Intro

Unlock wealth with compound interest, a powerful investing strategy that amplifies savings through interest on interest, exponential growth, and long-term financial gains.

The concept of compound interest has been a cornerstone of personal finance and investing for centuries. It's a powerful force that can help individuals grow their wealth over time, achieving their long-term financial goals. Whether you're saving for retirement, a down payment on a house, or your children's education, understanding how compound interest works is essential. In this article, we'll delve into the world of compound interest, exploring its benefits, how it works, and providing practical examples to help you make the most of this financial phenomenon.

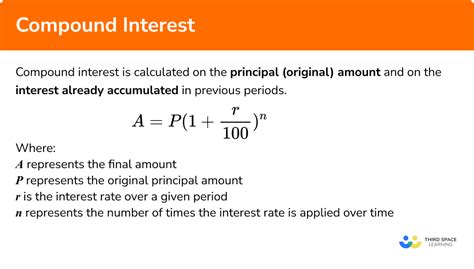

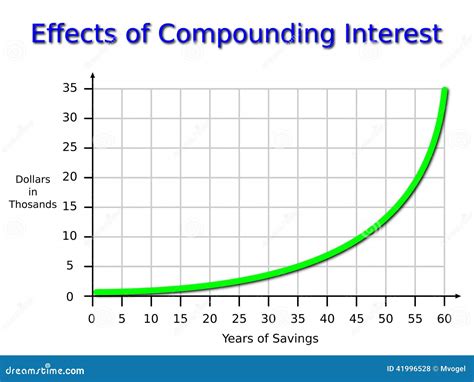

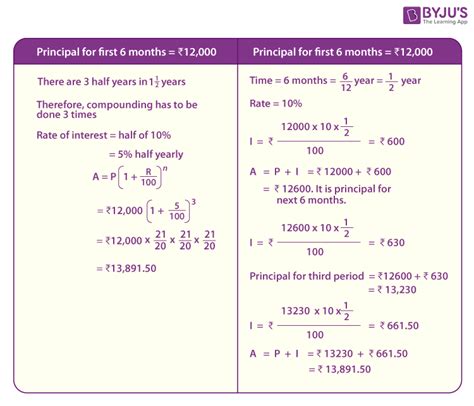

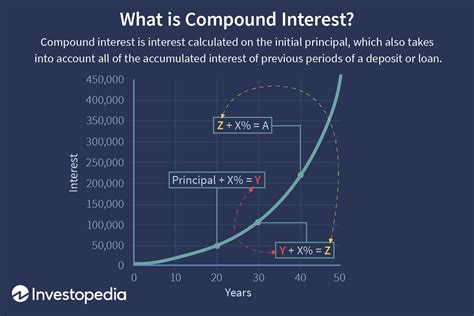

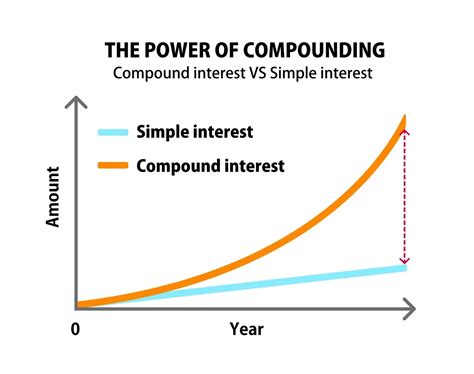

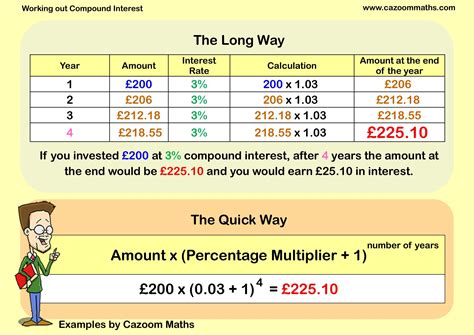

Compound interest is the interest calculated on the initial principal, which also includes all the accumulated interest from previous periods. This means that as your investment grows, so does the interest you earn, creating a snowball effect that can significantly boost your returns over time. For instance, if you deposit $1,000 into a savings account with a 5% annual interest rate, you'll earn $50 in interest in the first year, making your total balance $1,050. In the second year, you'll earn 5% interest on the new balance of $1,050, which is $52.50, bringing your total to $1,102.50. As you can see, the interest earned in the second year is greater than the first, even though the interest rate remains the same.

The power of compound interest lies in its ability to generate exponential growth. The longer your money is invested, the more time it has to grow, and the greater the potential for significant returns. This is why starting to save and invest early is crucial, even if it's just a small amount each month. Consistency and patience are key when it comes to harnessing the power of compound interest. By understanding how compound interest works and making informed decisions about your investments, you can set yourself up for long-term financial success.

