situation.

Real-World Applications

The Excel aging formula has numerous real-world applications, including: * Accounts receivable management: Use the Excel aging formula to track outstanding invoices and payments, and identify potential cash flow problems. * Accounts payable management: Use the Excel aging formula to track outstanding payments and identify potential cash flow problems. * Financial reporting: Use the Excel aging formula to create summary reports that show the total amount outstanding for each age group.Advanced Techniques for Using the Excel Aging Formula

To take your Excel aging formula skills to the next level, try these advanced techniques:

- Use the INDEX and MATCH functions to create a dynamic aging report that updates automatically when new data is added.

- Use the Power Pivot function to create a data model that combines data from multiple sources, such as accounts receivable and accounts payable.

- Use the DAX function to create custom calculations and measures that provide additional insights into the financial situation.

Conclusion and Next Steps

In conclusion, the Excel aging formula is a powerful tool that can help businesses and individuals to manage their finances effectively. By following the best practices and advanced techniques outlined in this article, you can get the most out of the Excel aging formula and take your financial management skills to the next level. Next steps include: * Implementing the Excel aging formula in your financial management system. * Regularly reviewing and updating the formulas to ensure that they are functioning as expected. * Exploring additional financial management tools, such as budgeting and forecasting, to get a complete picture of the financial situation.Excel Aging Formula Image Gallery

What is the Excel aging formula?

+The Excel aging formula is a formula used to calculate the age of outstanding invoices and payments.

How do I implement the Excel aging formula?

+To implement the Excel aging formula, create a table with the following columns: Invoice Date, Due Date, Amount, and Age. Use the formula =TODAY()-A2 to calculate the age of each invoice.

What are the benefits of using the Excel aging formula?

+The benefits of using the Excel aging formula include improved cash flow management, reduced bad debts, and increased efficiency.

Can I use the Excel aging formula for accounts payable management?

+Yes, the Excel aging formula can be used for accounts payable management to track outstanding payments and identify potential cash flow problems.

How often should I review and update the Excel aging formula?

+It is recommended to review and update the Excel aging formula regularly, such as monthly or quarterly, to ensure that it is functioning as expected and providing accurate results.

We hope this article has provided you with a comprehensive understanding of the Excel aging formula and its applications. If you have any further questions or would like to share your experiences with using the Excel aging formula, please comment below. Additionally, if you found this article helpful, please share it with others who may benefit from this information.