Understanding Compound Interest

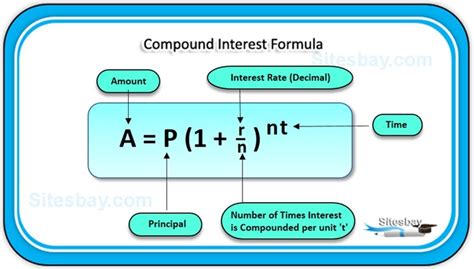

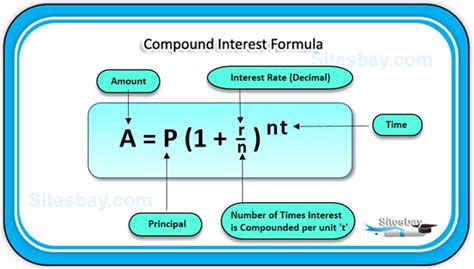

Key Components of Compound Interest

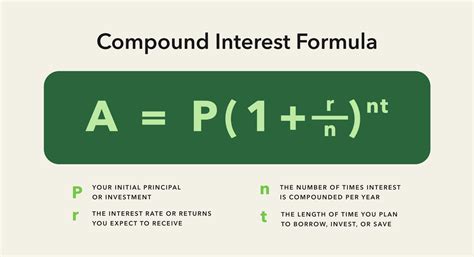

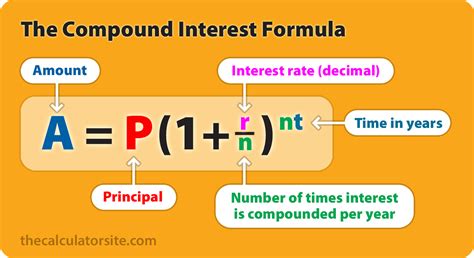

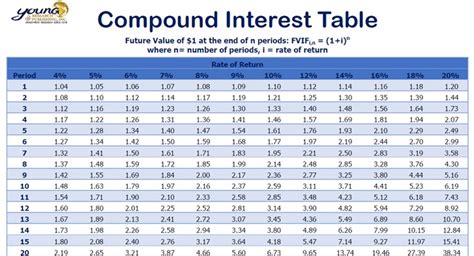

The key components of compound interest include the principal amount, the interest rate, the compounding frequency, and the time period. Each of these factors plays a crucial role in determining the overall growth of your investment. For example, a higher interest rate can significantly increase your returns over time, while more frequent compounding can also boost your earnings. Understanding how these components interact and affect your investments can help you make the most of compound interest.Benefits of Compound Interest

Real-World Examples of Compound Interest

To illustrate the power of compound interest, let's consider a few real-world examples. Suppose you start saving $500 per month at the age of 25, earning an average annual return of 7%. By the time you're 65, you'll have contributed $180,000, but your total balance could be over $1 million, thanks to the power of compound interest. Another example is a retirement account, such as a 401(k) or IRA, which can grow significantly over time due to compound interest. Even small, consistent contributions can add up to a substantial nest egg, providing a comfortable retirement.How to Make the Most of Compound Interest

Common Mistakes to Avoid

When it comes to compound interest, there are several common mistakes to avoid. One of the most significant is procrastination, or putting off saving and investing until later. This can significantly reduce the potential for growth, as your money has less time to compound. Another mistake is not taking advantage of tax-advantaged accounts, which can reduce your tax liability and increase your returns. Finally, failing to diversify your investments can also limit your potential for growth, as it increases your risk exposure.Compound Interest in Practice

Conclusion and Next Steps

In conclusion, compound interest is a powerful force that can help you achieve your long-term financial goals. By understanding how it works, avoiding common mistakes, and applying it in a practical way, you can harness its potential and build wealth over time. The next steps are to start early, be consistent, and be patient. Take control of your finances, create a budget, and stick to it. Consider taking advantage of tax-advantaged accounts and avoiding high-interest debt. With discipline, patience, and the right strategy, you can make the most of compound interest and secure your financial future.Compound Interest Image Gallery

What is compound interest?

+Compound interest is the interest calculated on the initial principal, which also includes all the accumulated interest from previous periods.

How does compound interest work?

+Compound interest works by calculating interest on the initial principal and all accumulated interest from previous periods, creating a snowball effect that can significantly boost returns over time.

What are the benefits of compound interest?

+The benefits of compound interest include long-term growth, discipline, and patience, as well as the potential for significant returns over time.

How can I make the most of compound interest?

+To make the most of compound interest, start early, be consistent, and be patient, and consider taking advantage of tax-advantaged accounts and avoiding high-interest debt.

What are some common mistakes to avoid when it comes to compound interest?

+Common mistakes to avoid include procrastination, not taking advantage of tax-advantaged accounts, and failing to diversify investments.

We hope this article has provided you with a comprehensive understanding of compound interest and its benefits. Whether you're a seasoned investor or just starting to build your wealth, compound interest can be a powerful tool in achieving your long-term financial goals. Share your thoughts and experiences with compound interest in the comments below, and don't forget to share this article with your friends and family to help them make the most of this financial phenomenon.